(ii) State when the inheritance tax (IHT) calculated in (i) would be payable and by whom. (2 marks)

题目

(ii) State when the inheritance tax (IHT) calculated in (i) would be payable and by whom. (2 marks)

相似考题

更多“(ii) State when the inheritance tax (IHT) calculated in (i) would be payable and by whom. (2 marks)”相关问题

-

第1题:

(c) Assuming that Joanne registers for value added tax (VAT) with effect from 1 April 2006:

(i) Calculate her income tax (IT) and capital gains tax (CGT) payable for the year of assessment 2005/06.

You are not required to calculate any national insurance liabilities in this sub-part. (6 marks)

正确答案:

-

第2题:

(ii) State, giving reasons, the tax reliefs in relation to inheritance tax (IHT) and capital gains tax (CGT) which

would be available to Alasdair if he acquires the warehouse and leases it to Gallus & Co, rather than to

an unconnected tenant. (4 marks)

正确答案:

(ii) Apart from the fact that Alasdair can keep an eye on his tenant, the main advantages are twofold:

IHT: If the firm are the tenants, the property will be land and buildings used in a business carried on by a partnership

in which the donor is a partner. Thus, Alasdair will be able to claim business property relief (BPR) at a rate of 50%

so long as he remains a partner in the firm. However, this relief would not be available until Alasdair has owned

the property for at least two years from his firm taking up the tenancy.

CGT: As Alasdair is a partner in the firm using the building, it will also be a qualifying asset for the purposes of rollover

relief on any gains arising from the disposal of the property. Assuming that Alasdair acquires a replacement asset

which will be used in the trade, the gain on sale can be deferred against the tax base cost of the replacement asset.

In the event that rollover relief cannot be used, any gains on disposal will be subject to business asset taper relief. -

第3题:

(c) Assuming that she will survive until July 2009, advise on the lifetime inheritance tax (IHT) planning

measures that could be undertaken by Debbie, quantifying the savings that can be made. (7 marks)

For this question you should assume that the rates and allowances for 2004/05 apply throughout.

正确答案:

(c) Debbie survives until July 2009

Debbie should consider giving away some of her assets to her children, while ensuring that she still has enough to live on.

Such gifts would be categorised as PETs. Although Debbie will not survive seven years (at which point the gifts would fall out

of Debbie’s estate for IHT purposes), taper relief will reduce the amount chargeable to IHT. If gifts were made prior to July

2005, 40% taper relief would be available.

It is important to remember that Debbie’s annual exemptions will reduce the value of any PET when assets are gifted. Debbie

has not used her annual exemption for the last two years, and so she can gift £6,000 (2 x £3,000) in the current tax year

as well as £3,000 per year in future tax years. Debbie could therefore give away £18,000, saving tax of £7,200 (£18,000

x 40%). Debbie can also make small exempt gifts of up to £250 per donee per year.

Debbie should consider making gifts to Allison’s children instead of Allison (using, for example, an accumulation &

maintenance trust). This would ensure that the gifts were excluded from Allison’s estate.

It does not make sense for Debbie to gift shares in Dee Limited, as these qualify for full business property relief and therefore

are not subject to IHT.

As Andrew is shortly to be married, Debbie could give up to £5,000 in consideration of his marriage. This would save £2,000

in IHT.

Expenditure out of normal income is also exempt from IHT. This is where the transferor is left with sufficient income to

maintain his/her usual standard of living. Broadly, you need to demonstrate evidence of a prior commitment, or a settled

pattern of expenditure.

If substantial gifts are made, the donees would be advised to consider taking out insurance policies on Debbie’s life to cover

the potential tax liabilities that may arise on PETs in the event of her early death. -

第4题:

(b) Mabel has two objectives when making the gifts to Bruce and Padma:

(1) To pay no tax on any gift in her lifetime; and

(2) To reduce the eventual liability to inheritance tax on her death.

Advise Mabel which item to gift to Bruce and to Padma in order to satisfy her objectives. Give reasons for

your advice.

Your advice should include a computation of the inheritance tax saved as a result of the two gifts, on the

assumption that Mabel dies on 30 June 2011. (10 marks)

正确答案:

-

第5题:

(b) Calculate the inheritance tax (IHT) liability arising as a result of Christopher’s death. (11 marks)

正确答案:

-

第6题:

(c) Explain the capital gains tax (CGT) and income tax (IT) issues Paul and Sharon should consider in deciding

which form. of trust to set up for Gisella and Gavin. You are not required to consider inheritance tax (IHT) or

stamp duty land tax (SDLT) issues. (10 marks)

You should assume that the tax rates and allowances for the tax year 2005/06 apply throughout this question.

正确答案:

(c) As the trust is created in the settlors’ (Paul and Sharon’s) lifetime its creation will constitute a chargeable disposal for capital

gains tax. Also, as the settlors and trustees are connected persons, the disposal will be deemed to be at market value, resulting

in a chargeable gain of £80,000 (160,000 – 80,000). No taper relief will be available as the property is a non-business

asset, and has been held for less than three years, but annual exemptions of £17,000 (2 x £8,500) will be available.

However, in the case of a discretionary trust, gift hold over relief will be available. This is because the gift will constitute a

chargeable lifetime transfer and because there is an immediate charge to inheritance tax (even though no tax is payable due

to the nil rate band) relief is available if a specific accumulation and maintenance trust is used, as in this case the gift will

qualify as a potentially exempt transfer and so gift relief would only be available in respect of business assets. The use of a

basic discretionary trust will thus facilitate the deferral of an immediate capital gains tax charge of £25,200 (63,000 x 40%).

If/when the property is disposed of, however, the trustees will pay capital gains tax on the deferred gain at the trust income

tax rate of 40%, and have an annual exemption of only £4,250 (50% of the normal individual rate) available to them. The

40% rate of tax and lower annual exemption rate also apply to chargeable gains arising in a specific accumulation and

maintenance trust, as well as a basic discretionary trust.

A chargeable disposal between connected persons will also arise for the purposes of capital gains tax if/when the property

vests in a beneficiary, i.e. one or more of the beneficiaries becomes absolutely entitled to all or part of the income or capital

of the trust. Gift hold over relief will again be available on all assets in the case of a discretionary trust, but only on business

assets in the case of an accumulation and maintenance trust, except where a beneficiary becomes entitled to both income

and capital at the same time.

The trust will have taxable property income in the form. of net rents from its creation and in future years is also likely to have

other investment income, probably in the form. of interest, to the extent that monies are retained in the trust. Whichever form

of trust is used, the trustees will pay tax at the standard trust rate of 40% on income other than dividend income (32·5%),

except to the extent of (1) the first £500 of taxable income, which is taxed at the rate that would otherwise apply to such

income (i.e. 22% for non-savings (rental) income, 20% for savings income (interest) and 10% for dividends) but, only to the

extent that it is not distributed; and (2) the legitimate trust management expenses, which are offsettable for the purposes of

the higher trust tax rates against the income with the lowest rate(s) of normal tax and so bear tax only at that rate. The higher

trust tax rate always applies to income that is distributed, other than to the extent that it has been treated as the settlor’s

income, and taxed at that settlor’s marginal tax rate.

As Paul and Sharon intend to create a trust for their unmarried minor (under 18) children, then even if the trust specifically

excludes them from any benefit under the trust, the trust income will be treated as theirs for income tax purposes to the extent

that it constitutes income paid for on behalf (including maintenance payments) of Gisella and Gavin; except where (1) the

total income arising does not exceed £100 gross per annum, and (2) income is held for the benefit of a child under an

accumulation and maintenance settlement, to the extent that it is not paid out. -

第7题:

(ii) Calculate the corporation tax (CT) payable by Tay Limited for the year ended 31 March 2006, taking

advantage of all available reliefs. (3 marks)

正确答案:

-

第8题:

(b) (i) Calculate Amanda’s income tax payable for the tax year 2006/07; (11 marks)

正确答案:

-

第9题:

(c) The inheritance tax payable by Adam in respect of the gift from his aunt. (4 marks)

Additional marks will be awarded for the appropriateness of the format and presentation of the memorandum and

the effectiveness with which the information is communicated. (2 marks)

Note: you should assume that the tax rates and allowances for the tax year 2006/07 will continue to apply for the

foreseeable future.

正确答案:

(c) Inheritance tax payable by Adam

The gift by AS’s aunt was a potentially exempt transfer. No tax will be due if she lives until 1 June 2014 (seven years after

the date of the gift).

The maximum possible liability, on the assumption that there are no annual exemptions or nil band available, is £35,216

(£88,040 x 40%). This will only arise if AS’s aunt dies before 1 June 2010.

The maximum liability will be reduced by taper relief of 20% for every full year after 31 May 2010 for which AS’s aunt lives.

The liability will also be reduced if the chargeable transfers made by the aunt in the seven years prior to 1 June 2007 are

less than £285,000 or if the annual exemption for 2006/07 and/or 2007/08 is/are available. -

第10题:

(iv) The stamp duty and/or stamp duty land tax payable by the Saturn Ltd group; (2 marks)

Additional marks will be awarded for the appropriateness of the format and presentation of the memorandum

and the effectiveness with which the information is communicated. (2 marks)

正确答案:

(iv) Stamp duty and stamp duty land tax

– The purchase of Tethys Ltd will give rise to a liability to ad valorem stamp duty of £1,175 (£235,000 x 0·5%).

The stamp duty must be paid by Saturn Ltd within 30 days of the share transfer in order to avoid interest being

charged. It is not an allowable expense for the purposes of corporation tax. -

第11题:

(ii) State, with reasons, whether Messier Ltd can provide Galileo with accommodation in the UK without

giving rise to a UK income tax liability. (2 marks)

正确答案:

(ii) Tax-free accommodation

It is not possible for Messier Ltd to provide Galileo with tax-free accommodation. The provision of accommodation by an

employer to an employee will give rise to a taxable benefit unless it is:

– necessary for the proper performance of the employee’s duties, e.g. a caretaker; or

– for the better performance of the employee’s duties and customary, e.g. a hotel manager; or

– part of arrangements arising out of threats to the employee’s security, e.g. a government minister.

As a manager of Messier Ltd Galileo is unable to satisfy any of the above conditions. -

第12题:

James died on 22 January 2015. He had made the following gifts during his lifetime:

(1) On 9 October 2007, a cash gift of £35,000 to a trust. No lifetime inheritance tax was payable in respect of this gift.

(2) On 14 May 2013, a cash gift of £420,000 to his daughter.

(3) On 2 August 2013, a gift of a property valued at £260,000 to a trust. No lifetime inheritance tax was payable in respect of this gift because it was covered by the nil rate band. By the time of James’ death on 22 January 2015, the property had increased in value to £310,000.

On 22 January 2015, James’ estate was valued at £870,000. Under the terms of his will, James left his entire estate to his children.

The nil rate band of James’ wife was fully utilised when she died ten years ago.

The nil rate band for the tax year 2007–08 is £300,000, and for the tax year 2013–14 it is £325,000.

Required:

(a) Calculate the inheritance tax which will be payable as a result of James’ death, and state who will be responsible for paying the tax. (6 marks)

(b) Explain why it might have been beneficial for inheritance tax purposes if James had left a portion of his estate to his grandchildren rather than to his children. (2 marks)

(c) Explain why it might be advantageous for inheritance tax purposes for a person to make lifetime gifts even when such gifts are made within seven years of death.

Notes:

1. Your answer should include a calculation of James’ inheritance tax saving from making the gift of property to the trust on 2 August 2013 rather than retaining the property until his death.

2. You are not expected to consider lifetime exemptions in this part of the question. (2 marks)

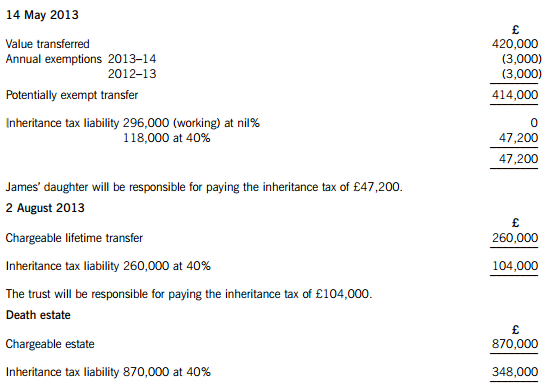

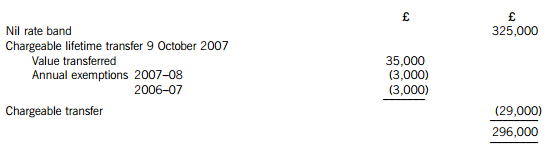

正确答案:(a) James – Inheritance tax arising on death

Lifetime transfers within seven years of death

The personal representatives of James’ estate will be responsible for paying the inheritance tax of £348,000.

Working – Available nil rate band

(b) Skipping a generation avoids a further charge to inheritance tax when the children die. Gifts will then only be taxed once before being inherited by the grandchildren, rather than twice.

(c) (1) Even if the donor does not survive for seven years, taper relief will reduce the amount of IHT payable after three years.

(2) The value of potentially exempt transfers and chargeable lifetime transfers are fixed at the time they are made.

(3) James therefore saved inheritance tax of £20,000 ((310,000 – 260,000) at 40%) by making the lifetime gift of property.

-

第13题:

(ii) Calculate her income tax (IT) and national insurance (NIC) payable for the year of assessment 2006/07.

(4 marks)

正确答案:

-

第14题:

(b) (i) Calculate the inheritance tax (IHT) that will be payable if Debbie were to die today (8 June 2005).

Assume that no tax planning measures are taken and that there has been no change in the value of any

of the assets since David’s death. (4 marks)

正确答案:

-

第15题:

(ii) Explain the income tax (IT), national insurance (NIC) and capital gains tax (CGT) implications arising on

the grant to and exercise by an employee of an option to buy shares in an unapproved share option

scheme and on the subsequent sale of these shares. State clearly how these would apply in Henry’s

case. (8 marks)

正确答案:

(ii) Exercising of share options

The share option is not part of an approved scheme, and will not therefore enjoy the benefits of such a scheme. There

are three events with tax consequences – grant, exercise and sale.

Grant. If shares or options over shares are sold or granted at less than market value, an income tax charge can arise on

the difference between the price paid and the market value. [Weight v Salmon]. In addition, if options can be exercised

more than 10 years after the date of the grant, an employment income charge can arise. This is based on the market

value at the date of grant less the grant and exercise priced.

In Henry’s case, the options were issued with an exercise price equal to the then market value, and cannot be exercised

more than 10 years from the grant. No income tax charge therefore arises on grant.

Exercise. On exercise, the individual pays the agreed amount in return for a number of shares in the company. The price

paid is compared with the open market value at that time, and if less, the difference is charged to income tax. National

insurance also applies, and the company has to pay Class 1 NIC. If the company and shareholder agree, the national

insurance can be passed onto the individual, and the liability becomes a deductible expense in calculating the income

tax charge.

In Henry’s case on exercise, the difference between market value (£14) and the price paid (£1) per share will be taxed

as income. Therefore, £130,000 (10,000 x (£14 – £1)) will be taxed as income. In addition, national insurance will

be chargeable on the company at 12·8% (£16,640) and on Henry at the rate of 1% (£1,300).

Sale. The base cost of the shares is taken to be the market value at the time of exercise. On the sale of the shares, any

gain or loss arising falls under the capital gains tax rules, and CGT will be payable on any gain. Business asset taper

relief will be available as the company is an unquoted trading company, but the relief will only run from the time that

the share options are exercised – i.e. from the time when the shares were acquired.

In Henry’s case, the sale of the shares will immediately follow the exercise of the option (6 days later). The sale proceeds

and the market value at the time of exercise are likely to be similar; thus little to no gain is likely to arise. -

第16题:

(d) Explain how Gloria would be taxed in the UK on the dividends paid by Bubble Inc and the capital gains tax

and inheritance tax implications of a future disposal of the shares. Clearly state, giving reasons, whether or

not the payment made to Eric is allowable for capital gains tax purposes. (9 marks)

You should assume that the rates and allowances for the tax year 2005/06 apply throughout this question.

正确答案:

(d) UK tax implications of shares in Bubble Inc

Income tax

Gloria is UK resident and is therefore subject to income tax on her worldwide income. However, because she is non-UK

domiciled, she will only be taxed on the foreign dividends she brings into the UK.

Dividends brought into the UK will be grossed up for any tax paid in Oceania. The gross amount is taxed at 10% if it falls

into the starting or basic rate band and at 321/2% if it falls into the higher rate band. The tax suffered in Oceania is available

for offset against the UK tax liability. The offset is restricted to a maximum of the UK tax on the dividend income.

Capital gains tax

Individuals are subject to capital gains tax on worldwide assets if they are resident or ordinarily resident in the UK. However,

because Gloria is non-UK domiciled and the shares are situated abroad, the gain is only taxable to the extent that the sales

proceeds are brought into the UK. Any tax suffered in Oceania in respect of the gain is available for offset against the UK

capital gains tax liability arising on the shares.

Any loss arising on the disposal of the shares would not be available for relief in the UK.

In computing a capital gain or allowable loss, a deduction is available for the incidental costs of acquisition. However, to be

allowable, such costs must be incurred wholly and exclusively for the purposes of acquiring the asset. The fee paid to Eric

related to general investment advice and not to the acquisition of the shares and therefore, would not be deductible in

computing the gain.

Taper relief will be at non-business asset rates as Bubble Inc is an investment company.

Inheritance tax

Assets situated abroad owned by non-UK domiciled individuals are excluded property for the purposes of inheritance tax.

However, Gloria will be deemed to be UK domiciled (for the purposes of inheritance tax only) if she has been resident in the

UK for 17 out of the 20 tax years ending with the year in which the disposal occurs.

Gloria has been running a business in the UK since June 1992 and would therefore, appear to have been resident for at least

15 tax years (1992/93 to 2006/07 inclusive).

If Gloria is deemed to be UK domiciled such that the shares in Bubble Inc are not excluded property, business property relief

will not be available because Bubble Inc is an investment company. -

第17题:

(b) (i) State the condition that would need to be satisfied for the exercise of Paul’s share options in Memphis

plc to be exempt from income tax and the tax implications if this condition is not satisfied.

(2 marks)

正确答案:

(b) (i) Paul has options in an HMRC approved share scheme. Under such schemes, no tax liabilities arise either on the grant

or exercise of the option. The excess of the proceeds over the price paid for the shares (the exercise price) is charged to

capital gains tax on their disposal.

However, in order to secure this treatment, one of the conditions to be satisfied is that the options cannot be exercised

within three years of the date of grant. If Paul were to exercise his options now (i.e. before the third anniversary of the

grant), the exercise would instead be treated as an unapproved exercise. At that date, income tax would be charged on

the difference between the market value of the shares on exercise and the price paid to exercise the option. -

第18题:

(iii) State how your answer in (ii) would differ if the sale were to be delayed until August 2006. (3 marks)

正确答案:

-

第19题:

(c) (i) Explain the inheritance tax (IHT) implications and benefits of Alvaro Pelorus varying the terms of his

father’s will such that part of Ray Pelorus’s estate is left to Vito and Sophie. State the date by which a

deed of variation would need to be made in order for it to be valid; (3 marks)

正确答案:

(c) (i) Variation of Ray’s will

The variation by Alvaro of Ray’s will, such that assets are left to Vito and Sophie, will not be regarded as a gift by Alvaro.

Instead, provided the deed states that it is intended to be effective for IHT purposes, it will be as if Ray had left the assets

to the children in his will.

This strategy, known as skipping a generation, will have no effect on the IHT due on Ray’s death but will reduce the

assets owned by Alvaro and thus his potential UK IHT liability. A deed of variation is more tax efficient than Alvaro

making gifts to the children as such gifts would be PETs and IHT may be due if Alvaro were to die within seven years.

The deed of variation must be entered into by 31 January 2009, i.e. within two years of the date of Ray’s death. -

第20题:

(ii) Advise Mr Fencer of the income tax implications of the proposed financing arrangements. (2 marks)

正确答案:

(ii) The income tax implications of the proposed financing arrangements

Mr Fencer has borrowed money from a UK bank in order to make a loan to Rapier Ltd, a close company. The interest

paid by Mr Fencer to the bank will be an allowable charge on income as long as he continues to hold more than 5% of

Rapier Ltd. Charges on income are deductible in arriving at an individual’s statutory total income.

Mr Fencer will receive interest from Rapier Ltd net of 20% income tax. The gross amount of interest will be subject to

income tax at either 10%, 20% or 40% depending on whether the income falls into Mr Fencer’s starting rate, basic rate

or higher rate tax band. Mr Fencer will obtain a tax credit for the 20% income tax suffered at source. -

第21题:

(b) State the immediate tax implications of the proposed gift of the share portfolio to Avril and identify an

alternative strategy that would achieve Crusoe’s objectives whilst avoiding a possible tax liability in the

future. State any deadline(s) in connection with your proposed strategy. (5 marks)

正确答案:

(b) Gift of the share portfolio to Avril

Inheritance tax

The gift would be a potentially exempt transfer at market value. No inheritance tax would be due at the time of the gift.

Capital gains tax

The gift would be a disposal by Crusoe deemed to be made at market value for the purposes of capital gains tax. No gain

would arise as the deemed proceeds will equal Crusoe’s base cost of probate value.

Stamp duty

There is no stamp duty on a gift of shares for no consideration.

Strategy to avoid a possible tax liability in the future

Crusoe should enter into a deed of variation directing the administrators to transfer the shares to Avril rather than to him. This

will not be regarded as a gift by Crusoe. Instead, provided the deed states that it is intended to be effective for inheritance tax

purposes, it will be as if Noland had left the shares to Avril in a will.

This strategy is more tax efficient than Crusoe gifting the shares to Avril as such a gift would be a potentially exempt transfer

and inheritance tax may be due if Crusoe were to die within seven years.

The deed of variation must be entered into by 1 October 2009, i.e. within two years of the date of Noland’s death. -

第22题:

(ii) Explain why Galileo is able to pay the inheritance tax due in instalments, state when the instalments are

due and identify any further issues relevant to Galileo relating to the payments. (3 marks)

正确答案:

(ii) Payment by instalments

The inheritance tax can be paid by instalments because Messier Ltd is an unquoted company controlled by Kepler at

the time of the gift and is still unquoted at the time of his death.

The tax is due in ten equal annual instalments starting on 30 November 2008.

Interest will be charged on any instalments paid late; otherwise the instalments will be interest free because Messier is

a trading company that does not deal in property or financial assets.

All of the outstanding inheritance tax will become payable if Galileo sells the shares in Messier Ltd.

Tutorial note

Candidates were also given credit for stating that payment by instalments is available because the shares represent at

least 10% of the company’s share capital and are valued at £20,000 or more. -

第23题:

(ii) The recoverability of the deferred tax asset. (4 marks)

正确答案:

(ii) Principal audit procedures – recoverability of deferred tax asset

– Obtain a copy of Bluebell Co’s current tax computation and deferred tax calculations and agree figures to any

relevant tax correspondence and/or underlying accounting records.

– Develop an independent expectation of the estimate to corroborate the reasonableness of management’s estimate.

– Obtain forecasts of profitability and agree that there is sufficient forecast taxable profit available for the losses to be

offset against. Evaluate the assumptions used in the forecast against business understanding. In particular consider

assumptions regarding the growth rate of taxable profit in light of the underlying detrimental trend in profit before

tax.

– Assess the time period it will take to generate sufficient profits to utilise the tax losses. If it is going to take a number

of years to generate such profits, it may be that the recognition of the asset should be restricted.

– Using tax correspondence, verify that there is no restriction on the ability of Bluebell Co to carry the losses forward

and to use the losses against future taxable profits.

Tutorial note: in many tax jurisdictions losses can only be carried forward to be utilised against profits generated

from the same trade. Although in the scenario there is no evidence of such a change in trade, or indeed any kind

of restriction on the use of losses, it is still a valid audit procedure to verify that this is the case