(d) Advise on any lifetime inheritance tax (IHT) planning that could be undertaken in respect of both Stuart andRebecca to help reduce the potential inheritance tax (IHT) liability calculated in (c) above. (7 marks)Relevant retail price index figures are:

题目

(d) Advise on any lifetime inheritance tax (IHT) planning that could be undertaken in respect of both Stuart and

Rebecca to help reduce the potential inheritance tax (IHT) liability calculated in (c) above. (7 marks)

Relevant retail price index figures are:

May 1994 144·7

April 1998 162·6

相似考题

更多“(d) Advise on any lifetime inheritance tax (IHT) planning that could be undertaken in respect of both Stuart andRebecca to help reduce the potential inheritance tax (IHT) liability calculated in (c) above. (7 marks)Relevant retail price index figures are:”相关问题

-

第1题:

(ii) State when the inheritance tax (IHT) calculated in (i) would be payable and by whom. (2 marks)

正确答案:

(ii) Inheritance tax administration

The tax on Debbie’s estate (personalty and realty) would be paid by the personal representatives, usually an executor.

Inheritance tax is due six months from the end of the month in which death occurred (31 December 2005) or the date

on which probate is obtained (if earlier). However, an instalment option is available for certain assets, which includes

land and buildings i.e. the residence whereby the tax can be paid in 10 equal annual instalments. -

第2题:

(c) State any reliefs Bob could claim regarding the fall in value of his shares in Willis Ltd, and describe how the

operation of any such reliefs could reduce Bob’s taxable income. (4 marks)

Relevant retail price index figures are:

September 1990 129·3

April 1998 162·6

December 2004 189·9

正确答案:

(c) Claims for capital losses

Where the value of shares (a chargeable asset) has become negligible (defined as <5% of the original cost), a claim can be

made to treat the asset as though it was sold and then immediately reacquired for its current market value. This is known as

a negligible value claim.

The sale and reacquisition is treated as taking place at the time that the claim is made or at a specified time (up to 2 years

before the start of the tax year in which the claim was made) if the asset was of negligible value at that time.

As the loss is on unquoted shares, a further relief (s.574 ICTA 1988) allows the loss to be relieved against the total income

of the taxpayer for the year in which the loss arose, and/or against the total income of the previous year.

Losses are first relieved against current year income, with any excess being available for offset against the prior year’s income.

Bob can therefore make a negligible value claim as at 1 December 2004. This will give rise to a loss of £14,500

(£500 – £15,000) which will be deemed to arise in the year 2004/05. By doing so, his taxable income for that year will be

reduced from £36,875 to £22,375. -

第3题:

(b) Mabel has two objectives when making the gifts to Bruce and Padma:

(1) To pay no tax on any gift in her lifetime; and

(2) To reduce the eventual liability to inheritance tax on her death.

Advise Mabel which item to gift to Bruce and to Padma in order to satisfy her objectives. Give reasons for

your advice.

Your advice should include a computation of the inheritance tax saved as a result of the two gifts, on the

assumption that Mabel dies on 30 June 2011. (10 marks)

正确答案:

-

第4题:

(ii) Advise Benny of the amount of tax he could save by delaying the sale of the shares by 30 days. For the

purposes of this part, you may assume that the benefit in respect of the furnished flat is £11,800 per

year. (3 marks)

正确答案:

-

第5题:

(c) (i) Compute Gloria’s capital gains tax liability for 2006/07 ignoring any claims or elections available to

reduce the liability. (3 marks)

正确答案:

-

第6题:

(ii) Assuming the relief in (i) is available, advise Sharon on the maximum amount of cash she could receive

on incorporation, without triggering a capital gains tax (CGT) liability. (3 marks)

正确答案:

(ii) As Sharon is entitled to the full rate of business asset taper relief, any gain will be reduced by 75%. The position is

maximised where the chargeable gain equals Sharon’s unused capital gains tax annual exemption of £8,500. Thus,

before taper relief, the gain she requires is £34,000 (1/0·25 x £8,500).

The amount to be held over is therefore £46,000 (80,000 – 34,000). Where part of the consideration is in the form

of cash, the gain eligible for incorporation relief is calculated using the formula:

Gain deferred = Gain x value of shares issued/total consideration

The formula is manipulated on the following basis:

£46,000 = £80,000 x (shares/120,000)

Shares/120,000 = £46,000/80,000

Shares = £46,000 x 120,000/80,000

i.e. £69,000.

As the total consideration is £120,000, this means that Sharon can take £51,000 (£120,000 – £69,000) in cash

without any CGT consequences. -

第7题:

(c) Explain the capital gains tax (CGT) and income tax (IT) issues Paul and Sharon should consider in deciding

which form. of trust to set up for Gisella and Gavin. You are not required to consider inheritance tax (IHT) or

stamp duty land tax (SDLT) issues. (10 marks)

You should assume that the tax rates and allowances for the tax year 2005/06 apply throughout this question.

正确答案:

(c) As the trust is created in the settlors’ (Paul and Sharon’s) lifetime its creation will constitute a chargeable disposal for capital

gains tax. Also, as the settlors and trustees are connected persons, the disposal will be deemed to be at market value, resulting

in a chargeable gain of £80,000 (160,000 – 80,000). No taper relief will be available as the property is a non-business

asset, and has been held for less than three years, but annual exemptions of £17,000 (2 x £8,500) will be available.

However, in the case of a discretionary trust, gift hold over relief will be available. This is because the gift will constitute a

chargeable lifetime transfer and because there is an immediate charge to inheritance tax (even though no tax is payable due

to the nil rate band) relief is available if a specific accumulation and maintenance trust is used, as in this case the gift will

qualify as a potentially exempt transfer and so gift relief would only be available in respect of business assets. The use of a

basic discretionary trust will thus facilitate the deferral of an immediate capital gains tax charge of £25,200 (63,000 x 40%).

If/when the property is disposed of, however, the trustees will pay capital gains tax on the deferred gain at the trust income

tax rate of 40%, and have an annual exemption of only £4,250 (50% of the normal individual rate) available to them. The

40% rate of tax and lower annual exemption rate also apply to chargeable gains arising in a specific accumulation and

maintenance trust, as well as a basic discretionary trust.

A chargeable disposal between connected persons will also arise for the purposes of capital gains tax if/when the property

vests in a beneficiary, i.e. one or more of the beneficiaries becomes absolutely entitled to all or part of the income or capital

of the trust. Gift hold over relief will again be available on all assets in the case of a discretionary trust, but only on business

assets in the case of an accumulation and maintenance trust, except where a beneficiary becomes entitled to both income

and capital at the same time.

The trust will have taxable property income in the form. of net rents from its creation and in future years is also likely to have

other investment income, probably in the form. of interest, to the extent that monies are retained in the trust. Whichever form

of trust is used, the trustees will pay tax at the standard trust rate of 40% on income other than dividend income (32·5%),

except to the extent of (1) the first £500 of taxable income, which is taxed at the rate that would otherwise apply to such

income (i.e. 22% for non-savings (rental) income, 20% for savings income (interest) and 10% for dividends) but, only to the

extent that it is not distributed; and (2) the legitimate trust management expenses, which are offsettable for the purposes of

the higher trust tax rates against the income with the lowest rate(s) of normal tax and so bear tax only at that rate. The higher

trust tax rate always applies to income that is distributed, other than to the extent that it has been treated as the settlor’s

income, and taxed at that settlor’s marginal tax rate.

As Paul and Sharon intend to create a trust for their unmarried minor (under 18) children, then even if the trust specifically

excludes them from any benefit under the trust, the trust income will be treated as theirs for income tax purposes to the extent

that it constitutes income paid for on behalf (including maintenance payments) of Gisella and Gavin; except where (1) the

total income arising does not exceed £100 gross per annum, and (2) income is held for the benefit of a child under an

accumulation and maintenance settlement, to the extent that it is not paid out. -

第8题:

(c) (i) Explain the inheritance tax (IHT) implications and benefits of Alvaro Pelorus varying the terms of his

father’s will such that part of Ray Pelorus’s estate is left to Vito and Sophie. State the date by which a

deed of variation would need to be made in order for it to be valid; (3 marks)

正确答案:

(c) (i) Variation of Ray’s will

The variation by Alvaro of Ray’s will, such that assets are left to Vito and Sophie, will not be regarded as a gift by Alvaro.

Instead, provided the deed states that it is intended to be effective for IHT purposes, it will be as if Ray had left the assets

to the children in his will.

This strategy, known as skipping a generation, will have no effect on the IHT due on Ray’s death but will reduce the

assets owned by Alvaro and thus his potential UK IHT liability. A deed of variation is more tax efficient than Alvaro

making gifts to the children as such gifts would be PETs and IHT may be due if Alvaro were to die within seven years.

The deed of variation must be entered into by 31 January 2009, i.e. within two years of the date of Ray’s death. -

第9题:

(c) The inheritance tax payable by Adam in respect of the gift from his aunt. (4 marks)

Additional marks will be awarded for the appropriateness of the format and presentation of the memorandum and

the effectiveness with which the information is communicated. (2 marks)

Note: you should assume that the tax rates and allowances for the tax year 2006/07 will continue to apply for the

foreseeable future.

正确答案:

(c) Inheritance tax payable by Adam

The gift by AS’s aunt was a potentially exempt transfer. No tax will be due if she lives until 1 June 2014 (seven years after

the date of the gift).

The maximum possible liability, on the assumption that there are no annual exemptions or nil band available, is £35,216

(£88,040 x 40%). This will only arise if AS’s aunt dies before 1 June 2010.

The maximum liability will be reduced by taper relief of 20% for every full year after 31 May 2010 for which AS’s aunt lives.

The liability will also be reduced if the chargeable transfers made by the aunt in the seven years prior to 1 June 2007 are

less than £285,000 or if the annual exemption for 2006/07 and/or 2007/08 is/are available. -

第10题:

(b) Calculate the amount of input tax that will be recovered by Vostok Ltd in respect of the new premises in the

year ending 31 March 2009 and explain, using illustrative calculations, how any additional recoverable input

tax will be calculated in future years. (5 marks)

正确答案:

(b) Recoverable input tax in respect of new premises

Vostok Ltd will recover £47,880 (£446,500 x 7/47 x 72%) in the year ending 31 March 2009.

The capital goods scheme will apply to the purchase of the building because it is to cost more than £250,000. Under the

scheme, the total amount of input tax recovered reflects the use of the building over the period of ownership, up to a maximum

of ten years, rather than merely the year of purchase.

Further input tax will be recovered in future years as the percentage of exempt supplies falls. (If the percentage of exempt

supplies were to rise, Vostok Ltd would have to repay input tax to HMRC.)

The additional recoverable input tax will be computed by reference to the percentage of taxable supplies in each year including

the year of sale. For example, if the percentage of taxable supplies in a particular subsequent year were to be 80%, the

additional recoverable input tax would be computed as follows.

£446,500 x 7/47 x 1/10 x (80% – 72%) = £532.

Further input tax will be recovered in the year of sale as if Vostok Ltd’s supplies in the remaining years of the ten-year period

are fully vatable. For example, if the building is sold in year seven, the additional recoverable amount for the remaining three

years will be calculated as follows.

£446,500 x 7/47 x 1/10 x (100% – 72%) x 3 = £5,586. -

第11题:

(ii) Write a letter to Donald advising him on the most tax efficient manner in which he can relieve the loss

incurred in the year to 31 March 2007. Your letter should briefly outline the types of loss relief available

and explain their relative merits in Donald’s situation. Assume that Donald will have no source of income

other than the business in the year of assessment 2006/07 and that any income he earned on a parttime

basis while at university was always less than his annual personal allowance. (9 marks)

Assume that the corporation tax rates and allowances for the financial year 2004 and the income tax rates

and allowances for 2004/05 apply throughout this question.

Relevant retail price index figures are:

January 1998 159·5

April 1998 162·6

正确答案:(ii) [Donald’s address] [Firm’s address]

Dear Donald [Date]

I understand that you have incurred a tax loss in your first year of trading. The following options are available in respect

of this loss.

1. The first option is to use the trading loss against other forms of income in the same year. If such a claim is made,

losses are offset against income before personal allowances.

Any excess loss can still be offset against capital gains of the year. However, any offset against capital gains is

before both taper relief and annual exemptions.

-

第12题:

问答题Inheritance tax is a tax which many countries levy on the total taxable value of the estate of a deceased person. Inheritance tax is paid by the inheritor of the estate or by the person in charge of its assets. In most cases, if the estate is left to a charitable organization or a surviving spouse, no inheritance tax is due. In China, inheritance tax does not exist. Should inheritance tax be introduced to China? The controversy that has raged over levying inheritance tax in China currently shows little sign of abating. The following are opinions from both sides. Read the excerpt carefully and write your response in about 300 words, in which you should: 1. summarize briefly the opinions from both sides, and then 2. give your comment. Marks will be awarded for content relevance, content sufficiency, organization and language quality. Failure to follow the above instructions may result in a loss of marks. Opponents of inheritance tax typically refer to it as “death tax.” They argue first that concern over burdening their children with this tax may lead elderly to make unwise investment decisions late in life, and that it may also discourage entrepreneurship earlier in life. Opponents also claim that morally it should be only the choice of the person who earned the money what should be done with it, not the government. They see taxing wealth at death as a kind of forced income redistribution that goes against the market economy. Proponents of inheritance tax say that it helps prevent consolidation of wealth in the hands of a few powerful families and is a basic building block of the nation’s system of taxation. They also feel that inheriting large sums without tax undermines people’s motives to work hard in the future and, thus, undercuts the principles of the market economy, encouraging people to become idle and unproductive, which hurts the country overall.正确答案:

【参考范文】

Should Inheritance Tax be Introduced to China? An inheritance tax is a tax paid by a person who inherits money or property or a levy on the estate of a person who has died. Many countries have inheritance tax, while China does not. Whether China should levy inheritance tax has become a hot topic of discussion. Supporters hold that it helps prevent the wealth from being always in the hands of a few powerful families. Inheriting large sums without tax weakens people’s enthusiasm for work, encouraging people to become lazy and unproductive, which is not conducive to the whole country. However, opponents argue that this tax may result in unwise investment decisions late in life, and discourage entrepreneurship earlier in life. It is a kind of forced income redistribution, ignoring the right of people earned the money.

From my points of view, inheritance tax should not be introduced to China. Firstly, it is a violation of human rights. In any country that has recognized the private property rights, a person’s private property can be handled without violating others all a person likes. The inheritance tax violates the rights of the people to dispose of their property. Secondly, inheritance tax will encourage abnormal consumption, conspicuous consumption of rich people, further intensifying contradictions and conflicts among social members. It may stimulate the rich to spend their money excessively before death and lead to hostility to the rich. Thirdly, inheritance tax will reduce the enthusiasm of entrepreneurs, exacerbate capital flight, economic migration and impede investment and capital inflows, inhibiting economic development. It may drive wealthy people to move assets out of the country or emigrate in order to avoid the tax, resulting in capital loss and brain drain.

To summarize, inheritance tax might not be an effective enough tool to narrow income disparity. Therefore, other measures are needed if the government wants to ensure a more equitable distribution of wealth in society.解析:

【审题构思】

本题要求考生围绕是否应该征收遗产税这一话题展开讨论。文章可以支持也可以反对,只要言之有理即可。考生首先要总结材料中的观点,然后明确陈述自己的观点。接下来论证自己的观点,注意要分点列举,这样才能做到内容充实,条理清晰。最后总结全文,重申观点;也可进一步补充观点,深化主题。 -

第13题:

(c) Assuming that she will survive until July 2009, advise on the lifetime inheritance tax (IHT) planning

measures that could be undertaken by Debbie, quantifying the savings that can be made. (7 marks)

For this question you should assume that the rates and allowances for 2004/05 apply throughout.

正确答案:

(c) Debbie survives until July 2009

Debbie should consider giving away some of her assets to her children, while ensuring that she still has enough to live on.

Such gifts would be categorised as PETs. Although Debbie will not survive seven years (at which point the gifts would fall out

of Debbie’s estate for IHT purposes), taper relief will reduce the amount chargeable to IHT. If gifts were made prior to July

2005, 40% taper relief would be available.

It is important to remember that Debbie’s annual exemptions will reduce the value of any PET when assets are gifted. Debbie

has not used her annual exemption for the last two years, and so she can gift £6,000 (2 x £3,000) in the current tax year

as well as £3,000 per year in future tax years. Debbie could therefore give away £18,000, saving tax of £7,200 (£18,000

x 40%). Debbie can also make small exempt gifts of up to £250 per donee per year.

Debbie should consider making gifts to Allison’s children instead of Allison (using, for example, an accumulation &

maintenance trust). This would ensure that the gifts were excluded from Allison’s estate.

It does not make sense for Debbie to gift shares in Dee Limited, as these qualify for full business property relief and therefore

are not subject to IHT.

As Andrew is shortly to be married, Debbie could give up to £5,000 in consideration of his marriage. This would save £2,000

in IHT.

Expenditure out of normal income is also exempt from IHT. This is where the transferor is left with sufficient income to

maintain his/her usual standard of living. Broadly, you need to demonstrate evidence of a prior commitment, or a settled

pattern of expenditure.

If substantial gifts are made, the donees would be advised to consider taking out insurance policies on Debbie’s life to cover

the potential tax liabilities that may arise on PETs in the event of her early death. -

第14题:

(c) Advise Alan on the proposed disposal of the shares in Mobile Ltd. Your answer should include calculations

of the potential capital gain, and explain any options available to Alan to reduce this tax liability. (7 marks)

正确答案:

However, an exemption from corporation tax exists for any gain arising when a trading company (or member of a trading

group) sells the whole or any part of a substantial shareholding in another trading company.

A substantial shareholding is one where the investing company holds 10% of the ordinary share capital and is beneficially

entitled to at least 10% of the

(i) profits available for distribution to equity holders and

(ii) assets of the company available for distribution to equity holders on a winding up.

In meeting the 10% test, shares owned by a chargeable gains group may be amalgamated. The 10% test must have been

met for a continuous 12 month period during the 2 years preceding the disposal.

The companies making the disposals must have been trading companies (or members of a trading group) throughout the

12 month period, as well as at the date of disposal. In addition, they must also be trading companies (or members of a trading

group) immediately after the disposal.

The exemption is given automatically, and acts to deny losses as well as eliminate gains.

While Alantech Ltd has owned its holding in Mobile Ltd for 33 months, its ownership of the Boron holding has only lasted

for 10 months (at 1 June 2005) since Boron was acquired on 1 July 2004. Selling the shares in June 2005 will fail the

12 month test, and the gain will become chargeable.

It would be better for the companies to wait for a further month until July 2005 before selling the amalgamated shareholding.

By doing so, they will both be able to take advantage of the substantial shareholdings relief, thereby saving tax of £29,625

assuming a corporation tax rate of 19%. -

第15题:

(c) Without changing the advice you have given in (b), or varying the terms of Luke’s will, explain how Mabel

could further reduce her eventual inheritance tax liability and quantify the tax saving that could be made.

(3 marks)

The increase in the retail prices index from April 1984 to April 1998 is 84%.

You should assume that the rates and allowances for the tax year 2005/06 will continue to apply for the

foreseeable future.

正确答案:

(c) Further advice

Mabel should consider delaying one of the gifts until after 1 May 2007 such that it is made more than seven years after the

gift to the discretionary trust. Both PETs would then be covered by the nil rate band resulting in a saving of inheritance tax

of £6,720 (from (b)).

Mabel should ensure that she uses her inheritance tax annual exemption of £3,000 every year by, say, making gifts of £1,500

each year to both Bruce and Padma. The effect of this will be to save inheritance tax of £1,200 (£3,000 x 40%) every year. -

第16题:

(ii) Compute the annual income tax saving from your recommendation in (i) above as compared with the

situation where Cindy retains both the property and the shares. Identify any other tax implications

arising from your recommendation. Your answer should consider all relevant taxes. (3 marks)

正确答案:

-

第17题:

(b) Calculate the inheritance tax (IHT) liability arising as a result of Christopher’s death. (11 marks)

正确答案:

-

第18题:

(ii) Calculate Paul’s tax liability if he exercises the share options in Memphis plc and subsequently sells the

shares in Memphis plc immediately, as proposed, and show how he may reduce this tax liability.

(4 marks)

正确答案:

-

第19题:

(ii) Advise Andrew of the tax implications arising from the disposal of the 7% Government Stock, clearly

identifying the tax year in which any liability will arise and how it will be paid. (3 marks)

正确答案:

(ii) Government stock is an exempt asset for the purposes of capital gains tax, however, as Andrew’s holding has a nominal

value in excess of £5,000, a charge to income tax will arise under the accrued income scheme. This charge to income

tax will arise in 2005/06, being the tax year in which the next interest payment following disposal falls due (20 April

2005) and it will relate to the income accrued for the period 21 October 2004 to 14 March 2005 of £279 (145/182

x £350). As interest on Government Stock is paid gross (unless the holder applies to receive it net), the tax due of £112

(£279 x 40%) will be collected via the self-assessment system and as the interest was an ongoing source of income

will be included within Andrew’s half yearly payments on account payable on 31 January and 31 July 2006. -

第20题:

(c) Calculate and explain the amount of income tax relief that Gerard will obtain in respect of the pension

contributions he proposes to make in the tax year 2007/08 and contrast this with how his position could be

improved by delaying some of the contributions that he could have made in 2007/08 until 2008/09. You

should include relevant supporting calculations and quantify the additional tax savings arising as a result of

your advice.

You should ignore the proposed changes to the bonus scheme for this part of this question and assume that

Gerard’s income will not change in 2008/09. (12 marks)

正确答案:

-

第21题:

(ii) Explain why Galileo is able to pay the inheritance tax due in instalments, state when the instalments are

due and identify any further issues relevant to Galileo relating to the payments. (3 marks)

正确答案:

(ii) Payment by instalments

The inheritance tax can be paid by instalments because Messier Ltd is an unquoted company controlled by Kepler at

the time of the gift and is still unquoted at the time of his death.

The tax is due in ten equal annual instalments starting on 30 November 2008.

Interest will be charged on any instalments paid late; otherwise the instalments will be interest free because Messier is

a trading company that does not deal in property or financial assets.

All of the outstanding inheritance tax will become payable if Galileo sells the shares in Messier Ltd.

Tutorial note

Candidates were also given credit for stating that payment by instalments is available because the shares represent at

least 10% of the company’s share capital and are valued at £20,000 or more. -

第22题:

(b) Given his recent diagnosis, advise Stuart as to which of the two proposed investments (Omikron plc/Omega

plc) would be the more tax efficient alternative. Give reasons for your choice. (3 marks)

正确答案:

(b) Both companies are listed. The only difference will be in the availability of inheritance tax relief – specifically business property

relief (BPR). If Stuart and Rebecca jointly hold in excess of 50% of the share capital of a listed company, BPR will apply at

the rate of 50%. Otherwise, no BPR is available.

Stuart can only buy 1,005,000 (£422,100/£0·42) shares in Omikron plc. This represents a shareholding of 2·00%

(1,005,000/50,250,000). As the shares in Omikron plc are listed, a 2% holding will not qualify for BPR.

At the moment, both Stuart and Rebecca own 2,400,000 shares in Omega plc. Their shareholdings are amalgamated for

IHT purposes under the related property rules. With a joint holding of 48%, BPR is not available. A further 200,001 shares

will be required to attain a 50% holding. Assuming Stuart and Rebecca can buy these shares, they must then hold their 50%

interest in the company for the period of at least two years in order to ensure that BPR applies.

On the basis that Stuart is expected to survive for two to three years, he should therefore buy further shares in Omega plc in

order to take advantage of the BPR available. -

第23题:

James died on 22 January 2015. He had made the following gifts during his lifetime:

(1) On 9 October 2007, a cash gift of £35,000 to a trust. No lifetime inheritance tax was payable in respect of this gift.

(2) On 14 May 2013, a cash gift of £420,000 to his daughter.

(3) On 2 August 2013, a gift of a property valued at £260,000 to a trust. No lifetime inheritance tax was payable in respect of this gift because it was covered by the nil rate band. By the time of James’ death on 22 January 2015, the property had increased in value to £310,000.

On 22 January 2015, James’ estate was valued at £870,000. Under the terms of his will, James left his entire estate to his children.

The nil rate band of James’ wife was fully utilised when she died ten years ago.

The nil rate band for the tax year 2007–08 is £300,000, and for the tax year 2013–14 it is £325,000.

Required:

(a) Calculate the inheritance tax which will be payable as a result of James’ death, and state who will be responsible for paying the tax. (6 marks)

(b) Explain why it might have been beneficial for inheritance tax purposes if James had left a portion of his estate to his grandchildren rather than to his children. (2 marks)

(c) Explain why it might be advantageous for inheritance tax purposes for a person to make lifetime gifts even when such gifts are made within seven years of death.

Notes:

1. Your answer should include a calculation of James’ inheritance tax saving from making the gift of property to the trust on 2 August 2013 rather than retaining the property until his death.

2. You are not expected to consider lifetime exemptions in this part of the question. (2 marks)

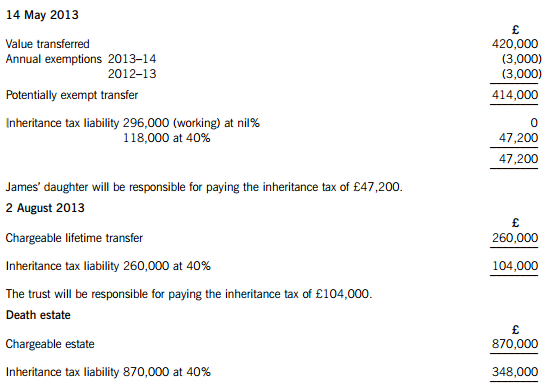

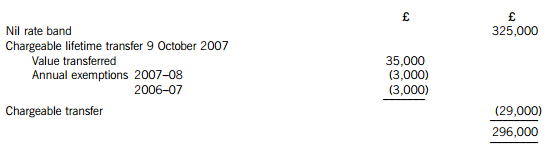

正确答案:(a) James – Inheritance tax arising on death

Lifetime transfers within seven years of death

The personal representatives of James’ estate will be responsible for paying the inheritance tax of £348,000.

Working – Available nil rate band

(b) Skipping a generation avoids a further charge to inheritance tax when the children die. Gifts will then only be taxed once before being inherited by the grandchildren, rather than twice.

(c) (1) Even if the donor does not survive for seven years, taper relief will reduce the amount of IHT payable after three years.

(2) The value of potentially exempt transfers and chargeable lifetime transfers are fixed at the time they are made.

(3) James therefore saved inheritance tax of £20,000 ((310,000 – 260,000) at 40%) by making the lifetime gift of property.