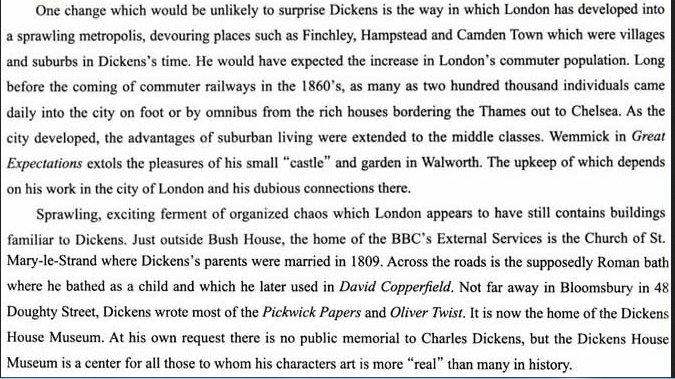

Text 1 The longest bull run in a century of artmarket history ended on a dramatic note with a sale of 56 works by Damien Hirst,Beautiful Inside My Head Forever,at Sotheby's in London on September 15th,2008.All but two pieces sold,fetching more than£70m,a

题目

By saying“spending of any sort became deeply unfashionable”(Para.3),the author suggests that____

B.people stopped every kind of spending and stayed away from galleries C.art collection as a fashion had lost its appeal to a great extent

C.works of art in general had gone out of fash

相似考题

更多“Text 1 The longest bull run in a century of artmarket history ended on a dramatic note with a sale of 56 works by Damien Hirst,Beautiful Inside My Head Forever,at Sotheby's in London on September 15t”相关问题

-

第1题:

(b) You are the audit manager of Jinack Co, a private limited liability company. You are currently reviewing two

matters that have been left for your attention on the audit working paper file for the year ended 30 September

2005:

(i) Jinack holds an extensive range of inventory and keeps perpetual inventory records. There was no full

physical inventory count at 30 September 2005 as a system of continuous stock checking is operated by

warehouse personnel under the supervision of an internal audit department.

A major systems failure in October 2005 caused the perpetual inventory records to be corrupted before the

year-end inventory position was determined. As data recovery procedures were found to be inadequate,

Jinack is reconstructing the year-end quantities through a physical count and ‘rollback’. The reconstruction

exercise is expected to be completed in January 2006. (6 marks)

Required:

Identify and comment on the implications of the above matters for the auditor’s report on the financial

statements of Jinack Co for the year ended 30 September 2005 and, where appropriate, the year ending

30 September 2006.

NOTE: The mark allocation is shown against each of the matters.

正确答案:

(b) Implications for the auditor’s report

(i) Corruption of perpetual inventory records

■ The loss of data (of physical inventory quantities at the balance sheet date) gives rise to a limitation on scope.

Tutorial note: It is the records of the asset that have been destroyed – not the physical asset.

■ The systems failure in October 2005 is clearly a non-adjusting post balance sheet event (IAS 10). If it is material

(such that non-disclosure could influence the economic decisions of users) Jinack should disclose:

– the nature of the event (i.e. systems failure); and

– an estimate of its financial effect (i.e. the cost of disruption and reconstruction of data to the extent that it is

not covered by insurance).

Tutorial note: The event has no financial effect on the realisability of inventory, only on its measurement for the

purpose of reporting it in the financial statements.

■ If material this disclosure could be made in the context of explaining how inventory has been estimated at

30 September 2005 (see later). If such disclosure, that the auditor considers to be necessary, is not made, the

audit opinion should be qualified ‘except for’ disagreement (over lack of disclosure).

Tutorial note: Such qualifications are extremely rare since management should be persuaded to make necessary

disclosure in the notes to the financial statements rather than have users’ attention drawn to the matter through

a qualification of the audit opinion.

■ The limitation on scope of the auditor’s work has been imposed by circumstances. Jinack’s accounting records

(for inventory) are inadequate (non-existent) for the auditor to perform. tests on them.

■ An alternative procedure to obtain sufficient appropriate audit evidence of inventory quantities at a year end is

subsequent count and ‘rollback’. However, the extent of ‘roll back’ testing is limited as records are still under

reconstruction.

■ The auditor may be able to obtain sufficient evidence that there is no material misstatement through a combination

of procedures:

– testing management’s controls over counting inventory after the balance sheet date and recording inventory

movements (e.g. sales and goods received);

– reperforming the reconstruction for significant items on a sample basis;

– analytical procedures such as a review of profit margins by inventory category.

■ ‘An extensive range of inventory’ is clearly material. The matter (i.e. systems failure) is not however pervasive, as

only inventory is affected.

■ Unless the reconstruction is substantially completed (i.e. inventory items not accounted for are insignificant) the

auditor cannot determine what adjustment, if any, might be determined to be necessary. The auditor’s report

should then be modified, ‘except for’, limitation on scope.

■ However, if sufficient evidence is obtained the auditor’s report should be unmodified.

■ An ‘emphasis of matter’ paragraph would not be appropriate because this matter is not one of significant

uncertainty.

Tutorial note: An uncertainty in this context is a matter whose outcome depends on future actions or events not

under the direct control of Jinack.

2006

■ If the 2005 auditor’s report is qualified ‘except for’ on grounds of limitation on scope there are two possibilities for

the inventory figure as at 30 September 2005 determined on completion of the reconstruction exercise:

(1) it is not materially different from the inventory figure reported; or

(2) it is materially different.

■ In (1), with the limitation now removed, the need for qualification is removed and the 2006 auditor’s report would

be unmodified (in respect of this matter).

■ In (2) the opening position should be restated and the comparatives adjusted in accordance with IAS 8 ‘Accounting

Policies, Changes in Accounting Estimates and Errors’. The 2006 auditor’s report would again be unmodified.

Tutorial note: If the error was not corrected in accordance with IAS 8 it would be a different matter and the

auditor’s report would be modified (‘except for’ qualification) disagreement on accounting treatment. -

第2题:

(b) Seymour offers health-related information services through a wholly-owned subsidiary, Aragon Co. Goodwill of

$1·8 million recognised on the purchase of Aragon in October 2004 is not amortised but included at cost in the

consolidated balance sheet. At 30 September 2006 Seymour’s investment in Aragon is shown at cost,

$4·5 million, in its separate financial statements.

Aragon’s draft financial statements for the year ended 30 September 2006 show a loss before taxation of

$0·6 million (2005 – $0·5 million loss) and total assets of $4·9 million (2005 – $5·7 million). The notes to

Aragon’s financial statements disclose that they have been prepared on a going concern basis that assumes that

Seymour will continue to provide financial support. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Seymour Co for the year ended

30 September 2006.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(b) Goodwill

(i) Matters

■ Cost of goodwill, $1·8 million, represents 3·4% consolidated total assets and is therefore material.

Tutorial note: Any assessments of materiality of goodwill against amounts in Aragon’s financial statements are

meaningless since goodwill only exists in the consolidated financial statements of Seymour.

■ It is correct that the goodwill is not being amortised (IFRS 3 Business Combinations). However, it should be tested

at least annually for impairment, by management.

■ Aragon has incurred losses amounting to $1·1 million since it was acquired (two years ago). The write-off of this

amount against goodwill in the consolidated financial statements would be material (being 61% cost of goodwill,

8·3% PBT and 2·1% total assets).

■ The cost of the investment ($4·5 million) in Seymour’s separate financial statements will also be material and

should be tested for impairment.

■ The fair value of net assets acquired was only $2·7 million ($4·5 million less $1·8 million). Therefore the fair

value less costs to sell of Aragon on other than a going concern basis will be less than the carrying amount of the

investment (i.e. the investment is impaired by at least the amount of goodwill recognised on acquisition).

■ In assessing recoverable amount, value in use (rather than fair value less costs to sell) is only relevant if the going

concern assumption is appropriate for Aragon.

■ Supporting Aragon financially may result in Seymour being exposed to actual and/or contingent liabilities that

should be provided for/disclosed in Seymour’s financial statements in accordance with IAS 37 Provisions,

Contingent Liabilities and Contingent Assets.

(ii) Audit evidence

■ Carrying values of cost of investment and goodwill arising on acquisition to prior year audit working papers and

financial statements.

■ A copy of Aragon’s draft financial statements for the year ended 30 September 2006 showing loss for year.

■ Management’s impairment test of Seymour’s investment in Aragon and of the goodwill arising on consolidation at

30 September 2006. That is a comparison of the present value of the future cash flows expected to be generated

by Aragon (a cash-generating unit) compared with the cost of the investment (in Seymour’s separate financial

statements).

■ Results of any impairment tests on Aragon’s assets extracted from Aragon’s working paper files.

■ Analytical procedures on future cash flows to confirm their reasonableness (e.g. by comparison with cash flows for

the last two years).

■ Bank report for audit purposes for any guarantees supporting Aragon’s loan facilities.

■ A copy of Seymour’s ‘comfort letter’ confirming continuing financial support of Aragon for the foreseeable future. -

第3题:

A

I'm Joe. I-m twelve years old. I like September very much. September 9th is my birthday, and my father's birthday is in September,too.We have a birthday party ev-ery year. Teachers Day is in September, too. And I can play with all my teachers. So September is my favorite. What about you?

( )21.1t is Joe's________ birthday this year.

A. twelve

B.twelfth

C. ninth

D. nine

正确答案:B

-

第4题:

Kamil argued that Europe had the longest history.()

参考答案:错误

-

第5题:

My old classmate, Comrade Sun, works at ______.Aa teacher college

Ba teacher’s college

Ca teachers’s college

Da college of a teacher’s

正确答案:B

-

第6题:

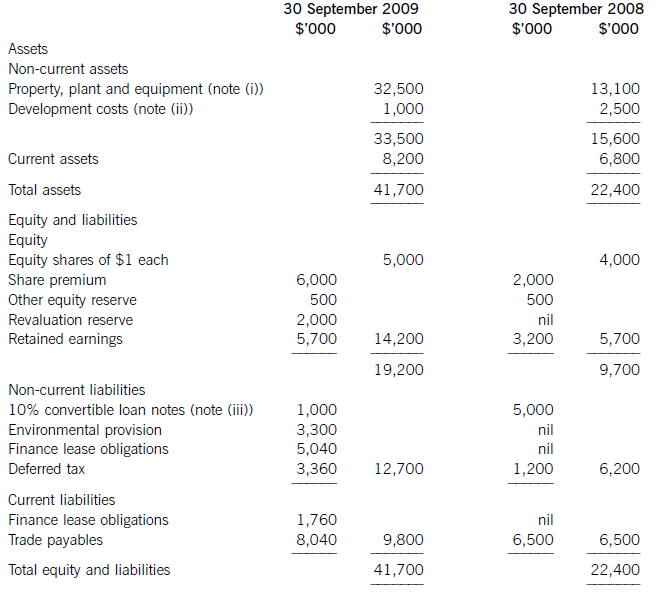

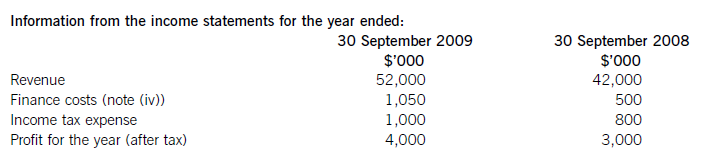

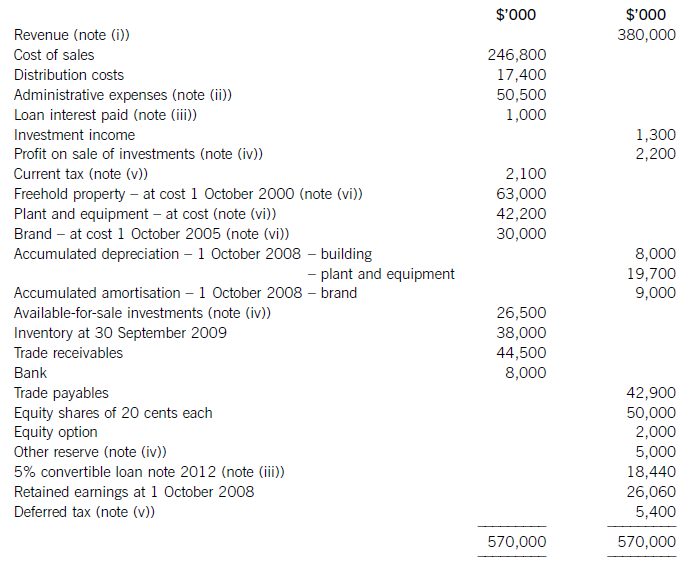

(a) The following information relates to Crosswire a publicly listed company.

Summarised statements of financial position as at:

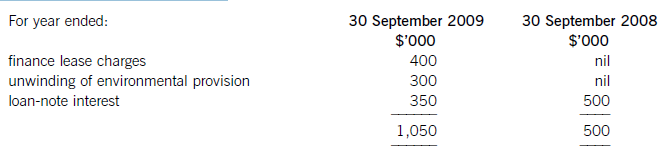

The following information is available:

(i) During the year to 30 September 2009, Crosswire embarked on a replacement and expansion programme for its non-current assets. The details of this programme are:

On 1 October 2008 Crosswire acquired a platinum mine at a cost of $5 million. A condition of mining the

platinum is a requirement to landscape the mining site at the end of its estimated life of ten years. The

present value of this cost at the date of the purchase was calculated at $3 million (in addition to the

purchase price of the mine of $5 million).

Also on 1 October 2008 Crosswire revalued its freehold land for the first time. The credit in the revaluation

reserve is the net amount of the revaluation after a transfer to deferred tax on the gain. The tax rate applicable to Crosswire for deferred tax is 20% per annum.

On 1 April 2009 Crosswire took out a finance lease for some new plant. The fair value of the plant was

$10 million. The lease agreement provided for an initial payment on 1 April 2009 of $2·4 million followed

by eight six-monthly payments of $1·2 million commencing 30 September 2009.

Plant disposed of during the year had a carrying amount of $500,000 and was sold for $1·2 million. The

remaining movement on the property, plant and equipment, after charging depreciation of $3 million, was

the cost of replacing plant.

(ii) From 1 October 2008 to 31 March 2009 a further $500,000 was spent completing the development

project at which date marketing and production started. The sales of the new product proved disappointing

and on 30 September 2009 the development costs were written down to $1 million via an impairment

charge.

(iii) During the year ended 30 September 2009, $4 million of the 10% convertible loan notes matured. The

loan note holders had the option of redemption at par in cash or to exchange them for equity shares on the

basis of 20 new shares for each $100 of loan notes. 75% of the loan-note holders chose the equity option.

Ignore any effect of this on the other equity reserve.

All the above items have been treated correctly according to International Financial Reporting Standards.

(iv) The finance costs are made up of:

Required:

(i) Prepare a statement of the movements in the carrying amount of Crosswire’s non-current assets for the

year ended 30 September 2009; (9 marks)

(ii) Calculate the amounts that would appear under the headings of ‘cash flows from investing activities’

and ‘cash flows from financing activities’ in the statement of cash flows for Crosswire for the year ended

30 September 2009.

Note: Crosswire includes finance costs paid as a financing activity. (8 marks)

(b) A substantial shareholder has written to the directors of Crosswire expressing particular concern over the

deterioration of the company’s return on capital employed (ROCE)

Required:

Calculate Crosswire’s ROCE for the two years ended 30 September 2008 and 2009 and comment on the

apparent cause of its deterioration.

Note: ROCE should be taken as profit before interest on long-term borrowings and tax as a percentage of equity plus loan notes and finance lease obligations (at the year end). (8 marks)

正确答案:

(i)Thecashelementsoftheincreaseinproperty,plantandequipmentare$5millionforthemine(thecapitalisedenvironmentalprovisionisnotacashflow)and$2·4millionforthereplacementplantmakingatotalof$7·4million.(ii)Ofthe$4millionconvertibleloannotes(5,000–1,000)thatwereredeemedduringtheyear,75%($3million)ofthesewereexchangedforequitysharesonthebasisof20newsharesforeach$100inloannotes.Thiswouldcreate600,000(3,000/100x20)newsharesof$1eachandsharepremiumof$2·4million(3,000–600).As1million(5,000–4,000)newshareswereissuedintotal,400,000musthavebeenforcash.Theremainingincrease(aftertheeffectoftheconversion)inthesharepremiumof$1·6million(6,000–2,000b/f–2,400conversion)mustrelatetothecashissueofshares,thuscashproceedsfromtheissueofsharesis$2million(400nominalvalue+1,600premium).(iii)Theinitialleaseobligationis$10million(thefairvalueoftheplant).At30September2009totalleaseobligationsare$6·8million(5,040+1,760),thusrepaymentsintheyearwere$3·2million(10,000–6,800).(b)TakingthedefinitionofROCEfromthequestion:Fromtheaboveitcanbeclearlyseenthatthe2009operatingmarginhasimprovedbynearly1%point,despitethe$2millionimpairmentchargeonthewritedownofthedevelopmentproject.ThismeansthedeteriorationintheROCEisduetopoorerassetturnover.Thisimpliestherehasbeenadecreaseintheefficiencyintheuseofthecompany’sassetsthisyearcomparedtolastyear.Lookingatthemovementinthenon-currentassetsduringtheyearrevealssomemitigatingpoints:Thelandrevaluationhasincreasedthecarryingamountofproperty,plantandequipmentwithoutanyphysicalincreaseincapacity.Thisunfavourablydistortsthecurrentyear’sassetturnoverandROCEfigures.TheacquisitionoftheplatinummineappearstobeanewareaofoperationforCrosswirewhichmayhaveadifferent(perhapslower)ROCEtootherpreviousactivitiesoritmaybethatitwilltakesometimefortheminetocometofullproductioncapacity.Thesubstantialacquisitionoftheleasedplantwashalf-waythroughtheyearandcanonlyhavecontributedtotheyear’sresultsforsixmonthsatbest.Infutureperiodsafullyear’scontributioncanbeexpectedfromthisnewinvestmentinplantandthisshouldimprovebothassetturnoverandROCE.Insummary,thefallintheROCEmaybeduelargelytotheabovefactors(effectivelythereplacementandexpansionprogramme),ratherthantopooroperatingperformance,andinfutureperiodsthismaybereversed.ItshouldalsobenotedthathadtheROCEbeencalculatedontheaveragecapitalemployedduringtheyear(ratherthantheyearendcapitalemployed),whichisarguablymorecorrect,thenthedeteriorationintheROCEwouldnothavebeenaspronounced. -

第7题:

The part of a windlass which physically engages the chain during hauling or paying out is the ______.

A.Devil's claw

B.Bull gear

C.Wildcat

D.Cat head

正确答案:C

-

第8题:

Text 1 The longest bull run in a century of artmarket history ended on a dramatic note with a sale of 56 works by Damien Hirst,Beautiful Inside My Head Forever,at Sotheby's in London on September 15th,2008.All but two pieces sold,fetching more than£70m,a record for a sale by a single artist.It was a last victory.As the auctioneer called out bids,in New York one of the oldest banks on Wall Street,Lehman Brothers,filed for bankruptcy.The world art market had already been losing momentum for a while after rising bewilderingly since 2003.At its peak in 2007 it was worth some$65 billion,reckons Clare McAndrew,founder of Arts Economics,a research firm—double the figure five years earlier.Since then it may have come down to$50 billion.But the market generates interest far beyond its size because it brings together great wealth,enormous egos,greed,passion and controversy in a way matched by few other industries.In the weeks and months that followed Mr Hirst's sale,spending of any sort became deeply unfashionable.In the art world that meant collectors stayed away from galleries and salerooms.Sales of contemporary art fell by twothirds,and in the most overheated sector,they were down by nearly 90%in the year to November 2008.Within weeks the world's two biggest auction houses,Sotheby's and Christie's,had to pay out nearly$200m in guarantees to clients who had placed works for sale with them.The current downturn in the art market is the worst since the Japanese stopped buying Impressionists at the end of 1989.This time experts reckon that prices are about 40%down on their peak on average,though some have been far more fluctuant.But Edward Dolman,Christie's chief executive,says:“I'm pretty confident we're at the bottom.”What makes this slump different from the last,he says,is that there are still buyers in the market.Almost everyone who was interviewed for this special report said that the biggest problem at the moment is not a lack of demand but a lack of good work to sell.The three Ds—death,debt and divorce—still deliver works of art to the market.But anyone who does not have to sell is keeping away,waiting for confidence to return.

The three Ds mentioned in the last paragraph are____A.auction houses'favorites

B.contemporary trends

C.factors promoting artwork circulation

D.styles representing Impressionists答案:C解析:细节题【命题思路】这是一道封闭式细节题。从全篇文章的结构来看,段落之间没有出现明显的转折关系,即文章的主题没有发生改变。通常在这种模式下,文章最后一段是主旨的重申。【直击答案】根据题干关键词“Three Ds”和“last paragraph”定位到最后一段第三句话“the three Ds—death,…to the market”,破折号中间的内容是对three Ds的解释说明,意为:3Ds依然为市场输送艺术品。而前一句话又提到,在当前的市场中缺少的不是对艺术品的需求,而是好卖的艺术品。因此C项为正确答案,“promoting art work circulation”等同于原文中的“deliver work of art to the market”。此外,只有C项提到了文章的主题“艺术品”。【干扰排除】文章第三段最后一句通过描述两家拍卖行的销售额表明目前艺术品市场的衰退现象,但并未提及拍卖行最爱的艺术品,故排除A项。文中的contemporary指contemporary arts(当代艺术品),而非contemporary trend,B项属于张冠李戴,故排除。D项中的Impressionist出自第四段的首句,但与本题无关。 -

第9题:

From whose works the term "TheLost Generation" in American literary history originated?A.Jack Kerouac.

B.Earnest Hemingway.

C.Mark Twain.

D.Jack London.答案:B解析:The Lost Generation(迷惘的一代)是第一次世界大战后美国的一个文学流派。20世纪20年代初.侨居巴黎的美国作家格?斯泰因对海明威说:“你们都是迷惘的一代。”海明威把这句话作为他第一部长篇小说The Sun Also Rises(《太阳照常升起》)的题词,“迷惘的一代”从此成为这批虽无纲领和组织但有相同的创作倾向的作家的称谓。 -

第10题:

It can be inferred from the passage that( )A.Dickens’s hatred toward London grew with his age

B.Dickens ’s works contributed to some of the changes of London

C.Dickens liked to portray only the dark sides of London

D.Dickens,a social reformer,was devoted to the changes of London答案:B解析:推断题。A项“狄更斯对于伦敦的怨恨与日俱增”,文章第一段就提到伦敦给予了他许多情感,不只是负面的情感,后文又提到现代人们将其对于伦敦的情感称作是love/hate relationship,所以A项的表述错误。C项“狄更斯只喜欢刻画伦敦的阴暗面”,这一表述过于绝对化,所以很显然也是错误的,文章最后几段就有提到他对于伦敦积极一面的描绘。D项“作为社会改革家,狄更斯致力于伦敦的改变”,这一表述夸大了狄更斯的角色,狄更斯更多是通过自己的小说来关注社会现实,警醒人们积极改善不好的方面,所以D项也排除。B项提到“狄更斯的作品有助于伦敦的一些改善”,这是相对于D项更为客观的表述。 -

第11题:

Bob, a technician, needs to backup a user’s local My Documents on a Windows XP workstation.Which of the following is the QUICKEST way to the user’s folder?()

- A、Browse to the root, Documents and Settings, user’s name, and then My Documents

- B、Browse to the root, Users, Documents and Settings, user’s name, and then My Documents

- C、Type %system% into the run box

- D、Type %temp% into the run box, My Documents, and then user’s name

正确答案:A -

第12题:

单选题In the Northern Hemisphere,your vessel is believed to be in the direct path of a hurricane,and plenty of sea room is available. The best course of action is to bring the wind on the().Astarboard bow,note the course,and head in that direction

Bstarboard quarter,note the course,and head in that direction

Cport quarter,note the course,and head in that direction

Dport bow,note the course,and head in that direction

正确答案: A解析: 暂无解析 -

第13题:

(ii) Audit work on after-date bank transactions identified a transfer of cash from Batik Co. The audit senior has

documented that the finance director explained that Batik commenced trading on 7 October 2005, after

being set up as a wholly-owned foreign subsidiary of Jinack. No other evidence has been obtained.

(4 marks)

Required:

Identify and comment on the implications of the above matters for the auditor’s report on the financial

statements of Jinack Co for the year ended 30 September 2005 and, where appropriate, the year ending

30 September 2006.

NOTE: The mark allocation is shown against each of the matters.

正确答案:

(ii) Wholly-owned foreign subsidiary

■ The cash transfer is a non-adjusting post balance sheet event. It indicates that Batik was trading after the balance

sheet date. However, that does not preclude Batik having commenced trading before the year end.

■ The finance director’s oral representation is wholly insufficient evidence with regard to the existence (or otherwise)

of Batik at 30 September 2005. If it existed at the balance sheet date its financial statements should have been

consolidated (unless immaterial).

■ The lack of evidence that might reasonably be expected to be available (e.g. legal papers, registration payments,

etc) suggests a limitation on the scope of the audit.

■ If such evidence has been sought but not obtained then the limitation is imposed by the entity (rather than by

circumstances).

■ Whilst the transaction itself may not be material, the information concerning the existence of Batik may be material

to users and should therefore be disclosed (as a non-adjusting event). The absence of such disclosure, if the

auditor considered necessary, would result in a qualified ‘except for’, opinion.

Tutorial note: Any matter that is considered sufficiently material to be worthy of disclosure as a non-adjusting

event must result in such a qualified opinion if the disclosure is not made.

■ If Batik existed at the balance sheet date and had material assets and liabilities then its non-consolidation would

have a pervasive effect. This would warrant an adverse opinion.

■ Also, the nature of the limitation (being imposed by the entity) could have a pervasive effect if the auditor is

suspicious that other audit evidence has been withheld. In this case the auditor should disclaim an opinion. -

第14题:

(ii) Briefly explain the implications of Parr & Co’s audit opinion for your audit opinion on the consolidated

financial statements of Cleeves Co for the year ended 30 September 2006. (3 marks)

正确答案:

(ii) Implications for audit opinion on consolidated financial statements of Cleeves

■ If the potential adjustments to non-current asset carrying amounts and loss are not material to the consolidated

financial statements there will be no implication. However, as Howard is material to Cleeves and the modification

appears to be ‘so material’ (giving rise to adverse opinion) this seems unlikely.

Tutorial note: The question clearly states that Howard is material to Cleeves, thus there is no call for speculation

on this.

■ As Howard is wholly-owned the management of Cleeves must be able to request that Howard’s financial statements

are adjusted to reflect the impairment of the assets. The auditor’s report on Cleeves will then be unmodified

(assuming that any impairment of the investment in Howard is properly accounted for in the separate financial

statements of Cleeves).

■ If the impairment losses are not recognised in Howard’s financial statements they can nevertheless be adjusted on

consolidation of Cleeves and its subsidiaries (by writing down assets to recoverable amounts). The audit opinion

on Cleeves should then be unmodified in this respect.

■ If there is no adjustment of Howard’s asset values (either in Howard’s financial statements or on consolidation) it

is most likely that the audit opinion on Cleeves’s consolidated financial statements would be ‘except for’. (It should

not be adverse as it is doubtful whether even the opinion on Howard’s financial statements should be adverse.)

Tutorial note: There is currently no requirement in ISA 600 to disclose that components have been audited by another

auditor unless the principal auditor is permitted to base their opinion solely upon the report of another auditor. -

第15题:

22. ________birthday isn't in September.

A. Joe's

B. Joe's father' s

C. Joe's mother's

D. My

正确答案:C

-

第16题:

Beautiful music, isn’t it?()A. Who’s the composer?

B. Yes. It’s my favorite.

C. So glad to hear that.

D. It’s a gift from my father.

参考答案:B

-

第17题:

The following trial balance relates to Sandown at 30 September 2009:

The following notes are relevant:

(i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2008. The terms of the sale are that Sandown will incur ongoing service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money.

(ii) Administrative expenses include an equity dividend of 4·8 cents per share paid during the year.

(iii) The 5% convertible loan note was issued for proceeds of $20 million on 1 October 2007. It has an effective interest rate of 8% due to the value of its conversion option.

(iv) During the year Sandown sold an available-for-sale investment for $11 million. At the date of sale it had a

carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the

investment. The remaining available-for-sale investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 2009. The other reserve in the trial balance represents the net increase in the value of the available-for-sale investments as at 1 October 2008. Ignore deferred tax on these transactions.

(v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2008. The directors have estimated the provision for income tax for the year ended 30 September 2009 at $16·2 million. At 30 September 2009 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%.

(vi) Non-current assets:

The freehold property has a land element of $13 million. The building element is being depreciated on a

straight-line basis.

Plant and equipment is depreciated at 40% per annum using the reducing balance method.

Sandown’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2009 which concluded that, based on estimated future sales, the brand had a value in use of $12 million and a remaining life of only three years.

However, on the same date as the impairment review, Sandown received an offer to purchase the brand for

$15 million. Prior to the impairment review, it was being depreciated using the straight-line method over a

10-year life.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September

2009. Depreciation, amortisation and impairment charges are all charged to cost of sales.

Required:

(a) Prepare the statement of comprehensive income for Sandown for the year ended 30 September 2009.

(13 marks)

(b) Prepare the statement of financial position of Sandown as at 30 September 2009. (12 marks)

Notes to the financial statements are not required.

A statement of changes in equity is not required.

正确答案:

(i)IAS18Revenuerequiresthatwheresalesrevenueincludesanamountforaftersalesservicingandsupportcoststhenaproportionoftherevenueshouldbedeferred.Theamountdeferredshouldcoverthecostandareasonableprofit(inthiscaseagrossprofitof40%)ontheservices.Astheservicingandsupportisforthreeyearsandthedateofthesalewas1October2008,revenuerelatingtotwoyears’servicingandsupportprovisionmustbedeferred:($1·2millionx2/0·6)=$4million.Thisisshownas$2millioninbothcurrentandnon-currentliabilities. -

第18题:

(a) The following figures have been calculated from the financial statements (including comparatives) of Barstead for

the year ended 30 September 2009:

increase in profit after taxation 80%

increase in (basic) earnings per share 5%

increase in diluted earnings per share 2%

Required:

Explain why the three measures of earnings (profit) growth for the same company over the same period can

give apparently differing impressions. (4 marks)

(b) The profit after tax for Barstead for the year ended 30 September 2009 was $15 million. At 1 October 2008 the company had in issue 36 million equity shares and a $10 million 8% convertible loan note. The loan note will mature in 2010 and will be redeemed at par or converted to equity shares on the basis of 25 shares for each $100 of loan note at the loan-note holders’ option. On 1 January 2009 Barstead made a fully subscribed rights issue of one new share for every four shares held at a price of $2·80 each. The market price of the equity shares of Barstead immediately before the issue was $3·80. The earnings per share (EPS) reported for the year ended 30 September 2008 was 35 cents.

Barstead’s income tax rate is 25%.

Required:

Calculate the (basic) EPS figure for Barstead (including comparatives) and the diluted EPS (comparatives not required) that would be disclosed for the year ended 30 September 2009. (6 marks)

正确答案:

(a)Whilstprofitaftertax(anditsgrowth)isausefulmeasure,itmaynotgiveafairrepresentationofthetrueunderlyingearningsperformance.Inthisexample,userscouldinterpretthelargeannualincreaseinprofitaftertaxof80%asbeingindicativeofanunderlyingimprovementinprofitability(ratherthanwhatitreallyis:anincreaseinabsoluteprofit).Itispossible,evenprobable,that(someof)theprofitgrowthhasbeenachievedthroughtheacquisitionofothercompanies(acquisitivegrowth).Wherecompaniesareacquiredfromtheproceedsofanewissueofshares,orwheretheyhavebeenacquiredthroughshareexchanges,thiswillresultinagreaternumberofequitysharesoftheacquiringcompanybeinginissue.ThisiswhatappearstohavehappenedinthecaseofBarsteadastheimprovementindicatedbyitsearningspershare(EPS)isonly5%perannum.ThisexplainswhytheEPS(andthetrendofEPS)isconsideredamorereliableindicatorofperformancebecausetheadditionalprofitswhichcouldbeexpectedfromthegreaterresources(proceedsfromthesharesissued)ismatchedwiththeincreaseinthenumberofshares.Simplylookingatthegrowthinacompany’sprofitaftertaxdoesnottakeintoaccountanyincreasesintheresourcesusedtoearnthem.Anyincreaseingrowthfinancedbyborrowings(debt)wouldnothavethesameimpactonprofit(asbeingfinancedbyequityshares)becausethefinancecostsofthedebtwouldacttoreduceprofit.ThecalculationofadilutedEPStakesintoaccountanypotentialequitysharesinissue.Potentialordinarysharesarisefromfinancialinstruments(e.g.convertibleloannotesandoptions)thatmayentitletheirholderstoequitysharesinthefuture.ThedilutedEPSisusefulasitalertsexistingshareholderstothefactthatfutureEPSmaybereducedasaresultofsharecapitalchanges;inasenseitisawarningsign.InthiscasethelowerincreaseinthedilutedEPSisevidencethatthe(higher)increaseinthebasicEPShas,inpart,beenachievedthroughtheincreaseduseofdilutingfinancialinstruments.Thefinancecostoftheseinstrumentsislessthantheearningstheirproceedshavegeneratedleadingtoanincreaseincurrentprofits(andbasicEPS);however,inthefuturetheywillcausemoresharestobeissued.ThiscausesadilutionwherethefinancecostperpotentialnewshareislessthanthebasicEPS. -

第19题:

Text 1 The longest bull run in a century of artmarket history ended on a dramatic note with a sale of 56 works by Damien Hirst,Beautiful Inside My Head Forever,at Sotheby's in London on September 15th,2008.All but two pieces sold,fetching more than£70m,a record for a sale by a single artist.It was a last victory.As the auctioneer called out bids,in New York one of the oldest banks on Wall Street,Lehman Brothers,filed for bankruptcy.The world art market had already been losing momentum for a while after rising bewilderingly since 2003.At its peak in 2007 it was worth some$65 billion,reckons Clare McAndrew,founder of Arts Economics,a research firm—double the figure five years earlier.Since then it may have come down to$50 billion.But the market generates interest far beyond its size because it brings together great wealth,enormous egos,greed,passion and controversy in a way matched by few other industries.In the weeks and months that followed Mr Hirst's sale,spending of any sort became deeply unfashionable.In the art world that meant collectors stayed away from galleries and salerooms.Sales of contemporary art fell by twothirds,and in the most overheated sector,they were down by nearly 90%in the year to November 2008.Within weeks the world's two biggest auction houses,Sotheby's and Christie's,had to pay out nearly$200m in guarantees to clients who had placed works for sale with them.The current downturn in the art market is the worst since the Japanese stopped buying Impressionists at the end of 1989.This time experts reckon that prices are about 40%down on their peak on average,though some have been far more fluctuant.But Edward Dolman,Christie's chief executive,says:“I'm pretty confident we're at the bottom.”What makes this slump different from the last,he says,is that there are still buyers in the market.Almost everyone who was interviewed for this special report said that the biggest problem at the moment is not a lack of demand but a lack of good work to sell.The three Ds—death,debt and divorce—still deliver works of art to the market.But anyone who does not have to sell is keeping away,waiting for confidence to return.

In the first paragraph,Damien Hirst's sale was referred to as“a last victory”because_____A.the art market had witnessed a succession of victories

B.the auctioneer finally got the two pieces at the highest bids

C.Beautiful Inside My Head Forever won over all masterpieces

D.it was successfully made just before the world financial crisis答案:D解析:推理题【命题思路】这是一道因果推理题。考生需要找出原因和结果。【直击答案】根据题干关键词“first paragraph”和“last victory”定位到第一段的倒数第二句“it was a last victory”。it指代文章前面所叙述的赫斯特作品大卖,创造了极佳的销售业绩。由第一句话可知,这个持续时间最长的艺术品市场牛市以赫斯特的作品成功拍卖而终止。而出现这一现象的原因在首段尾句进行了总结:“as the auctioneer called out bids,…,Lehman Brothers,filed for bankruptcy”,D项中的world financial crisis是原文中filed for bankruptcy的同义替换。因此,D项为正确选项。 -

第20题:

Text 1 The longest bull run in a century of artmarket history ended on a dramatic note with a sale of 56 works by Damien Hirst,Beautiful Inside My Head Forever,at Sotheby's in London on September 15th,2008.All but two pieces sold,fetching more than£70m,a record for a sale by a single artist.It was a last victory.As the auctioneer called out bids,in New York one of the oldest banks on Wall Street,Lehman Brothers,filed for bankruptcy.The world art market had already been losing momentum for a while after rising bewilderingly since 2003.At its peak in 2007 it was worth some$65 billion,reckons Clare McAndrew,founder of Arts Economics,a research firm—double the figure five years earlier.Since then it may have come down to$50 billion.But the market generates interest far beyond its size because it brings together great wealth,enormous egos,greed,passion and controversy in a way matched by few other industries.In the weeks and months that followed Mr Hirst's sale,spending of any sort became deeply unfashionable.In the art world that meant collectors stayed away from galleries and salerooms.Sales of contemporary art fell by twothirds,and in the most overheated sector,they were down by nearly 90%in the year to November 2008.Within weeks the world's two biggest auction houses,Sotheby's and Christie's,had to pay out nearly$200m in guarantees to clients who had placed works for sale with them.The current downturn in the art market is the worst since the Japanese stopped buying Impressionists at the end of 1989.This time experts reckon that prices are about 40%down on their peak on average,though some have been far more fluctuant.But Edward Dolman,Christie's chief executive,says:“I'm pretty confident we're at the bottom.”What makes this slump different from the last,he says,is that there are still buyers in the market.Almost everyone who was interviewed for this special report said that the biggest problem at the moment is not a lack of demand but a lack of good work to sell.The three Ds—death,debt and divorce—still deliver works of art to the market.But anyone who does not have to sell is keeping away,waiting for confidence to return.

The most appropriate title for this text could be____A.Fluctuation of Art Prices

B.Uptodate Art Auctions

C.Art Market in Decline

D.Shifted Interest in Arts答案:C解析:主旨题【命题思路】给文章加标题是常见的文章主旨题考查的方式之一。从这篇文章的整体结构来看,段落与段落之间并没有出现明显的转折,因此主旨贯穿全篇文章。考生可以总结每一段的段落大意,然后进行概括总结。【直击答案】本文第一段以赫斯特作品的大卖引出文章的讨论话题,即艺术品市场的低迷与衰退;第二段介绍了艺术品市场在经历了牛市后的衰落;第三、四段分别讨论了当前的艺术品市场形势,并在最后一段对未来趋势做出了预测。因此最合适的标题为C项“艺术品市场的衰退”。【干扰排除】虽然第二段第二、三句提到“价格波动”,但属于细节内容,以偏概全,因此排除A项。B项中的uptodate和文中的contemporary是同义词,文章第一段提及拍卖会是为了引出讨论话题,B项不具有概括性。文章提到艺术品收藏者远离了画廊和拍卖会现场是因为艺术品市场的不景气。D项与原文内容不符,故排除。长难句解析 -

第21题:

The best title for this passage is( )A.The History of Europe in 16th Century

B.The Religious History of Europe in 16th Century

C.The Causes of European Separation in 16th Century

D.The History of Europe after Separation答案:C解析:主旨题。在文章中,作者从三方面论及欧洲的分裂。从第三段第一句“这些情感,本身就危险,再加上地理和金钱两个问题,情况就更加不妙了”可知,A项“欧洲史”和B项“欧洲宗教史”这两项涉及范围更广。本文主要是从分裂原因来进行论述的,并不是完全关于分裂后的历史,因此D项“欧洲分裂后的历史”不符合。 -

第22题:

A.the art market had witnessed a succession of victories

A.the art market had witnessed a succession of victories

B.the auctioneer finally got the two pieces at the highest bids

C.Beautiful Inside My Head Forever won over all masterpieces

D.it was successfully made just before the world financial crisis答案:D解析:根据前文可知,这次拍卖会上,达米安·赫斯特的56件作品成功出售,所有作品中只有两件没有售出,销售额超过7 000万英镑,创造了单人艺术家的拍卖纪录。这是最后的一场胜利,最后一句话解释了其中的原因:在达米安·赫斯特的作品大卖的同时,雷曼兄弟的破产标志着世界经济开始走向衰退,所以作者将达米安·赫斯特作品的成功拍卖比作是艺术品市场交易的“最后胜利”,因此D项这次交易是在世界金融危机开始前完成的为正确答案。故本题选D。参考译文:2008年9月15日,伦敦苏富比拍卖行为达米安·赫斯特的56幅作品举办了以《美丽永驻我心》为主题的拍卖会。这一戏剧性的拍卖宣告了艺术品市场百年以来最长牛市的终结。所有作品中只有两件没有售出,总销售额超过7 000万英镑,创造了单人艺术家的拍卖纪录。这是最后的胜利。因为就在拍卖师喊出报价时,纽约华尔街上历史最悠久的银行之一雷曼兄弟正申请破产。 -

第23题:

问答题Practice 1 Directions: Read the text below. Write an essay in about 120 words, in which you should summarize the key points of the text and make comments on them. Try to use your own words. I was driving home the other day on a sunny afternoon. I had a smile on my face as I sang along to the songs on the radio. It was such a beautiful day that I felt full of happiness. My good mood ended, however, when the radio station took a news break between songs. Then suddenly I found myself listening to yet another story of a rich famous man who had broken the law. I shook my head as I came to a red traffic light. As I pulled to a stop I noticed four leather-jacketed bikers. They were standing in the middle of the road with two on either side of the light. They looked rough and dangerous, but as I got closer I noticed each one was holding their helmet in their hands. I rolled down my window as one approached my car. “We are the Brother of the wheel,” he said. “We are collecting money for Christmas Toy Drive for needy children.” As I pulled a dollar out of my wallet I looked past his beard and into his eyes. They shined with goodness and kindness that came right from his soul. I dropped the money in his helmet and waved to the other bikers as I drove off. My good mood had returned. My faith in mankind had been strengthened. And I remembered once again never to judge people by their appearance.正确答案: 【范文】

One afternoon, the author was driving his car. He was happy at first and sang along with the radio. But after a while his good mood was ended by a piece of news that a rich man had broken the law. Then he came across four bikers who were collecting money for needy children. Because of their goodness and kindness, the author concluded that people shouldn’t be judged by their appearance. At this moment, the man felt happy again.

Nowadays, we often judge others by their appearance. If a person looks rough and dangerous, we tend to regard him as a bad man, let alone speak to him and help him. In my opinion, we mustn’t judge books by their covers. We should learn that looks matter little and actions matter most. When we meet people in need, we should give them a hand even though they look somewhat rough, because kindness may live in their souls.解析: 暂无解析