(b) (i) Discuss the relationship between the concepts of ‘business risk’ and ‘financial statement risk’; and(4 marks)

题目

(b) (i) Discuss the relationship between the concepts of ‘business risk’ and ‘financial statement risk’; and

(4 marks)

相似考题

更多“(b) (i) Discuss the relationship between the concepts of ‘business risk’ and ‘financial statement risk’; and(4 marks)”相关问题

-

第1题:

2 (a) Discuss the nature of the financial objectives that may be set in a not-for-profit organisation such as a charity

or a hospital. (8 marks)

正确答案:2 (a) In the case of a not-for-profit (NFP) organisation, the limit on the services that can be provided is the amount of funds that

are available in a given period. A key financial objective for an NFP organisation such as a charity is therefore to raise as

much funds as possible. The fund-raising efforts of a charity may be directed towards the public or to grant-making bodies.

In addition, a charity may have income from investments made from surplus funds from previous periods. In any period,

however, a charity is likely to know from previous experience the amount and timing of the funds available for use. The same

is true for an NFP organisation funded by the government, such as a hospital, since such an organisation will operate under

budget constraints or cash limits. Whether funded by the government or not, NFP organisations will therefore have the

financial objective of keeping spending within budget, and budgets will play an important role in controlling spending and in

specifying the level of services or programmes it is planned to provide.

Since the amount of funding available is limited, NFP organisations will seek to generate the maximum benefit from available

funds. They will obtain resources for use by the organisation as economically as possible: they will employ these resources

efficiently, minimising waste and cutting back on any activities that do not assist in achieving the organisation’s non-financial

objectives; and they will ensure that their operations are directed as effectively as possible towards meeting their objectives.

The goals of economy, efficiency and effectiveness are collectively referred to as value for money (VFM). Economy is

concerned with minimising the input costs for a given level of output. Efficiency is concerned with maximising the outputs

obtained from a given level of input resources, i.e. with the process of transforming economic resources into desires services.

Effectiveness is concerned with the extent to which non-financial organisational goals are achieved.

Measuring the achievement of the financial objective of VFM is difficult because the non-financial goals of NFP organisations

are not quantifiable and so not directly measurable. However, current performance can be compared to historic performance

to ascertain the extent to which positive change has occurred. The availability of the healthcare provided by a hospital, for

example, can be measured by the time that patients have to wait for treatment or for an operation, and waiting times can be

compared year on year to determine the extent to which improvements have been achieved or publicised targets have been

met.Lacking a profit motive, NFP organisations will have financial objectives that relate to the effective use of resources, such as

achieving a target return on capital employed. In an organisation funded by the government from finance raised through

taxation or public sector borrowing, this financial objective will be centrally imposed. -

第2题:

(c) Discuss the ways in which budgets and the budgeting process can be used to motivate managers to

endeavour to meet the objectives of the company. Your answer should refer to:

(i) setting targets for financial performance;

(ii) participation in the budget-setting process. (12 marks)

正确答案:

(c) Examiner’s Note:

The topic of managerial motivation and budgeting has been a subject of discussion for a number of years. There are links

here to the topics of performance measurement and responsibility accounting. Discussion should be focused on the area of

budgets and the budgeting process, as specified in the question.

Setting targets for financial performance

It has been reasonably established that managers respond better in motivation and performance terms to a clearly defined,

quantitative target than to the absence of such targets. However, budget targets must be accepted by the responsible

managers if they are to have any motivational effect. Acceptance of budget targets will depend on several factors, including

the personality of an individual manager and the quality of communication in the budgeting process.

The level of difficulty of the budget target will also influence the level of motivation and performance. Budget targets that are

seen as average or above average will increase motivation and performance up to the point where such targets are seen as

impossible to achieve. Beyond this point, personal desire to achieve a particular level of performance falls off sharply. Careful

thought must therefore go into establishing budget targets, since the best results in motivation and performance terms will

arise from the most difficult goals that individual managers are prepared to accept4.

While budget targets that are seen as too difficult will fail to motivate managers to improve their performance, the same is

true of budget targets that are seen as being too easy. When budget targets are easy, managers are likely to outperform. the

budget but will fail to reach the level of performance that might be expected in the absence of a budget.

One consequence of the need for demanding or difficult budget targets is the frequent reporting of adverse variances. It is

important that these are not used to lay blame in the budgetary control process, since they have a motivational (or planning)

origin rather than an operational origin. Managerial reward systems may need to reward almost achieving, rather than

achieving, budget targets if managers are to be encouraged by receiving financial incentives.

Participation in the budget-setting process

A ‘top-down’ approach to budget setting leads to budgets that are imposed on managers. Where managers within an

organisation are believed to behave in a way that is consistent with McGregor’s Theory X perspective, imposed budgets may

improve performance, since accepting the budget is consistent with reduced responsibility and avoiding work.

It is also possible that acceptance of imposed budgets by managers who are responsible for their implementation and

achievement is diminished because they feel they have not been able to influence budget targets. Such a view is consistent

with McGregor’s Theory Y perspective, which holds that managers naturally seek responsibility and do not need to be tightly

controlled. According to this view, managers respond well to participation in the budget-setting process, since being able to

influence the budget targets for which they will be responsible encourages their acceptance. A participative approach to

budget-setting is also referred to as a ‘bottom-up’ approach.

In practice, many organisations adopt a budget-setting process that contains elements of both approaches, with senior

management providing strategic leadership of the budget-setting process and other management tiers providing input in terms

of identifying what is practical and offering detailed knowledge of their area of the organisation. -

第3题:

(b) Prepare a consolidated statement of financial position of the Ribby Group at 31 May 2008 in accordance

with International Financial Reporting Standards. (35 marks)

正确答案:

-

第4题:

(b) Discuss the relative costs to the preparer and benefits to the users of financial statements of increased

disclosure of information in financial statements. (14 marks)

Quality of discussion and reasoning. (2 marks)

正确答案:

(b) Increased information disclosure benefits users by reducing the likelihood that they will misallocate their capital. This is

obviously a direct benefit to individual users of corporate reports. The disclosure reduces the risk of misallocation of capital

by enabling users to improve their assessments of a company’s prospects. This creates three important results.

(i) Users use information disclosed to increase their investment returns and by definition support the most profitable

companies which are likely to be those that contribute most to economic growth. Thus, an important benefit of

information disclosure is that it improves the effectiveness of the investment process.

(ii) The second result lies in the effect on the liquidity of the capital markets. A more liquid market assists the effective

allocation of capital by allowing users to reallocate their capital quickly. The degree of information asymmetry between

the buyer and seller and the degree of uncertainty of the buyer and the seller will affect the liquidity of the market as

lower asymmetry and less uncertainty will increase the number of transactions and make the market more liquid.

Disclosure will affect uncertainty and information asymmetry.

(iii) Information disclosure helps users understand the risk of a prospective investment. Without any information, the user

has no way of assessing a company’s prospects. Information disclosure helps investors predict a company’s prospects.

Getting a better understanding of the true risk could lower the price of capital for the company. It is difficult to prove

however that the average cost of capital is lowered by information disclosure, even though it is logically and practically

impossible to assess a company’s risk without relevant information. Lower capital costs promote investment, which can

stimulate productivity and economic growth.

However although increased information can benefit users, there are problems of understandability and information overload.

Information disclosure provides a degree of protection to users. The benefit is fairness to users and is part of corporate

accountability to society as a whole.

The main costs to the preparer of financial statements are as follows:

(i) the cost of developing and disseminating information,

(ii) the cost of possible litigation attributable to information disclosure,

(iii) the cost of competitive disadvantage attributable to disclosure.

The costs of developing and disseminating the information include those of gathering, creating and auditing the information.

Additional costs to the preparers include training costs, changes to systems (for example on moving to IFRS), and the more

complex and the greater the information provided, the more it will cost the company.

Although litigation costs are known to arise from information disclosure, it does not follow that all information disclosure leads

to litigation costs. Cases can arise from insufficient disclosure and misleading disclosure. Only the latter is normally prompted

by the presentation of information disclosure. Fuller disclosure could lead to lower costs of litigation as the stock market would

have more realistic expectations of the company’s prospects and the discrepancy between the valuation implicit in the market

price and the valuation based on a company’s financial statements would be lower. However, litigation costs do not

necessarily increase with the extent of the disclosure. Increased disclosure could reduce litigation costs.

Disclosure could weaken a company’s ability to generate future cash flows by aiding its competitors. The effect of disclosure

on competitiveness involves benefits as well as costs. Competitive disadvantage could be created if disclosure is made relating

to strategies, plans, (for example, planned product development, new market targeting) or information about operations (for

example, production-cost figures). There is a significant difference between the purpose of disclosure to users and

competitors. The purpose of disclosure to users is to help them to estimate the amount, timing, and certainty of future cash

flows. Competitors are not trying to predict a company’s future cash flows, and information of use in that context is not

necessarily of use in obtaining competitive advantage. Overlap between information designed to meet users’ needs and

information designed to further the purposes of a competitor is often coincidental. Every company that could suffer competitive

disadvantage from disclosure could gain competitive advantage from comparable disclosure by competitors. Published figures

are often aggregated with little use to competitors.

Companies bargain with suppliers and with customers, and information disclosure could give those parties an advantage in

negotiations. In such cases, the advantage would be a cost for the disclosing entity. However, the cost would be offset

whenever information disclosure was presented by both parties, each would receive an advantage and a disadvantage.

There are other criteria to consider such as whether the information to be disclosed is about the company. This is both a

benefit and a cost criterion. Users of corporate reports need company-specific data, and it is typically more costly to obtain

and present information about matters external to the company. Additionally, consideration must be given as to whether the

company is the best source for the information. It could be inefficient for a company to obtain or develop data that other, more

expert parties could develop and present or do develop at present.

There are many benefits to information disclosure and users have unmet information needs. It cannot be known with any

certainty what the optimal disclosure level is for companies. Some companies through voluntary disclosure may have

achieved their optimal level. There are no quantitative measures of how levels of disclosure stand with respect to optimal

levels. Standard setters have to make such estimates as best they can, guided by prudence, and by what evidence of benefits

and costs they can obtain. -

第5题:

(b) Distinguish between strategic and operational risks, and explain why the secrecy option would be a source

of strategic risk. (10 marks)

正确答案:

(b) Strategic and operational risks

Strategic risks

These arise from the overall strategic positioning of the company in its environment. Some strategic positions give rise to

greater risk exposures than others. Because strategic issues typically affect the whole of an organisation and not just one or

more of its parts, strategic risks can potentially concern very high stakes – they can have very high hazards and high returns.

Because of this, they are managed at board level in an organisation and form. a key part of strategic management.

Operational risks

Operational risks refer to potential losses arising from the normal business operations. Accordingly, they affect the day-to-day

running of operations and business systems in contrast to strategic risks that arise from the organisation’s strategic positioning.

Operational risks are managed at risk management level (not necessarily board level) and can be managed and mitigated by

internal control systems.

The secrecy option would be a strategic risk for the following reasons.

It would radically change the environment that SHC is in by reducing competition. This would radically change SHC’s strategic

fit with its competitive environment. In particular, it would change its ‘five forces’ positioning which would change its risk

profile.

It would involve the largest investment programme in the company’s history with new debt substantially changing the

company’s financial structure and making it more vulnerable to short term liquidity problems and monetary pressure (interest

rates).

It would change the way that stakeholders view SHC, for better or worse. It is a ‘crisis issue’, certain to polarise opinion either

way.

It will change the economics of the industry thereby radically affecting future cost, revenue and profit forecasts.

There may be retaliatory behaviour by SHC’s close competitor on 25% of the market.

[Tutorial note: similar reasons if relevant and well argued will attract marks] -

第6题:

(c) Define ‘market risk’ for Mr Allejandra and explain why Gluck and Goodman’s market risk exposure is

increased by failing to have an effective audit committee. (5 marks)

正确答案:

(c) Market risk

Definition of market risk

Market risks are those arising from any of the markets that a company operates in. Most common examples are those risks

from resource markets (inputs), product markets (outputs) or capital markets (finance).

[Tutorial note: markers should exercise latitude in allowing definitions of market risk. IFRS 7, for example, offers a technical

definition: ‘Market risk is the risk that the fair value or cash flows of a financial instrument will fluctuate due to changes in

market prices. Market risk reflects interest rate risk, currency risk, and other price risks’.]

Why non-compliance increases market risk

The lack of a fully compliant committee structure (such as having a non-compliant audit committee) erodes investor

confidence in the general governance of a company. This will, over time, affect share price and hence company value. Low

company value will threaten existing management (possibly with good cause in the case of Gluck and Goodman) and make

the company a possible takeover target. It will also adversely affect price-earnings and hence market confidence in Gluck and

Goodman’s shares. This will make it more difficult to raise funds from the stock market. -

第7题:

5 A management accounting focus for performance management in an organisation may incorporate the following:

(1) the determination and quantification of objectives and strategies

(2) the measurement of the results of the strategies implemented and of the achievement of the results through a

number of determinants

(3) the application of business change techniques, in the improvement of those determinants.

Required:

(a) Discuss the meaning and inter-relationship of the terms (shown in bold type) in the above statement. Your

answer should incorporate examples that may be used to illustrate each term in BOTH profit-seeking

organisations and not-for-profit organisations in order to highlight any differences between the two types of

organisation. (14 marks)

正确答案:

5 (a) Objectives may be viewed as profit and market share in a profit-oriented organisation or the achievement of ‘value for money’

in a not-for-profit organisation (NFP). The overall objective of an organisation may be expressed in the wording of its mission

statement.

In order to achieve the objectives, long-term strategies will be required. In a profit-oriented organisation, this may incorporate

the evaluation of strategies that might include price reductions, product design changes, advertising campaign, product mix

change and methods changes, embracing change techniques such as BPR, JIT, TQM and ABM. In NFP situations, strategies

might address the need to achieve ‘economy’ through reduction in average cost per unit; ‘efficiency’ through maximisation of

the input:output ratio, whilst checking on ‘effectiveness’ through monitoring whether the objectives are achieved.

The annual budget will quantify the short-term results anticipated of the strategies. These results may be seen as the level of

financial performance and competitiveness achieved. This quantification may be compared with previous years and with

actual performance on an ongoing basis. Financial performance may be measured in terms of profit, liquidity, capital structure

and a range of ratios. Competitiveness may be measured by sales growth, market share and the number of new customers.

In a not-for-profit organisation, the results may be monitored by checking on the effectiveness of actions aimed at the

achievement of the objectives. For instance, the effectiveness of a University may be measured by the number of degrees

awarded and the grades achieved. The level of student ‘drop-outs’ each year may also be seen as a measure of ineffectiveness.

The determinants of results may consist of a number of measures. These may include the level of quality, customer

satisfaction, resource utilisation, innovation and flexibility that are achieved. Such determinants may focus on a range of nonfinancial

measures that may be monitored on an ongoing basis, as part of the feedback information in conjunction with

financial data.

A range of business change techniques may be used to enhance performance management.

Techniques may include:

Business process re-engineering (BPR) which involves the examination of business processes with a view to improving the

way in which each is implemented. A major focus may be on the production cycle, but it will also be applicable in areas such

as the accounting department.

Just-in-time (JIT) which requires commitment to the pursuit of ‘excellence’ in all aspects of an organisation.

Total quality management (TQM) which aims for continuous quality improvement in all aspects of the operation of an

organisation.

Activity based management systems (ABM) which focus on activities that are required in an organisation and the cost drivers

for such activities, with a view to identifying and improving activities that add value and eliminating those activities that do

not add value.

Long-term performance management is likely to embrace elements of BPR, JIT, TQM and ABM. All of these will be reflected

in the annual budget on an ongoing basis. -

第8题:

(ii) Comment on the figures in the statement prepared in (a)(i) above. (4 marks)

正确答案:

(ii) The statement of product profitability shows that CTC is forecast to achieve a profit of $2·185 million in 2008 giving a

profit:sales ratio of 11·9%. However, the forecast profit in 2009 is only $22,000 which would give a profit:sales ratio

of just 0·19%! Total sales volume in 2008 is 390,000 units which represent 97·5% utilisation of total annual capacity.

In stark contrast, the total sales volume in 2009 is forecast to be 240,000 units which represents 60% utilisation of

total annual capacity and shows the expected rapid decline in sales volumes of Bruno and Kong products. The rapid

decline in the sales of these two products is only offset to a relatively small extent by increased sales volume from the

Leo product. It is vital that a new product or products with healthy contribution to sales ratios are introduced.

Management should also undertake cost/benefit analyses in order to assess the potential of extending the life of Bruno

and Kong products. -

第9题:

(b) Describe the potential benefits for Hugh Co in choosing to have a financial statement audit. (4 marks)

正确答案:

(b) There are several benefits for Hugh Co in choosing a voluntary financial statement audit.

An annual audit will ensure that any material mistakes made by the part-qualified accountant in preparing the year end

financial statements will be detected. This is important as the directors will be using the year end accounts to review their

progress in the first year of trading and will need reliable figures to assess performance. An audit will give the directors comfort

that the financial statements are a sound basis for making business decisions.

Accurate first year figures will also enable more effective budgeting and forecasting, which will be crucial if rapid growth is to

be achieved.

The auditors are likely to use the quarterly management accounts as part of normal audit procedures. The auditors will be

able to advise Monty Parkes of any improvements that could be made to the management accounts, for example, increased

level of detail, more frequent reporting. Better quality management accounts will help the day-to-day running of the business

and enable a speedier response to any problems arising during the year.

As a by-product of the audit, a management letter (report to those charged with governance) will be produced, identifying

weaknesses and making recommendations on areas such as systems and controls which will improve the smooth running of

the business.

It is likely that Hugh Co will require more bank funding in order to expand, and it is likely that the bank would like to see

audited figures for review, before deciding on further finance. It will be easier and potentially cheaper to raise finance from

other providers with an audited set of financial statements.

As the business deals in cash sales, and retails small, luxury items there is a high risk of theft of assets. The external audit

can act as both a deterrent and a detective control, thus reducing the risk of fraud and resultant detrimental impact on the

financial statements.

Accurate financial statements will be the best basis for tax assessment and tax planning. An audit opinion will enhance the

credibility of the figures.

If the business grows rapidly, then it is likely that at some point in the future, the audit exemption limit will be exceeded and

thus an audit will become mandatory.

Choosing to have an audit from the first year of incorporation will reduce potential errors carried down to subsequent periods

and thus avoid qualifications of opening balances. -

第10题:

(c) Identify and discuss the implications for the audit report if:

(i) the directors refuse to disclose the note; (4 marks)

正确答案:

(c) (i) Audit report implications

Audit procedures have shown that there is a significant level of doubt over Dexter Co’s going concern status. IAS 1

requires that disclosure is made in the financial statements regarding material uncertainties which may cast significant

doubt on the ability of the entity to continue as a going concern. If the directors refuse to disclose the note to the financial

statements, there is a clear breach of financial reporting standards.

In this case the significant uncertainty is caused by not knowing the extent of the future availability of finance needed

to fund operating activities. If the note describing this uncertainty is not provided, the financial statements are not fairly

presented.

The audit report should contain a qualified or an adverse opinion due to the disagreement. The auditors need to make

a decision as to the significance of the non-disclosure. If it is decided that without the note the financial statements are

not fairly presented, and could be considered misleading, an adverse opinion should be expressed. Alternatively, it could

be decided that the lack of the note is material, but not pervasive to the financial statements; then a qualified ‘except

for’ opinion should be expressed.

ISA 570 Going Concern and ISA 701 Modifications to the Independent Auditor’s Report provide guidance on the

presentation of the audit report in the case of a modification. The audit report should include a paragraph which contains

specific reference to the fact that there is a material uncertainty that may cast significant doubt about the entity’s ability

to continue as a going concern. The paragraph should include a clear description of the uncertainties and would

normally be presented immediately before the opinion paragraph. -

第11题:

单句理解

听力原文:Interest rate risk refers to the exposure of a bank's financial condition to adverse movements in interest rates.

(1)

A.Bank's financial condition is the cause of interest rate risk.

B.Bank's financial condition has impact on interest rate risk.

C.Interest rate risk occurs when interest rate moves against the bank's financial condition.

D.Interest rate risk occurs when interest rate favours the bank's financial condition.

正确答案:C

解析:单句意思为“利率风险是指银行在不利的利率变动中暴露出的财务风险”。A项因果关 系颠倒,B项没有提及,D项“favour”一词与原句“adverse”相矛盾。 -

第12题:

Which of the following scheduling methods uses more of the risk management concepts( ) .A.ADM

B.PDM

C.CPM

D.PERT答案:D解析: -

第13题:

(b) Discuss how the operating statement you have produced can assist managers in:

(i) controlling variable costs;

(ii) controlling fixed production overhead costs. (8 marks)

正确答案:(b) Controlling variable costs

The first step in the process of controlling costs is to measure actual costs. The second step is to calculate variances that show

the difference between actual costs and budgeted or standard costs. These variances then need to be reported to those

managers who have responsibility for them. These managers can then decide whether action needs to be taken to bring actual

costs back into line with budgeted or standard costs. The operating statement therefore has a role to play in reporting

information to management in a way that assists in the decision-making process.

The operating statement quantifies the effect of the volume difference between budgeted and actual sales so that the actual

cost of the actual output can be compared with the standard (or budgeted) cost of the actual output. The statement clearly

differentiates between adverse and favourable variances so that managers can identify areas where there is a significant

difference between actual results and planned performance. This supports management by exception, since managers can

focus their efforts on these significant areas in order to obtain the most impact in terms of getting actual operations back in

line with planned activity.

In control terms, variable costs can be affected in the short term and so an operating statement for the last month showing

variable cost variances will highlight those areas where management action may be effective. In the short term, for example,

managers may be able to improve labour efficiency through training, or through reducing or eliminating staff actions which

do not assist the production process. In this way the adverse direct labour efficiency variance of £252, which is 7·3% of the

standard direct labour cost of the actual output, could be reduced.

Controlling fixed production overhead costs

In the short term, it is unlikely that fixed production overhead costs can be controlled. An operating statement from last month

showing fixed production overhead variances may not therefore assist in controlling fixed costs. Managers will not be able to

take any action to correct the adverse fixed production overhead expenditure variance, for example, which may in fact simply

show the need for improvement in the area of budget planning. Investigation of the component parts of fixed production

overhead will show, however, whether any of these are controllable. In general, this is not the case2.

Absorption costing gives rise to a fixed production overhead volume variance, which shows the effect of actual production

being different from planned production. Since fixed production overheads are a sunk cost, the volume variance shows little

more than that the standard hours for actual production were different from budgeted standard hours3. Similarly, the fixed

production overhead efficiency variance offers little more in information terms than the direct labour efficiency variance. While

fixed production overhead variances assist in reconciling budgeted profit with actual profit, therefore, their reporting in an

operating statement is unlikely to assist in controlling fixed costs. -

第14题:

(b) (i) Discuss the main factors that should be taken into account when determining how to treat gains and

losses arising on tangible non-current assets in a single statement of financial performance. (8 marks)

正确答案:

(b) (i) Currently there are many rules on how gains and losses on tangible non current assets should be reported and these

have traditionally varied from country to country. The main issues revolve around the reporting of depreciation,

disposal/revaluation gains and losses, and impairment losses. The reporting of such elements should take into account

whether the tangible non current assets have been revalued or held at historical cost. The problem facing standard

setters is where to report such gains and losses.The question is whether they should be reported as part of operating

activities or as ‘other gains and losses’.

Holding gains arising on the sale of tangible non current assets could be reported separately from operating results so

that the latter is not obscured by an asset realisation that reflects more a change in market prices than any increase in

the operating activity of the entity. Other changes in the carrying amounts of tangible non current assets will be reported

as part of the operating results. For example, the depreciation charge tries to reflect the consumption of the asset by the

entity and as such is not a holding loss. There may be cases where the depreciation charge does not reflect the

consumption of economic benefits. For example, the pattern and rate of depreciation could have been misjudged

because the asset’s useful life has been assessed incorrectly. In this case, when an asset is sold any excess or shortfall

of depreciation may need to be dealt with in the operating result.

Impairment is another factor to consider in reporting gains and losses on tangible non current assets. Impairment is

effectively accelerated depreciation. Impairment arises when the carrying amount of the asset is above its recoverable

amount. It follows therefore that any impairment loss should be reported as part of the operating result. Any losses on

disposal, to the extent that they represent impairment, could therefore be reported as part of the operating results. Any

losses which represent holding losses could be reported in ‘other gains and losses’. The difficulty will be differentiating

between holding losses and impairment losses. There will have to be clear and concise definitions of these terms or it

could lead to abuse by companies in their quest to maximise operating profits.

A distinction should be made between gains and losses arising on tangible non current assets as a result of revaluations

and those arising on disposal. The nature of the gain or loss is essentially the same although the timing and certainty

of the gain/loss is different. Therefore revaluation gains/losses may be reported in the ‘other gains and losses’ section.

Where an asset has been revalued, any loss on disposal that represents an impairment would be charged to operating

results and any remaining loss reported in ‘other gains and losses’.

Essentially, gains and losses should be reported on the basis of the characteristics of the gains and losses themselves.

Gains and losses with similar characteristics should be reported together thus helping the comparability of financial

performance nationally and internationally. -

第15题:

(b) Discuss how management’s judgement and the financial reporting infrastructure of a country can have a

significant impact on financial statements prepared under IFRS. (6 marks)

Appropriateness and quality of discussion. (2 marks)

正确答案:

(b) Management judgement may have a greater impact under IFRS than generally was the case under national GAAP. IFRS

utilises fair values extensively. Management have to use their judgement in selecting valuation methods and formulating

assumptions when dealing with such areas as onerous contracts, share-based payments, pensions, intangible assets acquired

in business combinations and impairment of assets. Differences in methods or assumptions can have a major impact on

amounts recognised in financial statements. IAS1 expects companies to disclose the sensitivity of carrying amounts to the

methods, assumptions and estimates underpinning their calculation where there is a significant risk of material adjustment

to their carrying amounts within the next financial year. Often management’s judgement is that there is no ‘significant risk’

and they often fail to disclose the degree of estimation or uncertainty and thus comparability is affected.

In addition to the IFRSs themselves, a sound financial reporting infrastructure is required. This implies effective corporate

governance practices, high quality auditing standards and practices, and an effective enforcement or oversight mechanism.

Therefore, consistency and comparability of IFRS financial statements will also depend on the robust nature of the other

elements of the financial reporting infrastructure.

Many preparers of financial statements will have been trained in national GAAP and may not have been trained in the

principles underlying IFRS and this can lead to unintended inconsistencies when implementing IFRS especially where the

accounting profession does not have a CPD requirement. Additionally where the regulatory system of a country is not well

developed, there may not be sufficient market information to utilise fair value measurements and thus this could lead to

hypothetical markets being created or the use of mathematical modelling which again can lead to inconsistencies because of

lack of experience in those countries of utilising these techniques. This problem applies to other assessments or estimates

relating to such things as actuarial valuations, investment property valuations, impairment testing, etc.

The transition to IFRS can bring significant improvement to the quality of financial performance and improve comparability

worldwide. However, there are issues still remaining which can lead to inconsistency and lack of comparability with those

financial statements. -

第16题:

(b) Explain the meaning of Stephanie’s comment: ‘I would like to get risk awareness embedded in the culture

at the Southland factory.’ (5 marks)

正确答案:

Embedded risk

Risk awareness is the knowledge of the nature, hazards and probabilities of risk in given situations. Whilst management will

typically be more aware than others in the organisation of many risks, it is important to embed awareness at all levels so as

to reduce the costs of risk to an organisation and its members (which might be measured in financial or non-financial terms).

In practical terms, embedding means introducing a taken-for-grantedness of risk awareness into the culture of an organisation

and its internal systems. Culture, defined in Handy’s terms as ‘the way we do things round here’ underpins all risk

management activity as it defines attitudes, actions and beliefs.

The embedding of risk awareness into culture and systems involves introducing risk controls into the process of work and the

environment in which it takes place. Risk awareness and risk mitigation become as much a part of a process as the process

itself so that people assume such measures to be non-negotiable components of their work experience. In such organisational

cultures, risk management is unquestioned, taken for granted, built into the corporate mission and culture and may be used

as part of the reward system.

Tutorial note: other meaningful definitions of culture in an organisational context are equally acceptable. -

第17题:

(c) Risk committee members can be either executive or non-executive.

Required:

(i) Distinguish between executive and non-executive directors. (2 marks)

正确答案:

(c) Risk committee members can be either executive on non-executive.

(i) Distinguish between executive and non-executive directors

Executive directors are full time members of staff, have management positions in the organisation, are part of the

executive structure and typically have industry or activity-relevant knowledge or expertise, which is the basis of their

value to the organisation.

Non-executive directors are engaged part time by the organisation, bring relevant independent, external input and

scrutiny to the board, and typically occupy positions in the committee structure. -

第18题:

(ii) Briefly discuss FOUR non-financial factors which might influence the above decision. (4 marks)

正确答案:

(ii) Four factors that could be considered are as follows:

(i) The quality of the service provided by NSC as evidenced by, for example, the comfort of the ferries, on-board

facilities, friendliness and responsiveness of staff.

(ii) The health and safety track record of NSC – passenger safety is a ‘must’ in such operations.

(iii) The reliability, timeliness and dependability of NSC as a service provider.

(iv) The potential loss of image due to redundancies within Wonderland plc. -

第19题:

(ii) Briefly discuss THREE disadvantages of using EVA? in the measurement of financial performance.

(3 marks)

正确答案:

(ii) Disadvantages of an EVA approach to the measurement of financial performance include:

(i) The calculation of EVA may be complicated due to the number of adjustments required.

(ii) It is difficult to use EVA for inter-firm and inter-divisional comparisons because it is not a ratio measure.

(iii) Economic depreciation is difficult to estimate and conflicts with generally accepted accounting principles.

Note: Other relevant discussion would be acceptable. -

第20题:

John Pentanol was appointed as risk manager at H&Z Company a year ago and he decided that his first task was to examine the risks that faced the company. He concluded that the company faced three major risks, which he assessed by examining the impact that would occur if the risk were to materialise. He assessed Risk 1 as being of low potential impact as even if it materialised it would have little effect on the company’s strategy. Risk 2 was assessed as being of medium potential impact whilst a third risk, Risk 3, was assessed as being of very high potential impact.

When John realised the potential impact of Risk 3 materialising, he issued urgent advice to the board to withdraw from the activity that gave rise to Risk 3 being incurred. In the advice he said that the impact of Risk 3 was potentially enormous and it would be irresponsible for H&Z to continue to bear that risk.

The company commercial director, Jane Xylene, said that John Pentanol and his job at H&Z were unnecessary and that risk management was ‘very expensive for the benefits achieved’. She said that all risk managers do is to tell people what can’t be done and that they are pessimists by nature. She said she wanted to see entrepreneurial risk takers in H&Z and not risk managers who, she believed, tended to discourage enterprise.

John replied that it was his job to eliminate all of the highest risks at H&Z Company. He said that all risk was bad and needed to be eliminated if possible. If it couldn’t be eliminated, he said that it should be minimised.

(a) The risk manager has an important role to play in an organisation’s risk management.

Required:

(i) Describe the roles of a risk manager. (4 marks)

(ii) Assess John Pentanol’s understanding of his role. (4 marks)

(b) With reference to a risk assessment framework as appropriate, criticise John’s advice that H&Z should

withdraw from the activity that incurs Risk 3. (6 marks)

(c) Jane Xylene expressed a particular view about the value of risk management in H&Z Company. She also said that she wanted to see ‘entrepreneurial risk takers’.

Required:

(i) Define ‘entrepreneurial risk’ and explain why it is important to accept entrepreneurial risk in business

organisations; (4 marks)

(ii) Critically evaluate Jane Xylene’s view of risk management. (7 marks)

正确答案:(a) (i) Roles of a risk manager

Providing overall leadership, vision and direction, involving the establishment of risk management (RM) policies,

establishing RM systems etc. Seeking opportunities for improvement or tightening of systems.

Developing and promoting RM competences, systems, culture, procedures, protocols and patterns of behaviour. It is

important to understand that risk management is as much about instituting and embedding risk systems as much as

issuing written procedure. The systems must be capable of accurate risk assessment which seem not to be the case at

H&Z as he didn’t account for variables other than impact/hazard.

Reporting on the above to management and risk committee as appropriate. Reporting information should be in a form

able to be used for the generation of external reporting as necessary. John’s issuing of ‘advice’ will usually be less useful

than full reporting information containing all of the information necessary for management to decide on risk policy.Ensuring compliance with relevant codes, regulations, statutes, etc. This may be at national level (e.g. Sarbanes Oxley)

or it may be industry specific. Banks, oil, mining and some parts of the tourism industry, for example, all have internal

risk rules that risk managers are required to comply with.

[Tutorial note: do not reward bullet lists. Study texts both use lists but question says ‘describe’.]

(ii) John Pentanol’s understanding of his role

John appears to misunderstand the role of a risk manager in four ways.

Whereas the establishment of RM policies is usually the most important first step in risk management, John launched

straight into detailed risk assessments (as he saw it). It is much more important, initially, to gain an understanding of

the business, its strategies, controls and risk exposures. The assessment comes once the policy has been put in place.

It is important for the risk manager to report fully on the risks in the organisation and John’s issuing of ‘advice’ will usually

be less useful than full reporting information. Full reporting would contain all of the information necessary for

management to decide on risk policy.

He told Jane Xylene that his role as risk manager involved eliminating ‘all of the highest risks at H&Z Company’ which

is an incorrect view. Jane Xylene was correct to say that entrepreneurial risk was important, for example.

The risk manager is an operational role in a company such as H&Z Company and it will usually be up to senior

management to decide on important matters such as withdrawal from risky activities. John was being presumptuous

and overstepping his role in issuing advice on withdrawal from Risk 3. It is his job to report on risks to senior

management and for them to make such decisions based on the information he provides.(b) Criticise John’s advice

The advice is based on an incomplete and flawed risk assessment. Most simple risk assessment frameworks comprise at least

two variables of which impact or hazard is only one. The other key variable is probability. Risk impact has to be weighed

against probability and the fact that a risk has a high potential impact does not mean the risk should be avoided as long as

the probability is within acceptable limits. It is the weighted combination of hazard/impact and probability that forms the basis

for meaningful risk assessment.

John appears to be very certain of his impact assessments but the case does not tell us on what information the assessment

is made. It is important to recognise that ‘hard’ data is very difficult to obtain on both impact and probability. Both measures

are often made with a degree of assumption and absolute measures such as John’s ranking of Risks 1, 2 and 3 are not as

straightforward as he suggests.

John also overlooks a key strategic reason for H&Z bearing the risks in the first place, which is the return achievable by the

bearing of risk. Every investment and business strategy carries a degree of risk and this must be weighed against the financial

return that can be expected by the bearing of the risk.

(c) (i) Define ‘entrepreneurial risk’

Entrepreneurial risk is the necessary risk associated with any new business venture or opportunity. It is most clearly seen

in entrepreneurial business activity, hence its name. In ‘Ansoff’ terms, entrepreneurial risk is expressed in terms of the

unknowns of the market/customer reception of a new venture or of product uncertainties, for example product design,

construction, etc. There is also entrepreneurial risk in uncertainties concerning the competences and skills of the

entrepreneurs themselves.

Entrepreneurial risk is necessary, as Jane Xylene suggested, because it is from taking these risks that business

opportunities arise. The fact that the opportunity may not be as hoped does not mean it should not be pursued. Any

new product, new market development or new activity is a potential source of entrepreneurial risk but these are also the

sources of future revenue streams and hence growth in company value.(ii) Critically evaluate Jane Xylene’s view of risk management

There are a number of arguments against risk management in general. These arguments apply against the totality of risk

management and also of the employment of inappropriate risk measures.

There is a cost associated with all elements of risk management which must obviously be borne by the company.

Disruption to normal organisational practices and procedures as risk systems are complied with.

Slowing (introducing friction to) the seizing of new business opportunities or the development of internal systems as they

are scrutinised for risk.

‘STOP’ errors can occur as a result of risk management systems where a practice or opportunity has been stopped on

the grounds of its risk when it should have been allowed to proceed. This may be the case with Risk 3 in the case.

(Contrast with ‘GO’ errors which are the opposite of STOP errors.)

There are also arguments for risk management people and systems in H&Z. The most obvious benefit is that an effective

risk system identifies those risks that could detract from the achievements of the company’s strategic objectives. In this

respect, it can prevent costly mistakes by advising against those actions that may lose the company value. It also has

the effect of reassuring investors and capital markets that the company is aware of and is in the process of managing

its risks. Where relevant, risk management is necessary for compliance with codes, listing rules or statutory instruments. -

第21题:

3 (a) Financial statements often contain material balances recognised at fair value. For auditors, this leads to additional

audit risk.

Required:

Discuss this statement. (7 marks)

正确答案:

3 Poppy Co

(a) Balances held at fair value are frequently recognised as material items in the statement of financial position. Sometimes it is

required by the financial reporting framework that the measurement of an asset or liability is at fair value, e.g. certain

categories of financial instruments, whereas it is sometimes the entity’s choice to measure an item using a fair value model

rather than a cost model, e.g. properties. It is certainly the case that many of these balances will be material, meaning that

the auditor must obtain sufficient appropriate evidence that the fair value measurement is in accordance with the

requirements of financial reporting standards. ISA 540 (Revised and Redrafted) Auditing Accounting Estimates Including Fair

Value Accounting Estimates and Related Disclosures and ISA 545 Auditing Fair Value Measurements and Disclosures

contain guidance in this area.

As part of the understanding of the entity and its environment, the auditor should gain an insight into balances that are stated

at fair value, and then assess the impact of this on the audit strategy. This will include an evaluation of the risk associated

with the balance(s) recognised at fair value.

Audit risk comprises three elements; each is discussed below in the context of whether material balances shown at fair value

will lead to increased risk for the auditor.

Inherent risk

Many measurements based on estimates, including fair value measurements, are inherently imprecise and subjective in

nature. The fair value assessment is likely to involve significant judgments, e.g. regarding market conditions, the timing of

cash flows, or the future intentions of the entity. In addition, there may be a deliberate attempt by management to manipulate

the fair value to achieve a desired aim within the financial statements, in other words to attempt some kind of window

dressing.

Many fair value estimation models are complicated, e.g. discounted cash flow techniques, or the actuarial calculations used

to determine the value of a pension fund. Any complicated calculations are relatively high risk, as difficult valuation techniques

are simply more likely to contain errors than simple valuation techniques. However, there will be some items shown at fair

value which have a low inherent risk, because the measurement of fair value may be relatively straightforward, e.g. assets

that are regularly bought and sold on open markets that provide readily available and reliable information on the market prices

at which actual exchanges occur.

In addition to the complexities discussed above, some fair value measurement techniques will contain significant

assumptions, e.g. the most appropriate discount factor to use, or judgments over the future use of an asset. Management

may not always have sufficient experience and knowledge in making these judgments.

Thus the auditor should approach some balances recognised at fair value as having a relatively high inherent risk, as their

subjective and complex nature means that the balance is prone to contain an error. However, the auditor should not just

assume that all fair value items contain high inherent risk – each balance recognised at fair value should be assessed for its

individual level of risk.

Control risk

The risk that the entity’s internal monitoring system fails to prevent and detect valuation errors needs to be assessed as part

of overall audit risk assessment. One problem is that the fair value assessment is likely to be performed once a year, outside

the normal accounting and management systems, especially where the valuation is performed by an external specialist.

Therefore, as a non-routine event, the assessment of fair value is likely not to have the same level of monitoring or controls

as a day-to-day business transaction.

However, due to the material impact of fair values on the statement of financial position, and in some circumstances on profit,

management may have made great effort to ensure that the assessment is highly monitored and controlled. It therefore could

be the case that there is extremely low control risk associated with the recognition of fair values.

Detection risk

The auditor should minimise detection risk via thorough planning and execution of audit procedures. The audit team may

lack experience in dealing with the fair value in question, and so would be unlikely to detect errors in the valuation techniques

used. Over-reliance on an external specialist could also lead to errors not being found.

Conclusion

It is true that the increasing recognition of items measured at fair value will in many cases cause the auditor to assess the

audit risk associated with the balance as high. However, it should not be assumed that every fair value item will be likely to

contain a material misstatement. The auditor must be careful to identify and respond to the level of risk for fair value items

on an individual basis to ensure that sufficient and appropriate evidence is gathered, thus reducing the audit risk to an

acceptable level. -

第22题:

听力原文:Seeking to maximize profits by assuming inappropriately large financial risk can cause investors to lose sleep.

(2)

A.Assuming inappropriately large financial risk can cause investors to lose sleep.

B.Financial risk will not cause investors to lose sleep.

C.Seeking to maximize profits appropriately can cause investors to lose sleep.

D.No matter how much they earn, the investors will lose sleep.

正确答案:A

解析:录音单句的意思为“通过承担相当大的不合适的金融风险来寻求最大的利润会使投资者失眠。” -

第23题:

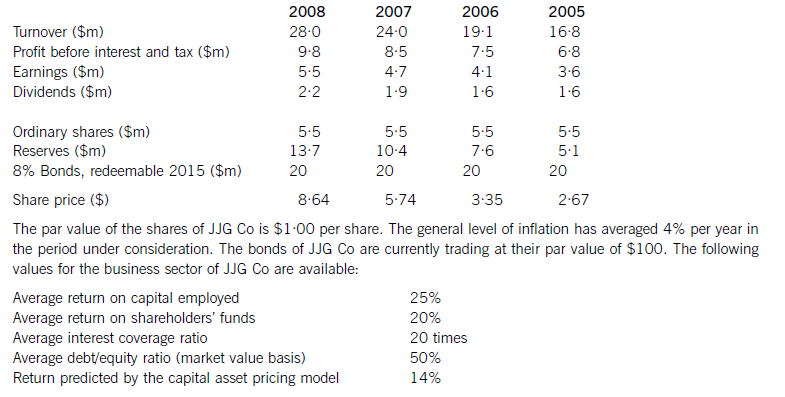

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

正确答案:

AchievementofcorporateobjectivesJJGCohasshareholderwealthmaximisationasanobjective.Thewealthofshareholdersisincreasedbydividendsreceivedandcapitalgainsonsharesowned.Totalshareholderreturncomparesthesumofthedividendreceivedandthecapitalgainwiththeopeningshareprice.TheshareholdersofJJGCohadareturnof58%in2008,comparedwithareturnpredictedbythecapitalassetpricingmodelof14%.Thelowestreturnshareholdershavereceivedwas21%andthehighestreturnwas82%.Onthisbasis,theshareholdersofthecompanyhaveexperiencedasignificantincreaseinwealth.Itisdebatablewhetherthishasbeenasaresultoftheactionsofthecompany,however.Sharepricesmayincreaseirrespectiveoftheactionsanddecisionsofmanagers,orevendespitethem.Infact,lookingatthedividendpersharehistoryofthecompany,therewasoneyear(2006)wheredividendswereconstant,eventhoughearningspershareincreased.Itisalsodifficulttoknowwhenwealthhasbeenmaximised.Anotherobjectiveofthecompanywastoachieveacontinuousincreaseinearningspershare.Analysisshowsthatearningspershareincreasedeveryyear,withanaverageincreaseof14·9%.Thisobjectiveappearstohavebeenachieved.CommentonfinancialperformanceReturnoncapitalemployed(ROCE)hasbeengrowingtowardsthesectoraverageof25%onayear-by-yearbasisfrom22%in2005.Thissteadygrowthintheprimaryaccountingratiocanbecontrastedwithirregulargrowthinturnover,thereasonsforwhichareunknown.Returnonshareholders’fundshasbeenconsistentlyhigherthantheaverageforthesector.ThismaybeduemoretothecapitalstructureofJJGCothantogoodperformancebythecompany,however,inthesensethatshareholders’fundsaresmalleronabookvaluebasisthanthelong-termdebtcapital.Ineverypreviousyearbut2008thegearingofthecompanywashigherthanthesectoraverage.(b)CalculationoftheoreticalexrightspershareCurrentshareprice=$8·64pershareCurrentnumberofshares=5·5millionsharesFinancetoberaised=$15mRightsissueprice=$7·50pershareNumberofsharesissued=15m/7·50=2millionsharesTheoreticalexrightspricepershare=((5·5mx8·64)+(2mx7·50))/7·5m=$8·34pershareThesharepricewouldfallfrom$8·64to$8·34pershareHowever,therewouldbenoeffectonshareholderwealthEffectofrightsissueonearningspershareCurrentEPS=100centspershareRevisedEPS=100x5·5m/7·5m=73centspershareTheEPSwouldfallfrom100centspershareto73centspershareHowever,asmentionedearlier,therewouldbenoeffectonshareholderwealthEffectofrightsissueonthedebt/equityratioCurrentdebt/equityratio=100x20/47·5=42%Revisedmarketvalueofequity=7·5mx8·34=$62·55millionReviseddebt/equityratio=100x20/62·55=32%Thedebt/equityratiowouldfallfrom42%to32%,whichiswellbelowthesectoraveragevalueandwouldsignalareductioninfinancialrisk(c)Thecurrentdebt/equityratioofJJGCois42%(20/47·5).Althoughthisislessthanthesectoraveragevalueof50%,itismoreusefulfromafinancialriskperspectivetolookattheextenttowhichinterestpaymentsarecoveredbyprofits.Theinterestonthebondissueis$1·6million(8%of$20m),givinganinterestcoverageratioof6·1times.IfJJGCohasoverdraftfinance,theinterestcoverageratiowillbelowerthanthis,butthereisinsufficientinformationtodetermineifanoverdraftexists.Theinterestcoverageratioisnotonlybelowthesectoraverage,itisalsolowenoughtobeacauseforconcern.Whiletheratioshowsanupwardtrendovertheperiodunderconsideration,itstillindicatesthatanissueoffurtherdebtwouldbeunwise.Aplacing,oranyissueofnewsharessuchasarightsissueorapublicoffer,woulddecreasegearing.Iftheexpansionofbusinessresultsinanincreaseinprofitbeforeinterestandtax,theinterestcoverageratiowillincreaseandfinancialriskwillfall.GiventhecurrentfinancialpositionofJJGCo,adecreaseinfinancialriskiscertainlypreferabletoanincrease.Aplacingwilldiluteownershipandcontrol,providingthenewequityissueistakenupbynewinstitutionalshareholders,whilearightsissuewillnotdiluteownershipandcontrol,providingexistingshareholderstakeuptheirrights.Abondissuedoesnothaveownershipandcontrolimplications,althoughrestrictiveornegativecovenantsinbondissuedocumentscanlimittheactionsofacompanyanditsmanagers.Allthreefinancingchoicesarelong-termsourcesoffinanceandsoareappropriateforalong-terminvestmentsuchastheproposedexpansionofexistingbusiness.Equityissuessuchasaplacingandarightsissuedonotrequiresecurity.Noinformationisprovidedonthenon-currentassetsofJJGCo,butitislikelythattheexistingbondissueissecured.Ifanewbondissuewasbeingconsidered,JJGCowouldneedtoconsiderwhetherithadsufficientnon-currentassetstoofferassecurity,althoughitislikelythatnewnon-currentassetswouldbeboughtaspartofthebusinessexpansion.