10 Which of the following factors would cause a company’s gearing ratio to fall?1 A bonus issue of ordinary shares.2 A rights issue of ordinary shares.3 An issue of loan notes.4 An upward revaluation of non-current assets.A 1 and 3B 2 and 3C 1 and 4D 2 an

题目

10 Which of the following factors would cause a company’s gearing ratio to fall?

1 A bonus issue of ordinary shares.

2 A rights issue of ordinary shares.

3 An issue of loan notes.

4 An upward revaluation of non-current assets.

A 1 and 3

B 2 and 3

C 1 and 4

D 2 and 4

相似考题

更多“10 Which of the following factors would cause a company’s gearing ratio to fall?1 A bonus issue of ordinary shares.2 A rights issue of ordinary shares.3 An issue of loan notes.4 An upward revaluation of non-current assets.A 1 and 3B 2 and 3C 1 and 4D 2 an”相关问题

-

第1题:

22 Which of the following statements about limited liability companies’ accounting is/are correct?

1 A revaluation reserve arises when a non-current asset is sold at a profit.

2 The authorised share capital of a company is the maximum nominal value of shares and loan notes the company

may issue.

3 The notes to the financial statements must contain details of all adjusting events as defined in IAS10 Events after

the balance sheet date.

A All three statements

B 1 and 2 only

C 2 and 3 only

D None of the statements

正确答案:D

-

第2题:

17 Which of the following statements are correct?

(1) All non-current assets must be depreciated.

(2) If goodwill is revalued, the revaluation surplus appears in the statement of changes in equity.

(3) If a tangible non-current asset is revalued, all tangible assets of the same class should be revalued.

(4) In a company’s published balance sheet, tangible assets and intangible assets must be shown separately.

A 1 and 2

B 2 and 3

C 3 and 4

D 1 and 4

正确答案:C

-

第3题:

Upon starting your database, you receive the following error:You can choose from the following steps:1.Restore the database datafiles.2.Issue the alter database clear unarchived logfile group 1 command.3.Issue the alter database open command.4.Issue the alter database open resetlogs command.5.Recover the database using point-in-time recovery.6.Issue the Startup Mount command to mount the database.7.Back up the database.Which is the correct order of these steps in this case?()

A. 1,6,5,4,7

B. 6,5,4

C. 6,2,3,7

D. 1,6,3

E. The database cannot be recovered

参考答案:C

-

第4题:

Users are unable to stay connected to the company‘s wireless network. Several times throughoutthe day the users‘ signals are dropped and they are forced to reconnect to the network.A technician determines the network cabling that supplies the WAP has been run inside with severalpower lines.Which of the following is the MOST likely cause of the network issue?()

A.Ashort

B.Open pairs

C.ESD

D.EMI

参考答案:D

-

第5题:

(a) The following figures have been calculated from the financial statements (including comparatives) of Barstead for

the year ended 30 September 2009:

increase in profit after taxation 80%

increase in (basic) earnings per share 5%

increase in diluted earnings per share 2%

Required:

Explain why the three measures of earnings (profit) growth for the same company over the same period can

give apparently differing impressions. (4 marks)

(b) The profit after tax for Barstead for the year ended 30 September 2009 was $15 million. At 1 October 2008 the company had in issue 36 million equity shares and a $10 million 8% convertible loan note. The loan note will mature in 2010 and will be redeemed at par or converted to equity shares on the basis of 25 shares for each $100 of loan note at the loan-note holders’ option. On 1 January 2009 Barstead made a fully subscribed rights issue of one new share for every four shares held at a price of $2·80 each. The market price of the equity shares of Barstead immediately before the issue was $3·80. The earnings per share (EPS) reported for the year ended 30 September 2008 was 35 cents.

Barstead’s income tax rate is 25%.

Required:

Calculate the (basic) EPS figure for Barstead (including comparatives) and the diluted EPS (comparatives not required) that would be disclosed for the year ended 30 September 2009. (6 marks)

正确答案:

(a)Whilstprofitaftertax(anditsgrowth)isausefulmeasure,itmaynotgiveafairrepresentationofthetrueunderlyingearningsperformance.Inthisexample,userscouldinterpretthelargeannualincreaseinprofitaftertaxof80%asbeingindicativeofanunderlyingimprovementinprofitability(ratherthanwhatitreallyis:anincreaseinabsoluteprofit).Itispossible,evenprobable,that(someof)theprofitgrowthhasbeenachievedthroughtheacquisitionofothercompanies(acquisitivegrowth).Wherecompaniesareacquiredfromtheproceedsofanewissueofshares,orwheretheyhavebeenacquiredthroughshareexchanges,thiswillresultinagreaternumberofequitysharesoftheacquiringcompanybeinginissue.ThisiswhatappearstohavehappenedinthecaseofBarsteadastheimprovementindicatedbyitsearningspershare(EPS)isonly5%perannum.ThisexplainswhytheEPS(andthetrendofEPS)isconsideredamorereliableindicatorofperformancebecausetheadditionalprofitswhichcouldbeexpectedfromthegreaterresources(proceedsfromthesharesissued)ismatchedwiththeincreaseinthenumberofshares.Simplylookingatthegrowthinacompany’sprofitaftertaxdoesnottakeintoaccountanyincreasesintheresourcesusedtoearnthem.Anyincreaseingrowthfinancedbyborrowings(debt)wouldnothavethesameimpactonprofit(asbeingfinancedbyequityshares)becausethefinancecostsofthedebtwouldacttoreduceprofit.ThecalculationofadilutedEPStakesintoaccountanypotentialequitysharesinissue.Potentialordinarysharesarisefromfinancialinstruments(e.g.convertibleloannotesandoptions)thatmayentitletheirholderstoequitysharesinthefuture.ThedilutedEPSisusefulasitalertsexistingshareholderstothefactthatfutureEPSmaybereducedasaresultofsharecapitalchanges;inasenseitisawarningsign.InthiscasethelowerincreaseinthedilutedEPSisevidencethatthe(higher)increaseinthebasicEPShas,inpart,beenachievedthroughtheincreaseduseofdilutingfinancialinstruments.Thefinancecostoftheseinstrumentsislessthantheearningstheirproceedshavegeneratedleadingtoanincreaseincurrentprofits(andbasicEPS);however,inthefuturetheywillcausemoresharestobeissued.ThiscausesadilutionwherethefinancecostperpotentialnewshareislessthanthebasicEPS. -

第6题:

A system administrator is trying to troubleshoot company wide email problems that may be related to DNS. Which of the following network tools would be MOST useful to determine if it is a DNS issue?()

- A、netstat

- B、tracert

- C、nslookup

- D、ping

正确答案:C -

第7题:

A user’s laptop does not produce sound even though the volume settings are at maximum in theoperating system. Which of the following would MOST likely resolve this issue?()

- A、A new sound card

- B、A new speaker

- C、A BIOS update

- D、A hardware volume control

正确答案:D -

第8题:

While troubleshooting connectivity issues, you log into a remote router. From there,you wish to see the layer 1 and layer 2 status of the interface. Which of the following IOS commands would you issue to check the current IP addressing, as well as theyer 1 and layer 2 status of an interface?()

- A、TK1# show version

- B、TK1# show protocols

- C、TK1# show interfaces

- D、TK1# show controllers

- E、TK1# show ip interface

- F、TK1# show startup-config

正确答案:C,D,E -

第9题:

Users are unable to stay connected to the company's wireless network. Several times throughout the day the users' signals are dropped and they are forced to reconnect to the network. A technician determines the network cabling that supplies the WAP has been run inside with several power lines. Which of the following is the MOST likely cause of the network issue?()

- A、Ashort

- B、Open pairs

- C、ESD

- D、EMI

正确答案:D -

第10题:

A customer asks the technician for an explanation of the cause of a printer issue, after the issue is resolved. Which of the following would be the MOST appropriate response?()

- A、“The process of removal is extremely complex and only certain individuals would understand”.

- B、“There was a moisture build up in the paper tray that apparently caused the paper jam”.

- C、“Condensation within the lower tray assembly hindered the functionality of the rollers which caused improper transfer”.

- D、“The paper jam was caused because irresponsible users spilled liquid in the bottom tray”.

正确答案:B -

第11题:

A user reports that the computer’s hard drive is constantly running and the hard drive light is constantly flashing. Which of the following tools would be used to resolve this issue without losing data?()

- A、chkdsk

- B、fdisk

- C、defrag

- D、format

正确答案:C -

第12题:

You are developing a bonus report for the payroll application to calculate and display the bonus issue to each envelope. Employees with a salary of less than 50000$ earn a bonus of 15% and the employees who earn 50000$ or more earn out 10% bonus. Which type of trigger would you use to conditionally assign a bonus percentage?()

- A、Report level trigger.

- B、Group filter.

- C、Format trigger.

- D、None of the above.

正确答案:D -

第13题:

11 Which of the following statements are correct?

1 A company might make a rights issue if it wished to raise more equity capital.

2 A rights issue might increase the share premium account whereas a bonus issue is likely to reduce it.

3 A bonus issue will reduce the gearing (leverage) ratio of a company.

4 A rights issue will always increase the number of shareholders in a company whereas a bonus issue will not.

A 1 and 2

B 1 and 3

C 2 and 3

D 2 and 4

正确答案:A

-

第14题:

21 Which of the following items must be disclosed in a company’s published financial statements?

1 Authorised share capital

2 Movements in reserves

3 Finance costs

4 Movements in non-current assets

A 1, 2 and 3 only

B 1, 2 and 4 only

C 2, 3 and 4 only

D All four items

正确答案:D

-

第15题:

New service from the telephone company is delivered over fiber, but the technician does not have a fiber module for the router. Which of the following would remedy this issue?()A. OTDR

B. Media converter

C. CSU/DSU

D. Fiber repeater

参考答案:B

-

第16题:

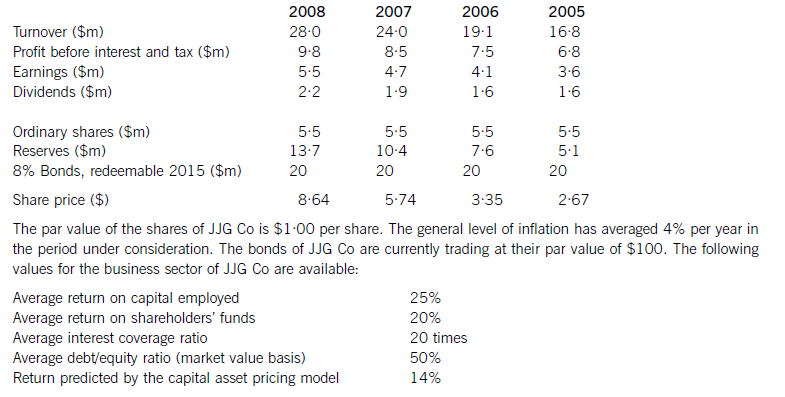

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

正确答案:

AchievementofcorporateobjectivesJJGCohasshareholderwealthmaximisationasanobjective.Thewealthofshareholdersisincreasedbydividendsreceivedandcapitalgainsonsharesowned.Totalshareholderreturncomparesthesumofthedividendreceivedandthecapitalgainwiththeopeningshareprice.TheshareholdersofJJGCohadareturnof58%in2008,comparedwithareturnpredictedbythecapitalassetpricingmodelof14%.Thelowestreturnshareholdershavereceivedwas21%andthehighestreturnwas82%.Onthisbasis,theshareholdersofthecompanyhaveexperiencedasignificantincreaseinwealth.Itisdebatablewhetherthishasbeenasaresultoftheactionsofthecompany,however.Sharepricesmayincreaseirrespectiveoftheactionsanddecisionsofmanagers,orevendespitethem.Infact,lookingatthedividendpersharehistoryofthecompany,therewasoneyear(2006)wheredividendswereconstant,eventhoughearningspershareincreased.Itisalsodifficulttoknowwhenwealthhasbeenmaximised.Anotherobjectiveofthecompanywastoachieveacontinuousincreaseinearningspershare.Analysisshowsthatearningspershareincreasedeveryyear,withanaverageincreaseof14·9%.Thisobjectiveappearstohavebeenachieved.CommentonfinancialperformanceReturnoncapitalemployed(ROCE)hasbeengrowingtowardsthesectoraverageof25%onayear-by-yearbasisfrom22%in2005.Thissteadygrowthintheprimaryaccountingratiocanbecontrastedwithirregulargrowthinturnover,thereasonsforwhichareunknown.Returnonshareholders’fundshasbeenconsistentlyhigherthantheaverageforthesector.ThismaybeduemoretothecapitalstructureofJJGCothantogoodperformancebythecompany,however,inthesensethatshareholders’fundsaresmalleronabookvaluebasisthanthelong-termdebtcapital.Ineverypreviousyearbut2008thegearingofthecompanywashigherthanthesectoraverage.(b)CalculationoftheoreticalexrightspershareCurrentshareprice=$8·64pershareCurrentnumberofshares=5·5millionsharesFinancetoberaised=$15mRightsissueprice=$7·50pershareNumberofsharesissued=15m/7·50=2millionsharesTheoreticalexrightspricepershare=((5·5mx8·64)+(2mx7·50))/7·5m=$8·34pershareThesharepricewouldfallfrom$8·64to$8·34pershareHowever,therewouldbenoeffectonshareholderwealthEffectofrightsissueonearningspershareCurrentEPS=100centspershareRevisedEPS=100x5·5m/7·5m=73centspershareTheEPSwouldfallfrom100centspershareto73centspershareHowever,asmentionedearlier,therewouldbenoeffectonshareholderwealthEffectofrightsissueonthedebt/equityratioCurrentdebt/equityratio=100x20/47·5=42%Revisedmarketvalueofequity=7·5mx8·34=$62·55millionReviseddebt/equityratio=100x20/62·55=32%Thedebt/equityratiowouldfallfrom42%to32%,whichiswellbelowthesectoraveragevalueandwouldsignalareductioninfinancialrisk(c)Thecurrentdebt/equityratioofJJGCois42%(20/47·5).Althoughthisislessthanthesectoraveragevalueof50%,itismoreusefulfromafinancialriskperspectivetolookattheextenttowhichinterestpaymentsarecoveredbyprofits.Theinterestonthebondissueis$1·6million(8%of$20m),givinganinterestcoverageratioof6·1times.IfJJGCohasoverdraftfinance,theinterestcoverageratiowillbelowerthanthis,butthereisinsufficientinformationtodetermineifanoverdraftexists.Theinterestcoverageratioisnotonlybelowthesectoraverage,itisalsolowenoughtobeacauseforconcern.Whiletheratioshowsanupwardtrendovertheperiodunderconsideration,itstillindicatesthatanissueoffurtherdebtwouldbeunwise.Aplacing,oranyissueofnewsharessuchasarightsissueorapublicoffer,woulddecreasegearing.Iftheexpansionofbusinessresultsinanincreaseinprofitbeforeinterestandtax,theinterestcoverageratiowillincreaseandfinancialriskwillfall.GiventhecurrentfinancialpositionofJJGCo,adecreaseinfinancialriskiscertainlypreferabletoanincrease.Aplacingwilldiluteownershipandcontrol,providingthenewequityissueistakenupbynewinstitutionalshareholders,whilearightsissuewillnotdiluteownershipandcontrol,providingexistingshareholderstakeuptheirrights.Abondissuedoesnothaveownershipandcontrolimplications,althoughrestrictiveornegativecovenantsinbondissuedocumentscanlimittheactionsofacompanyanditsmanagers.Allthreefinancingchoicesarelong-termsourcesoffinanceandsoareappropriateforalong-terminvestmentsuchastheproposedexpansionofexistingbusiness.Equityissuessuchasaplacingandarightsissuedonotrequiresecurity.Noinformationisprovidedonthenon-currentassetsofJJGCo,butitislikelythattheexistingbondissueissecured.Ifanewbondissuewasbeingconsidered,JJGCowouldneedtoconsiderwhetherithadsufficientnon-currentassetstoofferassecurity,althoughitislikelythatnewnon-currentassetswouldbeboughtaspartofthebusinessexpansion. -

第17题:

Which of the following groups would the skyscraper issue most concern?__________A.Electricians

B.Environmentalists

C.City planners

D.Television viewers答案:B解析:细节理解题。文章第一段第二句提到了这一点:“Ecologists pointed outthat a cluster oftallbuildings in a city often overburdens public transportation and parking lot capacities.”这里ecologists(生态学者)实际上就是environmentalists(环境保护人士)。 -

第18题:

A system administrator did not receive a response while attempting to ping loopback. Which of the following would most likely resolve this problem?()

- A、Issue startsrc -s loopback

- B、Issue startsrc -g tcpip

- C、Issue rc.tcpip

- D、Reconnect the network cable

正确答案:C -

第19题:

An administrator has implemented a solution to resolve a server’s problem in which the server unexpectedly reboots. Which of the following should be the administrator’s NEXT troubleshooting step?()

- A、Test the theory to determine if the solution will correct the issue, list all other possible causes.

- B、Verify full system functionality.

- C、Document the issue; include details regarding findings, actions taken to resolve the issue, and the outcome.

- D、Establish a theory of probable cause based on previous tests and determine next steps toresolve

正确答案:B -

第20题:

New service from the telephone company is delivered over fiber, but the technician does not have a fiber module for the router. Which of the following would remedy this issue?()

- A、OTDR

- B、Media converter

- C、CSU/DSU

- D、Fiber repeater

正确答案:B -

第21题:

An administrator is unable to ping a workstation. Which of the following tools would BEST help toresolve the issue?()

- A、Cable tester

- B、Multimeter

- C、Toner probe

- D、Protocol analyzer

正确答案:A -

第22题:

When attempting to boot a PC, the POST process completes without error. The PC then displays,‘non system disk or disk error’. Which of the following would MOST likely cause the issue?()

- A、Out-of-date BIOS

- B、Invalid motherboard jumper settings

- C、Failing power supply

- D、Floppy disk in the drive

正确答案:D -

第23题:

A technician is sent out to a client’s office to solve an issue involving a machine which has numerous Windows XP service failures upon startup. Which of the following would be the FIRST place to check for information on this?()

- A、Event Viewer

- B、MSCONFIG

- C、Services MMC

- D、Group Policy Editor

正确答案:A