3 You are the manager responsible for the audit of Volcan, a long-established limited liability company. Volcan operatesa national supermarket chain of 23 stores, five of which are in the capital city, Urvina. All the stores are managed inthe same way wit

题目

3 You are the manager responsible for the audit of Volcan, a long-established limited liability company. Volcan operates

a national supermarket chain of 23 stores, five of which are in the capital city, Urvina. All the stores are managed in

the same way with purchases being made through Volcan’s central buying department and product pricing, marketing,

advertising and human resources policies being decided centrally. The draft financial statements for the year ended

31 March 2005 show revenue of $303 million (2004 – $282 million), profit before taxation of $9·5 million (2004

– $7·3 million) and total assets of $178 million (2004 – $173 million).

The following issues arising during the final audit have been noted on a schedule of points for your attention:

(a) On 1 May 2005, Volcan announced its intention to downsize one of the stores in Urvina from a supermarket to

a ‘City Metro’ in response to a significant decline in the demand for supermarket-style. shopping in the capital.

The store will be closed throughout June, re-opening on 1 July 2005. Goodwill of $5·5 million was recognised

three years ago when this store, together with two others, was bought from a national competitor. It is Volcan’s

policy to write off goodwill over five years. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Volcan for the year ended

31 March 2005.

NOTE: The mark allocation is shown against each of the three issues.

相似考题

更多“3 You are the manager responsible for the audit of Volcan, a long-established limited liability company. Volcan operatesa national supermarket chain of 23 stores, five of which are in the capital city, Urvina. All the stores are managed inthe same way wit”相关问题

-

第1题:

(c) In October 2004, Volcan commenced the development of a site in a valley of ‘outstanding natural beauty’ on

which to build a retail ‘megastore’ and warehouse in late 2005. Local government planning permission for the

development, which was received in April 2005, requires that three 100-year-old trees within the valley be

preserved and the surrounding valley be restored in 2006. Additions to property, plant and equipment during

the year include $4·4 million for the estimated cost of site restoration. This estimate includes a provision of

$0·4 million for the relocation of the 100-year-old trees.

In March 2005 the trees were chopped down to make way for a car park. A fine of $20,000 per tree was paid

to the local government in May 2005. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Volcan for the year ended

31 March 2005.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(c) Site restoration

(i) Matters

■ The provision for site restoration represents nearly 2·5% of total assets and is therefore material if it is not

warranted.

■ The estimated cost of restoring the site is a cost directly attributable to the initial measurement of the tangible fixed

asset to the extent that it is recognised as a provision under IAS 37 ‘Provisions, Contingent Liabilities and

Contingent Assets’ (IAS 16 ‘Property, Plant and Equipment’).

■ A provision should not be recognised for site restoration unless it meets the definition of a liability, i.e:

– a present obligation;

– arising from past events;

– the settlement of which is expected to result in an outflow of resources embodying economic benefits.

■ The provision is overstated by nearly $0·34m since Volcan is not obliged to relocate the trees and de facto has

only an obligation of $60,000 as at 31 March 2005 (being the penalty for having felled them). When considered

in isolation, this overstatement is immaterial (representing only 0·2% of total assets and 3·6% of PBT).

■ It seems that even if there are local government regulations calling for site restoration there is no obligation unless

the penalties for non-compliance are prohibitive (unlike the fines for the trees).

■ It is unlikely that commencement of site development has given rise to a constructive obligation, since past actions

(disregarding the preservation of the trees) must dispel any expectation that Volcan will honour any pledge to

restore the valley.

■ Whether commencing development of the site, and destroying the trees, conflicts with any statement of socioenvironmental

responsibility in the annual report.

(ii) Audit evidence

■ A copy of the planning application and permission granted setting out the penalties for non-compliance.

■ Payment of $60,000 to local government in May 2005 agreed to the bank statement.

■ The present value calculation of the future cash expenditure making up the $4·0m provision.

Tutorial note: Evidence supporting the calculation of $0·4m is irrelevant as there is no liability to be provided for.

■ Agreement that the pre-tax discount rate used reflects current market assessments of the time value of money (as

for (a)).

■ Asset inspection at the site as at 31 March 2005.

■ Any contracts entered into which might confirm or dispute management’s intentions to restore the site. For

example, whether plant hire (bulldozers, etc) covers only the period over which the warehouse will be constructed

– or whether it extends to the period in which the valley would be ‘made good’. -

第2题:

The square in front of the supermarket is so limited that when going there, first of all, you should consider ______your car.

A. parking

B. where to park

C. to park

D. where parking

正确答案:B7.答案为B 参考译文:超市前面的空地太小了,所以你去那儿首先要考虑在哪儿停车。用不定式作宾语,表示将要去做的具体的动作。而动名词作宾语是表示抽象的概念。

-

第3题:

You wish to enable an audit policy for all database users, except SYS, SYSTEM, and SCOTT.You issue the following statements:SQL> AUDIT POLICY ORA_DATABASE_PARAMETER EXCEPT SYS;SQL> AUDIT POLICY ORA_DATABASE_PARAMETER EXCEPT SYSTEM;SQL> AUDIT POLICY ORA_DATABASE_PARAMETER EXCEPT SCOTT;For which database users is the audit policy now active?()

A. All users except SYS

B. All users except SCOTT

C. All users except sys and SCOTT

D. All users except sys, system, and SCOTT

参考答案:B

-

第4题:

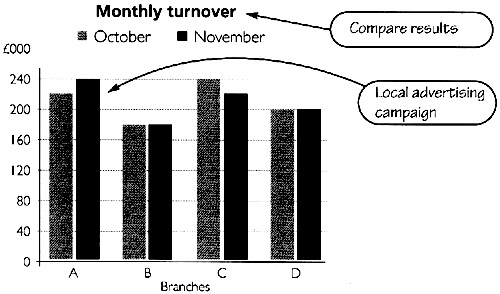

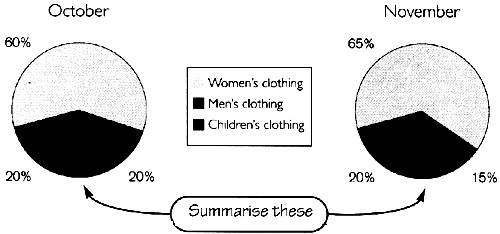

—You work for a small chain of clothing stores. The Managing Director has asked you to write a short report on last month's performance.

—Look at the charts and table below, on which you have already made some handwritten notes.

—Then, using all your handwritten notes, write the report for your Managing Director

—Write 120-140 words.

正确答案:To: Chris Sutcliffe Managing Director From: Lynn Dent Subject: Performance in November This report covers November's results in branches A-D compared with those in October MO NTH LY TURN OVER Only branch A saw an improvement in turnover which was probably the result of an advertising campaign in the local media. Neither branch B nor branch D reported any change while in branch C turnover fell considerably STAFF TURNOVER The only significant changes in staff turnover were in branches C and D. In C it rose sharply from 2% to 8% mainly because of dissatisfaction with the new manager on the other hand there was an improvement in branch D's previous high level of 10%. SALES BY PRODUCTTYPE Women's clothes which are already the best selling goods increased from 60 to 65% of total sales at the expense 'of men's clothing. Children's clothes were unchanged at 20%.

正确答案:To: Chris Sutcliffe Managing Director From: Lynn Dent Subject: Performance in November This report covers November's results in branches A-D compared with those in October MO NTH LY TURN OVER Only branch A saw an improvement in turnover which was probably the result of an advertising campaign in the local media. Neither branch B nor branch D reported any change while in branch C turnover fell considerably STAFF TURNOVER The only significant changes in staff turnover were in branches C and D. In C it rose sharply from 2% to 8% mainly because of dissatisfaction with the new manager on the other hand there was an improvement in branch D's previous high level of 10%. SALES BY PRODUCTTYPE Women's clothes which are already the best selling goods increased from 60 to 65% of total sales at the expense 'of men's clothing. Children's clothes were unchanged at 20%.

To: Chris Sutcliffe, Managing Director From: Lynn Dent Subject: Performance in November This report covers November's results in branches A-D, compared with those in October MO NTH LY TURN OVER Only branch A saw an improvement in turnover, which was probably the result of an advertising campaign in the local media. Neither branch B nor branch D reported any change, while in branch C turnover fell considerably STAFF TURNOVER The only significant changes in staff turnover were in branches C and D. In C it rose sharply, from 2% to 8%, mainly because of dissatisfaction with the new manager on the other hand, there was an improvement in branch D's previous high level of 10%. SALES BY PRODUCTTYPE Women's clothes, which are already the best selling goods, increased from 60 to 65% of total sales, at the expense 'of men's clothing. Children's clothes were unchanged, at 20%. -

第5题:

Customs,upon boarding a vessel desiring entry into PRC port,would inspect which document? ______.

A.Cargo Manifest

B.Certified Crew List

C.Stores List

D.All of the above

正确答案:D

-

第6题:

共用题干

Canada Ikea:What a Great Place for You to Shop There are many different stores that people go to in order to buy various household goods. _______(46) The Canada Ikea(宜家)is not confined to one city alone in that country. Instead you will find there are many different branches spread out in many different localities. As with all of the Ikea stores the Canada Ikea deals mainly with selling top quality Swedish furniture. _________( 47 ) One facet(方面)of the Canada Ikea that its customers will like is that the store has tile ability of catering(迎合)to their English speaking customers as well as their French customers. To make shopping for furniture and other goods easy the Ikea stores in every country,are all set out in the same manners_______(48)As a result of this the Canada Ikea is one that its local and foreign customers enjoy visiting. To help make it easy for you to shop for the items that you want there are large blue and yellow bags or shopping carts available.______(49) As you wander through the store you will find many interesting items that you can use for your home or even office.With these products you will have a beautiful house that you can live comfortably in._______(50)The Canada Ikea is a great place for you to shop._______(49)

A:.The larger sized objects are displayed in the showrooms of the Canada Ikea stores.

B:.This furniture is designed to provide the home owner with stylish(时髦的)furniture that is also affordable and perfect for everyday use.

C:.With so many items to be found you are sure to want to buy everything that catches your fancy.

D: These bags and carts are perfect for the many different lamp shades , cushions(垫子) bed linens(亚麻布),toys and other medium to small sized objects that you want.

E: This makes it very easy for visitors from other countries to buy the items they need with-out wandering around the store trying to find their goods.

F: One such store that you can find in many different countries including that of Canada is that of the Ikea chain of stores.答案:D解析:第一段第一句:“There are many different stores that people go to in order to buy various household goods.”接下来是:“The Canada Ikea(宜家)is not confined to one city alone in that country.”才民据上下文,One such store that you can find in many different countries in-cluding that of Canada is that of the Ikea chain of stores是最合适的。承上,指出宜家是这样一家商场,启下,进一步介绍宜家。所以选F。

空格前一句:“As with all of the Ikea stores the Canada Ikea deals mainly with selling top quality Swedish furniture.”而选项“B. This furniture is designed to provide the home owner with stylish(时髦的)furniture that is also affordable and perfect for everyday use.”是对家具作进一步的说明。其他选项都没有提到家具。

第三段第一句:“To make shopping for furniture and other goods easy the Ikea stores in every country , are all set out in the same manner.”选项“E. This makes it very easy for visi-tors from other countries to buy the items they need without wandering around the store trying to find their goods. ”This指代空格前的这句话。这两句是因果关系。

第四段第一句:“To help make it easy tor you to shop for the items that you want there are large blue and yellow bags or shopping carts available.”只有选项D提到了bags and carts。

最后一段说在宜家:“you will find nany interesting items”只有“C. With so many items to be found you are sure to want to buy everything that catches your fancy.”符合逻辑。 -

第7题:

You wish to enable an audit policy for all database users, except SYS, SYSTEM, and SCOTT.You issue the following statements: SQL> AUDIT POLICY ORA_DATABASE_PARAMETER EXCEPT SYS;SQL> AUDIT POLICY ORA_DATABASE_PARAMETER EXCEPT SYSTEM; SQL> AUDIT POLICY ORA_DATABASE_PARAMETER EXCEPT SCOTT; For which database users is the audit policy now active?()

- A、All users except SYS

- B、All users except SCOTT

- C、All users except sys and SCOTT

- D、All users except sys, system, and SCOTT

正确答案:B -

第8题:

Your network consists of a single Active Directory domain. All domain controllers run Windows Server 2008 R2. You need to plan an auditing strategy that meets the following requirements: èAudits all changes to Active Directory Domain Services (AD?DS) èStores all auditing data in a central location. What should you include in your plan?()

- A、Configure an audit policy for the domain. Configure Event Forwarding.

- B、Configure an audit policy for the domain controllers. Configure Data Collector Sets.

- C、Implement Windows Server Resource Manager (WSRM) in managing mode.

- D、Implement Windows Server Resource Manager (WSRM) in accounting mode.

正确答案:A -

第9题:

问答题The following appeared in a memorandum written by the vice president of Nature’s Way, a chain of stores selling health food and other health-related products. “Previous experience has shown that our stores are most profitable in areas where residents are highy concerned with leading healthy lives. We should therefore build our next new store in Plalnsville, which has many such residents. Plainsiville merchants report that sales of running shoes and exercise dothiog are at all-time highs. The local health club, which nearly closed five years ago due to lack of business, has more members than ever, and the weight training and aerobics classes are always full. We can even anticipate a new generation of customers: Plainsiville’s schoolchildren are required to participate in a ‘fitness for life’ program, which emphasizes the benefits of regular exercise at an early age.” Discuss how well-reasoned you find this argument. In your discussion, be sure to analyze the line of reasoning and the use of evidence in the argument. For example, you may need to consider what questionable assumptions underlie the thinking and what alternative examples or counterexamples might weaken the conclusion. You can also discuss what sort of evidence would strengthen or refute the argument, what changes in the argument would make it more logically sound, and what, if anything, would help you better evaluate its conclusion.正确答案: 【参考范文】

In this memo the vice president of Nature’s Way (NW), a chain of stores selling health food and health-related products, recommends opening a store in Plainesville. To support this recommendation the vice president cites the following facts about Plainesville: (1) sales of exercise shoes and clothing are at all-time highs; (2) the local health club is more popular than ever; and (3) the city’s schoolchildren are required to participate in a fitness program. Close scrutiny of each of these facts, however, reveals that none of them lend credible support to the recommehdation.

First, strong sales of exercise apparel do not necessarily indicate that Plainesville residents would be interested in NW’s products, or that these residents are interested in exercising. Perhaps exercise apparel happens to be fashionable at the moment, or inexpensive compared to other types of clothing. For that matter, perhaps the stronger-than-usual sales are due to increasing sales to tourists. In short, without ruling out other possible reasons for the strong sales the vice president cannot convince me on the basis of them that Plainesville residents are exercising regularly, let alone that they would be interested in buying the sorts of food and other products that NW sells.

Secondly, even if exercise is more popular among Plainesville residents than ever before, the vice president assumes further that people who exercise regularly are also interested in buying health food and health-related products. Yet the memo contains no evidence to support this assumption. Lacking such evidence it is equally possible that aside fron exercising Plainesville residents have little interest in leading a healthy lifestyle. In fact, perhaps as a result of regular exercise they believe they are sufficiently fit and healthy and do not need a heathy diet.

Thirdly, the popularity of the local health club is little indication that NW will earn a profit from a store in Plalnesville. Perhaps club membem live in an area of Plainesville nowhere near feasible sites for a NW store. Or perhaps the club’s primary appeal is as a singles meeting place, and that members actually have little interest in a healthy lifestyle. Besides, even if the club’s members would patronize a NW store these members might be insufficient in number to ensure a profit for the store, especially considering that this health club is the only one in Plainesville.

Fourth, the fact that a certain fitness program is mandatory for Plainesville’s schoolchildren accomplishes nothing toward bolstering the recommendation. Many years must pass before these children will be old enough to make buying decisions when it comes to food and health-related products. Their habits and interests might change radically over time. Besides, mandatory participation is no indication of genuine interest in health or fitness. Moreover, when these children grow older it is entirely possible that they will favor an unhealthy lifestyle—as a reaction to the healthful habits imposed upon them now.

Finally, even assuming that Plainesville residents are strongly interested in eating health foods and health-related products, the recommendation rests on two additional assumptions: (1) that this interest will continue in the foreseeable future, and (2) that Plainesville residents will prefer NW over other merchants that sell similar products. Until the vice president substantiates both assumptions I remain unconvinced that a NW store in Plainesville would be profitable.

In sum, the recommendmion relies on certiain doubtful assumptions that render it unconvincing as it stands. To bolster the recommendation the vice president must provide clear evidence—perhaps by way of a local survey or study—that Plainesville residents who buy and wear exercise apparel, and especially the health club’s members, do in fact exercise regularly, and that these exercisers are likely to buy health foods and health-related products at a NW store. To better assess the recommendation, I would need to know why Plainesville’s health club is popular, and why Plainesville does not contain more health clubs. I would also need to know what competition NW might face in Plainesville. 解析: 暂无解析 -

第10题:

单选题You are ordering ship’s stores. Which statement is TRUE?().AUp to five gallons of a flammable liquid may be stowed in the engine room

BAll stores of line,rags,linens and other similar type stores must be certified by UL as being fire retardant

CCylinders containing compressed gasses must be constructed and tested in accordance with the Bureau of Standards

DAll distress flares when received must be stored in the portable magazine chest

正确答案: C解析: 暂无解析 -

第11题:

单选题AShe should go to the nearest supermarket to buy everything she wants.

BShe should bargain with the seller for a lower price

CShe should visit various stores and compare the prices.

DShe should not buy anything in the discount stores.

正确答案: A解析:

细节题。录音中男士首先建议“Visit various stores, examine the goods carefully and compare prices.”,即多逛商店、检查商品、比较价格。故选C。 -

第12题:

单选题John buys a cake at a bakery and a hammer at a hard-ware store. If there are five hardware stores and three bakeries, in how many different combinations of stores can he purchase the cake and the hammer?A20

B15

C8

D5

E3

正确答案: D解析:

There are 5×3 = 15. -

第13题:

5 You are an audit manager in Fox & Steeple, a firm of Chartered Certified Accountants, responsible for allocating staff

to the following three audits of financial statements for the year ending 31 December 2006:

(a) Blythe Co is a new audit client. This private company is a local manufacturer and distributor of sportswear. The

company’s finance director, Peter, sees little value in the audit and put it out to tender last year as a cost-cutting

exercise. In accordance with the requirements of the invitation to tender your firm indicated that there would not

be an interim audit.

(b) Huggins Co, a long-standing client, operates a national supermarket chain. Your firm provided Huggins Co with

corporate financial advice on obtaining a listing on a recognised stock exchange in 2005. Senior management

expects a thorough examination of the company’s computerised systems, and are also seeking assurance that

the annual report will not attract adverse criticism.

(c) Gray Co has been an audit client since 1999 after your firm advised management on a successful buyout. Gray

provides communication services and software solutions. Your firm provides Gray with technical advice on

financial reporting and tax services. Most recently you have been asked to conduct due diligence reviews on

potential acquisitions.

Required:

For these assignments, compare and contrast:

(i) the threats to independence;

(ii) the other professional and practical matters that arise; and

(iii) the implications for allocating staff.

(15 marks)

正确答案:

5 FOX & STEEPLE – THREE AUDIT ASSIGNMENTS

(i) Threats to independence

Self-interest

Tutorial note: This threat arises when a firm or a member of the audit team could benefit from a financial interest in, or

other self-interest conflict with, an assurance client.

■ A self-interest threat could potentially arise in respect of any (or all) of these assignments as, regardless of any fee

restrictions (e.g. per IFAC’s ‘Code of Ethics for Professional Accountants’), the auditor is remunerated by clients for

services provided.

■ This threat is likely to be greater for Huggins Co (larger/listed) and Gray Co (requires other services) than for Blythe Co

(audit a statutory necessity).

■ The self-interest threat may be greatest for Huggins Co. As a company listed on a recognised stock exchange it may

give prestige and credibility to Fox & Steeple (though this may be reciprocated). Fox & Steeple could be pressurised into

taking evasive action to avoid the loss of a listed client (e.g. concurring with an inappropriate accounting treatment).

Self-review

Tutorial note: This arises when, for example, any product or judgment of a previous engagement needs to be re-evaluated

in reaching conclusions on the audit engagement.

■ This threat is also likely to be greater for Huggins and Gray where Fox & Steeple is providing other (non-audit) services.

■ A self-review threat may be created by Fox & Steeple providing Huggins with a ‘thorough examination’ of its computerised

systems if it involves an extension of the procedures required to conduct an audit in accordance with International

Standards on Auditing (ISAs).

■ Appropriate safeguards must be put in place if Fox & Steeple assists Huggins in the performance of internal audit

activities. In particular, Fox & Steeple’s personnel must not act (or appear to act) in a capacity equivalent to a member

of Huggins’ management (e.g. reporting, in a management role, to those charged with governance).

■ Fox & Steeple may provide Gray with accounting and bookkeeping services, as Gray is not a listed entity, provided that

any self-review threat created is reduced to an acceptable level. In particular, in giving technical advice on financial

reporting, Fox & Steeple must take care not to make managerial decisions such as determining or changing journal

entries without obtaining Gray’s approval.

■ Taxation services comprise a broad range of services, including compliance, planning, provision of formal taxation

opinions and assistance in the resolution of tax disputes. Such assignments are generally not seen to create threats to

independence.

Tutorial note: It is assumed that the provision of tax services is permitted in the jurisdiction (i.e. that Fox and Steeple

are not providing such services if prohibited).

■ The due diligence reviews for Gray may create a self-review threat (e.g. on the fair valuation of net assets acquired).

However, safeguards may be available to reduce these threats to an acceptable level.

■ If staff involved in providing other services are also assigned to the audit, their work should be reviewed by more senior

staff not involved in the provision of the other services (to the extent that the other service is relevant to the audit).

■ The reporting lines of any staff involved in the audit of Huggins and the provision of other services for Huggins should

be different. (Similarly for Gray.)

Familiarity

Tutorial note: This arises when, by virtue of a close relationship with an audit client (or its management or employees) an

audit firm (or a member of the audit team) becomes too sympathetic to the client’s interests.

■ Long association of a senior member of an audit team with an audit client may create a familiarity threat. This threat

is likely to be greatest for Huggins, a long-standing client. It may also be significant for Gray as Fox & Steeple have had

dealings with this client for seven years now.

■ As Blythe is a new audit client this particular threat does not appear to be relevant.

■ Senior personnel should be rotated off the Huggins and Gray audit teams. If this is not possible (for either client), an

additional professional accountant who was not a member of the audit team should be required to independently review

the work done by the senior personnel.

■ The familiarity threat of using the same lead engagement partner on an audit over a prolonged period is particularly

relevant to Huggins, which is now a listed entity. IFAC’s ‘Code of Ethics for Professional Accountants’ requires that the

lead engagement partner should be rotated after a pre-defined period, normally no more than seven years. Although it

might be time for the lead engagement partner of Huggins to be changed, the current lead engagement partner may

continue to serve for the 2006 audit.

Tutorial note: Two additional years are permitted when an existing client becomes listed, since it may not be in the

client’s best interests to have an immediate rotation of engagement partner.

Intimidation

Tutorial note: This arises when a member of the audit team may be deterred from acting objectively and exercising

professional skepticism by threat (actual or perceived), from the audit client.

■ This threat is most likely to come from Blythe as auditors are threatened with a tendering process to keep fees down.

■ Peter may have already applied pressure to reduce inappropriately the extent of audit work performed in order to reduce

fees, by stipulating that there should not be an interim audit.

■ The audit senior allocated to Blythe will need to be experienced in standing up to client management personnel such as

Peter.

Tutorial note: ‘Correct’ classification under ‘ethical’, ‘other professional’, ‘practical’ or ‘staff implications’ is not as important

as identifying the matters.

(ii) Other professional and practical matters

Tutorial note: ‘Other professional’ includes quality control.

■ The experience of staff allocated to each assignment should be commensurate with the assessment of associated risk.

For example, there may be a risk that insufficient audit evidence is obtained within the budget for the audit of Blythe.

Huggins, as a listed client, carries a high reputational risk.

■ Sufficient appropriate staff should be allocated to each audit to ensure adequate quality control (in particular in the

direction, supervision, review of each assignment). It may be appropriate for a second partner to be assigned to carry

out a ‘hot review’ (before the auditor’s report is signed) of:

– Blythe, because it is the first audit of a new client; and

– Huggins, as it is listed.

■ Existing clients (Huggins and Gray) may already have some expectation regarding who should be assigned to their

audits. There is no reason why there should not be some continuity of staff providing appropriate safeguards are put in

place (e.g. to overcome any familiarity threat).

■ Senior staff assigned to Blythe should be alerted to the need to exercise a high degree of professional skepticism (in the

light of Peter’s attitude towards the audit).

■ New staff assigned to Huggins and Gray would perhaps be less likely to assume unquestioned honesty than staff

previously involved with these audits.

Logistics (practical)

■ All three assignments have the same financial year end, therefore there will be an element of ‘competition’ for the staff

to be assigned to the year-end visits and final audit assignments. As a listed company, Huggins is likely to have the

tightest reporting deadline and so have a ‘priority’ for staff.

■ Blythe is a local and private company. Staff involved in the year-end visit (e.g. to attend the physical inventory count)

should also be involved in the final audit. As this is a new client, staff assigned to this audit should get involved at every

stage to increase their knowledge and understanding of the business.

■ Huggins is a national operation and may require numerous staff to attend year-end procedures. It would not be expected

that all staff assigned to year-end visits should all be involved in the final audit.

Time/fee/staff budgets

■ Time budgets will need to be prepared for each assignment to determine manpower requirements (and to schedule audit

work).

(iii) Implications for allocating staff

■ Fox & Steeple should allocate staff so that those providing other services to Huggins and Gray (that may create a selfreview

threat) do not participate in the audit engagement.

Competence and due care (Qualifications/Specialisation)

■ All audit assignments will require competent staff.

■ Huggins will require staff with an in-depth knowledge of their computerised system.

■ Gray will require senior audit staff to be experienced in financial reporting matters specific to communications and

software solutions (e.g. in revenue recognition issues and accounting for internally-generated intangible assets).

■ Specialists providing tax services and undertaking the due diligence reviews for Gray may not be required to have any

involvement in the audit assignment. -

第14题:

Uniformity is the guiding principle for the franchise and chain stores.()

正确答案:对

-

第15题:

can you list some ship’s stores?

正确答案:The ship’s stores include the oil, water, paint, spare parts, and so on.

-

第16题:

As an experienced technician, you are responsible for Technical Support in your company. You ask one of the trainees to document the layers of an existing CIS network. Which three statements best characterize this process? ()(Choose three.)

A. It provides reliable input for verifying network consistency.

B. It requires a network audit to support some upgrade decisions.

C. It requires a network audit to support any network restructuring.

D. It begins with gathering organizational input that may be inaccurate.

参考答案:A, C, D

-

第17题:

Although the Shipowner may be responsible for the loss or damage to the goods,his liability may be limited ______ the terms of the contract or the statute.

A.with

B.on

C.for

D.by

正确答案:D

-

第18题:

You need to create a servlet filter that stores all request headers to a database for all requests to the webapplication’s home page "/index.jsp". Which HttpServletRequest method allows you to retrieve all of therequest headers?()

- A、String[] getHeaderNames()

- B、String[] getRequestHeaders()

- C、java.util.Iterator getHeaderNames()

- D、java.util.Iterator getRequestHeaders()

- E、java.util.Enumeration getHeaderNames()

正确答案:E -

第19题:

You need to design a method to log changes that are made to servers and domain controllers. You also need to track when administrators modify local security account manager objects on servers. What should you do?()

- A、Enable failure audit for privilege user and object access on all servers and domain controllers

- B、Enable success audit for policy change and account management on all servers and domain controllers

- C、Enable success audit for process tracking and logon events on all servers and domain controllers

- D、Enable failure audit for system events and directory service access on all servers and domain controllers

正确答案:B -

第20题:

单选题Although the Shipowner may be responsible for the loss or damage to the goods,his liability may be limited()the terms of the contract or the statute.Awith

Bon

Cfor

Dby

正确答案: A解析: 暂无解析 -

第21题:

多选题As an experienced technician, you are responsible for Technical Support in your company. You ask one of the trainees to document the layers of an existing CIS network. Which three statements best characterize this process? ()(Choose three.)AIt provides reliable input for verifying network consistency.

BIt requires a network audit to support some upgrade decisions.

CIt requires a network audit to support any network restructuring.

DIt begins with gathering organizational input that may be inaccurate.

正确答案: B,C解析: 暂无解析 -

第22题:

单选题Which of the following is NOT true according to the passage?AThe models of the online fashion stores were not suitable.

BSome online fashion stores still make profits.

CThere are online stores in Italy that make money.

DSweden’s online stores are doing well by discount.

正确答案: A解析:

是非题。第二段第二句中提到Sweden’s sportswear vendor Sportus仍然doing well in a very tough environment,但并未提及瑞典的网上店家是通过打折将生意做好的。因此选项D的表述与文章不符。 -

第23题:

多选题You work as a database administrator for Certkiller .com. In your development environmentenvironment, the developers are responsible for modifying the table structure according to the application requirements. However, you want to keep track of the ALTER TABLE commands being executed by developers, so you enable auditing to achieve this objective. Which two views would you refer to find out the audit information?()ADBA_AUDIT_TRAIL

BDBA_AUDIT_SESSION

CDBA_FGA_AUDIT_TRAIL

DDBA_COMMON_AUDIT_TRAIL

正确答案: D,B解析: 暂无解析