(c) Assuming that she will survive until July 2009, advise on the lifetime inheritance tax (IHT) planningmeasures that could be undertaken by Debbie, quantifying the savings that can be made. (7 marks)For this question you should assume that the rates and

题目

(c) Assuming that she will survive until July 2009, advise on the lifetime inheritance tax (IHT) planning

measures that could be undertaken by Debbie, quantifying the savings that can be made. (7 marks)

For this question you should assume that the rates and allowances for 2004/05 apply throughout.

相似考题

更多“(c) Assuming that she will survive until July 2009, advise on the lifetime inheritance tax (IHT) planningmeasures that could be undertaken by Debbie, quantifying the savings that can be made. (7 marks)For this question you should assume that the rates and”相关问题

-

第1题:

(ii) State, giving reasons, the tax reliefs in relation to inheritance tax (IHT) and capital gains tax (CGT) which

would be available to Alasdair if he acquires the warehouse and leases it to Gallus & Co, rather than to

an unconnected tenant. (4 marks)

正确答案:

(ii) Apart from the fact that Alasdair can keep an eye on his tenant, the main advantages are twofold:

IHT: If the firm are the tenants, the property will be land and buildings used in a business carried on by a partnership

in which the donor is a partner. Thus, Alasdair will be able to claim business property relief (BPR) at a rate of 50%

so long as he remains a partner in the firm. However, this relief would not be available until Alasdair has owned

the property for at least two years from his firm taking up the tenancy.

CGT: As Alasdair is a partner in the firm using the building, it will also be a qualifying asset for the purposes of rollover

relief on any gains arising from the disposal of the property. Assuming that Alasdair acquires a replacement asset

which will be used in the trade, the gain on sale can be deferred against the tax base cost of the replacement asset.

In the event that rollover relief cannot be used, any gains on disposal will be subject to business asset taper relief. -

第2题:

(ii) State when the inheritance tax (IHT) calculated in (i) would be payable and by whom. (2 marks)

正确答案:

(ii) Inheritance tax administration

The tax on Debbie’s estate (personalty and realty) would be paid by the personal representatives, usually an executor.

Inheritance tax is due six months from the end of the month in which death occurred (31 December 2005) or the date

on which probate is obtained (if earlier). However, an instalment option is available for certain assets, which includes

land and buildings i.e. the residence whereby the tax can be paid in 10 equal annual instalments. -

第3题:

(b) Mabel has two objectives when making the gifts to Bruce and Padma:

(1) To pay no tax on any gift in her lifetime; and

(2) To reduce the eventual liability to inheritance tax on her death.

Advise Mabel which item to gift to Bruce and to Padma in order to satisfy her objectives. Give reasons for

your advice.

Your advice should include a computation of the inheritance tax saved as a result of the two gifts, on the

assumption that Mabel dies on 30 June 2011. (10 marks)

正确答案:

-

第4题:

(ii) Advise Benny of the amount of tax he could save by delaying the sale of the shares by 30 days. For the

purposes of this part, you may assume that the benefit in respect of the furnished flat is £11,800 per

year. (3 marks)

正确答案:

-

第5题:

(d) Explain how Gloria would be taxed in the UK on the dividends paid by Bubble Inc and the capital gains tax

and inheritance tax implications of a future disposal of the shares. Clearly state, giving reasons, whether or

not the payment made to Eric is allowable for capital gains tax purposes. (9 marks)

You should assume that the rates and allowances for the tax year 2005/06 apply throughout this question.

正确答案:

(d) UK tax implications of shares in Bubble Inc

Income tax

Gloria is UK resident and is therefore subject to income tax on her worldwide income. However, because she is non-UK

domiciled, she will only be taxed on the foreign dividends she brings into the UK.

Dividends brought into the UK will be grossed up for any tax paid in Oceania. The gross amount is taxed at 10% if it falls

into the starting or basic rate band and at 321/2% if it falls into the higher rate band. The tax suffered in Oceania is available

for offset against the UK tax liability. The offset is restricted to a maximum of the UK tax on the dividend income.

Capital gains tax

Individuals are subject to capital gains tax on worldwide assets if they are resident or ordinarily resident in the UK. However,

because Gloria is non-UK domiciled and the shares are situated abroad, the gain is only taxable to the extent that the sales

proceeds are brought into the UK. Any tax suffered in Oceania in respect of the gain is available for offset against the UK

capital gains tax liability arising on the shares.

Any loss arising on the disposal of the shares would not be available for relief in the UK.

In computing a capital gain or allowable loss, a deduction is available for the incidental costs of acquisition. However, to be

allowable, such costs must be incurred wholly and exclusively for the purposes of acquiring the asset. The fee paid to Eric

related to general investment advice and not to the acquisition of the shares and therefore, would not be deductible in

computing the gain.

Taper relief will be at non-business asset rates as Bubble Inc is an investment company.

Inheritance tax

Assets situated abroad owned by non-UK domiciled individuals are excluded property for the purposes of inheritance tax.

However, Gloria will be deemed to be UK domiciled (for the purposes of inheritance tax only) if she has been resident in the

UK for 17 out of the 20 tax years ending with the year in which the disposal occurs.

Gloria has been running a business in the UK since June 1992 and would therefore, appear to have been resident for at least

15 tax years (1992/93 to 2006/07 inclusive).

If Gloria is deemed to be UK domiciled such that the shares in Bubble Inc are not excluded property, business property relief

will not be available because Bubble Inc is an investment company. -

第6题:

(ii) Assuming the relief in (i) is available, advise Sharon on the maximum amount of cash she could receive

on incorporation, without triggering a capital gains tax (CGT) liability. (3 marks)

正确答案:

(ii) As Sharon is entitled to the full rate of business asset taper relief, any gain will be reduced by 75%. The position is

maximised where the chargeable gain equals Sharon’s unused capital gains tax annual exemption of £8,500. Thus,

before taper relief, the gain she requires is £34,000 (1/0·25 x £8,500).

The amount to be held over is therefore £46,000 (80,000 – 34,000). Where part of the consideration is in the form

of cash, the gain eligible for incorporation relief is calculated using the formula:

Gain deferred = Gain x value of shares issued/total consideration

The formula is manipulated on the following basis:

£46,000 = £80,000 x (shares/120,000)

Shares/120,000 = £46,000/80,000

Shares = £46,000 x 120,000/80,000

i.e. £69,000.

As the total consideration is £120,000, this means that Sharon can take £51,000 (£120,000 – £69,000) in cash

without any CGT consequences. -

第7题:

(iii) State the value added tax (VAT) and stamp duty (SD) issues arising as a result of inserting Bold plc as

a holding company and identify any planning actions that can be taken to defer or minimise these tax

costs. (4 marks)

You should assume that the corporation tax rates for the financial year 2005 and the income tax rates

and allowances for the tax year 2005/06 apply throughout this question.

正确答案:

(iii) Bold plc will be making a taxable supply of services, likely to exceed the VAT threshold. It should therefore consider

registering for VAT – either immediately on a voluntary basis, or when its cumulative taxable supplies in the previous

twelve months exceed £60,000.

As an alternative, the new group can apply for a group VAT registration. This will simplify its VAT administration as intragroup

transactions are broadly disregarded for VAT purposes, and only one VAT return is required for the group as a

whole.

Stamp duty normally applies at 0·5% on the consideration payable in respect of transactions in shares. However, an

exemption is available in the case of a takeover, reconstruction or amalgamation where there is no real change in

ownership, i.e. the new shareholdings mirror the old shareholdings, and the transaction is for commercial purposes. The

insertion of a new holding company over an existing company, as proposed here, would qualify for this exemption.

There is no VAT on transactions in shares. -

第8题:

(iii) The effect of the restructuring on the group’s ability to recover directly and non-directly attributable input

tax. (6 marks)

You are required to prepare calculations in respect of part (ii) only of this part of this question.

Note: – You should assume that the corporation tax rates and allowances for the financial year 2006 apply

throughout this question.

正确答案:(iii) The effect of the restructuring on the group’s ability to recover its input tax

Prior to the restructuring

Rapier Ltd and Switch Ltd make wholly standard rated supplies and are in a position to recover all of their input tax

other than that which is specifically blocked. Dirk Ltd and Flick Ltd are unable to register for VAT as they do not make

taxable supplies. Accordingly, they cannot recover any of their input tax.

Following the restructuring

Rapier Ltd will be carrying on four separate trades, two of which involve the making of exempt supplies such that it will

be a partially exempt trader. Its recoverable input tax will be calculated as follows.

– Input tax in respect of inputs wholly attributable to taxable supplies is recoverable.

– Input tax in respect of inputs wholly attributable to exempt supplies cannot be recovered (subject to the de minimis

limits below).

– A proportion of the company’s residual input tax, i.e. input tax in respect of inputs which cannot be directly

attributed to particular supplies, is recoverable. The proportion is taxable supplies (VAT exclusive) divided by total

supplies (VAT exclusive). This proportion is rounded up to the nearest whole percentage where total residual input

tax is no more than £400,000 per quarter.

The balance of the residual input tax cannot be recovered (subject to the de minimis limits below).

– If the de minimis limits are satisfied, Rapier Ltd will be able to recover all of its input tax (other than that which is

specifically blocked) including that which relates to exempt supplies. The de minimis limits are satisfied where the

irrecoverable input tax:

– is less than or equal to £625 per month on average; and

– is less than or equal to 50% of total input tax.

The impact of the restructuring on the group’s ability to recover its input tax will depend on the level of supplies made

by the different businesses and the amounts of input tax involved. The restructuring could result in the group being able

to recover all of its input tax (if the de minimis limits are satisfied). Alternatively the amount of irrecoverable input tax

may be more or less than the amounts which cannot be recovered by Dirk Ltd and Flick Ltd under the existing group

structure.

-

第9题:

(d) Evaluate the effect on Gerard of the changes to be made by Fizz plc to its performance related bonus scheme.

You should ignore the effect of any pension contributions to be made by Gerard in the future, consider both

the value and timing of amounts received by Gerard and include relevant supporting calculations.

(5 marks)

Note: – You should assume that the income tax rates and allowances for the tax year 2006/07 apply throughout

this question.

正确答案:

(d) Implications for Gerard of the changes to Fizz plc’s bonus scheme

Value received

Under the existing scheme Gerard receives approximately £4,500 each year. This is subject to income tax at 40% and

national insurance contributions at 1% such that Gerard receives £2,655 (£4,500 x 59%) after all taxes.

Under the proposed share incentive plan (SIP), Gerard expects to receive free shares worth £3,500 (£2,100 + £1,400).

Provided the shares remain in the plan for at least five years there will be no income tax or national insurance contributions

in respect of the value received. Gerard’s base cost in the shares for the purposes of capital gains tax will be their value at

the time they are withdrawn from the scheme.

In addition, the amount he spends on partnership shares will be allowable for both income tax and national insurance such

that he will obtain shares with a value of £700 for a cost of only £413 (£700 x 59%).

Accordingly, Gerard will receive greater value under the SIP than he does under the existing bonus scheme. However, as noted

below, he will not be able to sell the free or matching shares until they have been in the scheme for at least three years by

which time they may have fallen in value.

Timing of receipt of benefit

Under the existing scheme Gerard receives a cash bonus each year.

The value of free and matching shares awarded under a SIP cannot be realised until the shares are withdrawn from the

scheme and sold. This withdrawal cannot take place until at least three years after the shares are awarded to Gerard.

Accordingly, Gerard will not have access to the value of the bonuses he receives under the SIP until the scheme has been in

operation for at least three years. In addition, if the shares are withdrawn within five years of being awarded, income tax and

national insurance contributions will become payable on the lower of their value at the time of the award and their value at

the time of withdrawal thus reducing the value of Gerard’s bonus. -

第10题:

(c) Explanatory notes, together with relevant supporting calculations, in connection with the loan. (8 marks)

Additional marks will be awarded for the appropriateness of the format and presentation of the schedules, the

effectiveness with which the information is communicated and the extent to which the schedules are structured in

a logical manner. (3 marks)

Notes: – you should assume that the tax rates and allowances for the tax year 2006/07 and for the financial year

to 31 March 2007 apply throughout the question.

– you should ignore value added tax (VAT).

正确答案:

(c) Tax implications of there being a loan from Flores Ltd to Banda

Flores Ltd should have paid tax to HMRC equal to 25% of the loan, i.e. £5,250. The tax should have been paid on the

company’s normal due date for corporation tax in respect of the accounting period in which the loan was made, i.e. 1 April

following the end of the accounting period.

The tax is due because Flores Ltd is a close company that has made a loan to a participator and that loan is not in the ordinary

course of the company’s business.

HMRC will repay the tax when the loan is either repaid or written off.

Flores Ltd should have included the loan on Banda’s Form. P11D in order to report it to HMRC.

Banda should have paid income tax on an annual benefit equal to 5% of the amount of loan outstanding during each tax

year. Accordingly, for each full year for which the loan was outstanding, Banda should have paid income tax of £231

(£21,000 x 5% x 22%).

Interest and penalties may be charged in respect of the tax underpaid by both Flores Ltd and Banda and in respect of the

incorrect returns made to HMRC

Willingness to act for Banda

We would not wish to be associated with a client who has engaged in deliberate tax evasion as this poses a threat to the

fundamental principles of integrity and professional behaviour. Accordingly, we should refuse to act for Banda unless she is

willing to disclose the details regarding the loan to HMRC and pay the ensuing tax liabilities. Even if full disclosure is made,

we should consider whether the loan was deliberately hidden from HMRC or Banda’s previous tax adviser.

In addition, companies are prohibited from making loans to directors under the Companies Act. We should advise Banda to

seek legal advice on her own position and that of Flores Ltd. -

第11题:

(ii) Explain how the inclusion of rental income in Coral’s UK income tax computation could affect the

income tax due on her dividend income. (2 marks)

You are not required to prepare calculations for part (b) of this question.

Note: you should assume that the tax rates and allowances for the tax year 2006/07 and for the financial year to

31 March 2007 will continue to apply for the foreseeable future.

正确答案:

(ii) The effect of taxable rental income on the tax due on Coral’s dividend income

Remitting rental income to the UK may cause some of Coral’s dividend income currently falling within the basic rate

band to fall within the higher rate band. The effect of this would be to increase the tax on the gross dividend income

from 0% (10% less the 10% tax credit) to 221/2% (321/2% less 10%).

Tutorial note

It would be equally acceptable to state that the effective rate of tax on the dividend income would increase from 0%

to 25%. -

第12题:

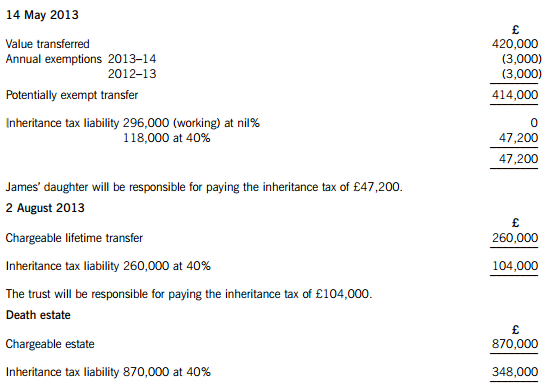

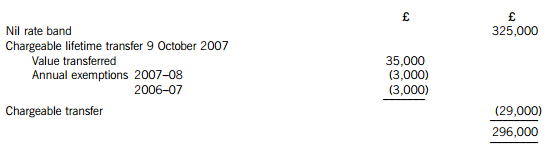

James died on 22 January 2015. He had made the following gifts during his lifetime:

(1) On 9 October 2007, a cash gift of £35,000 to a trust. No lifetime inheritance tax was payable in respect of this gift.

(2) On 14 May 2013, a cash gift of £420,000 to his daughter.

(3) On 2 August 2013, a gift of a property valued at £260,000 to a trust. No lifetime inheritance tax was payable in respect of this gift because it was covered by the nil rate band. By the time of James’ death on 22 January 2015, the property had increased in value to £310,000.

On 22 January 2015, James’ estate was valued at £870,000. Under the terms of his will, James left his entire estate to his children.

The nil rate band of James’ wife was fully utilised when she died ten years ago.

The nil rate band for the tax year 2007–08 is £300,000, and for the tax year 2013–14 it is £325,000.

Required:

(a) Calculate the inheritance tax which will be payable as a result of James’ death, and state who will be responsible for paying the tax. (6 marks)

(b) Explain why it might have been beneficial for inheritance tax purposes if James had left a portion of his estate to his grandchildren rather than to his children. (2 marks)

(c) Explain why it might be advantageous for inheritance tax purposes for a person to make lifetime gifts even when such gifts are made within seven years of death.

Notes:

1. Your answer should include a calculation of James’ inheritance tax saving from making the gift of property to the trust on 2 August 2013 rather than retaining the property until his death.

2. You are not expected to consider lifetime exemptions in this part of the question. (2 marks)

正确答案:(a) James – Inheritance tax arising on death

Lifetime transfers within seven years of death

The personal representatives of James’ estate will be responsible for paying the inheritance tax of £348,000.

Working – Available nil rate band

(b) Skipping a generation avoids a further charge to inheritance tax when the children die. Gifts will then only be taxed once before being inherited by the grandchildren, rather than twice.

(c) (1) Even if the donor does not survive for seven years, taper relief will reduce the amount of IHT payable after three years.

(2) The value of potentially exempt transfers and chargeable lifetime transfers are fixed at the time they are made.

(3) James therefore saved inheritance tax of £20,000 ((310,000 – 260,000) at 40%) by making the lifetime gift of property.

-

第13题:

(b) (i) Calculate the inheritance tax (IHT) that will be payable if Debbie were to die today (8 June 2005).

Assume that no tax planning measures are taken and that there has been no change in the value of any

of the assets since David’s death. (4 marks)

正确答案:

-

第14题:

(b) Assuming that the income from the sale of the books is not treated as trading income, calculate Bob’s taxable

income and gains for all relevant tax years, using any loss reliefs in the most tax-efficient manner. Your

answer should include an explanation of the loss reliefs available and your reasons for using (or not using)

them. (12 marks)

Assume that the rates and allowances for 2004/05 apply throughout this part of the question.

正确答案:

-

第15题:

(c) Without changing the advice you have given in (b), or varying the terms of Luke’s will, explain how Mabel

could further reduce her eventual inheritance tax liability and quantify the tax saving that could be made.

(3 marks)

The increase in the retail prices index from April 1984 to April 1998 is 84%.

You should assume that the rates and allowances for the tax year 2005/06 will continue to apply for the

foreseeable future.

正确答案:

(c) Further advice

Mabel should consider delaying one of the gifts until after 1 May 2007 such that it is made more than seven years after the

gift to the discretionary trust. Both PETs would then be covered by the nil rate band resulting in a saving of inheritance tax

of £6,720 (from (b)).

Mabel should ensure that she uses her inheritance tax annual exemption of £3,000 every year by, say, making gifts of £1,500

each year to both Bruce and Padma. The effect of this will be to save inheritance tax of £1,200 (£3,000 x 40%) every year. -

第16题:

(c) Outline the ways in which Arthur and Cindy can reduce their income tax liability by investing in unquoted

shares and recommend, with reasons, which form. of investment best suits their circumstances. You are not

required to discuss the qualifying conditions applicable to the investment vehicle recommended. (5 marks)

You should assume that the income tax rates and allowances for the tax year 2005/06 apply throughout this

question

正确答案:

(c) Reduction of income tax liability by investing in unquoted shares

The two forms of investment

Income tax relief is available for investments in venture capital trusts (VCTs) and enterprise investment scheme (EIS) shares.

A VCT is a quoted company that invests in shares in a number of unquoted trading companies. EIS shares are shares in

qualifying unquoted trading companies.

Recommendation

The most suitable investment for Arthur and Cindy is a VCT for the following reasons.

– An investment in a VCT is likely to be less risky than investing directly in EIS companies as the risk will be spread over

a greater number of companies.

– The tax deduction is 40% of the amount invested as opposed to 20% for EIS shares.

– Dividends from a VCT are not taxable whereas dividends on EIS shares are taxed in the normal way. -

第17题:

(c) Prepare brief notes for the proposed meeting with Charles and Jane. Clearly identify the further information

you would need in order to advise them more fully and suggest appropriate personal financial planning

protection products, in respect of both death and serious illness. (9 marks)

You should assume that the income tax rates and allowances for the tax year 2005/06 and the corporation tax

rates for the financial year 2005 apply throughout this question.

正确答案:

When considering the shortfall

– The family’s expenditure is likely to increase as the children get older, particularly if there is a need for school fees.

– There will be a need for some cash immediately to pay for the cost of the funeral.

– It is assumed that the whole of Jane’s estate has been left to Charles such that there will be no inheritance tax on her

death.

– The shortfall may be reduced by:

(i) State benefits and tax credits.

(ii) Expenditure on non-essential items, e.g. holidays and entertainment included in the annual expenditure of

£45,500.

(iii) The income generated by Charles if he were to return to work.

– The shortfall may be increased by additional child-care costs due to Charles being a single parent, particularly if he

returns to work full-time.

Further information required

– The level of state benefits and tax credits available to Charles.

– The current level of expenditure on non-essential items.

– The costs of child-care if Charles were to return to work.

– Details of any wills made by Charles or Jane.

– Whether Charles’ investment properties could be sold and the proceeds invested in assets with a higher annual return.

– Whether there is any value in Speak Write Ltd independent of Jane, such that the company could be sold after Jane’s

death.

Other related issues

– The couple should consider making provision for their retirement via pension contributions or some other form. of long

term investment plan.

– The couple should recognise that there would be significant financial problems if Jane were to become seriously ill. In

addition to the family’s income falling as set out above, its expenditure would probably increase.

Protection products

– Term life assurance

A qualifying life policy would pay out a tax-free lump sum on Jane’s death.

– Permanent health insurance

Would provide a regular income if Jane were unable to work due to illness.

– Critical illness insurance

Would provide a capital sum in the event of Jane being diagnosed with an insured illness. -

第18题:

(c) Explain the capital gains tax (CGT) and income tax (IT) issues Paul and Sharon should consider in deciding

which form. of trust to set up for Gisella and Gavin. You are not required to consider inheritance tax (IHT) or

stamp duty land tax (SDLT) issues. (10 marks)

You should assume that the tax rates and allowances for the tax year 2005/06 apply throughout this question.

正确答案:

(c) As the trust is created in the settlors’ (Paul and Sharon’s) lifetime its creation will constitute a chargeable disposal for capital

gains tax. Also, as the settlors and trustees are connected persons, the disposal will be deemed to be at market value, resulting

in a chargeable gain of £80,000 (160,000 – 80,000). No taper relief will be available as the property is a non-business

asset, and has been held for less than three years, but annual exemptions of £17,000 (2 x £8,500) will be available.

However, in the case of a discretionary trust, gift hold over relief will be available. This is because the gift will constitute a

chargeable lifetime transfer and because there is an immediate charge to inheritance tax (even though no tax is payable due

to the nil rate band) relief is available if a specific accumulation and maintenance trust is used, as in this case the gift will

qualify as a potentially exempt transfer and so gift relief would only be available in respect of business assets. The use of a

basic discretionary trust will thus facilitate the deferral of an immediate capital gains tax charge of £25,200 (63,000 x 40%).

If/when the property is disposed of, however, the trustees will pay capital gains tax on the deferred gain at the trust income

tax rate of 40%, and have an annual exemption of only £4,250 (50% of the normal individual rate) available to them. The

40% rate of tax and lower annual exemption rate also apply to chargeable gains arising in a specific accumulation and

maintenance trust, as well as a basic discretionary trust.

A chargeable disposal between connected persons will also arise for the purposes of capital gains tax if/when the property

vests in a beneficiary, i.e. one or more of the beneficiaries becomes absolutely entitled to all or part of the income or capital

of the trust. Gift hold over relief will again be available on all assets in the case of a discretionary trust, but only on business

assets in the case of an accumulation and maintenance trust, except where a beneficiary becomes entitled to both income

and capital at the same time.

The trust will have taxable property income in the form. of net rents from its creation and in future years is also likely to have

other investment income, probably in the form. of interest, to the extent that monies are retained in the trust. Whichever form

of trust is used, the trustees will pay tax at the standard trust rate of 40% on income other than dividend income (32·5%),

except to the extent of (1) the first £500 of taxable income, which is taxed at the rate that would otherwise apply to such

income (i.e. 22% for non-savings (rental) income, 20% for savings income (interest) and 10% for dividends) but, only to the

extent that it is not distributed; and (2) the legitimate trust management expenses, which are offsettable for the purposes of

the higher trust tax rates against the income with the lowest rate(s) of normal tax and so bear tax only at that rate. The higher

trust tax rate always applies to income that is distributed, other than to the extent that it has been treated as the settlor’s

income, and taxed at that settlor’s marginal tax rate.

As Paul and Sharon intend to create a trust for their unmarried minor (under 18) children, then even if the trust specifically

excludes them from any benefit under the trust, the trust income will be treated as theirs for income tax purposes to the extent

that it constitutes income paid for on behalf (including maintenance payments) of Gisella and Gavin; except where (1) the

total income arising does not exceed £100 gross per annum, and (2) income is held for the benefit of a child under an

accumulation and maintenance settlement, to the extent that it is not paid out. -

第19题:

(iii) The extent to which Amy will be subject to income tax in the UK on her earnings in respect of duties

performed for Cutlass Inc and the travel costs paid for by that company. (5 marks)

Appropriateness of format and presentation of the report and the effectiveness with which its advice is

communicated. (2 marks)

Note:

You should assume that the income tax rates and allowances for the tax year 2006/07 and the corporation tax

rates and allowances for the financial year 2006 apply throughout this questio

正确答案:

(iii) Amy’s UK income tax position

Amy will remain UK resident and ordinarily resident as she is not leaving the UK permanently or for a complete tax year

under a full time contract of employment. Accordingly, she will continue to be subject to UK tax on her worldwide income

including her earnings in respect of the duties she performs for Cutlass Inc. The earnings from these duties will also be

taxable in Sharpenia as the income arises in that country.

The double tax treaty between the UK and Sharpenia will either exempt the employment income in one of the two

countries or give double tax relief for the tax paid in Sharpenia. The double tax relief will be the lower of the UK tax and

the Sharpenian tax on the income from Cutlass Inc.

Amy will not be subject to UK income tax on the expenses borne by Cutlass Inc in respect of her flights to and from

Sharpenia provided her journeys are wholly and exclusively for the purposes of performing her duties in Sharpenia.

The amounts paid by Cutlass Inc in respect of Amy’s family travelling to Sharpenia will be subject to UK income tax as

Amy will not be absent from the UK for a continuous period of at least 60 days. -

第20题:

(c) Calculate and explain the amount of income tax relief that Gerard will obtain in respect of the pension

contributions he proposes to make in the tax year 2007/08 and contrast this with how his position could be

improved by delaying some of the contributions that he could have made in 2007/08 until 2008/09. You

should include relevant supporting calculations and quantify the additional tax savings arising as a result of

your advice.

You should ignore the proposed changes to the bonus scheme for this part of this question and assume that

Gerard’s income will not change in 2008/09. (12 marks)

正确答案:

-

第21题:

(c) The inheritance tax payable by Adam in respect of the gift from his aunt. (4 marks)

Additional marks will be awarded for the appropriateness of the format and presentation of the memorandum and

the effectiveness with which the information is communicated. (2 marks)

Note: you should assume that the tax rates and allowances for the tax year 2006/07 will continue to apply for the

foreseeable future.

正确答案:

(c) Inheritance tax payable by Adam

The gift by AS’s aunt was a potentially exempt transfer. No tax will be due if she lives until 1 June 2014 (seven years after

the date of the gift).

The maximum possible liability, on the assumption that there are no annual exemptions or nil band available, is £35,216

(£88,040 x 40%). This will only arise if AS’s aunt dies before 1 June 2010.

The maximum liability will be reduced by taper relief of 20% for every full year after 31 May 2010 for which AS’s aunt lives.

The liability will also be reduced if the chargeable transfers made by the aunt in the seven years prior to 1 June 2007 are

less than £285,000 or if the annual exemption for 2006/07 and/or 2007/08 is/are available. -

第22题:

(b) Explain why making sales of Sabals in North America will have no effect on Nikau Ltd’s ability to recover its

input tax. (3 marks)

Notes: – you should assume that the corporation tax rates and allowances for the financial year to 31 March 2007

will continue to apply for the foreseeable future.

– you should ignore indexation allowance.

正确答案:

(b) Recoverability of input tax

Sales by Nikau Ltd of its existing products are subject to UK VAT at 17·5% because it is selling to domestic customers who

will not be registered for VAT. Accordingly, at present, Nikau Ltd can recover all of its input tax.

Sales to customers in North America will be zero rated because the goods are being exported from the EU. Zero rated supplies

are classified as taxable for the purposes of VAT and therefore Nikau Ltd will continue to be able to recover all of its input tax. -

第23题:

(c) On the assumption that the administrators of Noland’s estate will sell quoted shares in order to fund the

inheritance tax due as a result of his death, calculate the value of the quoted shares that will be available to

transfer to Avril. You should include brief notes of your treatment of the house and the shares in Kurb Ltd.

(9 marks)

Note: you should assume that the tax rates and allowances for the tax year 2006/07 apply throughout this

question.

正确答案:(c) Value of quoted shares that can be transferred to Avril

The value of shares to be transferred to Avril will be equal to £370,000 less the inheritance tax due by the estate.

IHT is payable on transfers in the seven years prior to Noland’s death and on the death estate.

The only chargeable gift in the seven years prior to Noland’s death is the transfer to the discretionary trust. No tax is due in

respect of this gift as it is covered by the nil rate band.