(b) Ambush loaned $200,000 to Bromwich on 1 December 2003. The effective and stated interest rate for thisloan was 8 per cent. Interest is payable by Bromwich at the end of each year and the loan is repayable on30 November 2007. At 30 November 2005, the d

题目

(b) Ambush loaned $200,000 to Bromwich on 1 December 2003. The effective and stated interest rate for this

loan was 8 per cent. Interest is payable by Bromwich at the end of each year and the loan is repayable on

30 November 2007. At 30 November 2005, the directors of Ambush have heard that Bromwich is in financial

difficulties and is undergoing a financial reorganisation. The directors feel that it is likely that they will only

receive $100,000 on 30 November 2007 and no future interest payment. Interest for the year ended

30 November 2005 had been received. The financial year end of Ambush is 30 November 2005.

Required:

(i) Outline the requirements of IAS 39 as regards the impairment of financial assets. (6 marks)

相似考题

更多“(b) Ambush loaned $200,000 to Bromwich on 1 December 2003. The effective and stated interest rate for thisloan was 8 per cent. Interest is payable by Bromwich at the end of each year and the loan is repayable on30 November 2007. At 30 November 2005, the d”相关问题

-

第1题:

(ii) Explain the accounting treatment under IAS39 of the loan to Bromwich in the financial statements of

Ambush for the year ended 30 November 2005. (4 marks)

正确答案:

(ii) There is objective evidence of impairment because of the financial difficulties and reorganisation of Bromwich. The

impairment loss on the loan will be calculated by discounting the estimated future cash flows. The future cash flows

will be $100,000 on 30 November 2007. This will be discounted at an effective interest rate of 8% to give a present

value of $85,733. The loan will, therefore, be impaired by ($200,000 – $85,733) i.e. $114,267.

(Note: IAS 39 requires accrual of interest on impaired loans at the original effective interest rate. In the year to

30 November 2006 interest of 8% of $85,733 i.e. $6,859 would be accrued.)

-

第2题:

(d) Sirus raised a loan with a bank of $2 million on 1 May 2007. The market interest rate of 8% per annum is to

be paid annually in arrears and the principal is to be repaid in 10 years time. The terms of the loan allow Sirus

to redeem the loan after seven years by paying the full amount of the interest to be charged over the ten year

period, plus a penalty of $200,000 and the principal of $2 million. The effective interest rate of the repayment

option is 9·1%. The directors of Sirus are currently restructuring the funding of the company and are in initial

discussions with the bank about the possibility of repaying the loan within the next financial year. Sirus is

uncertain about the accounting treatment for the current loan agreement and whether the loan can be shown as

a current liability because of the discussions with the bank. (6 marks)

Appropriateness of the format and presentation of the report and quality of discussion (2 marks)

Required:

Draft a report to the directors of Sirus which discusses the principles and nature of the accounting treatment of

the above elements under International Financial Reporting Standards in the financial statements for the year

ended 30 April 2008.

正确答案:

(d) Repayment of the loan

If at the beginning of the loan agreement, it was expected that the repayment option would not be exercised, then the effective

interest rate would be 8% and at 30 April 2008, the loan would be stated at $2 million in the statement of financial position

with interest of $160,000 having been paid and accounted for. If, however, at 1 May 2007, the option was expected to be

exercised, then the effective interest rate would be 9·1% and at 30 April 2008, the cash interest paid would have been

$160,000 and the interest charged to the income statement would have been (9·1% x $2 million) $182,000, giving a

statement of financial position figure of $2,022,000 for the amount of the financial liability. However, IAS39 requires the

carrying amount of the financial instrument to be adjusted to reflect actual and revised estimated cash flows. Thus, even if

the option was not expected to be exercised at the outset but at a later date exercise became likely, then the carrying amount

would be revised so that it represented the expected future cash flows using the effective interest rate. As regards the

discussions with the bank over repayment in the next financial year, if the loan was shown as current, then the requirements

of IAS1 ‘Presentation of Financial Statements’ would not be met. Sirus has an unconditional right to defer settlement for longer

than twelve months and the liability is not due to be legally settled in 12 months. Sirus’s discussions should not be considered

when determining the loan’s classification.

It is hoped that the above report clarifies matters. -

第3题:

(d) The management of Wonderland plc have become concerned about the increased level of operating costs

associated with its petrol-driven ferries and have made a strategic decision to dispose of these. They are now

considering entering into a contract with the Newman Steamship Company (NSC), a shipping organisation based

in Robynland. The contract would entail NSC providing transport to and from Cinola Island for all visitors to the

zoo and circus.

As a result of negotiations with NSC, the directors of Wonderland plc are considering two options whereby NSC

will become responsible for the transportation of visitors to and from Cinola Island with effect from 1 December

2007 or 1 December 2008.

Additional information is available as follows:

(1) NSC would require Wonderland plc to pay for the necessary modifications to their steamships in order that

they would satisfy marine regulations with regard to passenger transportation. The only firm which could

undertake this work is currently working to full capacity and would require a payment of £2,450,000 in

order to undertake the work necessary so that the ferries could be in operation by 1 December 2007. The

same firm would require a payment of £1,725,000 in order to make the necessary modifications so that

the ferries could be in operation by 1 December 2008. The government of Robynland would be willing to

pay a grant of 8% towards the cost of getting the ferries into operation by 1 December 2007, but would not

be willing to pay a grant in respect of any later date.

(2) On 1 December 2002 Wonderland plc paid £500,000 to the Port Licencing Authority of Robynland. This

payment was for a licence which entitles Wonderland plc to use all harbour facilities in Robynland during

the five-year period ending 30 November 2007. The licence could be renewed on 1 December 2007 at a

cost of £150,000 per annum.

(3) Redundancy payments would need to be paid in respect of loss of employment. These would amount to

£1,200,000 if the contract with NSC commenced on 1 December 2007. This amount would reduce to

£750,000 if the contract commenced on 1 December 2008.

(4) Wonderland plc has a contract for the provision of petrol for its ferries which is due to expire on 30 November

2008. Early termination of the contract would incur a penalty charge of £76,000. An emergency reserve

stock of petrol held by Wonderland plc, which cannot be used after 30 November 2007 due to marine

regulations regarding the age of fuel, could be sold for £55,000 on 1 December 2007 but not on any date

thereafter.

(5) The ferries could be sold for £3,300,000 on 1 December 2007. If retained after 1 December 2007 the

ferries would require servicing during the year ending 30 November 2008 which would incur costs

amounting to £150,000. The resale value of the ferries on 1 December 2008 would be £2,900,000.

(6) Stock of consumable items which originally cost £150,000 could be sold on 1 December 2007 for

£110,000 and on 1 December 2008 for £50,000.

Required:

(i) On purely financial grounds, advise whether the management of Wonderland plc should enter into a

contract with NSC with effect from 1 December 2007 or 1 December 2008. You may ignore the time

value of money. (9 marks)

正确答案:

-

第4题:

单句理解

听力原文:For one full year when the full principal plus interest is paid together, compound interest and simple interest yield the same dollar amount.

(1)

A.If the time period of the loan is one year, the simple interest and compound interest are the same.

B.If the time period of the loan is the same, the simple interest and compound interest are the same.

C.When the full principal plus interest is paid together, compound interest and simple interest are of the same dollar amount.

D.When the full principal plus interest is paid together, compound interest and simple interest are not of the same dollar amount.

正确答案:A

解析:单句意思为“当本金和利息整整一年才一起支付时,复利计息和单利计息的数额一样”。 -

第5题:

听力原文: Some banks offer other types of loans repayable by monthly installments, such as business development loans, house improvement loans, and farm development loans. These may be either secured or unsecured. Secured loans attract a slightly lower rate of interest than unsecured loans. Some banks offer revolving credit schemes. These normally involve loans repayable by regular monthly installments, but they differ from other loans repayable by installments in two respects. First, the borrower need not take up the full amount of the loan at the outset. Secondly, as his repayments reduce his indebtedness, he can "top up" his loan by borrowing more, provided that the total debt outstanding does not exceed his agreed credit limit. In 1967 some banks introduced a new form. of account called a "budget account". The object is to allow personal customers to spread the incidence of normal personal and household expenditure.

24. Which of the following loans is not repaid by installments?

25.Which of the following loans would attract a lower rate of interest?

26.How does a borrower "top up" his loan?

27.What is the objective of introduction of the budget account?

(24)

A.Business development loans.

B.House improvement loans.

C.Farm development loans.

D.Overdrafts.

正确答案:D

解析:录音原文一开始提到Some banks offer...and farm development loans. 一些银行推出其他种类按月分期还款的贷款,例如商业发展贷款、住房改善贷款和农业发展贷款。 -

第6题:

Meeting Notice

To: All salesmen

Subject: The Year-end Sales Meeting From: Tracy, Secretary

The last sales meeting for 2018 will be 1) _______ on Monday, December 17th 9:00 a.m. 2) _______ 3:00 p.m. at the Head Office.

Lunch will be 3) ________.

The 4) _________ will be mailed by the end of November.

If you have any items to be included, please forward them to me by November 20th. If you are unable to 5) ________, please call 63419403, not later than November 30th.

Thank you.

正确答案:1、held2、until3、provided4、agenda5、attend

-

第7题:

The statements concerning nominal and real interest rate are true except that ______.

A.the nominal interest rate is the growth rate of your money

B.the real interest rate is the growth rate of your purchasing power

C.the nominal rate is the real interest rate deducted by the rate of inflation

D.all of the above statements

正确答案:C

解析:名义利率减去通货膨胀率等于实际利率。nominal interest rate名义利率。 -

第8题:

The interest rate specified in the bond indenture is called the ().A.market rate

B.effective rate

C.discount rate

D.contract rate

正确答案:D

-

第9题:

(a) The following figures have been calculated from the financial statements (including comparatives) of Barstead for

the year ended 30 September 2009:

increase in profit after taxation 80%

increase in (basic) earnings per share 5%

increase in diluted earnings per share 2%

Required:

Explain why the three measures of earnings (profit) growth for the same company over the same period can

give apparently differing impressions. (4 marks)

(b) The profit after tax for Barstead for the year ended 30 September 2009 was $15 million. At 1 October 2008 the company had in issue 36 million equity shares and a $10 million 8% convertible loan note. The loan note will mature in 2010 and will be redeemed at par or converted to equity shares on the basis of 25 shares for each $100 of loan note at the loan-note holders’ option. On 1 January 2009 Barstead made a fully subscribed rights issue of one new share for every four shares held at a price of $2·80 each. The market price of the equity shares of Barstead immediately before the issue was $3·80. The earnings per share (EPS) reported for the year ended 30 September 2008 was 35 cents.

Barstead’s income tax rate is 25%.

Required:

Calculate the (basic) EPS figure for Barstead (including comparatives) and the diluted EPS (comparatives not required) that would be disclosed for the year ended 30 September 2009. (6 marks)

正确答案:

(a)Whilstprofitaftertax(anditsgrowth)isausefulmeasure,itmaynotgiveafairrepresentationofthetrueunderlyingearningsperformance.Inthisexample,userscouldinterpretthelargeannualincreaseinprofitaftertaxof80%asbeingindicativeofanunderlyingimprovementinprofitability(ratherthanwhatitreallyis:anincreaseinabsoluteprofit).Itispossible,evenprobable,that(someof)theprofitgrowthhasbeenachievedthroughtheacquisitionofothercompanies(acquisitivegrowth).Wherecompaniesareacquiredfromtheproceedsofanewissueofshares,orwheretheyhavebeenacquiredthroughshareexchanges,thiswillresultinagreaternumberofequitysharesoftheacquiringcompanybeinginissue.ThisiswhatappearstohavehappenedinthecaseofBarsteadastheimprovementindicatedbyitsearningspershare(EPS)isonly5%perannum.ThisexplainswhytheEPS(andthetrendofEPS)isconsideredamorereliableindicatorofperformancebecausetheadditionalprofitswhichcouldbeexpectedfromthegreaterresources(proceedsfromthesharesissued)ismatchedwiththeincreaseinthenumberofshares.Simplylookingatthegrowthinacompany’sprofitaftertaxdoesnottakeintoaccountanyincreasesintheresourcesusedtoearnthem.Anyincreaseingrowthfinancedbyborrowings(debt)wouldnothavethesameimpactonprofit(asbeingfinancedbyequityshares)becausethefinancecostsofthedebtwouldacttoreduceprofit.ThecalculationofadilutedEPStakesintoaccountanypotentialequitysharesinissue.Potentialordinarysharesarisefromfinancialinstruments(e.g.convertibleloannotesandoptions)thatmayentitletheirholderstoequitysharesinthefuture.ThedilutedEPSisusefulasitalertsexistingshareholderstothefactthatfutureEPSmaybereducedasaresultofsharecapitalchanges;inasenseitisawarningsign.InthiscasethelowerincreaseinthedilutedEPSisevidencethatthe(higher)increaseinthebasicEPShas,inpart,beenachievedthroughtheincreaseduseofdilutingfinancialinstruments.Thefinancecostoftheseinstrumentsislessthantheearningstheirproceedshavegeneratedleadingtoanincreaseincurrentprofits(andbasicEPS);however,inthefuturetheywillcausemoresharestobeissued.ThiscausesadilutionwherethefinancecostperpotentialnewshareislessthanthebasicEPS. -

第10题:

November 1st, 2006

STMP Capital

058 Rue du Chateau des Rentiers

Paris, FRA

75014

To: Melanie Marie Bourgeois and Jessica Lee Lariviere:

We wish to remind you that you are presently bound to a lease from December 1st 2005 to November 30th

2006

We are informing you that for the period of prolongation of your lease, from December 1st, 2006 to November

30th 2007, our rent will be increased to $825 monthly. All other conditions of your lease will remain the same.You are hereby notified that you have one month following receipt of the present notice to respond.

Sincerely,

Sandro Milano

STMP Capital

When is the current lease over?A. November 1st, 2006

B. November 1st, 2007

C. December 1st, 2006

D. November 30th, 2006答案:D解析: -

第11题:

资料:Bank CD is the instrument uniformly figuring in the investment options of most investors. Bank of India CDs are safe, FDIC insured & offer decent returns. There is no brokerage, no fees or hidden costs. However, the Bank may impose a fee for administrative expenses involved in any legal action in connection with the CD. Look at our ‘Star CD’ plan below.

High Interest: Higher on Large amount

Our rates on certificate of deposits are among the best in the industry. The rate may vary on day-to day basis. For CD’s of above $250,000.00, the interest is simple i.e not compounded; therefore, annual percentage yield is same as annual interest rate. The interest is payable on the day of maturity of deposit. Interest paid during the year is reported to Internal Revenue Services. For today’s rates please refer to Current Rates of Interest on STAR CDs.

Maturity Period: Flexible to your needs

You may choose any maturity date with a minimum period of 7 days to a maximum period of 1 year to suit your needs. Your CD is automatically renewed for the same period in absence of any other instruction, at the ruling rate of interest on the date of renewal. There is no grace period for automatic renewal of deposits on maturity. For deposits issued for 1 year or more, we send maturity notices to the depositors 2 to 4 weeks before the due date.

Minimum Amount: Easy to Start

The minimum amount accepted is USD 2000

Other Features:

1.FDIC Insurance Up to $100,000

2.Facility to Open Joint & Corporate Accounts

Additional Deposits:

Additional amounts deposited into an account will be treated as fresh deposits & separate certificates of deposits will be issued for such deposits.

Early Withdrawal:

Withdrawal of deposit before its date of maturity may be allowed at bank’s discretion. In that event, interest will be paid at the rate applicable for the period for which the deposit remained with the bank or the contracted rate, whichever is lower, as prevailing on the date of deposit, less one percent. However, no interest shall be paid on the deposit which runs for less than 30 days. There is no other penalty or charge on early withdrawal.

The CD’s annual percentage yield is ( ) annual interest rate.A.more than

B.less than

C.the same as

D.not comparable with答案:C解析:本题考查细节理解。

【关键词】The CD’s annual percentage yield; annual interest rate

【主题句】

第三段For CD’s of above $250,000.00, the interest is simple i.e not compounded; therefore, annual percentage yield is same as annual interest rate. 对于250,000美金以上的大额存单,利息是单利的,不是复利的;因此,其年收益与年利率相同。

【解析】题目意为“大额存单年收益率与年利率______。” 选项A意为“多于”;选项B意为“少于”;选项C意为“一样”;选项D意为“不可比拟”。根据主题句,年收益与年利率相同,因此选项C正确。 -

第12题:

资料:Bank CD is the instrument uniformly figuring in the investment options of most investors. Bank of India CDs are safe, FDIC insured & offer decent returns. There is no brokerage, no fees or hidden costs. However, the Bank may impose a fee for administrative expenses involved in any legal action in connection with the CD. Look at our ‘Star CD’ plan below.

High Interest: Higher on Large amount

Our rates on certificate of deposits are among the best in the industry. The rate may vary on day-to day basis. For CD’s of above $250,000.00, the interest is simple i.e not compounded; therefore, annual percentage yield is same as annual interest rate. The interest is payable on the day of maturity of deposit. Interest paid during the year is reported to Internal Revenue Services. For today’s rates please refer to Current Rates of Interest on STAR CDs.

Maturity Period: Flexible to your needs

You may choose any maturity date with a minimum period of 7 days to a maximum period of 1 year to suit your needs. Your CD is automatically renewed for the same period in absence of any other instruction, at the ruling rate of interest on the date of renewal. There is no grace period for automatic renewal of deposits on maturity. For deposits issued for 1 year or more, we send maturity notices to the depositors 2 to 4 weeks before the due date.

Minimum Amount: Easy to Start

The minimum amount accepted is USD 2000

Other Features:

1.FDIC Insurance Up to $100,000

2.Facility to Open Joint & Corporate Accounts

Additional Deposits:

Additional amounts deposited into an account will be treated as fresh deposits & separate certificates of deposits will be issued for such deposits.

Early Withdrawal:

Withdrawal of deposit before its date of maturity may be allowed at bank’s discretion. In that event, interest will be paid at the rate applicable for the period for which the deposit remained with the bank or the contracted rate, whichever is lower, as prevailing on the date of deposit, less one percent. However, no interest shall be paid on the deposit which runs for less than 30 days. There is no other penalty or charge on early withdrawal.

Bank of India CDs are safe because ( )A.CD is a safe instrument.

B.Bank of India is safe.

C.CD is insured

D.All of the above答案:D解析:本题考查细节理解。

【关键词】Bank of India CDs; safe; because

【主题句】

第一段Bank CD is the instrument uniformly figuring in the investment options of most investors. Bank of India CDs are safe, FDIC insured & offer decent returns. There is no brokerage, no fees or hidden costs. 银行大额存单(CD)是大多数投资者普遍选择投资的工具。印度银行的大额存单是安全的,联邦存款保险公司(FDIC)投保,并提供体面的回报。没有经纪人,没有收费或隐藏费用。

【解析】题目意为“印度银行大额存单是安全的,因为______。” 选项A意为“大额存单是一个安全的工具”;选项B意为“印度银行是安全的”;选项C意为“大额存单被投保”;选项D意为“以上皆是”。根据主题句,选项A、B、C均提到,因此选项D正确。

-

第13题:

(c) Issue of bond

The club proposes to issue a 7% bond with a face value of $50 million on 1 January 2007 at a discount of 5%

that will be secured on income from future ticket sales and corporate hospitality receipts, which are approximately

$20 million per annum. Under the agreement the club cannot use the first $6 million received from corporate

hospitality sales and reserved tickets (season tickets) as this will be used to repay the bond. The money from the

bond will be used to pay for ground improvements and to pay the wages of players.

The bond will be repayable, both capital and interest, over 15 years with the first payment of $6 million due on

31 December 2007. It has an effective interest rate of 7·7%. There will be no active market for the bond and

the company does not wish to use valuation models to value the bond. (6 marks)

Required:

Discuss how the above proposals would be dealt with in the financial statements of Seejoy for the year ending

31 December 2007, setting out their accounting treatment and appropriateness in helping the football club’s

cash flow problems.

(Candidates do not need knowledge of the football finance sector to answer this question.)

正确答案:(c) Issue of bond

This form. of financing a football club’s operations is known as ‘securitisation’. Often in these cases a special purpose vehicle

is set up to administer the income stream or assets involved. In this case, a special purpose vehicle has not been set up. The

benefit of securitisation of the future corporate hospitality sales and season ticket receipts is that there will be a capital

injection into the club and it is likely that the effective interest rate is lower because of the security provided by the income

from the receipts. The main problem with the planned raising of capital is the way in which the money is to be used. The

use of the bond for ground improvements can be commended as long term cash should be used for long term investment but

using the bond for players’ wages will cause liquidity problems for the club.

This type of securitisation is often called a ‘future flow’ securitisation. There is no existing asset transferred to a special purpose

vehicle in this type of transaction and, therefore, there is no off balance sheet effect. The bond is shown as a long term liability

and is accounted for under IAS39 ‘Financial Instruments: Recognition and Measurement’. There are no issues of

derecognition of assets as there can be in other securitisation transactions. In some jurisdictions there are legal issues in

assigning future receivables as they constitute an unidentifiable debt which does not exist at present and because of this

uncertainty often the bond holders will require additional security such as a charge on the football stadium.

The bond will be a financial liability and it will be classified in one of two ways:

(i) Financial liabilities at fair value through profit or loss include financial liabilities that the entity either has incurred for

trading purposes and, where permitted, has designated to the category at inception. Derivative liabilities are always

treated as held for trading unless they are designated and effective as hedging instruments. An example of a liability held

for trading is an issued debt instrument that the entity intends to repurchase in the near term to make a gain from shortterm

movements in interest rates. It is unlikely that the bond will be classified in this category.

(ii) The second category is financial liabilities measured at amortised cost. It is the default category for financial liabilities

that do not meet the criteria for financial liabilities at fair value through profit or loss. In most entities, most financial

liabilities will fall into this category. Examples of financial liabilities that generally would be classified in this category are

account payables, note payables, issued debt instruments, and deposits from customers. Thus the bond is likely to be

classified under this heading. When a financial liability is recognised initially in the balance sheet, the liability is

measured at fair value. Fair value is the amount for which a liability can be settled between knowledgeable, willing

parties in an arm’s length transaction. Since fair value is a market transaction price, on initial recognition fair value will

usually equal the amount of consideration received for the financial liability. Subsequent to initial recognition financial

liabilities are measured using amortised cost or fair value. In this case the company does not wish to use valuation

models nor is there an active market for the bond and, therefore, amortised cost will be used to measure the bond.

The bond will be shown initially at $50 million × 95%, i.e. $47·5 million as this is the consideration received. Subsequentlyat 31 December 2007, the bond will be shown as follows:

-

第14题:

(b) Calculate the percentage of maximum capacity at which the zoo will break even during the year ending

30 November 2007. You should assume that 50% of the revenue from sales of ticket type ZC is attributable

to the zoo. (7 marks)

正确答案:

-

第15题:

(ii) Describe the procedures to verify the number of serious accidents in the year ended 30 November 2007.

(4 marks)

正确答案:

(ii) Procedures to verify the number of serious accidents during 2007 could include the following:

Tutorial note: procedures should focus on the completeness of the disclosure as it is in the interest of Sci-Tech Co to

understate the number of serious accidents.

– Review the accident log book and count the total number of accidents during the year

– Discuss the definition of ‘serious accident’ with the directors and clarify exactly what criteria need to be met to

satisfy the definition

– For serious accidents identified:

? review HR records to determine the amount of time taken off work

? review payroll records to determine the financial amount of sick pay awarded to the employee

? review correspondence with the employee regarding the accident.

Tutorial note: the above will help to clarify that the accident was indeed serious.

– Review board minutes where the increase in the number of serious accidents has been discussed

– Review correspondence with Sci-Tech Co’s legal advisors to ascertain any legal claims made against the company

due to accidents at work

– Enquire as to whether any health and safety visits have been conducted during the year by regulatory bodies, and

review any documentation or correspondence issued to Sci-Tech Co after such visits.

Tutorial note: it is highly likely that in a regulated industry such as pharmaceutical research, any serious accident

would trigger a health and safety inspection from the appropriate regulatory body.

– Discuss the level of accidents with representatives of Sci-Tech Co’s employees to reach an understanding as to

whether accidents sometimes go unreported in the accident log book. -

第16题:

Usually the borrowing firm of term loans promises to repay ______.

A.the principal and interest until the end of the loan period

B.the principal and interest at the end of the loan period

C.the loan in a series of installments

D.at any time when cash is more abundant ______.

正确答案:C

解析:第一段第二句后半句...and then pledges to meet the scheduled repayment in a series of installments(often payments are made every quarter or even monthly),意指借款企业向银行保证分期还款,通常是按月或者按季度分期还款。Installment分期还款。 -

第17题:

Why did the dollar rally at the beginning of the year?

A.It was the beginning of the year.

B.Traders' sentiment was changing greatly.

C.People thought that the US economy would recover and German interest rate would ease soon.

D.The present US-German interest rate differential would be unlikely to narrow.

正确答案:C

解析:文章第二段提到dollar rallied due to...German interest rate would ease soon。美元的回升是由于人们的乐观情绪。 -

第18题:

单句理解

听力原文:Interest rate risk refers to the exposure of a bank's financial condition to adverse movements in interest rates.

(1)

A.Bank's financial condition is the cause of interest rate risk.

B.Bank's financial condition has impact on interest rate risk.

C.Interest rate risk occurs when interest rate moves against the bank's financial condition.

D.Interest rate risk occurs when interest rate favours the bank's financial condition.

正确答案:C

解析:单句意思为“利率风险是指银行在不利的利率变动中暴露出的财务风险”。A项因果关 系颠倒,B项没有提及,D项“favour”一词与原句“adverse”相矛盾。 -

第19题:

The rate of interest paid on a bank loan will depend () your firm’s standing with the bank and may be 2 per cent or 3 percent.

A、of

B、upon

C、for

D、in

参考答案:B

-

第20题:

The bank (56) borrowers enough interest to pay the expense of the bank and have something left over for (57) . The interest cannot be higher than the legal rate, which is established by state law and in most states is 6% per year. (58) big loans, the interest rate is much less, even as low as 2%. The rate depends on the money market, when there is plenty of money (59) to be borrowed, banks charge low rates of interest. A savings bank may pay its depositors 2% and lend the money at 3.5% or 4%. But when money is tight, interest rates go up, and a savings bank may try to (60) depositors by offering 4% or 4.5% or even more and lending the money at 5% or 6%.

(41)

A.receives

B.gets

C.charges

D.pays

正确答案:C

解析:句意:银行向贷款人索取足够的利息以支付银行日常开销,并保证部分盈余。这里表示索取费用的词是charge。receive收到。pay支付,交纳。 -

第21题:

The2010WorldExpoinShanghaiwillendon_________.

A.September30

B.October31

C.November30

D.December31

正确答案:B

-

第22题:

John, CPA, is auditing the financial statements of ABC Bank Co.for the year ended December 31,20×8. The following information is available:

(a)John assessed the risk of material misstatements in short-term loan account at 80% and plans to limit to 10% the risk of failing to detect misstatements in the account equal to the tolerable error assigned to the account.

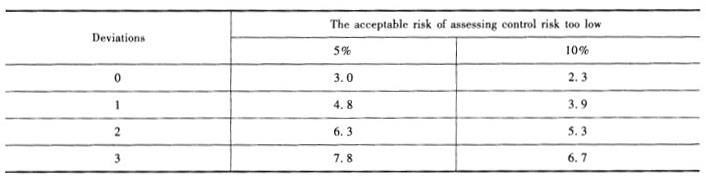

(b) John is testing the operating effectiveness of the loan approval procedure(a control activ- ity) related to granting loans. In 20×8,ABC Bank granted to 10 000 loans in total. John deter- mined that the acceptable risk of assessing control risk too low is 10%. He selected a sample made up of 60 sampling units and tested without any deviation found. Some Poisson Risk Factors(Relia- bility Factors) are reprinted as follows:

(c) John is using the Ratio Estimation Variable Sampling method to test the long-term loan balance at December 31, 20×8. The total recorded balance is RMB¥300 billion , made up of 4 000 items. John designed a sample made up of 200 items . The book value of the sample is RMB¥16. 5 billion. However, the audited value is RMB¥15. 6 billion.

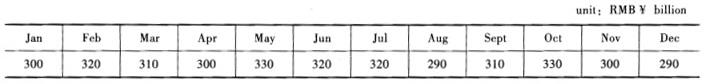

(d) John is performing substantive procedures on interest income from short-term loan. The average annual market interest rate for short-term loan is 5 percent. The audited short-term loan balances of ABC Bank Co. at the end of each month in 20×8 are as follows:

Required :

(1) Based on (a) , calculate the acceptable detection risk.

(2) Based on (b) , calculate the upper limit of population deviation rate.

(3) Based on (c), make a point estimate of the misstatement in the population. Sampling error need not to be considered.

(4) Based on (d) , develop the expected result of interest income from short-term loan.

(5) Assume that after the tests mentioned in (d) , John found that the interest income from short-term loan was understated by RMB¥0. 05billion. Prepare the adjusting entry.

答案:解析:(1) acceptable detection risk = audit risk/the risk of material misstatement s = 10%/80% = 12. 5%

(2) The upper limit of population deviation rate = Poisson risk factor/sample size = 2. 3/60 = 3. 83 %

(3) ratio = 156/165 = 94. 54%

estimate the actual value of the population = 3 000*94. 54% = 283. 62 billion a point estimate of the misstatement in of the population =3 000 -283. 62 *10 = 16. 38 billion

(4) the expected result of interest income from short-term loan = (300 +320 +310 +300 + 330 +320 +320 +290 +310 +330 +300 +290)*5% =18. 6 billion

(5) the adjusting accounting entry:

Dr: Interest suspense 156

Cr: Interest income 156

-

第23题:

资料:Bank CD is the instrument uniformly figuring in the investment options of most investors. Bank of India CDs are safe, FDIC insured & offer decent returns. There is no brokerage, no fees or hidden costs. However, the Bank may impose a fee for administrative expenses involved in any legal action in connection with the CD. Look at our ‘Star CD’ plan below.

High Interest: Higher on Large amount

Our rates on certificate of deposits are among the best in the industry. The rate may vary on day-to day basis. For CD’s of above $250,000.00, the interest is simple i.e not compounded; therefore, annual percentage yield is same as annual interest rate. The interest is payable on the day of maturity of deposit. Interest paid during the year is reported to Internal Revenue Services. For today’s rates please refer to Current Rates of Interest on STAR CDs.

Maturity Period: Flexible to your needs

You may choose any maturity date with a minimum period of 7 days to a maximum period of 1 year to suit your needs. Your CD is automatically renewed for the same period in absence of any other instruction, at the ruling rate of interest on the date of renewal. There is no grace period for automatic renewal of deposits on maturity. For deposits issued for 1 year or more, we send maturity notices to the depositors 2 to 4 weeks before the due date.

Minimum Amount: Easy to Start

The minimum amount accepted is USD 2000

Other Features:

1.FDIC Insurance Up to $100,000

2.Facility to Open Joint & Corporate Accounts

Additional Deposits:

Additional amounts deposited into an account will be treated as fresh deposits & separate certificates of deposits will be issued for such deposits.

Early Withdrawal:

Withdrawal of deposit before its date of maturity may be allowed at bank’s discretion. In that event, interest will be paid at the rate applicable for the period for which the deposit remained with the bank or the contracted rate, whichever is lower, as prevailing on the date of deposit, less one percent. However, no interest shall be paid on the deposit which runs for less than 30 days. There is no other penalty or charge on early withdrawal.

For deposit running for more than 30 days, early withdrawal may be ( ), ( ) penalty or charge.A.allowed, without

B.banned, with

C.allowed, with

D.banned, without答案:A解析:本题考查细节理解。

【关键词】deposit running for more than 30 days; early withdrawal; penalty or charge.

【主题句】

最后一段Withdrawal of deposit before its date of maturity may be allowed at bank’s discretion. There is no other penalty or charge on early withdrawal. However, no interest shall be paid on the deposit which runs for less than 30 days. 在其到期日之前撤回存款可由银行酌情决定。提前退出时没有其他处罚或收费。但是,对于运行时间少于30天不应支付利息。

【解析】题目意为“对于存款时间少于30天的情况,提出退出___,_____处罚或罚款”。根据主题句,提前退出可由银行酌情决定,但无需受到处罚或收费,只是运行时间少于30天不应支付利息。选项A与题意相符,因此正确。