(c) Explain the capital gains tax (CGT) and income tax (IT) issues Paul and Sharon should consider in decidingwhich form. of trust to set up for Gisella and Gavin. You are not required to consider inheritance tax (IHT) orstamp duty land tax (SDLT) issues.

题目

(c) Explain the capital gains tax (CGT) and income tax (IT) issues Paul and Sharon should consider in deciding

which form. of trust to set up for Gisella and Gavin. You are not required to consider inheritance tax (IHT) or

stamp duty land tax (SDLT) issues. (10 marks)

You should assume that the tax rates and allowances for the tax year 2005/06 apply throughout this question.

相似考题

更多“(c) Explain the capital gains tax (CGT) and income tax (IT) issues Paul and Sharon should consider in decidingwhich form. of trust to set up for Gisella and Gavin. You are not required to consider inheritance tax (IHT) orstamp duty land tax (SDLT) issues.”相关问题

-

第1题:

(c) Assuming that Joanne registers for value added tax (VAT) with effect from 1 April 2006:

(i) Calculate her income tax (IT) and capital gains tax (CGT) payable for the year of assessment 2005/06.

You are not required to calculate any national insurance liabilities in this sub-part. (6 marks)

正确答案:

-

第2题:

(ii) State when the inheritance tax (IHT) calculated in (i) would be payable and by whom. (2 marks)

正确答案:

(ii) Inheritance tax administration

The tax on Debbie’s estate (personalty and realty) would be paid by the personal representatives, usually an executor.

Inheritance tax is due six months from the end of the month in which death occurred (31 December 2005) or the date

on which probate is obtained (if earlier). However, an instalment option is available for certain assets, which includes

land and buildings i.e. the residence whereby the tax can be paid in 10 equal annual instalments. -

第3题:

(ii) Explain the income tax (IT), national insurance (NIC) and capital gains tax (CGT) implications arising on

the grant to and exercise by an employee of an option to buy shares in an unapproved share option

scheme and on the subsequent sale of these shares. State clearly how these would apply in Henry’s

case. (8 marks)

正确答案:

(ii) Exercising of share options

The share option is not part of an approved scheme, and will not therefore enjoy the benefits of such a scheme. There

are three events with tax consequences – grant, exercise and sale.

Grant. If shares or options over shares are sold or granted at less than market value, an income tax charge can arise on

the difference between the price paid and the market value. [Weight v Salmon]. In addition, if options can be exercised

more than 10 years after the date of the grant, an employment income charge can arise. This is based on the market

value at the date of grant less the grant and exercise priced.

In Henry’s case, the options were issued with an exercise price equal to the then market value, and cannot be exercised

more than 10 years from the grant. No income tax charge therefore arises on grant.

Exercise. On exercise, the individual pays the agreed amount in return for a number of shares in the company. The price

paid is compared with the open market value at that time, and if less, the difference is charged to income tax. National

insurance also applies, and the company has to pay Class 1 NIC. If the company and shareholder agree, the national

insurance can be passed onto the individual, and the liability becomes a deductible expense in calculating the income

tax charge.

In Henry’s case on exercise, the difference between market value (£14) and the price paid (£1) per share will be taxed

as income. Therefore, £130,000 (10,000 x (£14 – £1)) will be taxed as income. In addition, national insurance will

be chargeable on the company at 12·8% (£16,640) and on Henry at the rate of 1% (£1,300).

Sale. The base cost of the shares is taken to be the market value at the time of exercise. On the sale of the shares, any

gain or loss arising falls under the capital gains tax rules, and CGT will be payable on any gain. Business asset taper

relief will be available as the company is an unquoted trading company, but the relief will only run from the time that

the share options are exercised – i.e. from the time when the shares were acquired.

In Henry’s case, the sale of the shares will immediately follow the exercise of the option (6 days later). The sale proceeds

and the market value at the time of exercise are likely to be similar; thus little to no gain is likely to arise. -

第4题:

(ii) Compute the annual income tax saving from your recommendation in (i) above as compared with the

situation where Cindy retains both the property and the shares. Identify any other tax implications

arising from your recommendation. Your answer should consider all relevant taxes. (3 marks)

正确答案:

-

第5题:

(d) Explain how Gloria would be taxed in the UK on the dividends paid by Bubble Inc and the capital gains tax

and inheritance tax implications of a future disposal of the shares. Clearly state, giving reasons, whether or

not the payment made to Eric is allowable for capital gains tax purposes. (9 marks)

You should assume that the rates and allowances for the tax year 2005/06 apply throughout this question.

正确答案:

(d) UK tax implications of shares in Bubble Inc

Income tax

Gloria is UK resident and is therefore subject to income tax on her worldwide income. However, because she is non-UK

domiciled, she will only be taxed on the foreign dividends she brings into the UK.

Dividends brought into the UK will be grossed up for any tax paid in Oceania. The gross amount is taxed at 10% if it falls

into the starting or basic rate band and at 321/2% if it falls into the higher rate band. The tax suffered in Oceania is available

for offset against the UK tax liability. The offset is restricted to a maximum of the UK tax on the dividend income.

Capital gains tax

Individuals are subject to capital gains tax on worldwide assets if they are resident or ordinarily resident in the UK. However,

because Gloria is non-UK domiciled and the shares are situated abroad, the gain is only taxable to the extent that the sales

proceeds are brought into the UK. Any tax suffered in Oceania in respect of the gain is available for offset against the UK

capital gains tax liability arising on the shares.

Any loss arising on the disposal of the shares would not be available for relief in the UK.

In computing a capital gain or allowable loss, a deduction is available for the incidental costs of acquisition. However, to be

allowable, such costs must be incurred wholly and exclusively for the purposes of acquiring the asset. The fee paid to Eric

related to general investment advice and not to the acquisition of the shares and therefore, would not be deductible in

computing the gain.

Taper relief will be at non-business asset rates as Bubble Inc is an investment company.

Inheritance tax

Assets situated abroad owned by non-UK domiciled individuals are excluded property for the purposes of inheritance tax.

However, Gloria will be deemed to be UK domiciled (for the purposes of inheritance tax only) if she has been resident in the

UK for 17 out of the 20 tax years ending with the year in which the disposal occurs.

Gloria has been running a business in the UK since June 1992 and would therefore, appear to have been resident for at least

15 tax years (1992/93 to 2006/07 inclusive).

If Gloria is deemed to be UK domiciled such that the shares in Bubble Inc are not excluded property, business property relief

will not be available because Bubble Inc is an investment company. -

第6题:

(b) (i) State the condition that would need to be satisfied for the exercise of Paul’s share options in Memphis

plc to be exempt from income tax and the tax implications if this condition is not satisfied.

(2 marks)

正确答案:

(b) (i) Paul has options in an HMRC approved share scheme. Under such schemes, no tax liabilities arise either on the grant

or exercise of the option. The excess of the proceeds over the price paid for the shares (the exercise price) is charged to

capital gains tax on their disposal.

However, in order to secure this treatment, one of the conditions to be satisfied is that the options cannot be exercised

within three years of the date of grant. If Paul were to exercise his options now (i.e. before the third anniversary of the

grant), the exercise would instead be treated as an unapproved exercise. At that date, income tax would be charged on

the difference between the market value of the shares on exercise and the price paid to exercise the option. -

第7题:

(iii) State the value added tax (VAT) and stamp duty (SD) issues arising as a result of inserting Bold plc as

a holding company and identify any planning actions that can be taken to defer or minimise these tax

costs. (4 marks)

You should assume that the corporation tax rates for the financial year 2005 and the income tax rates

and allowances for the tax year 2005/06 apply throughout this question.

正确答案:

(iii) Bold plc will be making a taxable supply of services, likely to exceed the VAT threshold. It should therefore consider

registering for VAT – either immediately on a voluntary basis, or when its cumulative taxable supplies in the previous

twelve months exceed £60,000.

As an alternative, the new group can apply for a group VAT registration. This will simplify its VAT administration as intragroup

transactions are broadly disregarded for VAT purposes, and only one VAT return is required for the group as a

whole.

Stamp duty normally applies at 0·5% on the consideration payable in respect of transactions in shares. However, an

exemption is available in the case of a takeover, reconstruction or amalgamation where there is no real change in

ownership, i.e. the new shareholdings mirror the old shareholdings, and the transaction is for commercial purposes. The

insertion of a new holding company over an existing company, as proposed here, would qualify for this exemption.

There is no VAT on transactions in shares. -

第8题:

(c) Briefly outline the corporation tax (CT) issues that Tay Limited should consider when deciding whether to

acquire the shares or the assets of Tagus LDA. You are not required to discuss issues relating to transfer

pricing. (7 marks)

正确答案:

(c) (1) Acquisition of shares

Status

The acquisition of shares in Tagus LDA will add another associated company to the group. This may have an adverse

effect on the rates of corporation tax paid by the two existing group companies, particularly Tay Limited.

Taxation of profits

Profits will be taxed in Portugal. Any profits remitted to the UK as dividends will be taxable as Schedule D Case V income,

but will attract double tax relief. Double tax relief will be available against two types of tax suffered in Portugal. Credit

will be given for any tax withheld on payments from Tagus LDA to Tay Limited and relief will also be available for the

underlying tax as Tay Limited owns at least 10% of the voting power of Tagus LDA. The underlying tax is the tax

attributable to the relevant profits from which the dividend was paid. Double tax relief is given at the lower rate of the

UK tax and the foreign tax (withholding and underlying taxes) suffered.

Losses

As Tagus LDA is a non-UK resident company, losses arising in Tagus LDA cannot be group relieved against profits of the

two UK companies. Similarly, any UK trading losses cannot be used against profits generated by Tagus LDA.

(2) Acquisition of assets

Status

The business of Tagus will be treated as a branch of Tay Limited i.e. an extension of the UK company’s activities. The

number of associated companies will be unaffected.

Taxation of profits

Tay Limited will be treated as having a permanent establishment in Portugal. Profits attributable to the Tagus business

will thus still be taxed in Portugal. In addition, the profits will be taxed in the UK as trading income. Double tax relief

will be available for the tax already suffered in Portugal at the lower of the two rates.

Capital allowances will be available. As the assets in question will not previously have been subject to a claim for UK

capital allowances, there will be no cost restriction and the consideration attributable to each asset will form. the basis

for the capital allowance claim.

Losses

The Tagus trade is part of Tay Limited’s trade, so any losses incurred by the Portuguese trade will automatically be offset

against the trading profits of the UK trade, and vice versa. -

第9题:

(b) Calculate Alvaro Pelorus’s capital gains tax liability for the tax year 2006/07 on the assumption that all

available reliefs are claimed. (8 marks)

正确答案:

-

第10题:

(ii) Explain how the inclusion of rental income in Coral’s UK income tax computation could affect the

income tax due on her dividend income. (2 marks)

You are not required to prepare calculations for part (b) of this question.

Note: you should assume that the tax rates and allowances for the tax year 2006/07 and for the financial year to

31 March 2007 will continue to apply for the foreseeable future.

正确答案:

(ii) The effect of taxable rental income on the tax due on Coral’s dividend income

Remitting rental income to the UK may cause some of Coral’s dividend income currently falling within the basic rate

band to fall within the higher rate band. The effect of this would be to increase the tax on the gross dividend income

from 0% (10% less the 10% tax credit) to 221/2% (321/2% less 10%).

Tutorial note

It would be equally acceptable to state that the effective rate of tax on the dividend income would increase from 0%

to 25%. -

第11题:

听力原文:The tax return does not show accrued income.

(8)

A.The tax return is not shown in the income.

B.The income is not accurate in taxation.

C.The tax should be returned according to the income.

D.The tax return is not in accordance with the income that should be taxed.

正确答案:D

解析:单句意思为“纳税申报单不能反映应计收入”,D项意思与之接近。 -

第12题:

问答题Inheritance tax is a tax which many countries levy on the total taxable value of the estate of a deceased person. Inheritance tax is paid by the inheritor of the estate or by the person in charge of its assets. In most cases, if the estate is left to a charitable organization or a surviving spouse, no inheritance tax is due. In China, inheritance tax does not exist. Should inheritance tax be introduced to China? The controversy that has raged over levying inheritance tax in China currently shows little sign of abating. The following are opinions from both sides. Read the excerpt carefully and write your response in about 300 words, in which you should: 1. summarize briefly the opinions from both sides, and then 2. give your comment. Marks will be awarded for content relevance, content sufficiency, organization and language quality. Failure to follow the above instructions may result in a loss of marks. Opponents of inheritance tax typically refer to it as “death tax.” They argue first that concern over burdening their children with this tax may lead elderly to make unwise investment decisions late in life, and that it may also discourage entrepreneurship earlier in life. Opponents also claim that morally it should be only the choice of the person who earned the money what should be done with it, not the government. They see taxing wealth at death as a kind of forced income redistribution that goes against the market economy. Proponents of inheritance tax say that it helps prevent consolidation of wealth in the hands of a few powerful families and is a basic building block of the nation’s system of taxation. They also feel that inheriting large sums without tax undermines people’s motives to work hard in the future and, thus, undercuts the principles of the market economy, encouraging people to become idle and unproductive, which hurts the country overall.正确答案:

【参考范文】

Should Inheritance Tax be Introduced to China? An inheritance tax is a tax paid by a person who inherits money or property or a levy on the estate of a person who has died. Many countries have inheritance tax, while China does not. Whether China should levy inheritance tax has become a hot topic of discussion. Supporters hold that it helps prevent the wealth from being always in the hands of a few powerful families. Inheriting large sums without tax weakens people’s enthusiasm for work, encouraging people to become lazy and unproductive, which is not conducive to the whole country. However, opponents argue that this tax may result in unwise investment decisions late in life, and discourage entrepreneurship earlier in life. It is a kind of forced income redistribution, ignoring the right of people earned the money.

From my points of view, inheritance tax should not be introduced to China. Firstly, it is a violation of human rights. In any country that has recognized the private property rights, a person’s private property can be handled without violating others all a person likes. The inheritance tax violates the rights of the people to dispose of their property. Secondly, inheritance tax will encourage abnormal consumption, conspicuous consumption of rich people, further intensifying contradictions and conflicts among social members. It may stimulate the rich to spend their money excessively before death and lead to hostility to the rich. Thirdly, inheritance tax will reduce the enthusiasm of entrepreneurs, exacerbate capital flight, economic migration and impede investment and capital inflows, inhibiting economic development. It may drive wealthy people to move assets out of the country or emigrate in order to avoid the tax, resulting in capital loss and brain drain.

To summarize, inheritance tax might not be an effective enough tool to narrow income disparity. Therefore, other measures are needed if the government wants to ensure a more equitable distribution of wealth in society.解析:

【审题构思】

本题要求考生围绕是否应该征收遗产税这一话题展开讨论。文章可以支持也可以反对,只要言之有理即可。考生首先要总结材料中的观点,然后明确陈述自己的观点。接下来论证自己的观点,注意要分点列举,这样才能做到内容充实,条理清晰。最后总结全文,重申观点;也可进一步补充观点,深化主题。 -

第13题:

(ii) State, giving reasons, the tax reliefs in relation to inheritance tax (IHT) and capital gains tax (CGT) which

would be available to Alasdair if he acquires the warehouse and leases it to Gallus & Co, rather than to

an unconnected tenant. (4 marks)

正确答案:

(ii) Apart from the fact that Alasdair can keep an eye on his tenant, the main advantages are twofold:

IHT: If the firm are the tenants, the property will be land and buildings used in a business carried on by a partnership

in which the donor is a partner. Thus, Alasdair will be able to claim business property relief (BPR) at a rate of 50%

so long as he remains a partner in the firm. However, this relief would not be available until Alasdair has owned

the property for at least two years from his firm taking up the tenancy.

CGT: As Alasdair is a partner in the firm using the building, it will also be a qualifying asset for the purposes of rollover

relief on any gains arising from the disposal of the property. Assuming that Alasdair acquires a replacement asset

which will be used in the trade, the gain on sale can be deferred against the tax base cost of the replacement asset.

In the event that rollover relief cannot be used, any gains on disposal will be subject to business asset taper relief. -

第14题:

(c) (i) Explain the capital gains tax (CGT) implications of a takeover where the consideration is in the form. of

shares (a ‘paper for paper’ transaction) stating any conditions that need to be satisfied. (4 marks)

正确答案:

(c) (i) Paper for paper rules

The proposed transaction broadly falls under the ‘paper for paper’ rules. Where this is the case, chargeable gains do not

arise. Instead, the new holding stands in the shoes (and inherits the base cost) of the original holding.

The company issuing the new shares must:

(i) end up with more than 25% of the ordinary share capital (or a majority of the voting power) of the old company,

OR

(ii) make a general offer to shareholders in the other company with a condition that, if satisfied, would give the

acquiring company control of the other company.

The exchange must be for bona fide commercial reasons and must not have as its main purpose (or one of its main

purposes) the avoidance of CGT or corporation tax. The acquiring company can obtain advance clearance from the

Inland Revenue that the conditions will be met.

If part of the offer consideration is in the form. of cash, a gain must be calculated using the part disposal rules. If the

cash received is not more than the higher of £3,000 or 5% of the total value on takeover, then the amount received in

cash can be deducted from the base cost of the securities under the small distribution rules. -

第15题:

(c) Without changing the advice you have given in (b), or varying the terms of Luke’s will, explain how Mabel

could further reduce her eventual inheritance tax liability and quantify the tax saving that could be made.

(3 marks)

The increase in the retail prices index from April 1984 to April 1998 is 84%.

You should assume that the rates and allowances for the tax year 2005/06 will continue to apply for the

foreseeable future.

正确答案:

(c) Further advice

Mabel should consider delaying one of the gifts until after 1 May 2007 such that it is made more than seven years after the

gift to the discretionary trust. Both PETs would then be covered by the nil rate band resulting in a saving of inheritance tax

of £6,720 (from (b)).

Mabel should ensure that she uses her inheritance tax annual exemption of £3,000 every year by, say, making gifts of £1,500

each year to both Bruce and Padma. The effect of this will be to save inheritance tax of £1,200 (£3,000 x 40%) every year. -

第16题:

(c) Outline the ways in which Arthur and Cindy can reduce their income tax liability by investing in unquoted

shares and recommend, with reasons, which form. of investment best suits their circumstances. You are not

required to discuss the qualifying conditions applicable to the investment vehicle recommended. (5 marks)

You should assume that the income tax rates and allowances for the tax year 2005/06 apply throughout this

question

正确答案:

(c) Reduction of income tax liability by investing in unquoted shares

The two forms of investment

Income tax relief is available for investments in venture capital trusts (VCTs) and enterprise investment scheme (EIS) shares.

A VCT is a quoted company that invests in shares in a number of unquoted trading companies. EIS shares are shares in

qualifying unquoted trading companies.

Recommendation

The most suitable investment for Arthur and Cindy is a VCT for the following reasons.

– An investment in a VCT is likely to be less risky than investing directly in EIS companies as the risk will be spread over

a greater number of companies.

– The tax deduction is 40% of the amount invested as opposed to 20% for EIS shares.

– Dividends from a VCT are not taxable whereas dividends on EIS shares are taxed in the normal way. -

第17题:

(ii) Assuming the relief in (i) is available, advise Sharon on the maximum amount of cash she could receive

on incorporation, without triggering a capital gains tax (CGT) liability. (3 marks)

正确答案:

(ii) As Sharon is entitled to the full rate of business asset taper relief, any gain will be reduced by 75%. The position is

maximised where the chargeable gain equals Sharon’s unused capital gains tax annual exemption of £8,500. Thus,

before taper relief, the gain she requires is £34,000 (1/0·25 x £8,500).

The amount to be held over is therefore £46,000 (80,000 – 34,000). Where part of the consideration is in the form

of cash, the gain eligible for incorporation relief is calculated using the formula:

Gain deferred = Gain x value of shares issued/total consideration

The formula is manipulated on the following basis:

£46,000 = £80,000 x (shares/120,000)

Shares/120,000 = £46,000/80,000

Shares = £46,000 x 120,000/80,000

i.e. £69,000.

As the total consideration is £120,000, this means that Sharon can take £51,000 (£120,000 – £69,000) in cash

without any CGT consequences. -

第18题:

(c) For commercial reasons, Damian believes that it would be sensible to place a new holding company, Bold plc,

over the existing company, Linden Limited. Bold plc would also be unquoted and would acquire the existing

Linden Limited shares in exchange for the issue of its own shares.

If the new structure is implemented, Bold plc will provide management services to Linden Limited, but the

amount that will be charged for these services is yet to be determined.

Required:

(i) State the capital gains tax (CGT) issues that Damian should be aware of before disposing of his shares

in Linden Limited to Bold plc. Your answer should include details of any conditions that will need to be

satisfied if an immediate charge to tax is to be avoided. (4 marks)

正确答案:

(c) (i) The proposed transaction broadly falls under the ‘paper for paper’ rules. Where this is the case, chargeable gains do not

arise. Instead, the new holding stands in the shoes (and inherits the base cost) of the original holding.

The company issuing the new shares must:

(i) end up with more than 25% of the ordinary share capital or a majority of the voting power of the old company,

OR

(ii) make a general offer to shareholders in the old company with a condition which would give the acquiring company

control of the company if accepted.

The exchange must be for bona fide commercial reasons and not have as its main purpose (or one of its main purposes)

the avoidance of capital gains tax or corporation tax.

The issue of shares by Bold plc satisfies these conditions, thus Damian, as a shareholder of Linden Limited, will not be

taxed on the exchange of shares. -

第19题:

(b) For this part, assume today’s date is 1 May 2010.

Bill and Ben decided not to sell their company, and instead expanded the business themselves. Ben, however,

is now pursuing other interests, and is no longer involved with the day to day activities of Flower Limited. Bill

believes that the company would be better off without Ben as a voting shareholder, and wishes to buy Ben’s

shares. However, Bill does not have sufficient funds to buy the shares himself, and so is wondering if the

company could acquire the shares instead.

The proposed price for Ben’s shares would be £500,000. Both Bill and Ben pay income tax at the higher rate.

Required:

Write a letter to Ben:

(1) stating the income tax (IT) and/or capital gains tax (CGT) implications for Ben if Flower Limited were to

repurchase his 50% holding of ordinary shares, immediately in May 2010; and

(2) advising him of any available planning options that might improve this tax position. Clearly explain any

conditions which must be satisfied and quantify the tax savings which may result.

(13 marks)

Assume that the corporation tax rates for the financial year 2005 and the income tax rates and allowances

for the tax year 2005/06 apply throughout this question.

正确答案:(b) [Ben’s address] [Firm’s address]

Dear Ben [Date]

A company purchase of own shares can be subject to capital gains treatment if certain conditions are satisfied. However, one

of these conditions is that the shares in question must have been held for a minimum period of five years. As at 1 May 2010,

your shares in Flower Limited have only been held for four years and ten months. As a result, the capital gains treatment will

not apply.

In the absence of capital gains treatment, the position on a company repurchase of its own shares is that the payment will

be treated as an income distribution (i.e. a dividend) in the hands of the recipient. The distribution element is calculated as

the proceeds received for the shares less the price paid for them. On the basis that the purchase price is £500,000, then the

element of distribution will be £499,500 (500,000 – 500). This would be taxed as follows:

-

第20题:

(b) (i) Advise Andrew of the income tax (IT) and capital gains tax (CGT) reliefs available on his investment in

the ordinary share capital of Scalar Limited, together with any conditions which need to be satisfied.

Your answer should clearly identify any steps that should be taken by Andrew and the other investors

to obtain the maximum relief. (13 marks)

正确答案:

(b) (i) Andrew may be able to take advantage of tax reliefs under the enterprise investment scheme (EIS) provided the

necessary conditions are met. The conditions that have to be satisfied before full relief is available fall into three areas,

and broadly require that a ‘qualifying individual’ subscribes for ‘eligible shares’ in a ‘qualifying company’.

‘Qualifying Individual’

To be a qualifying individual, Andrew must not be connected with the EIS company. This means that he should not be

an employee (or, at the time the shares are issued, a director) or have an interest in (i.e. control) 30% or more of the

capital of the company. These conditions need to be satisfied throughout the period beginning two years before the share

issue and three years after the ‘relevant date’. Where the relevant date is defined as the later of the date the shares were

issued and the date on which the company commenced trading.

Andrew does not intend to become an employee (or director) of Scalar Limited, but he needs to exercise caution as to

how many shares he subscribes for. If only three investors subscribe for 100% of the shares, each will hold 33% of the

share capital. This exceeds the 30% limit and will mean that EIS relief (other than deferral relief) will not be available.

Therefore, Andrew and the other two investors should ensure not only that the potential fourth investor is recruited, but

that s/he subscribes for sufficient shares, such that none of them will hold 30% or more of the issued share capital, as

only then will they all attain qualifying individual status.

‘Eligible shares’

Qualifying shares need to be new ordinary shares which are subscribed for in cash and fully paid up at the time of issue.

The shares must not be redeemable for at least three years from the relevant date, and not carry any preferential rights

to dividends. On the basis of the information provided, the shares of Scalar Limited would qualify as eligible shares.

‘Qualifying Company’

The company must be unquoted, not controlled by another company, and engaged in qualifying business activities. The

latter requires that the company engage in a trading activity, which is carried on wholly or mainly in the UK, throughout

the three years following the relevant date. While certain trading activities, such as dealing in shares or trading in land,

are excluded, the manufacturing trade Scalar Limited proposes to carry on will qualify.

However, it is also necessary for at least 80% of the money raised to be used for the qualifying business activity within

12 months of the relevant date and the remaining 20% to be so used within the following 12 months. Andrew and the

other investors will thus have to ensure that Scalar Limited has not raised more funds than it is able to employ in the

business within the appropriate time periods.

Reliefs available:

Andrew can claim income tax relief at 20% income tax relief on the amount invested up to a maximum of £200,000

in any one tax year. The relief is given in the form. of a tax reducing allowance, which can reduce the investor’s income

tax liability to nil, but cannot be used to generate a tax refund. If the investment is made prior to 6 October in the tax

year, then 50% of the amount invested (up to a maximum of £25,000) can be treated as having been made in the

previous tax year.

Any capital gains arising on the sale of EIS shares will be fully exempt from capital gains tax provided that income tax

relief was given on the investment when made and has not been withdrawn. If the EIS shares are disposed of at a loss,

capital losses are still allowable, but reduced by the amount of any EIS relief attributable to the shares disposed of.

In addition, gains from the disposal of other assets can be deferred against the base cost of EIS shares acquired within

one year before and three years after their disposal. Such gains will, thus, not normally become chargeable until the EIS

shares themselves are disposed of. Further, for deferral relief to be available, it is not necessary for the investment to

qualify for EIS income tax relief, i.e. deferral is available even where the investor is not a qualifying individual. Thus,

Andrew could still defer the gain arising on the disposal of the residential property lease made in order to raise part of

the funds for his EIS investment, even if no fourth investor were to be found and his shareholding were to exceed 30%

of the issued share capital of Scalar Limited. Does not require the existence of income tax relief in order to be claimed.

Withdrawal of relief:

Any EIS relief claimed by Andrew will be withdrawn (partially or fully) if, within three year of the relevant date:

(1) he disposes of the shares;

(2) he receives value from the company;

(3) he ceases to be a qualifying individual; or

(4) Scalar Limited ceases to be a qualifying company.

With regard to receiving value from the company, the definition excludes dividends which do not exceed a normal rate

of return, but does include the repayment of any loans made to the company before the shares were issued, the provision

of benefits and the purchase of assets from the company at an undervalue. In this regard, Andrew and the other

subscribers should ensure that the £50,000 they are to invest in Scalar Limited as loan capital is appropriately timed

and structured relative to the issue of the EIS shares. -

第21题:

(d) Evaluate the effect on Gerard of the changes to be made by Fizz plc to its performance related bonus scheme.

You should ignore the effect of any pension contributions to be made by Gerard in the future, consider both

the value and timing of amounts received by Gerard and include relevant supporting calculations.

(5 marks)

Note: – You should assume that the income tax rates and allowances for the tax year 2006/07 apply throughout

this question.

正确答案:

(d) Implications for Gerard of the changes to Fizz plc’s bonus scheme

Value received

Under the existing scheme Gerard receives approximately £4,500 each year. This is subject to income tax at 40% and

national insurance contributions at 1% such that Gerard receives £2,655 (£4,500 x 59%) after all taxes.

Under the proposed share incentive plan (SIP), Gerard expects to receive free shares worth £3,500 (£2,100 + £1,400).

Provided the shares remain in the plan for at least five years there will be no income tax or national insurance contributions

in respect of the value received. Gerard’s base cost in the shares for the purposes of capital gains tax will be their value at

the time they are withdrawn from the scheme.

In addition, the amount he spends on partnership shares will be allowable for both income tax and national insurance such

that he will obtain shares with a value of £700 for a cost of only £413 (£700 x 59%).

Accordingly, Gerard will receive greater value under the SIP than he does under the existing bonus scheme. However, as noted

below, he will not be able to sell the free or matching shares until they have been in the scheme for at least three years by

which time they may have fallen in value.

Timing of receipt of benefit

Under the existing scheme Gerard receives a cash bonus each year.

The value of free and matching shares awarded under a SIP cannot be realised until the shares are withdrawn from the

scheme and sold. This withdrawal cannot take place until at least three years after the shares are awarded to Gerard.

Accordingly, Gerard will not have access to the value of the bonuses he receives under the SIP until the scheme has been in

operation for at least three years. In addition, if the shares are withdrawn within five years of being awarded, income tax and

national insurance contributions will become payable on the lower of their value at the time of the award and their value at

the time of withdrawal thus reducing the value of Gerard’s bonus. -

第22题:

(c) In November 2006 Seymour announced the recall and discontinuation of a range of petcare products. The

product recall was prompted by the high level of customer returns due to claims of poor quality. For the year to

30 September 2006, the product range represented $8·9 million of consolidated revenue (2005 – $9·6 million)

and $1·3 million loss before tax (2005 – $0·4 million profit before tax). The results of the ‘petcare’ operations

are disclosed separately on the face of the income statement. (6 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Seymour Co for the year ended

30 September 2006.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

■ The discontinuation of the product line after the balance sheet date provides additional evidence that, as at the

balance sheet date, it was of poor quality. Therefore, as at the balance sheet date:

– an allowance (‘provision’) may be required for credit notes for returns of products after the year end that were

sold before the year end;

– goods returned to inventory should be written down to net realisable value (may be nil);

– any plant and equipment used exclusively in the production of the petcare range of products should be tested

for impairment;

– any material contingent liabilities arising from legal claims should be disclosed.

(ii) Audit evidence

■ A copy of Seymour’s announcement (external ‘press release’ and any internal memorandum).

■ Credit notes raised/refunds paid after the year end for faulty products returned.

■ Condition of products returned as inspected during physical attendance of inventory count.

■ Correspondence from customers claiming reimbursement/compensation for poor quality.

■ Direct confirmation from legal adviser (solicitor) regarding any claims for customers including estimates of possible

payouts. -

第23题:

James died on 22 January 2015. He had made the following gifts during his lifetime:

(1) On 9 October 2007, a cash gift of £35,000 to a trust. No lifetime inheritance tax was payable in respect of this gift.

(2) On 14 May 2013, a cash gift of £420,000 to his daughter.

(3) On 2 August 2013, a gift of a property valued at £260,000 to a trust. No lifetime inheritance tax was payable in respect of this gift because it was covered by the nil rate band. By the time of James’ death on 22 January 2015, the property had increased in value to £310,000.

On 22 January 2015, James’ estate was valued at £870,000. Under the terms of his will, James left his entire estate to his children.

The nil rate band of James’ wife was fully utilised when she died ten years ago.

The nil rate band for the tax year 2007–08 is £300,000, and for the tax year 2013–14 it is £325,000.

Required:

(a) Calculate the inheritance tax which will be payable as a result of James’ death, and state who will be responsible for paying the tax. (6 marks)

(b) Explain why it might have been beneficial for inheritance tax purposes if James had left a portion of his estate to his grandchildren rather than to his children. (2 marks)

(c) Explain why it might be advantageous for inheritance tax purposes for a person to make lifetime gifts even when such gifts are made within seven years of death.

Notes:

1. Your answer should include a calculation of James’ inheritance tax saving from making the gift of property to the trust on 2 August 2013 rather than retaining the property until his death.

2. You are not expected to consider lifetime exemptions in this part of the question. (2 marks)

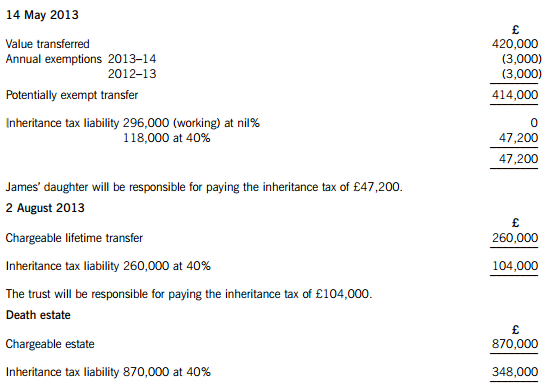

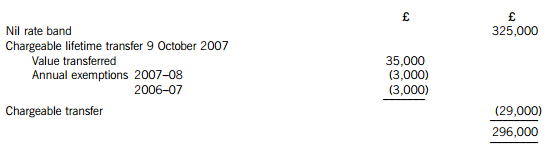

正确答案:(a) James – Inheritance tax arising on death

Lifetime transfers within seven years of death

The personal representatives of James’ estate will be responsible for paying the inheritance tax of £348,000.

Working – Available nil rate band

(b) Skipping a generation avoids a further charge to inheritance tax when the children die. Gifts will then only be taxed once before being inherited by the grandchildren, rather than twice.

(c) (1) Even if the donor does not survive for seven years, taper relief will reduce the amount of IHT payable after three years.

(2) The value of potentially exempt transfers and chargeable lifetime transfers are fixed at the time they are made.

(3) James therefore saved inheritance tax of £20,000 ((310,000 – 260,000) at 40%) by making the lifetime gift of property.