(d) Estimate by how much the bid might be increased without the shareholders of Paxis suffering a fall in their expected wealth, and discuss whether or not the directors of Paxis should proceed with the bid. (5 marks)

题目

(d) Estimate by how much the bid might be increased without the shareholders of Paxis suffering a fall in their expected wealth, and discuss whether or not the directors of Paxis should proceed with the bid. (5 marks)

相似考题

更多“(d) Estimate by how much the bid might be increased without the shareholders of Paxis suffering a fall in their expected wealth, and discuss whether or not the directors of Paxis should proceed with the bid. (5 marks)”相关问题

-

第1题:

(iii) How items not dealt with by an IFRS for SMEs should be treated. (5 marks)

正确答案:

(iii) The treatment of items not dealt with by an IFRS for SMEs

IFRSs for SMEs would not necessarily deal with all the recognition and measurement issues facing an entity but the key

issues should revolve around the nature of the recognition, measurement and disclosure of the transactions of SMEs. In

the case where the item is not dealt with by the standards there are three alternatives:

(a) the entity can look to the full IFRS to resolve the issue

(b) management’s judgement can be used with reference to the Framework and consistency with other IFRSs for SMEs

(c) existing practice could be used.

The first approach is more likely to result in greater consistency and comparability. However, this approach may also

increase the burden on SMEs as it can be argued that they are subject to two sets of standards.

An SME may wish to make a disclosure required by a full IFRS which is not required by the SME standard, or a

measurement principle is simplified or exempted in the SME standard, or the IFRS may give a choice between two

measurement options and the SME standard does not allow choice. Thus the issue arises as to whether SMEs should

be able to choose to comply with a full IFRS for some items and SME standards for other items, allowing an SME to

revert to IFRS on a principle by principle basis. The problem which will arise will be a lack of consistency and

comparability of SME financial statements.

-

第2题:

(c) Discuss the ethical responsibility of the company accountant in ensuring that manipulation of the statement

of cash flows, such as that suggested by the directors, does not occur. (5 marks)

Note: requirements (b) and (c) include 2 professional marks in total for the quality of the discussion.

正确答案:

(c) Companies can give the impression that they are generating more cash than they are, by manipulating cash flow. The way

in which acquisitions, loans and, as in this case, the sale of assets, is shown in the statement of cash flows, can change the

nature of operating cash flow and hence the impression given by the financial statements. The classification of cash flows

can give useful information to users and operating cash flow is a key figure. The role of ethics in the training and professional

lives of accountants is extremely important. Decision-makers expect the financial statements to be true and fair and fairly

represent the underlying transactions.

There is a fine line between deliberate misrepresentation and acceptable presentation of information. Pressures on

management can result in the misrepresentation of information. Financial statements must comply with International

Financial Reporting Standards (IFRS), the Framework and local legislation. Transparency, and full and accurate disclosure is

important if the financial statements are not to be misleading. Accountants must possess a high degree of professional

integrity and the profession’s reputation depends upon it. Ethics describe a set of moral principles taken as a reference point.

These principles are outside the technical and practical application of accounting and require judgement in their application.

Professional accountancy bodies set out ethical guidelines within which their members operate covering standards of

behaviour, and acceptable practice. These regulations are supported by a number of codes, for example, on corporate

governance which assist accountants in making ethical decisions. The accountant in Warrburt has a responsibility not to mask

the true nature of the statement of cash flow. Showing the sale of assets as an operating cash flow would be misleading if

the nature of the transaction was masked. Users of financial statements would not expect its inclusion in this heading and

could be misled. The potential misrepresentation is unacceptable. The accountant should try and persuade the directors to

follow acceptable accounting principles and comply with accounting standards. There are implications for the truth and

fairness of the financial statements and the accountant should consider his position if the directors insist on the adjustments

by pointing the inaccuracies out to the auditors. -

第3题:

(b) Assess the benefits of the separation of the roles of chief executive and chairman that Alliya Yongvanich

argued for and explain her belief that ‘accountability to shareholders’ is increased by the separation of these

roles. (12 marks)

正确答案:

(b) Separation of the roles of CEO and chairman

Benefits of separation of roles

The separation of the roles of chief executive and chairman was first provided for in the UK by the 1992 Cadbury provisions

although it has been included in all codes since. Most relevant to the case is the terms of the ICGN clause s.11 and OECD

VI (E) both of which provide for the separation of these roles. In the UK it is covered in the combined code section A2.

The separation of roles offers the benefit that it frees up the chief executive to fully concentrate on the management of the

organisation without the necessity to report to shareholders or otherwise become distracted from his or her executive

responsibilities. The arrangement provides a position (that of chairman) that is expected to represent shareholders’ interests

and that is the point of contact into the company for shareholders. Some codes also require the chairman to represent the

interests of other stakeholders such as employees.

Having two people rather than one at the head of a large organisation removes the risks of ‘unfettered powers’ being

concentrated in a single individual and this is an important safeguard for investors concerned with excessive secrecy or

lack of transparency and accountability. The case of Robert Maxwell is a good illustration of a single dominating

executive chairman operating unchallenged and, in so doing, acting illegally. Having the two roles separated reduces

the risk of a conflict of interest in a single person being responsible for company performance whilst also reporting on

that performance to markets. Finally, the chairman provides a conduit for the concerns of non-executive directors who,

in turn, provide an important external representation of external concerns on boards of directors.

Tutorial note: Reference to codes other than the UK is also acceptable. In all cases, detailed (clause number) knowledge

of code provisions is not required.

Accountability and separation of roles

In terms of the separation of roles assisting in the accountability to shareholders, four points can be made.

The chairman scrutinises the chief executive’s management performance on behalf of the shareholders and will be

involved in approving the design of the chief executive’s reward package. It is the responsibility of the chairman to hold

the chief executive to account on shareholders’ behalfs.

Shareholders have an identified person (chairman) to hold accountable for the performance of their investment. Whilst

day-to-day contact will normally be with the investor relations department (or its equivalent) they can ultimately hold

the chairman to account.

The presence of a separate chairman ensures that a system is in place to ensure NEDs have a person to report to outside the

executive structure. This encourages the freedom of expression of NEDs to the chairman and this, in turn, enables issues to

be raised and acted upon when necessary.

The chairman is legally accountable and, in most cases, an experienced person. He/she can be independent and more

dispassionate because he or she is not intimately involved with day-to-day management issues. -

第4题:

(d) Discuss the main benefits that might accrue from the successful implementation of a Total Quality

Management programme by the management of the combined entity. (5 marks)

正确答案:

(d) The benefits that might accrue from the successful implementation of a Total quality management programme by the

management of the combined entity include the following:

– There will be an increased awareness of all personnel within Quicklink Ltd of the need to establish a ‘quality culture’

within the company which will provide a basis of improved performance throughout the organisation.

– The successful adoption of a TQM philosophy would ensure that there is a real commitment to ‘continuous improvement’

in all processes.

– It would place a greater focus on customer satisfaction since at the heart of any TQM programme is a deep-seated

commitment to the satisfaction of every customer.

– There would be a greater emphasis upon teamwork which would be used in a number of forms e.g. quality circles which

could be established with a view to improving performance within every area of the business. The fostering of team spirit

will also improve communication within Quicklink Ltd.

– A major characteristic of a TQM programme is process-redesign which is used to simplify processes, systems,

procedures and the organisation itself. In this respect the adoption of a TQM philosophy will be invaluable since the

integration of the Quicklink Ltd and Celer Transport businesses will require, of necessity, a detailed review of those

processes currently employed.

– The adoption of a TQM philosophy will necessitate the monitoring of quality costs in order to measure whether the

objective of continuous improvement is being achieved. In this respect the aim will be to eliminate internal failure costs

such as late deliveries and lost items which are clearly detrimental to a business which operates in the transport and

haulage industry. -

第5题:

(ii) Briefly discuss FOUR non-financial factors which might influence the above decision. (4 marks)

正确答案:

(ii) Four factors that could be considered are as follows:

(i) The quality of the service provided by NSC as evidenced by, for example, the comfort of the ferries, on-board

facilities, friendliness and responsiveness of staff.

(ii) The health and safety track record of NSC – passenger safety is a ‘must’ in such operations.

(iii) The reliability, timeliness and dependability of NSC as a service provider.

(iv) The potential loss of image due to redundancies within Wonderland plc. -

第6题:

(b) Explain how growth may be assessed, and critically discuss the advantages and issues that might arise as a

result of a decision by the directors of CSG to pursue the objective of growth. (8 marks)

正确答案:

(b) Growth may be measured in a number of ways which are as follows:

Cash flow

This is a very important measure of growth as it ultimately determines the amount of funds available for re-investment by any

business.

Sales revenue

Growth in sales revenues generated is only of real value to investors if it precipitates growth in profits.

Profitability

There are many measures relating to profit which include sales margin, earnings before interest, taxation, depreciation and

amortisation (EBITDA) and earnings per share. More sophisticated measures such as return on capital employed and residual

income consider the size of the investment relative to the level of profits earned. In general terms, measures of profitability

are only meaningful if they are used as a basis for comparisons over time or in conjunction with other measures of

performance. Growth rate in profitability are useful when compared with other companies and also with other industries.

Return on investment

A growing return upon invested capital suggests that capital is being used more and more productively. Indicators of a growing

return would be measured by reference to dividend payment and capital growth.

Market share

Growth in market share is generally seen as positive as it can generate economies of scale.

Number of products/service offerings

Growth is only regarded as useful if products and services are profitable.

Number of employees

Measures of productivity such as value added per employee and profit per employee are often used by shareholders in

assessing growth. Very often an increased headcount is a measure of success in circumstances where more people are

needed in order to deliver a service to a required standard. However it is incumbent on management to ensure that all

employees are utilised in an effective manner.

It is a widely held belief that growth requires profits and that growth produces profits. Profits are essential in order to prevent

a company which has achieved growth from becoming a target for a take-over or in a worse case scenario goes into

liquidation. Hence it is fundamental that a business is profitable throughout its existence. Growth accompanied by growth in

profits is also likely to aid the long-term survival of an organisation. CSG operates in Swingland which experiences fluctuations

in its economic climate and in this respect the exploitation of profitable growth opportunities will help CSG to survive at the

expense of its competitors who do not exploit such opportunities.

Note: Alternative relevant discussion and examples would be accepted. -

第7题:

JOL Co was the market leader with a share of 30% three years ago. The managing director of JOL Co stated at a

recent meeting of the board of directors that: ‘our loss of market share during the last three years might lead to the

end of JOL Co as an organisation and therefore we must address this issue immediately’.

Required:

(b) Discuss the statement of the managing director of JOL Co and discuss six performance indicators, other than

decreasing market share, which might indicate that JOL Co might fail as a corporate entity. (10 marks)

正确答案:

(b) It would appear that JOL’s market share has declined from 30% to (80 – 26)/3 = 18% during the last three years. A 12%

fall in market share is probably very significant with a knock-on effect on profits and resultant cash flows. Obviously such a

declining trend needs to be arrested immediately and this will require a detailed investigation to be undertaken by the directors

of JOL. Consequently loss of market share can be seen to be an indicator of potential corporate failure. Other indicators of

corporate failure are as follows:

Six performance indicators that an organisation might fail are as follows:

Poor cash flow

Poor cash flow might render an organisation unable to pay its debts as and when they fall due for payment. This might mean,

for example, that providers of finance might be able to invoke the terms of a loan covenant and commence legal action against

an organisation which might eventually lead to its winding-up.

Lack of new production/service introduction

Innovation can often be seen to be the difference between ‘life and death’ as new products and services provide continuity

of income streams in an ever-changing business environment. A lack of new product/service introduction may arise from a

shortage of funds available for re-investment. This can lead to organisations attempting to compete with their competitors with

an out of date range of products and services, the consequences of which will invariably turn out to be disastrous.

General economic conditions

Falling demand and increasing interest rates can precipitate the demise of organisations. Highly geared organisations will

suffer as demand falls and the weight of the interest burden increases. Organisations can find themselves in a vicious circle

as increasing amounts of interest payable are paid from diminishing gross margins leading to falling profits/increasing losses

and negative cash flows. This leads to the need for further loan finance and even higher interest burden, further diminution

in margins and so on.

Lack of financial controls

The absence of sound financial controls has proven costly to many organisations. In extreme circumstances it can lead to

outright fraud (e.g. Enron and WorldCom).

Internal rivalry

The extent of internal rivalry that exists within an organisation can prove to be of critical significance to an organisation as

managerial effort is effectively channeled into increasing the amount of internal conflict that exists to the detriment of the

organisation as a whole. Unfortunately the adverse consequences of internal rivalry remain latent until it is too late to redress

them.

Loss of key personnel

In certain types of organisation the loss of key personnel can ‘spell the beginning of the end’ for an organisation. This is

particularly the case when individuals possess knowledge which can be exploited by direct competitors, e.g. sales contacts,

product specifications, product recipes, etc.

-

第8题:

(b) The Superior Fitness Co (SFC), which is well established in Mayland, operates nine centres. Each of SFC’s

centres is similar in size to those of HFG. SFC also provides dietary plans and fitness programmes to its clients.

The directors of HFG have decided that they wish to benchmark the performance of HFG with that of SFC.

Required:

Discuss the problems that the directors of HFG might experience in their wish to benchmark the performance

of HFG with the performance of SFC, and recommend how such problems might be successfully addressed.

(7 marks)

正确答案:

(b) There are a number of potential problems which the directors of HFG need to recognise. These are as follows:

(i) There needs to exist a sufficient incentive for SFO to share their information with HFG as the success of any

benchmarking programme is dependent upon obtaining accurate information about the comparator organisation. This is

not an easy task to accomplish, as many organisations are reluctant to reveal confidential information to competitors.

The directors of HFG must be able to convince the directors of SFO that entering into a benchmarking arrangement is a

potential ‘win-win situation’.

(ii) The value of the exercise must be sufficient to justify the cost involved. Also, it is inevitable that behavioural issues will

need to be addressed in any benchmarking programme. Management should give priority to the need to communicate

the reasons for undertaking a programme of benchmarking in order to gain the full co-operation of its personnel whilst

reducing the potential level of resistance to change.

(iii) Management need to handle the ethical implications relating to the introduction of benchmarking in a sensitive manner

and should endeavour, insofar as possible, to provide reassurance to employees that their status, remuneration and

working conditions will not suffer as a consequence of the introduction of any benchmarking initiatives. -

第9题:

(b) The directors of Carver Ltd are aware that some of the company’s shareholders want to realise the value in their

shares immediately. Accordingly, instead of investing in the office building or the share portfolio they are

considering two alternative strategies whereby, following the sale of the company’s business, a payment will be

made to the company’s shareholders.

(i) Liquidate the company. The payment by the liquidator would be £126 per share.

(ii) The payment of a dividend of £125 per share following which a liquidator will be appointed. The payment

by the liquidator to the shareholders would then be £1 per share.

The company originally issued 20,000 £1 ordinary shares at par value to 19 members of the Cutler family.

Following a number of gifts and inheritances there are now 41 shareholders, all of whom are family members.

The directors have asked you to attend a meeting to set out the tax implications of these two alternative strategies

for each of the two main groups of shareholders: adults with shareholdings of more than 500 shares and children

with shareholdings of 200 shares or less.

Required:

Prepare notes explaining:

– the amount chargeable to tax; and

– the rates of tax that will apply

in respect of each of the two strategies for each of the two groups of shareholders ready for your meeting

with the directors of Carver Ltd. You should assume that none of the shareholders will have any capital

losses either in the tax year 2007/08 or brought forward as at 5 April 2007. (10 marks)

Note:

You should assume that the rates and allowances for the tax year 2006/07 will continue to apply for the

foreseeable future.

正确答案:

-

第10题:

(c) Identify and discuss the implications for the audit report if:

(i) the directors refuse to disclose the note; (4 marks)

正确答案:

(c) (i) Audit report implications

Audit procedures have shown that there is a significant level of doubt over Dexter Co’s going concern status. IAS 1

requires that disclosure is made in the financial statements regarding material uncertainties which may cast significant

doubt on the ability of the entity to continue as a going concern. If the directors refuse to disclose the note to the financial

statements, there is a clear breach of financial reporting standards.

In this case the significant uncertainty is caused by not knowing the extent of the future availability of finance needed

to fund operating activities. If the note describing this uncertainty is not provided, the financial statements are not fairly

presented.

The audit report should contain a qualified or an adverse opinion due to the disagreement. The auditors need to make

a decision as to the significance of the non-disclosure. If it is decided that without the note the financial statements are

not fairly presented, and could be considered misleading, an adverse opinion should be expressed. Alternatively, it could

be decided that the lack of the note is material, but not pervasive to the financial statements; then a qualified ‘except

for’ opinion should be expressed.

ISA 570 Going Concern and ISA 701 Modifications to the Independent Auditor’s Report provide guidance on the

presentation of the audit report in the case of a modification. The audit report should include a paragraph which contains

specific reference to the fact that there is a material uncertainty that may cast significant doubt about the entity’s ability

to continue as a going concern. The paragraph should include a clear description of the uncertainties and would

normally be presented immediately before the opinion paragraph. -

第11题:

A solution provider has identified a number of risks with a configuration in a customer’s request for bid. What is the most appropriate action to take to mitigate those risks for the customer?()

- A、Decide not to bid.

- B、Provide a solution in the bid.

- C、Provide a disclaimer in the bid.

- D、Discuss options with the customer.

正确答案:D -

第12题:

单选题Your vessel is off a lee shore in heavy weather and laboring. Which action should you take?().APut the sea and wind about two points on either how and reduce speed

BHeave to in the trough of the sea

CPut the sea and wind on either quarter and proceed at increased speed

DPut the bow directly into the sea and proceed at full speed

正确答案: B解析: 暂无解析 -

第13题:

(c) Discuss how the manipulation of financial statements by company accountants is inconsistent with their

responsibilities as members of the accounting profession setting out the distinguishing features of a

profession and the privileges that society gives to a profession. (Your answer should include reference to the

above scenario.) (7 marks)

Note: requirement (c) includes 2 marks for the quality of the discussion.

正确答案:

(c) Accounting and ethical implications of sale of inventory

Manipulation of financial statements often does not involve breaking laws but the purpose of financial statements is to present

a fair representation of the company’s position, and if the financial statements are misrepresented on purpose then this could

be deemed unethical. The financial statements in this case are being manipulated to show a certain outcome so that Hall

may be shown to be in a better financial position if the company is sold. The retained earnings of Hall will be increased by

$4 million, and the cash received would improve liquidity. Additionally this type of transaction was going to be carried out

again in the interim accounts if Hall was not sold. Accountants have the responsibility to issue financial statements that do

not mislead the public as the public assumes that such professionals are acting in an ethical capacity, thus giving the financial

statements credibility.

A profession is distinguished by having a:

(i) specialised body of knowledge

(ii) commitment to the social good

(iii) ability to regulate itself

(iv) high social status

Accountants should seek to promote or preserve the public interest. If the idea of a profession is to have any significance,

then it must make a bargain with society in which they promise conscientiously to serve the public interest. In return, society

allocates certain privileges. These might include one or more of the following:

– the right to engage in self-regulation

– the exclusive right to perform. particular functions

– special status

There is more to being an accountant than is captured by the definition of the professional. It can be argued that accountants

should have the presentation of truth, in a fair and accurate manner, as a goal. -

第14题:

(c) Critically discuss FOUR principal roles of non-executive directors and explain the potential tensions between

these roles that WM’s non-executive directors may experience in advising on the disclosure of the

overestimation of the mallerite reserve. (12 marks)

正确答案:

(c) Non-executive directors

Roles of NEDs

Non-executive directors have four principal roles.

The strategy role recognises that NEDs are full members of the board and thus have the right and responsibility to contribute

to the strategic success of the organisation for the benefit of shareholders. The enterprise must have a clear strategic direction

and NEDs should be able to bring considerable experience from their lives and business experience to bear on ensuring that

chosen strategies are sound. In this role they may challenge any aspect of strategy they see fit and offer advice or input to

help to develop successful strategy.

In the scrutinising or performance role, NEDs are required to hold executive colleagues to account for decisions taken and

company performance. In this respect they are required to represent the shareholders’ interests against the possibility that

agency issues arise to reduce shareholder value.

The risk role involves NEDs ensuring the company has an adequate system of internal controls and systems of risk

management in place. This is often informed by prescribed codes (such as Turnbull in the UK) but some industries, such as

chemicals, have other systems in place, some of which fall under ISO standards. In this role, NEDs should satisfy themselves

on the integrity of financial information and that financial controls and systems of risk management are robust and defensible.

Finally, the ‘people’ role involves NEDs overseeing a range of responsibilities with regard to the management of the executive

members of the board. This typically involves issues on appointments and remuneration, but might also involve contractual

or disciplinary issues and succession planning.

Tutorial note: these four roles are as described in the UK Higgs Report and are also contained in the Combined Code 2003.

Tensions in NED roles in the case

This refers to a potential tension in the loyalties of the NEDs. Although the NED is accountable, through the chairman to the

shareholders and thus must always act in the economic best interests of the shareholders, he or she is also a part of the board

of the company and they may, in some situations, advise discretion. Withholding information might be judged correct because

of strategic considerations or longer-term shareholder interests. In most situations, NEDs will argue for greater transparency,

less concealment and more clarity of how and why a given action will be in the interests of shareholders.

The case of mallerite overestimation places the WM NEDs in a position of some tension. Any instinct to conceal the full extent

of the overestimate of the reserve for the possible protection of the company’s short-term value must be balanced against the

duty to serve longer-term strategic interests and the public interest. Whilst concealment would protect the company’s

reputation and share price in the short term, it would be a duty of the NEDs to point out that WM should observe transparency

as far as possible in its dealing with the shareholders and other capital market participants. -

第15题:

(b) Identify and explain THREE approaches that the directors of Moffat Ltd might apply in assessing the

QUALITATIVE benefits of the proposed investment in a new IT system. (6 marks)

正确答案:

(b) One approach that the directors of Moffat Ltd could adopt would be to ignore the qualitative benefits that may arise on the

basis that there is too much subjectivity involved in their assessment. The problem that this causes is that the investment will

probably look unattractive since all costs will be included in the evaluation whereas significant benefits and savings will have

been ignored. Hence such an approach is lacking in substance and is not recommended.

An alternative approach would involve attempting to attribute values to each of the identified benefits that are qualitative in

nature. Such an approach will necessitate the use of management estimates in order to derive the cash flows to be

incorporated in a cost benefit analysis. The problems inherent in this approach include gaining consensus among interested

parties regarding the footing of the assumptions from which estimated cash flows have been derived. Furthermore, if the

proposed investment does take place then it may well be impossible to prove that the claimed benefits of the new system

have actually been realised.

Perhaps the preferred approach is to acknowledge the existence of qualitative benefits and attempt to assess them in a

reasonable manner acceptable to all parties including the company’s bank. The financial evaluation would then not only

incorporate ‘hard’ facts relating to costs and benefits that are quantitative in nature, but also would include details of

qualitative benefits which management consider exist but have not attempted to assess in financial terms. Such benefits might

include, for example, the average time saved by location managers in analysing information during each operating period.

Alternatively the management of Moffat Ltd could attempt to express qualitative benefits in specific terms linked to a hierarchy

of organisational requirements. For example, qualitative benefits could be categorised as being:

(1) Essential to the business

(2) Very useful attributes

(3) Desirable, but not essential

(4) Possible, if funding is available

(5) Doubtful and difficult to justify. -

第16题:

(b) Discuss FOUR factors that distinguish service from manufacturing organisations and explain how each of

these factors relates to the services provided by the Dental Health Partnership. (5 marks)

正确答案:

(b) The major characteristics of services which distinguish services from manufacturing are as follows:

– Intangibility.

When a dentist provides a service to a client there are many intangible factors involved such as for example the

appearance of the surgery, the personality of the dentist, the manner and efficiency of the dental assistant. The output

of the service is ‘performance’ by the dentist as opposed to tangible goods.

– Simultaneity.

The service provided by the dentist to the patient is created by the dentist at the same time as the patient consumed it

thus preventing any advance verification of quality.

– Heterogeneity.

Many service organisations face the problem of achieving consistency in the quality of its output. Whilst each of the

dentists within the Dental Health Partnership will have similar professional qualifications there will be differences in the

manner they provide services to clients.

– Perishability.

Many services are perishable. The services of a dentist are purchased only for the duration of an appointment. -

第17题:

(e) Briefly discuss FOUR initiatives that management might consider in order to further enhance profitability.

(4 marks)

正确答案:

(e) In order to enhance profitability management might take the following actions:

(i) Increase the maximum capacity of the circus.

(ii) Undertake a detailed review of operating costs which are budgeted at £239,200,000. Such a review might identify nonvalue

added costs which may be eliminated thereby increasing profitability.

(iii) Enter into a strategic arrangement with large hotels and travel agencies to offer travel and accommodation inclusive

arrangements for visitors to Cinola Island. This might help to increase the number of visitors to the zoo thereby increasing

profits.

(iv) Change the price structure and entitlement of tickets so that purchasers might visit Cinola Island on two separate days

in order to attend the zoo and circus. Additional revenues would arise as a consequence of the increased number of

visitors to the zoo, thereby increasing profitability.

(v) Hold prize draws for free tickets to the zoo for families on an ‘all-inclusive basis’, including restaurants, photographs,

souvenirs etc.

N.B. Only four initiatives were required to be discussed. -

第18题:

(c) Briefly discuss why the directors of HFL might choose contract D irrespective of whether or not contract D

would have been selected using expected values as per part (a). (2 marks)

正确答案:

(c) The directors might select Contract D under which 360,000 kilograms of organic mushrooms would be supplied to HFL for

each outlet. This is the entire capacity of HFL which would ensure that competitors would not be able to supply the same

product and hence the competitive advantage held by HFL might be preserved. -

第19题:

(c) Explain the reasons for the concerns of the government of Happyland with companies such as TMC and

advise the directors of a strategy that might be considered in order to avoid being subject to any forthcoming

legislation concerning the environment. (5 marks)

正确答案:

(c) The government of Happyland will be concerned by the negative impact on the environment. The growth in the number of

children born in Happyland will have raised the demand for disposable nappies as is evidenced from the market size data

contained in the question. In some countries disposable nappies make up around 4% of all household waste and can take

up to five hundred years to decompose! The government will be concerned by the fact that trees are being destroyed in order

to keep babies and infant children in nappies. The disposal costs incurred by the government in terms of landfill etc will be

very high, hence its green paper on the effect of non-biodegradable products in Happyland. The costs of such operations as

the landfill for such products will need to be funded out of increased taxation.

It might be beneficial for the directors of TMC to develop more eco-friendly products such as washable nappies which, by

definition, are recyclable many times over during the life of the ‘product’. Many parents are now changing to ‘real nappies’

because they work out cheaper and better for the environment than disposables. -

第20题:

(c) Briefly outline the corporation tax (CT) issues that Tay Limited should consider when deciding whether to

acquire the shares or the assets of Tagus LDA. You are not required to discuss issues relating to transfer

pricing. (7 marks)

正确答案:

(c) (1) Acquisition of shares

Status

The acquisition of shares in Tagus LDA will add another associated company to the group. This may have an adverse

effect on the rates of corporation tax paid by the two existing group companies, particularly Tay Limited.

Taxation of profits

Profits will be taxed in Portugal. Any profits remitted to the UK as dividends will be taxable as Schedule D Case V income,

but will attract double tax relief. Double tax relief will be available against two types of tax suffered in Portugal. Credit

will be given for any tax withheld on payments from Tagus LDA to Tay Limited and relief will also be available for the

underlying tax as Tay Limited owns at least 10% of the voting power of Tagus LDA. The underlying tax is the tax

attributable to the relevant profits from which the dividend was paid. Double tax relief is given at the lower rate of the

UK tax and the foreign tax (withholding and underlying taxes) suffered.

Losses

As Tagus LDA is a non-UK resident company, losses arising in Tagus LDA cannot be group relieved against profits of the

two UK companies. Similarly, any UK trading losses cannot be used against profits generated by Tagus LDA.

(2) Acquisition of assets

Status

The business of Tagus will be treated as a branch of Tay Limited i.e. an extension of the UK company’s activities. The

number of associated companies will be unaffected.

Taxation of profits

Tay Limited will be treated as having a permanent establishment in Portugal. Profits attributable to the Tagus business

will thus still be taxed in Portugal. In addition, the profits will be taxed in the UK as trading income. Double tax relief

will be available for the tax already suffered in Portugal at the lower of the two rates.

Capital allowances will be available. As the assets in question will not previously have been subject to a claim for UK

capital allowances, there will be no cost restriction and the consideration attributable to each asset will form. the basis

for the capital allowance claim.

Losses

The Tagus trade is part of Tay Limited’s trade, so any losses incurred by the Portuguese trade will automatically be offset

against the trading profits of the UK trade, and vice versa. -

第21题:

(b) (i) Explain the matters you should consider to determine whether capitalised development costs are

appropriately recognised; and (5 marks)

正确答案:

(b) (i) Materiality

The net book value of capitalised development costs represent 7% of total assets in 2007 (2006 – 7·7%), and is

therefore material. The net book value has increased by 13%, a significant trend.

The costs capitalised during the year amount to $750,000. If it was found that the development cost had been

inappropriately capitalised, the cost should instead have been expensed. This would reduce profit before tax by

$750,000, representing 42% of the year’s profit. This is highly material. It is therefore essential to gather sufficient

evidence to support the assertion that development costs should be recognised as an asset.

In 2007, $750,000 capitalised development costs have been incurred, when added to $160,000 research costs

expensed, total research and development costs are $910,000 which represents 20·2% of total revenue, again

indicating a high level of materiality for this class of transaction.

Relevant accounting standard

Development costs should only be capitalised as an intangible asset if the recognition criteria of IAS 38 Intangible Assets

have been demonstrated in full:

– Intention to complete the intangible asset and use or sell it

– Technical feasibility and ability to use or sell

– Ability to generate future economic benefit

– Availability of technical, financial and other resources to complete

– Ability to measure the expenditure attributable to the intangible asset.

Research costs must be expensed, as should development costs which do not comply with the above criteria. The

auditors must consider how Sci-Tech Co differentiates between research and development costs.

There is risk that not all of the criteria have been demonstrated, especially due to the subjective nature of the

development itself:

– Pharmaceutical development is highly regulated. If the government does not license the product then the product

cannot be sold, and economic benefits will therefore not be received.

– Market research should justify the commercial viability of the product. The launch of a rival product to Flortex

means that market share is likely to be much lower than anticipated, and the ability to sell Flortex is reduced. This

could mean that Flortex will not generate an overall economic benefit if future sales will not recover the research

and development costs already suffered, and yet to be suffered, prior to launch. The existence of the rival product

could indicate that Flortex is no longer commercially viable, in which case the capitalised development costs

relating to Flortex should be immediately expensed.

– The funding on which development is dependent may be withdrawn, indicating that there are not adequate

resources to complete the development of the products. Sci-Tech has failed to meet one of its required key

performance indicators (KPI) in the year ended 30 November 2007, as products valued at 0·8% revenue have

been donated to charity, whereas the required KPI is 1% revenue.

Given that there is currently a breach of the target KPIs, this is likely to result in funding equivalent to 25% of

research and development expenditure being withdrawn. If Sci-Tech Co is unable to source alternative means of

finance, then it would seem that adequate resources may not be available to complete the development of new

products. -

第22题:

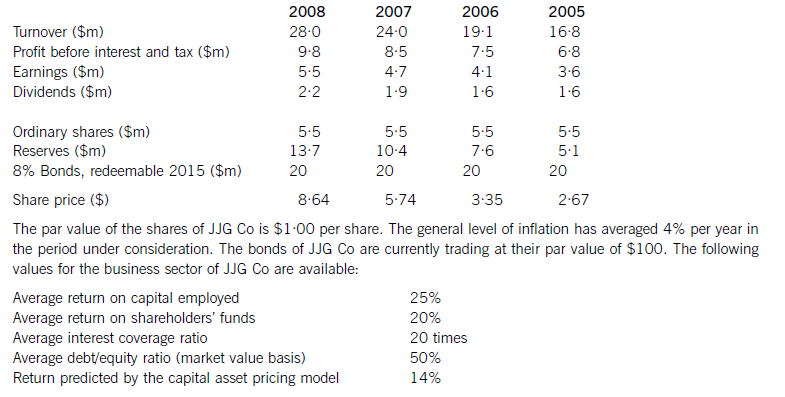

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

正确答案:

AchievementofcorporateobjectivesJJGCohasshareholderwealthmaximisationasanobjective.Thewealthofshareholdersisincreasedbydividendsreceivedandcapitalgainsonsharesowned.Totalshareholderreturncomparesthesumofthedividendreceivedandthecapitalgainwiththeopeningshareprice.TheshareholdersofJJGCohadareturnof58%in2008,comparedwithareturnpredictedbythecapitalassetpricingmodelof14%.Thelowestreturnshareholdershavereceivedwas21%andthehighestreturnwas82%.Onthisbasis,theshareholdersofthecompanyhaveexperiencedasignificantincreaseinwealth.Itisdebatablewhetherthishasbeenasaresultoftheactionsofthecompany,however.Sharepricesmayincreaseirrespectiveoftheactionsanddecisionsofmanagers,orevendespitethem.Infact,lookingatthedividendpersharehistoryofthecompany,therewasoneyear(2006)wheredividendswereconstant,eventhoughearningspershareincreased.Itisalsodifficulttoknowwhenwealthhasbeenmaximised.Anotherobjectiveofthecompanywastoachieveacontinuousincreaseinearningspershare.Analysisshowsthatearningspershareincreasedeveryyear,withanaverageincreaseof14·9%.Thisobjectiveappearstohavebeenachieved.CommentonfinancialperformanceReturnoncapitalemployed(ROCE)hasbeengrowingtowardsthesectoraverageof25%onayear-by-yearbasisfrom22%in2005.Thissteadygrowthintheprimaryaccountingratiocanbecontrastedwithirregulargrowthinturnover,thereasonsforwhichareunknown.Returnonshareholders’fundshasbeenconsistentlyhigherthantheaverageforthesector.ThismaybeduemoretothecapitalstructureofJJGCothantogoodperformancebythecompany,however,inthesensethatshareholders’fundsaresmalleronabookvaluebasisthanthelong-termdebtcapital.Ineverypreviousyearbut2008thegearingofthecompanywashigherthanthesectoraverage.(b)CalculationoftheoreticalexrightspershareCurrentshareprice=$8·64pershareCurrentnumberofshares=5·5millionsharesFinancetoberaised=$15mRightsissueprice=$7·50pershareNumberofsharesissued=15m/7·50=2millionsharesTheoreticalexrightspricepershare=((5·5mx8·64)+(2mx7·50))/7·5m=$8·34pershareThesharepricewouldfallfrom$8·64to$8·34pershareHowever,therewouldbenoeffectonshareholderwealthEffectofrightsissueonearningspershareCurrentEPS=100centspershareRevisedEPS=100x5·5m/7·5m=73centspershareTheEPSwouldfallfrom100centspershareto73centspershareHowever,asmentionedearlier,therewouldbenoeffectonshareholderwealthEffectofrightsissueonthedebt/equityratioCurrentdebt/equityratio=100x20/47·5=42%Revisedmarketvalueofequity=7·5mx8·34=$62·55millionReviseddebt/equityratio=100x20/62·55=32%Thedebt/equityratiowouldfallfrom42%to32%,whichiswellbelowthesectoraveragevalueandwouldsignalareductioninfinancialrisk(c)Thecurrentdebt/equityratioofJJGCois42%(20/47·5).Althoughthisislessthanthesectoraveragevalueof50%,itismoreusefulfromafinancialriskperspectivetolookattheextenttowhichinterestpaymentsarecoveredbyprofits.Theinterestonthebondissueis$1·6million(8%of$20m),givinganinterestcoverageratioof6·1times.IfJJGCohasoverdraftfinance,theinterestcoverageratiowillbelowerthanthis,butthereisinsufficientinformationtodetermineifanoverdraftexists.Theinterestcoverageratioisnotonlybelowthesectoraverage,itisalsolowenoughtobeacauseforconcern.Whiletheratioshowsanupwardtrendovertheperiodunderconsideration,itstillindicatesthatanissueoffurtherdebtwouldbeunwise.Aplacing,oranyissueofnewsharessuchasarightsissueorapublicoffer,woulddecreasegearing.Iftheexpansionofbusinessresultsinanincreaseinprofitbeforeinterestandtax,theinterestcoverageratiowillincreaseandfinancialriskwillfall.GiventhecurrentfinancialpositionofJJGCo,adecreaseinfinancialriskiscertainlypreferabletoanincrease.Aplacingwilldiluteownershipandcontrol,providingthenewequityissueistakenupbynewinstitutionalshareholders,whilearightsissuewillnotdiluteownershipandcontrol,providingexistingshareholderstakeuptheirrights.Abondissuedoesnothaveownershipandcontrolimplications,althoughrestrictiveornegativecovenantsinbondissuedocumentscanlimittheactionsofacompanyanditsmanagers.Allthreefinancingchoicesarelong-termsourcesoffinanceandsoareappropriateforalong-terminvestmentsuchastheproposedexpansionofexistingbusiness.Equityissuessuchasaplacingandarightsissuedonotrequiresecurity.Noinformationisprovidedonthenon-currentassetsofJJGCo,butitislikelythattheexistingbondissueissecured.Ifanewbondissuewasbeingconsidered,JJGCowouldneedtoconsiderwhetherithadsufficientnon-currentassetstoofferassecurity,althoughitislikelythatnewnon-currentassetswouldbeboughtaspartofthebusinessexpansion. -

第23题:

问答题Discuss, and decide together: ● What the likely reactions from staff might be to the introduction of the scheme? ● How feedback should be given to staff on their performance?正确答案:

【参考范例】

Candidate A=A Candidate B=B

A: ABC Company is about to introduce an appraisal scheme to assess the performance of staff. It will benefit both individual and company. Individual appraisals are not always very effective, and people tend to think that there are too many categories. They are not sure how the system works, so they are not happy with the legal aspects. What might be the likely reactions of the staff to the introduction of the scheme?

B: I think some employees would accept the appraisal scheme, in the hope that introduction of the scheme will be beneficial to both individual and company. Some would regard it as a chance to improve their salary. Some others may dislike it for they don’t like the way they are assessed. Many more have doubt about the meaning of the staff appraisal. Everybody works in teams these days and team members share responsibility for results. And team leaders could sense resentment between members. Teams much prefer to be awarded a group rating. We often receive complaints about the system of performance appraisals. What is your opinion of the feedback on appraisal? I think the feedback on performance appraisal is very likely not as positive as the leaders have expected.

A: I agree with you. The staff appraisal may be one of the biggest causes of dissatisfaction at work. In America, the unhappy workers even sue their employers over appraisal interviews. Problems will rise from the scheme itself and from the implementation and understanding of that scheme. Senior staff find it difficult to do appraisals. They have no choice but to listen to staff’s complaint about the company during the appraisal.

B: Therefore, I recommend that before reversing the appraisal’s negative associations, an organization needs to find out the underlying reasons contributing to them. The guidelines should be given to the employees by the management These guidelines suggest that a successful scheme have a clear appeal process, that all the negative feedback should be accompanied by evidence like dates, times and outcomes and that, most importantly, ratings should be able to reflect specific measurable elements of the job requirements.

A: I suggest we should make some changes to the current schemes. But how should feedback be given to staff on their performance?

B: That’s the question that needs discussion. Yes, you’re right. Some changes to current schemes are actually simply a matter of logic.

A: For example, if employees are constantly encouraged to work in teams and to shoulder joint responsibility for their successes and failures, it practically makes little sense for the appraisals to focus on individuals, as this may result in resentments and cause divisions within the group. Therefore, it is possible, and more suitable in some cases to arrange appraisals where performance is rated for the group.

B: And in addition, staff members should also be educated about the best way to approach appraisals. They feel uncomfortable about being asked to play a more supportive role than they are accustomed to without any training. I think it is sensible to give written feedback to most staff members. For some employees, we’d better give them oral feedback on their performance plus the written one.

A: Your idea is acceptable. However, those who are appraised may regard it as a chance to air their grievances and highlight the company’s failings instead of considering their own role. Therefore, the feedback to be given to staff should not be too negative. Rather, the appraisal needs to be positive.解析: 暂无解析