[A] business[B] estate[C] obligation[D] property

题目

[A] business

[B] estate

[C] obligation

[D] property

相似考题

更多“[A] business[B] estate[C] obligation[D] property”相关问题

-

第1题:

The proprietor owns all of the property of the business and is responsible ________ everything.A to ;

B for ;

C at

参考答案:B

-

第2题:

You are creating a Windows Communication Foundation (WCF) service that accepts messages from clients when they are started. The message is defined as follows:[MessageContract] public class Agent {A. Add a MessageBodyMember attribute to the CodeName property and set the ProtectionLevel to Sign. Add a MessageBodyMember attribute to the SecretHandshake property and set the ProtectionLevel to EncryptAndSign.

B. Add a DataProtectionPermission attribute to the each property and set the ProtectData property to true.

C. Add an xmlText attribute to the CodeName property and set the DataType property to Signed. Add a PasswordPropertyText attribute to the SecretHandshake property and set its value to true.

D. Add an ImmutableObject attribute to the CodeName property and set its value property to true. Add a Browsable attribute to the SecretHandshake property and set its value to false.

参考答案:A

-

第3题:

Business models have taken on greater importance recently as a form. of intellectual property that can be protected with a patent.正确答案:最近,商务模式作为一种知识产权的形式,能够受到专利保护,因而其重要性也凸现出来。

-

第4题:

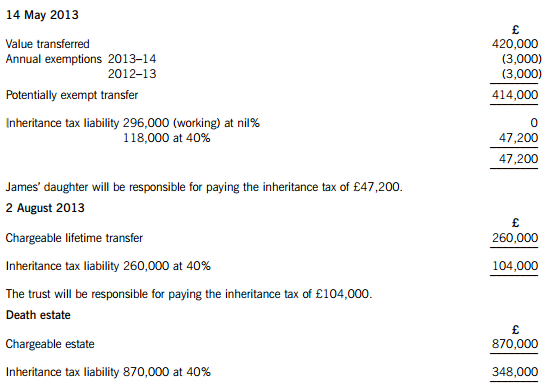

James died on 22 January 2015. He had made the following gifts during his lifetime:

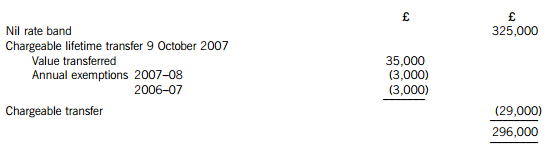

(1) On 9 October 2007, a cash gift of £35,000 to a trust. No lifetime inheritance tax was payable in respect of this gift.

(2) On 14 May 2013, a cash gift of £420,000 to his daughter.

(3) On 2 August 2013, a gift of a property valued at £260,000 to a trust. No lifetime inheritance tax was payable in respect of this gift because it was covered by the nil rate band. By the time of James’ death on 22 January 2015, the property had increased in value to £310,000.

On 22 January 2015, James’ estate was valued at £870,000. Under the terms of his will, James left his entire estate to his children.

The nil rate band of James’ wife was fully utilised when she died ten years ago.

The nil rate band for the tax year 2007–08 is £300,000, and for the tax year 2013–14 it is £325,000.

Required:

(a) Calculate the inheritance tax which will be payable as a result of James’ death, and state who will be responsible for paying the tax. (6 marks)

(b) Explain why it might have been beneficial for inheritance tax purposes if James had left a portion of his estate to his grandchildren rather than to his children. (2 marks)

(c) Explain why it might be advantageous for inheritance tax purposes for a person to make lifetime gifts even when such gifts are made within seven years of death.

Notes:

1. Your answer should include a calculation of James’ inheritance tax saving from making the gift of property to the trust on 2 August 2013 rather than retaining the property until his death.

2. You are not expected to consider lifetime exemptions in this part of the question. (2 marks)

正确答案:(a) James – Inheritance tax arising on death

Lifetime transfers within seven years of death

The personal representatives of James’ estate will be responsible for paying the inheritance tax of £348,000.

Working – Available nil rate band

(b) Skipping a generation avoids a further charge to inheritance tax when the children die. Gifts will then only be taxed once before being inherited by the grandchildren, rather than twice.

(c) (1) Even if the donor does not survive for seven years, taper relief will reduce the amount of IHT payable after three years.

(2) The value of potentially exempt transfers and chargeable lifetime transfers are fixed at the time they are made.

(3) James therefore saved inheritance tax of £20,000 ((310,000 – 260,000) at 40%) by making the lifetime gift of property.

-

第5题:

Questions 76-79 refer to the following advertisement.

BONDHAM INTERNATIONAL

Bondham International, one of the leading real estate firm in the world, has been in business for over 50 years. We began our business by specializing in residential sales, primarily in Australia. Over time, our business has grown to include property rental and management services in locations throughout the world. We now sell, and manage over 15000 commercial and residential properties, and our global network includes employees in Australia, Canada, England, Kenya, and Mexico. We have won numerous industry awards, and our firm has been named one of the top ten international real estate firms by the World Association of Property Management.

In our effort to provide the highest quality service available, we have made significant investments in staff training. As a result, our sales agents offer a wealth of real estate expertise that our clients can always rely on. In addition, through market research and customer satisfaction surveys, we have been able to fulfill client expectations by consistently delivering the highest quality of service.

Whether you have interested in selling a home,

purchasing a commercial property, or simply obtaining expert real estate advice, Bondham International can respond effectively to your needs. Learn more about our firm by visiting our Website, www.bondhaminternational.co.au.

What is NOT one of Bondham International main activities?A. Offering expert advice

B. Conducting research

C. Managing property

D. Building private homes答案:B解析: -

第6题:

Which of the following statements concerning intellectual property is wrong?()

- A、Intellectual property is an intangible creation

- B、Intellectual property in ludes patents,trademarks,copyrights,etc.

- C、Intellectual property is a visible creation

- D、There are some agreement sconcerning intellectual property under the WTO

正确答案:C -

第7题:

transition-property属性语法格式正确的是()。

- A、transition-property:name;

- B、transition-property:none;

- C、transition-property:widthheight;

- D、transition-property:all;

正确答案:B,D -

第8题:

You use Microsoft .NET Framework 4 to create a Windows Presentation Foundation (WPF) application. You add a property named ServiceContext to a control. You need the value of ServiceContext to flow to the child controls exactly like the value of the DataContext property of the FrameworkElement class. What should you do? ()

- A、 Inherit the control class from the DependencyObject class.

- B、 Register a dependency property. In the options settings of the property metadata, specify the Inherits option.

- C、 Declare a new property. In the get and set methods of the new property, create an instance of the TraversalRequest class.

- D、 Declare a new property. In the get method of the new property call VisualTreeHelper.GetParent. In the set method of the new property, call VisualTreeHelper.GetChild.

正确答案:B -

第9题:

You are creating a Windows Communication Foundation (WCF) service that accepts messages from clients when they are started. The message is defined as follows. [MessageContract] public class Agent { public string CodeName { get; set; }public string SecretHandshake { get; set; } } You have the following requirements: "The CodeName property must be sent in clear text. The service must be able to verify that the property value was not changed after being sent by the client. "The SecretHandshake property must not be sent in clear text and must be readable by the service. What should you do?()

- A、 Add a MessageBodyMember attribute to the CodeName property and set the ProtectionLevel to Sign. Add a MessageBodyMember attribute to the SecretHandshake property and set the protectionLevel to EncryptAndSign.

- B、 Add a DataProtectionPermission attribute to the each property and set the ProtectData property to true.

- C、 Add an XmlText attribute to the CodeName property and set the DataType property to Signed. add a PasswordPropertyText attribute to the SecretHandshake property and set its value to true.

- D、 Add an ImmutableObject attribute to the CodeName property and set its value property to true. Add a Browsable attribute to the SecretHandshake property and set its value to false.

正确答案:A -

第10题:

单选题Which of the following statements concerning intellectual property is wrong?()AIntellectual property is an intangible creation

BIntellectual property in ludes patents,trademarks,copyrights,etc.

CIntellectual property is a visible creation

DThere are some agreement sconcerning intellectual property under the WTO

正确答案: C解析: 暂无解析 -

第11题:

单选题You are creating a Windows Communication Foundation (WCF) service that accepts messages from clients when they are started. The message is defined as follows. [MessageContract] public class Agent { public string CodeName { get; set; }public string SecretHandshake { get; set; } } You have the following requirements: "The CodeName property must be sent in clear text. The service must be able to verify that the property value was not changed after being sent by the client. "The SecretHandshake property must not be sent in clear text and must be readable by the service. What should you do?()AAdd a MessageBodyMember attribute to the CodeName property and set the ProtectionLevel to Sign. Add a MessageBodyMember attribute to the SecretHandshake property and set the protectionLevel to EncryptAndSign.

BAdd a DataProtectionPermission attribute to the each property and set the ProtectData property to true.

CAdd an XmlText attribute to the CodeName property and set the DataType property to Signed. add a PasswordPropertyText attribute to the SecretHandshake property and set its value to true.

DAdd an ImmutableObject attribute to the CodeName property and set its value property to true. Add a Browsable attribute to the SecretHandshake property and set its value to false.

正确答案: D解析: 暂无解析 -

第12题:

单选题You have a custom button, with should have a Property "IsActive", one must be able to bind this Property on a class Property.()ADependency Property

BINotifyPropertyChanged

Cnet Property

正确答案: A解析: 暂无解析 -

第13题:

The mansion and the estate are part of his().

A、legacy

B、heritage

C、hope

D、things

参考答案:B

-

第14题:

InaJSP-centricshoppingcartapplication,youneedtomoveaclient’shomeaddressoftheCustomerobjectintotheshippingaddressoftheOrderobject.TheaddressdataisstoredinavalueobjectclasscalledAddresswithpropertiesfor:streetaddress,city,province,country,andpostalcode.WhichtwoJSPcodesnippetscanbeusedtoaccomplishthisgoal?()

A.<c:setvar=’order’property=’shipAddress’value=’${client.homeAddress}’/>

B.<c:settarget=’${order}’property=’shipAddress’value=’${client.homeAddress}’/>

C.<jsp:setPropertyname=’${order}’property=’shipAddress’value=’${client.homeAddress}’/>

D.<c:setvar=’order’property=’shipAddress’><jsp:getPropertyname=’client’property=’homeAddress’/></c:store>

E.<c:settarget=’${order}’property=’shipAddress’><jsp:getPropertyname=’client’property=’homeAddress’/></c:set>

参考答案:B, E

-

第15题:

In 2014 Mr Yuan inherited an estate of RMB2 million from his uncle who had died two months earlier.

What is the correct treatment of the estate income for individual income tax purposes?

A.The estate income is not taxable

B.The estate income will be taxed as occasional (ad hoc) income

C.The estate income will be taxed as other income

D.The estate income will be taxed as service income

正确答案:A

-

第16题:

Questions 76-79 refer to the following advertisement.

BONDHAM INTERNATIONAL

Bondham International, one of the leading real estate firm in the world, has been in business for over 50 years. We began our business by specializing in residential sales, primarily in Australia. Over time, our business has grown to include property rental and management services in locations throughout the world. We now sell, and manage over 15000 commercial and residential properties, and our global network includes employees in Australia, Canada, England, Kenya, and Mexico. We have won numerous industry awards, and our firm has been named one of the top ten international real estate firms by the World Association of Property Management.

In our effort to provide the highest quality service available, we have made significant investments in staff training. As a result, our sales agents offer a wealth of real estate expertise that our clients can always rely on. In addition, through market research and customer satisfaction surveys, we have been able to fulfill client expectations by consistently delivering the highest quality of service.

Whether you have interested in selling a home,

purchasing a commercial property, or simply obtaining expert real estate advice, Bondham International can respond effectively to your needs. Learn more about our firm by visiting our Website, www.bondhaminternational.co.au.

What is stated about Bondham International?A. Most of its work is done online.

B. The staff works only in Australia.

C. Its prices are the lowest in the industry.

D. It has expanded over the years.答案:D解析: -

第17题:

资料:Now you are preparing a report for the business negotiation which will be held next Friday.

There are 5 sentences excerpted from the report,each sentence has four words or phrases underlined.The four underlined ports of the sentence are marked(A),(B),(C),(D).You are to identify the one underlined word or phase that should be collected or rewritten.Then,find the number of the question and mark your answer.

“China’s residential housing market would hit the iceberg(A)very soon and after the collision,risks in the property market will result in(B)more serious risks in the financial sector”,said Pan Shiyi,a real estate tycoon,at the China Entrepreneurs Forum held in Beijing on May 23,it (C)may be a little exaggerating,but risks in the housing market are real as following a strong performance in 2013,China’s real estate market has shown signs of cooling down(D).

A.A

B.B

C.D

D.D答案:C解析:本题考查的是改错。

【关键词】it改为which

【主题句】said Pan Shiyi,a real estate tycoon,at the China Entrepreneurs Forum held in Beijing on May 23,it may be a little exaggerating,潘石屹,一位真正的地产界大亨在北京于5月23日举办的中国企业家论坛上谈到,这或许有点夸张。

【解析】 文中C所在句子缺乏连词,所以应该使用which,引导限制性定语从句。 -

第18题:

物业的概念与房地产的概念的区别是在英语中,物业与房地产是一个词(Real— estate或Real property)。在我们通常使用上,房地产一词是一个()的概念,物业一词则是个()的概念。

正确答案:宏观;微观 -

第19题:

Banks have legal obligation to inspect the actual merchandise.

正确答案:错误 -

第20题:

You have a custom button, with should have a Property "IsActive", one must be able to bind this Property on a class Property.()

- A、 Dependency Property

- B、 INotifyPropertyChanged

- C、 net Property

正确答案:B -

第21题:

问答题A postman delivers mail round a housing estate.

He does not want to visit the same street more than once, but can pass over the same street corners.

On which housing estate is this possible?正确答案: D解析: 只有在第四个地图中邮递员可以不用走重复的路线即可把信送到。即先走外面圆形的路,再走中间三角形的路,反之亦然。但是其他三幅地图,邮递员必须要走重复的路线才可以把所有的信送达。 -

第22题:

问答题Practice 7 In recent years intellectual property has received a lot more attention because ideas and innovations have become the most important resource, replacing land, energy and raw materials. As much as three-quarters of the value of publicly traded companies in America comes from intangible assets, up from around 40% in the early 1980s. “The economic product of the United States”, says Alan Greenspan, the chairman of America’s Federal Reserve, has become “predominantly conceptual”. Intellectual property forms part of those conceptual assets. In information technology and telecoms in particular, the role of intellectual property has changed radically. What used to be the preserve of corporate lawyers and engineers in R&D labs has been speedily embraced by the boardroom. “Intellectual-asset management” now figures as a strategic business issue. In America alone, technology licensing revenue accounts for an estimated $45 billion annually; worldwide, the figure is around $100 billion and growing fast. Technology firms are seeking more patents, expanding their scope, licensing more, litigating more and overhauling their business models around intellectual property. Yet paradoxically, as some companies batten down the hatches, other firms have found ways of making money by opening up their treasure-chest of innovation and sharing it with others. The rise of open-source software is just one example. And a new breed of companies has appeared on the periphery of today’s tech firms, acting as intellectual-property intermediaries and creating a market for ideas.正确答案:

【参考译文】

知识产权近年来受到了更多的关注,原因在于理念与创新取代了土地、能源和原材料,已经成为最重要的资源。现在,美国上市公司高达3/4的价值来源于无形资产,而在80年代早期,这仅占约40%。美国联邦储备委员会主席阿兰·格林斯番断言,“美国的经济产出”变的“更加观念化”。知识产权形成了这些观念化资产中的一部分。

在信息技术,特别是电信方面,知识产权的作用已经发生了根本性的变化。曾几何时,被公司律师和研发实验室的工程师们独占的领域,现在迅速成为董事会上讨论的热点。“知识资产管理”现在被塑造为战略商务问题。仅在美国,技术特许收益每年估计达到450亿美元;在全球范围,该数字约为1000亿美元,而且仍在快速增长。

技术公司在寻求更多的专利,扩大其经营范围,转让更多的特许经营项目,提起更多的法律诉讼,并全面修订其知识产权的商务模式。然而,似乎矛盾的情形是,正当有些公司在封堵知识产权外露之时,其他公司却寻找到了种种途径,敞开创新的财富之门,与他人共享创新成果,从中赚钱。开源软件的兴起就是一个典型的例证。此外,一种新型的公司已出现于当今的技术公司的外围,扮演着知识产权中介机构的角色,开辟理念、点子市场。解析: 暂无解析 -

第23题:

问答题Practice 4 ● Look at the list below. It shows articles in a business website. ● For questions 6-10, decide which article (A-H) each person on the opposite page should read. ● For each question, mark one letter (A-H) on your Answer Sheet. ● Do not use any letter more than once. Articles A Setting up an Online Home Based Business—2 Mistakes to Avoid B Tips to Buying Property Abroad C How to Conduct an Interview? D Management Communication Techniques E Five Tips on Advertising Your Property F Honesty Proves Best Policy for Job Hunter G Land Investment—An Investors’ Guideline H Five Signs You’re in the Wrong Job 6. John Shawn wants to sell his house. 7. Robin Seaton is responsible for recruiting new staff. 8. Thomas Kingsley is looking for a new job. 9. Mary Kay would like to start business on the Internet. 10. James Bensen is going to buy a house in another country.正确答案: 6.E 本题的意思是“John Shawn想卖掉他的房子。”与房地产有关的文章是B、E、G这三篇文章,但B是关于国外买房的,而G是关于土地投资,因为E是与卖房有关的,这里的“Property”表示“房产”,所以E项正确。

7.C 本题的意思是“Robin Seaton负责招聘新员工。”面试是招聘新员工时必不可少的一个步骤,所以Robin Seaton应该读的文章是文章C “How to Conduct an Interview?”。因此C项正确。

8.F 本题的意思是“Thomas Kingsley正在找工作。”文章H是此题的干扰项,这篇文章描述的是入错行的五个迹象,针对的对象主要在职者。而Thomas Kingsley最应该读的文章是文章F“诚实是求职者的最佳策略”,因此F项正确。

9.A 本题的意思是“Mary Kay想在网上做生意。”根据A文章的题目可知,A文章应该是关于网上做生意的,所以在网上做生意的人应该了解本文章的内容,所以A项正确。

10.B 本题的意思是“James Bensen要在其他的国家买房子。”James Bensen应该读的文章是文章B“在国外购房的注意事项”。因此B项正确。解析: 暂无解析