Glove Co makes high quality, hand-made gloves which it sells for an average of $180 per pair. The standard cost of labour for each pair is $42 and the standard labour time for each pair is three hours. In the last quarter, Glove Co had budgeted production

题目

Glove Co makes high quality, hand-made gloves which it sells for an average of $180 per pair. The standard cost of labour for each pair is $42 and the standard labour time for each pair is three hours. In the last quarter, Glove Co had budgeted production of 12,000 pairs, although actual production was 12,600 pairs in order to meet demand.

37,000 hours were used to complete the work and there was no idle time. The total labour cost for the quarter was $531,930.

At the beginning of the last quarter, the design of the gloves was changed slightly. The new design required workers to sew the company’s logo on to the back of every glove made and the estimated time to do this was 15 minutes for each pair. However, no-one told the accountant responsible for updating standard costs that the standard time per pair of gloves needed to be changed. Similarly, although all workers were given a 2% pay rise at the beginning of the last quarter, the accountant was not told about this either. Consequently, the standard was not updated to reflect these changes.

When overtime is required, workers are paid 25% more than their usual hourly rate.

Required:

(a) Calculate the total labour rate and total labour efficiency variances for the last quarter. (2 marks)

(b) Analyse the above total variances into component parts for planning and operational variances in as much detail as the information allows. (6 marks)

(c) Assess the performance of the production manager for the last quarter. (7 marks)

相似考题

参考答案和解析

(a)BasicvariancesLabourratevarianceStandardcostoflabourperhour=$42/3=$14perhour.Labourratevariance=(actualhourspaidxactualrate)–(actualhourspaidxstdrate)Actualhourspaidxactualrate=$531,930.Actualhourspaidxstdrate=37,000x$14=$518,000.Thereforeratevariance=$531,930–$518,000=$13,930ALabourefficiencyvarianceLabourefficiencyvariance=(actualproductioninstdhours–actualhoursworked)xstdrate[(12,600x3)–37,000]x$14=$11,200F(b)PlanningandoperationalvariancesLabourrateplanningvariance(Revisedrate–stdrate)xactualhourspaid=[$14·00–($14·00x1·02)]x37,000=$10,360A.LabourrateoperationalvarianceRevisedratexactualhourspaid=$14·28x37,000=$528,360.Actualcost=$531,930.Variance=$3,570A.Labourefficiencyplanningvariance(Standardhoursforactualproduction–revisedhoursforactualproduction)xstdrateRevisedhoursforeachpairofgloves=3·25hours.[37,800–(12,600x3·25)]x$14=$44,100A.Labourefficiencyoperationalvariance(Revisedhoursforactualproduction–actualhoursforactualproduction)xstdrate(40,950–37,000)x$14=$55,300F.(c)AnalysisofperformanceAtafirstglance,performancelooksmixedbecausethetotallabourratevarianceisadverseandthetotallabourefficiencyvarianceisfavourable.However,theoperationalandplanningvariancesprovidealotmoredetailonhowthesevarianceshaveoccurred.Theproductionmanagershouldonlybeheldaccountableforvarianceswhichhecancontrol.Thismeansthatheshouldonlybeheldaccountablefortheoperationalvariances.Whentheseoperationalvariancesarelookedatitcanbeseenthatthelabourrateoperationalvarianceis$3,570A.Thismeansthattheproductionmanagerdidhavetopayforsomeovertimeinordertomeetdemandbutthemajorityofthetotallabourratevarianceisdrivenbythefailuretoupdatethestandardforthepayrisethatwasappliedatthestartofthelastquarter.Theovertimeratewouldalsohavebeenimpactedbythatpayincrease.Then,whenthelabourefficiencyoperationalvarianceislookedat,itisactually$55,300F.Thisshowsthattheproductionmanagerhasmanagedhisdepartmentwellwithworkerscompletingproductionmorequicklythanwouldhavebeenexpectedwhenthenewdesignchangeistakenintoaccount.Thetotaloperatingvariancesaretherefore$51,730Fandsooverallperformanceisgood.Theadverseplanningvariancesof$10,360and$44,100donotreflectontheperformanceoftheproductionmanagerandcanthereforebeignoredhere.

更多“Glove Co makes high quality, hand-made gloves which it sells for an average of $180 per pair. The standard cost of labour for each pair is $42 and the standard labour time for each pair is three hours. In the last quarter, Glove Co had budgeted production”相关问题

-

第1题:

175 Quality control charts show a characteristic of the product or service against:

A. the specification limits

B. customer requirements

C. control limits based on three standard deviations in each direction

D. control limits based on six standard deviations in each direction

E. A and D only

正确答案:C

-

第2题:

There are 4 words marked A), B), C) and D ) in each group. Choose the one which underlined part has a different pronunciation from the other three ________A.gone

B.done

C.another

D.glove

参考答案:A

-

第3题:

(c) In August 2004 it was discovered that the inventory at 31 December 2003 had been overstated by $100,000.

(4 marks)

Required:

Advise the directors on the correct treatment of these matters, stating the relevant accounting standard which

justifies your answer in each case.

NOTE: The mark allocation is shown against each of the three matters.

正确答案:

(c) The opening inventory should be included in the current year’s income statement at the corrected figure, and the opening

balance of retained profit reduced by $100,000. The $100,000 reduction will appear in the statement of changes in equity.

(IAS8 Accounting policies, changes in accounting estimates and errors) -

第4题:

2 The Rubber Group (TRG) manufactures and sells a number of rubber-based products. Its strategic focus is channelled

through profit centres which sell products transferred from production divisions that are operated as cost centres. The

profit centres are the primary value-adding part of the business, where commercial profit centre managers are

responsible for the generation of a contribution margin sufficient to earn the target return of TRG. The target return is

calculated after allowing for the sum of the agreed budgeted cost of production at production divisions, plus the cost

of marketing, selling and distribution costs and central services costs.

The Bettamould Division is part of TRG and manufactures moulded products that it transfers to profit centres at an

agreed cost per tonne. The agreed cost per tonne is set following discussion between management of the Bettamould

Division and senior management of TRG.

The following information relates to the agreed budget for the Bettamould Division for the year ending 30 June 2009:

(1) The budgeted output of moulded products to be transferred to profit centres is 100,000 tonnes. The budgeted

transfer cost has been agreed on a two-part basis as follows:

(i) A standard variable cost of $200 per tonne of moulded products;

(ii) A lump sum annual charge of $50,000,000 in respect of fixed costs, which is charged to profit centres, at

$500 per tonne of moulded products.

(2) Budgeted standard variable costs (as quoted in 1 above) have been set after incorporating each of the following:

(i) A provision in respect of processing losses amounting to 15% of material inputs. Materials are sourced on

a JIT basis from chosen suppliers who have been used for some years. It is felt that the 15% level of losses

is necessary because the ageing of the machinery will lead to a reduction in the efficiency of output levels.

(ii) A provision in respect of machine idle time amounting to 5%. This is incorporated into variable machine

costs. The idle time allowance is held at the 5% level partly through elements of ‘real-time’ maintenance

undertaken by the machine operating teams as part of their job specification.

(3) Quality checks are carried out on a daily basis on 25% of throughput tonnes of moulded products.

(4) All employees and management have contracts based on fixed annual salary agreements. In addition, a bonus

of 5% of salary is payable as long as the budgeted output of 100,000 tonnes has been achieved;

(5) Additional information relating to the points in (2) above (but NOT included in the budget for the year ending

30 June 2009) is as follows:

(i) There is evidence that materials of an equivalent specification could be sourced for 40% of the annual

requirement at the Bettamould Division, from another division within TRG which has spare capacity.

(ii) There is evidence that a move to machine maintenance being outsourced from a specialist company could

help reduce machine idle time and hence allow the possibility of annual output in excess of 100,000 tonnes

of moulded products.

(iii) It is thought that the current level of quality checks (25% of throughput on a daily basis) is vital, although

current evidence shows that some competitor companies are able to achieve consistent acceptable quality

with a quality check level of only 10% of throughput on a daily basis.

The directors of TRG have decided to investigate claims relating to the use of budgeting within organisations which

have featured in recent literature. A summary of relevant points from the literature is contained in the following

statement:

‘The use of budgets as part of a ‘performance contract’ between an organisation and its managers may be seen as a

practice that causes management action which might lead to the following problems:

(a) Meeting only the lowest targets

(b) Using more resources than necessary

(c) Making the bonus – whatever it takes

(d) Competing against other divisions, business units and departments

(e) Ensuring that what is in the budget is spent

(f) Providing inaccurate forecasts

(g) Meeting the target, but not beating it

(h) Avoiding risks.’

Required:

(a) Explain the nature of any SIX of the eight problems listed above relating to the use of budgeting;

(12 marks)

正确答案:

2 Suggested answer content for each of the eight problems contained within the scenario is as follows:

(a) The nature of each of the problems relating to the use of budgeting is as follows:

Meeting only the lowest targets

– infers that once a budget has been negotiated, the budget holder will be satisfied with this level of performance unless

there is good reason to achieve a higher standard.

Using more resources than necessary

– Once the budget has been agreed the focus will be to ensure that the budgeted utilisation of resources has been adhered

to. Indeed the current system does not provide a specific incentive not to exceed the budget level. It may be, however,

that failure to achieve budget targets would reflect badly on factors such as future promotion prospects or job security.

Making the bonus – whatever it takes

– A bonus system is linked to the budget setting and achievement process might lead to actions by employees and

management which they regard as ‘fair game’. This is because they view the maximisation of bonuses as the main

priority in any aspect of budget setting or work output.

Competing against other divisions, business units and departments

– Competition may manifest itself through the attitudes adopted in relation to transfer pricing of goods/services between

divisions, lack of willingness to co-operate on sharing information relating to methods, sources of supply, expertise, etc.

Ensuring that what is in the budget is spent

– Management may see the budget setting process as a competition for resources. Irrespective of the budgeting method

used, there will be a tendency to feel that unless the budget allowance for one year is spent, there will be imposed

reductions in the following year. This will be particularly relevant in the case of fixed cost areas where expenditure is

viewed as discretionary to some extent.

Providing inaccurate forecasts

– This infers that some aspects of budgeting problems such as ‘Gaming’ and ‘misrepresentation’ may be employed by the

budget holder in order to gain some advantage. Gaming may be seen as a deliberate distortion of the measure in order

to secure some strategic advantage. Misrepresentation refers to creative planning in order to suggest that the measure

is acceptable.

Meeting the target but not beating it

– There may be a view held by those involved in the achievement of the budget target that there is no incentive for them

to exceed that level of effectiveness.

Avoiding risks

– There may be a prevailing view by those involved in the achievement of the budget target that wherever possible

strategies incorporated into the achievement of the budget objective should be left unchanged if they have been shown

to be acceptable in the past. Change may be viewed as increasing the level of uncertainty that the proposed budget

target will be achievable. -

第5题:

When ordering switches for a new building, which of the following is the BEST way for the technician to determine the number of switches to put in each network closet?()A. Review the architectural plans to see how many drops go to each closet.

B. Count the number of rooms near each closet and standardize eight drops per room.

C. Wireless is the new standard and no network switches will be needed in the building,

D. Count the number of phone ports and configure two network ports for each phone port.

参考答案:A

-

第6题:

Your vessel is proceeding down a channel,and you see a pair of range lights that are in line dead ahead.The chart indicates that the direction of this pair of lights is 229°T,and variation is 6°W.If the heading of your vessel at the time of the sighting is 232°per standard magnetic compass,what is the correct deviation ________.

A.3°E

B.9°E

C.3°W

D.9°W

正确答案:A

-

第7题:

My new glasses cost me__the last pair that I bought.A.three times

B.three times as much as

C.three times as much

D.three times much as答案:B解析:表示倍数的词用在比较句中常用的结构是:主语+谓语动词+倍数+as+much/many+as+名词或代词。 -

第8题:

Which three of these are characteristics of UTP cable?()

- A、The wires in each pair are wrapped around each other

- B、An insulating material covers each of the individual copper wires in it

- C、It comes in eight-pair wire bindles

- D、EMI and RFI cause only limited degradation to signals running over it

- E、It comes in seven categories

- F、IT has an external diameter of approximately 0 28 inches

正确答案:A,B,D -

第9题:

When ordering switches for a new building, which of the following is the BEST way for the technician to determine the number of switches to put in each network closet?()

- A、Review the architectural plans to see how many drops go to each closet.

- B、Count the number of rooms near each closet and standardize eight drops per room.

- C、Wireless is the new standard and no network switches will be needed in the building,

- D、Count the number of phone ports and configure two network ports for each phone port.

正确答案:A -

第10题:

单选题The time interval between the transmission of signals from a pair of Loran-C stations is very closely controlled and operates with().AAn atomic time standard

BDaylight Savings Time

CEastern Standard Time

DGreenwich Mean Time

正确答案: A解析: 暂无解析 -

第11题:

多选题Which three of these are characteristics of UTP cable?()AThe wires in each pair are wrapped around each other

BAn insulating material covers each of the individual copper wires in it

CIt comes in eight-pair wire bindles

DEMI and RFI cause only limited degradation to signals running over it

EIt comes in seven categories

FIT has an external diameter of approximately 0 28 inches

正确答案: D,B解析: 暂无解析 -

第12题:

单选题Which of the following is true according to the passage? ______.AThe Division of Labour makes work more interesting.

BSpecialisation could solve the problem of unemployment.

CAdam Smith put forward the idea of the Division of Labour.

DAdam Smith insisted that each worker be better paid.

正确答案: A解析:

可以采取排除法。文中最后一句提到“they have also brought us a little misery in overcrowded towns,boring jobs and,most of all,unemployment”,A项和B项意义与文意恰好相反。D项是无关项。所以选C。另外,本文的主旨即是介绍斯密的劳动分工论。 -

第13题:

May I ask what the standard of your securities’ payment is?

A.Each gets paid twenty Yuan per hour

B.Each gets paid twelve Yuan per hour

C.Thirty Yuan for each fellow per hour

D.Fifteen Yuan for each security guard per hour

正确答案:A

-

第14题:

(b) During the inventory count on 31 December, some goods which had cost $80,000 were found to be damaged.

In February 2005 the damaged goods were sold for $85,000 by an agent who received a 10% commission out

of the sale proceeds. (2 marks)

Required:

Advise the directors on the correct treatment of these matters, stating the relevant accounting standard which

justifies your answer in each case.

NOTE: The mark allocation is shown against each of the three matters.

正确答案:

(b) The inventories should be valued at the lower of cost and net realisable value. Cost is $80,000, net realisable value is

$85,000 less 10%, or $76,500. The net realisable value of $76,500 should therefore be taken (IAS2 Inventories) -

第15题:

1 The Great Western Cake Company (GWCC) is a well-established manufacturer of specialist flour confectionery

products, including cakes. GWCC sells its products to national supermarket chains. The company’s success during

recent years is largely attributable to its ability to develop innovative products which appeal to the food selectors within

national supermarket chains.

The marketing department of Superstores plc, a national supermarket chain has asked GWCC to manufacture a cake

known as the ‘Mighty Ben’. Mighty Ben is a character who has recently appeared in a film which was broadcast

around the world. The cake is expected to have a minimum market life of one year although the marketing department

consider that this might extend to eighteen months.

The management accountant of GWCC has collated the following estimated information in respect of the Mighty Ben

cake:

(1) Superstores plc has decided on a launch price of £20·25 for the Mighty Ben cake and it is expected that this

price will be maintained for the duration of the product’s life. Superstores plc will apply a 35% mark-up on the

purchase price of each cake from GWCC.

(2) Sales of the Mighty Ben cake are expected to be 100,000 units per month during the first twelve months.

Thereafter sales of the Mighty Ben cake are expected to decrease by 10,000 units in each subsequent month.

(3) Due to the relatively short shelf-life of the Mighty Ben cake, management has decided to manufacture the cakes

on a ‘just-in-time’ basis for delivery in accordance with agreed schedules. The cakes will be manufactured in

batches of 1,000. Direct materials input into the baking process will cost £7,000 per batch for each of the first

three months’ production. The material cost of the next three months’ production is expected to be 95% of the

cost of the first three months’ production. All batches manufactured thereafter will cost 90% of the cost of the

second three months’ production.

(4) Packaging costs will amount to £0·75 per cake. The original costs of the artwork and design of the packaging

will amount to £24,000. Superstores plc will reimburse GWCC £8,000 in the event that the product is

withdrawn from sale after twelve months.

(5) The design of the Mighty Ben cake is such that it is required to be hand-finished. A 75% learning curve will

apply to the total labour time requirement until the end of month five. Thereafter a steady state will apply with

labour time required per batch stabilising at that of the final batch in month five. The labour requirement for the

first batch of Mighty Ben cakes to be manufactured is expected to be 6,000 hours at £10 per hour.

(6) A royalty of 5% of sales revenue (subject to a maximum royalty of £1·1 million) will be payable by GWCC to the

owners of the Mighty Ben copyright.

(7) Variable overheads are estimated at £3·50 per direct labour hour.

(8) The manufacture of the Mighty Ben cake will increase fixed overheads by £75,000 per month.

(9) In order to provide a production facility dedicated to the Mighty Ben cake, an investment of £1,900,000 will be

required and this will be fully depreciated over twelve months.

(10) The directors of GWCC require an average annual return of 35% on their investment over 12 months and

18 months.

(11) Ignore taxation and the present value of cash flows.

Note: Learning curve formula:

y = axb

where y = average cost per batch

a = the cost of the initial batch

x = the total number of batches

b = learning index (= –0·415 for 75% learning rate)

Required:

(a) Prepare detailed calculations to show whether the manufacture of Mighty Ben cakes will provide the required

rate of return for GWCC over periods of twelve months and eighteen months. (20 marks)

正确答案:

-

第16题:

Which of the following represents a wiring standard for twisted pair cables?()A.Fiber

B.T568A

C.IEEE1394

D.CAT5

参考答案:B

-

第17题:

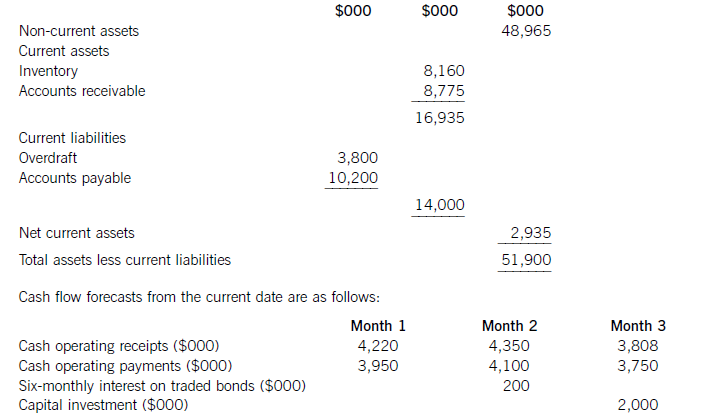

The following financial information relates to HGR Co:

Statement of financial position at the current date (extracts)

The finance director has completed a review of accounts receivable management and has proposed staff training and operating procedure improvements, which he believes will reduce accounts receivable days to the average sector value of 53 days. This reduction would take six months to achieve from the current date, with an equal reduction in each month. He has also proposed changes to inventory management methods, which he hopes will reduce inventory days by two days per month each month over a three-month period from the current date. He does not expect any change in the current level of accounts payable.

HGR Co has an overdraft limit of $4,000,000. Overdraft interest is payable at an annual rate of 6·17% per year, with payments being made each month based on the opening balance at the start of that month. Credit sales for the year to the current date were $49,275,000 and cost of sales was $37,230,000. These levels of credit sales and cost of sales are expected to be maintained in the coming year. Assume that there are 365 working days in each year.

Required:

(a) Discuss the working capital financing strategy of HGR Co. (7 marks)

(b) For HGR Co, calculate:

(i) the bank balance in three months’ time if no action is taken; and

(ii) the bank balance in three months’ time if the finance director’s proposals are implemented.

Comment on the forecast cash flow position of HGR Co and recommend a suitable course of action.

(10 marks)

(c) Discuss how risks arising from granting credit to foreign customers can be managed and reduced.

(8 marks)

正确答案:

(a)Whenconsideringthefinancingofworkingcapital,itisusefultodividecurrentassetsintofluctuatingcurrentassetsandpermanentcurrentassets.Fluctuatingcurrentassetsrepresentchangesinthelevelofcurrentassetsduetotheunpredictabilityofbusinessactivity.Permanentcurrentassetsrepresentthecorelevelofinvestmentincurrentassetsneededtosupportagivenlevelofturnoverorbusinessactivity.Asturnoverorlevelofbusinessactivityincreases,thelevelofpermanentcurrentassetswillalsoincrease.Thisrelationshipcanbemeasuredbytheratioofturnovertonetcurrentassets.Thefinancingchoiceasfarasworkingcapitalisconcernedisbetweenshort-termandlong-termfinance.Short-termfinanceismoreflexiblethanlong-termfinance:anoverdraft,forexample,isusedbyabusinessorganisationastheneedarisesandvariableinterestischargedontheoutstandingbalance.Short-termfinanceisalsomoreriskythanlong-termfinance:anoverdraftfacilitymaybewithdrawn,orashort-termloanmayberenewedonlessfavourableterms.Intermsofcost,thetermstructureofinterestratessuggeststhatshort-termdebtfinancehasalowercostthanlong-termdebtfinance.Thematchingprinciplesuggeststhatlong-termfinanceshouldbeusedforlong-terminvestment.Applyingthisprincipletoworkingcapitalfinancing,long-termfinanceshouldbematchedwithpermanentcurrentassetsandnon-currentassets.Afinancingpolicywiththisobjectiveiscalleda‘matchingpolicy’.HGRCoisnotusingthisfinancingpolicy,sinceofthe$16,935,000ofcurrentassets,$14,000,000or83%isfinancedfromshort-termsources(overdraftandtradepayables)andonly$2,935,000or17%isfinancedfromalong-termsource,inthiscaseequityfinance(shareholders’funds)ortradedbonds.ThefinancingpolicyorapproachtakenbyHGRCotowardsthefinancingofworkingcapital,whereshort-termfinanceispreferred,iscalledanaggressivepolicy.Relianceonshort-termfinancemakesthisriskierthanamatchingapproach,butalsomoreprofitableduetothelowercostofshort-termfinance.Followinganaggressiveapproachtofinancingcanleadtoovertrading(undercapitalisation)andthepossibilityofliquidityproblems.(b)Bankbalanceinthreemonths’timeifnoactionistaken:Workings:ReductioninaccountsreceivabledaysCurrentaccountsreceivabledays=(8,775/49,275)x365=65daysReductionindaysoversixmonths=65–53=12daysMonthlyreduction=12/6=2daysEachreceivablesdayisequivalentto8,775,000/65=$135,000(Alternatively,eachreceivablesdayisequivalentto49,275,000/365=$135,000)Monthlyreductioninaccountsreceivable=2x135,000=$270,000ReductionininventorydaysCurrentinventorydays=(8,160/37,230)x365=80daysEachinventorydayisequivalentto8,160,000/80=$102,000(Alternatively,eachinventoryday=37,230,000/365=$102,000)Monthlyreductionininventory=102,000x2=$204,000OverdraftinterestcalculationsMonthlyoverdraftinterestrate=1·06171/12=1·005or0·5%Ifnoactionistaken:Period1interest=3,800,000x0·005=$19,000Period2interest=3,549,000x0·005=$17,745or$18,000Period3interest=3,517,000x0·005=$17,585or$18,000Ifactionistaken:Period1interest=3,800,000x0.005=$19,000Period2interest=3,075,000x0.005=$15,375or$15,000Period3interest=2,566,000x0.005=$12,830or$13,000DiscussionIfnoactionistaken,thecashflowforecastshowsthatHGRCowillexceeditsoverdraftlimitof$4millionby$1·48millioninthreemonths’time.Ifthefinancedirector’sproposalsareimplemented,thereisapositiveeffectonthebankbalance,buttheoverdraftlimitisstillexceededinthreemonths’time,althoughonlyby$47,000ratherthanby$1·47million.Ineachofthethreemonthsfollowingthat,thecontinuingreductioninaccountsreceivabledayswillimprovethebankbalanceby$270,000permonth.Withoutfurtherinformationonoperatingreceiptsandpayments,itcannotbeforecastwhetherthebankbalancewillreturntolessthanthelimit,orevencontinuetoimprove.Themainreasonfortheproblemwiththebankbalanceisthe$2millioncapitalexpenditure.Purchaseofnon-currentassetsshouldnotbefinancedbyanoverdraft,butalong-termsourceoffinancesuchasequityorbonds.Ifthecapitalexpenditurewereremovedfromtheareaofworkingcapitalmanagement,theoverdraftbalanceattheendofthreemonthswouldbe$3·48millionifnoactionweretakenand$2·05millionifthefinancedirector’sproposalswereimplemented.GiventhatHGRCohasalmost$50millionofnon-currentassetsthatcouldpossiblybeusedassecurity,raisinglong-termdebtthrougheitherabankloanorabondissueappearstobesensible.Assumingabondinterestrateof10%peryear,currentlong-termdebtintheform.oftradedbondsisapproximately($200mx2)/0·1=$4m,whichismuchlessthantheamountofnoncurrentassets.AsuitablecourseofactionforHGRCotofollowwouldthereforebe,firstly,toimplementthefinancedirector’sproposalsand,secondly,tofinancethecapitalexpenditurefromalong-termsource.Considerationcouldalsobegiventousingsomelong-termdebtfinancetoreducetheoverdraftandtoreducethelevelofaccountspayable,currentlystandingat100days.(c)Whencreditisgrantedtoforeigncustomers,twoproblemsmaybecomeespeciallysignificant.First,thelongerdistancesoverwhichtradetakesplaceandthemorecomplexnatureoftradetransactionsandtheirelementsmeansforeignaccountsreceivableneedmoreinvestmentthantheirdomesticcounterparts.Longertransactiontimesincreaseaccountsreceivablebalancesandhencetheleveloffinancingandfinancingcosts.Second,theriskofbaddebtsishigherwithforeignaccountsreceivablethanwiththeirdomesticcounterparts.Inordertomanageandreducecreditrisks,therefore,exportersseektoreducetheriskofbaddebtandtoreducethelevelofinvestmentinforeignaccountsreceivable.Manyforeigntransactionsareon‘openaccount’,whichisanagreementtosettletheamountoutstandingonapredetermineddate.Openaccountreflectsagoodbusinessrelationshipbetweenimporterandexporter.Italsocarriesthehighestriskofnon-payment.Onewaytoreduceinvestmentinforeignaccountsreceivableistoagreeearlypaymentwithanimporter,forexamplebypaymentinadvance,paymentonshipment,orcashondelivery.Thesetermsoftradeareunlikelytobecompetitive,however,anditismorelikelythatanexporterwillseektoreceivecashinadvanceofpaymentbeingmadebythecustomer.Onewaytoacceleratecashreceiptsistousebillfinance.Billsofexchangewithasignedagreementtopaytheexporteronanagreedfuturedate,supportedbyadocumentaryletterofcredit,canbediscountedbyabanktogiveimmediatefunds.Thisdiscountingiswithoutrecourseifbillsofexchangehavebeencountersignedbytheimporter’sbank.Documentarylettersofcreditareapaymentguaranteebackedbyoneormorebanks.Theycarryalmostnorisk,providedtheexportercomplieswiththetermsandconditionscontainedintheletterofcredit.Theexportermustpresentthedocumentsstatedintheletter,suchasbillsoflading,shippingdocuments,billsofexchange,andsoon,whenseekingpayment.Aseachsupportingdocumentrelatestoakeyaspectoftheoveralltransaction,lettersofcreditgivesecuritytotheimporteraswellastheexporter.Companiescanalsomanageandreduceriskbygatheringappropriateinformationwithwhichtoassessthecreditworthinessofnewcustomers,suchasbankreferencesandcreditreports.Insurancecanalsobeusedtocoversomeoftherisksassociatedwithgivingcredittoforeigncustomers.Thiswouldavoidthecostofseekingtorecovercashduefromforeignaccountsreceivablethroughaforeignlegalsystem,wheretheexportercouldbeatadisadvantageduetoalackoflocalorspecialistknowledge.Exportfactoringcanalsobeconsidered,wheretheexporterpaysforthespecialistexpertiseofthefactorasawayofreducinginvestmentinforeignaccountsreceivableandreducingtheincidenceofbaddebts. -

第18题:

The time interval between the transmission of signals from a pair of Loran-C stations is very closely controlled and operates with ______.

A.An atomic time standard

B.Daylight Savings Time

C.Eastern Standard Time

D.Greenwich Mean Time

正确答案:A

-

第19题:

The earliest telephones required a different pair of wires for each phone ___ you wished to connect.A.that

B.which

C.where

D.to which答案:D解析:本题考察定语从句。题目意为“最早的电话需要一对不同的线路分别给本机和想要接通的电话。”本题是介词+关系代词形式,connect表示连接二者时,需要介词,connect sb/sth with/to sth。关系代词which在定语从句中作介词的宾语时,可以跟介词一起放在主句和从句之间,这时的关系代词不能省略;有时为了使关系代词紧跟它所修饰的先行词,也可以把介词放在从句中有关动词的后面,这时的which可用that替换。

考点

定语从句 -

第20题:

Which of the following represents a wiring standard for twisted pair cables?()

- A、Fiber

- B、T568A

- C、IEEE1394

- D、CAT5

正确答案:B -

第21题:

问答题Kara attends a university where students study for an average (arithmetic mean) of 13.4 hours per week. How many hours per week does Kara study? (1) The standard deviation of study time at Kara’s school is 2.8. (2) Kara’s study time is one standard deviation away from the mean.正确答案: E解析:

(1)条件告诉了Kara学校学生学习时间的总标准差,无法计算Kara的学习时间数值;(2)条件指出Kara的学习时间距离平均数有两个标准差区间,不能确定其是高于还是低于平均值,故本题应选E项。 -

第22题:

单选题What is the minimum standard for making an eye splice in a wire to be used as cargo gear().AMake three tucks with full strands,remove half the wires from each strand,and make two more tucks

BMake four tucks in each strand,cut away every other strand,and make two more tucks with each remaining strand

CMake four tucks with each full strand

DMake six tucks with each strand,removing a few wires from each strand as each additional tuck is made

正确答案: D解析: 暂无解析 -

第23题:

单选题The customer service department had fewer complaints last quarter, which challenges the ______ that the quality of our product is worsening.Aattention

Bfunction

Cexception

Dperception

正确答案: B解析:

句意:上季度我们客户服务部接到的投诉很少,这有力驳斥了我们的产品质量下滑这种说法。本题考查词义辨析,根据上下文,此处意为“驳斥了…的说法、看法”,因此要用perception。attention专心,精神集中。function功能,用。exception除外,例外。