(c) insider dealing. (5 marks)

题目

(c) insider dealing. (5 marks)

相似考题

更多“(c) insider dealing. (5 marks)”相关问题

-

第1题:

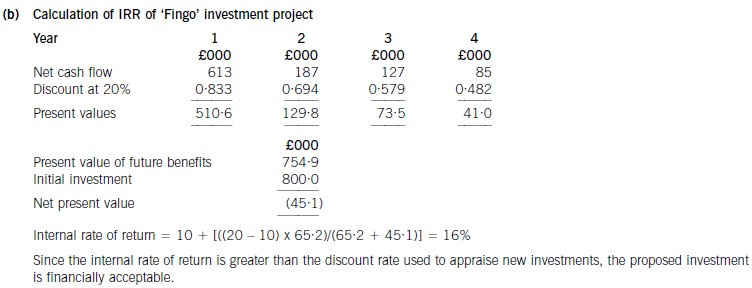

(b) Calculate the internal rate of return of the proposed investment and comment on your findings. (5 marks)

正确答案:

-

第2题:

(b) How can Maslow’s theory be applied to the motivation of staff? (5 marks)

正确答案:

(b) This theory is based on the idea that the goals of the individual and the organisation can be integrated and that personal satisfaction can be achieved through the workplace. It also assumes that individuals will achieve self-actualisation through their role in assisting the organisation to achieve its objectives. It follows therefore that work is the principal source of satisfaction.

The theory’s practical application is that managers should recognise that subordinates’ needs are always evolving and increasing, so continued attention to increasing the employees’ personal development, opportunities for advancement and recognition of achievement are essential to keep them motivated.

-

第3题:

(ii) job enlargement; (5 marks)

正确答案:

(ii) Job enlargement is often referred to as ‘horizontal job enlargement’ and is aimed at widening the content of jobs by increasing the number of operations in which the job holder is involved and is another method by which employees at Bailey’s might become more involved. It reduces the level of repetition and dullness by providing a horizontal extension to activity, reducing monotony and boredom inherent in the operations at Bailey’s.

-

第4题:

(e) Briefly provide five reasons to the management of Bailey’s why financial rewards could be considered to improve motivation. (5 marks)

正确答案:

(e) There are issues at Bailey’s as a consequence of poor pay. Although non-financial motivation has an important role to play in encouraging commitment, the fact remains that financial rewards act as a strong motivating factor, especially in what has been a low pay business. Financial rewards are all encompassing and apply to all employees at all levels, are universally applicable, able to satisfy all types of need and simple to apply and understand. At Bailey’s, financial rewards have a greater effect because they can provide recognition and prestige if pay is improved, are seen as the most important hygiene factor(especially in a business with a history of low pay and low morale) and are a measure of achievement against goals, especially if some form. of bonus or performance related pay is introduced by the new management at Bailey’s. In addition, financial rewards are a basis for satisfaction and are often used as a form. of professional or social comparison outside the organisation.

-

第5题:

(c) Briefly describe five factors to be taken into account when deciding whether to use recruitment consultants.(5 marks)

正确答案:

(c) An organisation considering the use of external recruitment consultants would make its decision upon the availability, level and appropriateness of expertise available within the host organisation and its likely effectiveness, together with the cost of using consultants set against the cost of using the organisation’s own staff. The organisation should consider the level of expertise required of potential employees and therefore the appropriate knowledge required of the consultants and the need for impartiality or security which may be of particular importance for some organisations. In addition, the views of internal staff as to the likely effect of using outside consultants must be considered, as is the effect the use of consultants might have on the need to develop expertise within the organisation.

-

第6题:

(ii) why the ‘fair value option’ was initially introduced and why it has caused such concern. (5 marks)

正确答案:

(ii) Fair value option

As set out above, the standard permits entities to designate irrevocably on initial recognition any financial asset or liability

as one to be measured at fair value with gains and losses recognised in profit or loss. The fair value option was generally

introduced to reduce profit or loss volatility as it can be used to measure an economically matched position in the same

way (at fair value). Additionally it can be used in place of IAS 39’s requirement to separate embedded derivatives as

the entire contract is measured at fair value with changes reported in profit or loss.

Although the fair value option can be of use, it can be used in an inappropriate manner thus defeating its original

purpose. For example, companies might apply the option to instruments whose fair value is difficult to estimate so as

to smooth profit or loss as valuation of these instruments might be subjective. Also the use of this option might increase

rather than decrease volatility in profit or loss where, for example, a company applies the option to only one part of a

‘matched’ position. Finally, if a company applied the option to financial liabilities, it might result in the company

recognising gains or losses for changes in its own credit worthiness.

The IASB has issued an exposure draft amending IAS 39 in this area restricting the financial assets and liabilities to

which the fair value option can be applied.

I hope that the above information is useful.

-

第7题:

(c) Define ‘retirement by rotation’ and explain its importance in the context of Rosh and Company.

(5 marks)

正确答案:

(c) Retirement by rotation.

Definition

Retirement by rotation is an arrangement in a director’s contract that specifies his or her contract to be limited to a specific

period (typically three years) after which he or she must retire from the board or offer himself (being eligible) for re-election.

The director must be actively re-elected back onto the board to serve another term. The default is that the director retires

unless re-elected.

Importance of

Retirement by rotation reduces the cost of contract termination for underperforming directors. They can simply not be

re-elected after their term of office expires and they will be required to leave the service of the board as a retiree (depending

on contract terms).

It encourages directors’ performance (they know they are assessed by shareholders and reconsidered every three years) and

focuses their minds upon the importance of meeting objectives in line with shareholders’ aims.

It is an opportunity, over time, to replace the board membership whilst maintaining medium term stability of membership

(one or two at a time).

Applied to Rosh

Retirement by rotation would enable the board of Rosh to be changed over time. There is evidence that some directors may

have stayed longer than is ideal because of links with other board members going back many years. -

第8题:

(c) Discuss the practical problems that may be encountered in the implementation of an activity-based system

of product cost management. (5 marks)

正确答案:

(c) The benefits of an activity-based system as the basis for product cost/profit estimation may not be straightforward. A number

of problems may be identified.

The selection of relevant activities and cost drivers may be complicated where there are many activities and cost drivers in

complex business situations.

There may be difficulty in the collection of data to enable accurate cost driver rates to be calculated. This is also likely to

require an extensive data collection and analysis system.

The problem of ‘cost driver denominator level’ may also prove difficult. This is similar to the problem in a traditional volume

related system. This is linked to the problem of fixed/variable cost analysis. For example the cost per batch may be fixed. Its

impact may be reduced, however, where the batch size can be increased without a proportionate increase in cost.

The achievement of the required level of management skill and commitment to change may also detract from the

implementation of the new system. Management may feel that the activity based approach contains too many assumptions

and estimates about activities and cost drivers. There may be doubt as to the degree of increased accuracy which it provides.

(alternative relevant examples and discussion would be acceptable) -

第9题:

(iii) Whether or not you agree with the statement of the marketing director in note (9) above. (5 marks)

Professional marks for appropriateness of format, style. and structure of the report. (4 marks)

正确答案:(iii) The marketing director is certainly correct in recognising that success is dependent on levels of service quality provided

by HFG to its clients. However, whilst the number of complaints is an important performance measure, it needs to be

used with caution. The nature of a complaint is, very often, far more indicative of the absence, or a lack, of service

quality. For example, the fact that 50 clients complained about having to wait for a longer time than they expected to

access gymnasium equipment is insignificant when compared to an accident arising from failure to maintain properly a

piece of gymnasium equipment. Moreover, the marketing director ought to be aware that the absolute number of

complaints may be misleading as much depends on the number of clients serviced during any given period. Thus, in

comparing the number of complaints received by the three centres then a relative measure of complaints received per

1,000 client days would be far more useful than the absolute number of complaints received.

The marketing director should also be advised that the number of complaints can give a misleading picture of the quality

of service provision since individuals have different levels of willingness to complain in similar situations.

The marketing director seems to accept the current level of complaints but is unwilling to accept any increase above this

level. This is not indicative of a quality-oriented organisation which would seek to reduce the number of complaints over

time via a programme of ‘continuous improvement’.

From the foregoing comments one can conclude that it would be myopic to focus on the number of client complaints

as being the only performance measure necessary to measure the quality of service provision. Other performance

measures which may indicate the level of service quality provided to clients by HFG are as follows:

– Staff responsiveness assumes critical significance in service industries. Hence the time taken to resolve client

queries by health centre staff is an important indicator of the level of service quality provided to clients.

– Staff appearance may be viewed as reflecting the image of the centres.

– The comfort of bedrooms and public rooms including facilities such as air-conditioning, tea/coffee-making and cold

drinks facilities, and office facilities such as e-mail, facsimile and photocopying.

– The availability of services such as the time taken to gain an appointment with a dietician or fitness consultant.

– The cleanliness of all areas within the centres will enhance the reputation of HFG. Conversely, unclean areas will

potentially deter clients from making repeat visits and/or recommendations to friends, colleagues etc.

– The presence of safety measures and the frequency of inspections made regarding gymnasium equipment within

the centres and compliance with legislation are of paramount importance in businesses like that of HFG.

– The achievement of target reductions in weight that have been agreed between centre consultants and clients.

(Other relevant measures would be acceptable.)

-

第10题:

In relation to the courts’ powers to interpret legislation, explain and differentiate between:

(a) the literal approach, including the golden rule; and (5 marks)

(b) the purposive approach, including the mischief rule. (5 marks)

正确答案:Tutorial note:

In order to apply any piece of legislation, judges have to determine its meaning. In other words they are required to interpret the

statute before them in order to give it meaning. The diffi culty, however, is that the words in statutes do not speak for themselves and

interpretation is an active process, and at least potentially a subjective one depending on the situation of the person who is doing

the interpreting.

Judges have considerable power in deciding the actual meaning of statutes, especially when they are able to deploy a number of

competing, not to say contradictory, mechanisms for deciding the meaning of the statute before them. There are, essentially, two

contrasting views as to how judges should go about determining the meaning of a statute – the restrictive, literal approach and the

more permissive, purposive approach.

(a) The literal approach

The literal approach is dominant in the English legal system, although it is not without critics, and devices do exist for

circumventing it when it is seen as too restrictive. This view of judicial interpretation holds that the judge should look primarily

to the words of the legislation in order to construe its meaning and, except in the very limited circumstances considered below,

should not look outside of, or behind, the legislation in an attempt to fi nd its meaning.

Within the context of the literal approach there are two distinct rules:

(i) The literal rule

Under this rule, the judge is required to consider what the legislation actually says rather than considering what it might

mean. In order to achieve this end, the judge should give words in legislation their literal meaning, that is, their plain,

ordinary, everyday meaning, even if the effect of this is to produce what might be considered an otherwise unjust or

undesirable outcome (Fisher v Bell (1961)) in which the court chose to follow the contract law literal interpretation of

the meaning of offer in the Act in question and declined to consider the usual non-legal literal interpretation of the word

(offer).(ii) The golden rule

This rule is applied in circumstances where the application of the literal rule is likely to result in what appears to the court

to be an obviously absurd result. It should be emphasised, however, that the court is not at liberty to ignore, or replace,

legislative provisions simply on the basis that it considers them absurd; it must fi nd genuine diffi culties before it declines

to use the literal rule in favour of the golden one. As examples, there may be two apparently contradictory meanings to a

particular word used in the statute, or the provision may simply be ambiguous in its effect. In such situations, the golden

rule operates to ensure that preference is given to the meaning that does not result in the provision being an absurdity.

Thus in Adler v George (1964) the defendant was found guilty, under the Offi cial Secrets Act 1920, with obstruction

‘in the vicinity’ of a prohibited area, although she had actually carried out the obstruction ‘inside’ the area.

(b) The purposive approach

The purposive approach rejects the limitation of the judges’ search for meaning to a literal construction of the words of

legislation itself. It suggests that the interpretative role of the judge should include, where necessary, the power to look beyond

the words of statute in pursuit of the reason for its enactment, and that meaning should be construed in the light of that purpose

and so as to give it effect. This purposive approach is typical of civil law systems. In these jurisdictions, legislation tends to set

out general principles and leaves the fi ne details to be fi lled in later by the judges who are expected to make decisions in the

furtherance of those general principles.

European Community (EC) legislation tends to be drafted in the continental manner. Its detailed effect, therefore, can only be

determined on the basis of a purposive approach to its interpretation. This requirement, however, runs counter to the literal

approach that is the dominant approach in the English system. The need to interpret such legislation, however, has forced

a change in that approach in relation to Community legislation and even with respect to domestic legislation designed to

implement Community legislation. Thus, in Pickstone v Freemans plc (1988), the House of Lords held that it was permissible,

and indeed necessary, for the court to read words into inadequate domestic legislation in order to give effect to Community

law in relation to provisions relating to equal pay for work of equal value. (For a similar approach, see also the House of Lords’

decision in Litster v Forth Dry Dock (1989) and the decision in Three Rivers DC v Bank of England (No 2) (1996).) However,

it has to recognise that the purposive rule is not particularly modern and has its precursor in a long established rule of statutory

interpretation, namely the mischief rule.The mischief rule

This rule permits the court to go behind the actual wording of a statute in order to consider the problem that the statute is

supposed to remedy.

In its traditional expression it is limited by being restricted to using previous common law rules in order to decide the operation

of contemporary legislation. Thus in Heydon’s case (1584) it was stated that in making use of the mischief rule the court

should consider what the mischief in the law was which the common law did not adequately deal with and which statute law

had intervened to remedy. Use of the mischief rule may be seen in Corkery v Carpenter (1950), in which a man was found

guilty of being drunk in charge of a carriage although he was in fact only in charge of a bicycle. -

第11题:

(b) (i) Explain the matters you should consider to determine whether capitalised development costs are

appropriately recognised; and (5 marks)

正确答案:

(b) (i) Materiality

The net book value of capitalised development costs represent 7% of total assets in 2007 (2006 – 7·7%), and is

therefore material. The net book value has increased by 13%, a significant trend.

The costs capitalised during the year amount to $750,000. If it was found that the development cost had been

inappropriately capitalised, the cost should instead have been expensed. This would reduce profit before tax by

$750,000, representing 42% of the year’s profit. This is highly material. It is therefore essential to gather sufficient

evidence to support the assertion that development costs should be recognised as an asset.

In 2007, $750,000 capitalised development costs have been incurred, when added to $160,000 research costs

expensed, total research and development costs are $910,000 which represents 20·2% of total revenue, again

indicating a high level of materiality for this class of transaction.

Relevant accounting standard

Development costs should only be capitalised as an intangible asset if the recognition criteria of IAS 38 Intangible Assets

have been demonstrated in full:

– Intention to complete the intangible asset and use or sell it

– Technical feasibility and ability to use or sell

– Ability to generate future economic benefit

– Availability of technical, financial and other resources to complete

– Ability to measure the expenditure attributable to the intangible asset.

Research costs must be expensed, as should development costs which do not comply with the above criteria. The

auditors must consider how Sci-Tech Co differentiates between research and development costs.

There is risk that not all of the criteria have been demonstrated, especially due to the subjective nature of the

development itself:

– Pharmaceutical development is highly regulated. If the government does not license the product then the product

cannot be sold, and economic benefits will therefore not be received.

– Market research should justify the commercial viability of the product. The launch of a rival product to Flortex

means that market share is likely to be much lower than anticipated, and the ability to sell Flortex is reduced. This

could mean that Flortex will not generate an overall economic benefit if future sales will not recover the research

and development costs already suffered, and yet to be suffered, prior to launch. The existence of the rival product

could indicate that Flortex is no longer commercially viable, in which case the capitalised development costs

relating to Flortex should be immediately expensed.

– The funding on which development is dependent may be withdrawn, indicating that there are not adequate

resources to complete the development of the products. Sci-Tech has failed to meet one of its required key

performance indicators (KPI) in the year ended 30 November 2007, as products valued at 0·8% revenue have

been donated to charity, whereas the required KPI is 1% revenue.

Given that there is currently a breach of the target KPIs, this is likely to result in funding equivalent to 25% of

research and development expenditure being withdrawn. If Sci-Tech Co is unable to source alternative means of

finance, then it would seem that adequate resources may not be available to complete the development of new

products. -

第12题:

单选题The International Association of Lighthouse authorities (IALA) buoyage system “A” uses some types of marks to distinguish safe navigation? Which type(s) does(do) not belong to the system?()Alateral marks and cardinal marks

Bsafe water marks

Cisolated danger marks and special marks

Ddangerous water marks

正确答案: B解析: 暂无解析 -

第13题:

(ii) the panel interview with more than one interviewer. (5 marks)

正确答案:

(ii) Panel interviews are often used for senior appointments and consist of two or more interviewers.The advantages of such interviews are that they allow opinion and views to be shared amongst the panel. They provide a more complete and coherent approach, hence problems of bias inherent in face to face interviews can be reduced.

They may also be appropriate where an individual with specialist or technical skills has to support the interviewer in relation to assessing the technical competencies of the interviewee.The disadvantages are that panel interviews can be difficult to control, interviewers may deviate or ask irrelevant questions and they can be easily dominated by a strong personality who is able unduly to influence others. In addition,

such interviews can often result in disagreement amongst the panel members. -

第14题:

(d) Explain to the management of Bailey’s why consideration should be given to resolving the problems through:

(i) job rotation; (5 marks)

正确答案:

(d) (i) Job rotation is the planned rotation of staff between jobs and tasks to reduce monotony and boredom and provide fresh opportunities and challenges. This could be a useful way of encouraging employees at Bailey’s alongside enrichment and enlargement. Rotation would encourage better understanding between employees at Bailey’s. It takes two forms,the transfer to another job after some time in an existing job and the introduction of another individual to the job being vacated, or as a form. of training where individuals are moved through different jobs to learn new skills.

-

第15题:

(iii) job enrichment. (5 marks)

正确答案:

(iii) Job enrichment, which is often referred to as ‘vertical job enlargement’, is a planned, deliberate action to build greater responsibility, breadth and challenge into the work of the individual. The emphasis is on the individual rather than the organisation, team or group. This may be a way forward for some of Bailey’s employees since it provides the individual employee with the responsibility for decision making of a higher order, provides greater freedom to decide how the job or task should be undertaken, improves understanding of the entire process, encourages participation in the planning and production procedures and provides regular feedback to management – urgently needed at Bailey’s.

-

第16题:

(b) Describe the advantages of external recruitment. (5 marks)

正确答案:

(b) External recruitment describes the situation where the organisation decides to fill a staff vacancy and recruit from outside the organisation.

It may be essential if particular skills or expertise are not already available within the organisation and is necessary to restore depleted staffing levels or when for some reason the organisation urgently needs new employees. New staff members bring new ideas and novel approaches to the organisation and to the specific task, often providing experience and work methods from other employers.

-

第17题:

5 All managers need to understand the importance of motivation in the workplace.

Required:

(a) Explain the ‘content theory’ of motivation. (5 marks)

正确答案:

5 The way in which managers treat their employees can significantly influence the satisfaction that the employees derive from their work and thus the overall success of the organisation. Understanding the importance of motivation is therefore an important management skill.

(a) Content theories address the question ‘What are the things that motivate people?’

Content theories are also called need theories (because they concentrate on the needs fulfilled by work) and are based on the notion that all human beings have a set of needs or required outcomes, and according to this theory, these needs can be satisfied through work. The theory focuses on what arouses, maintains and regulates good, directed behaviour and what specific individual forces motivate people. However, content theories assume that everyone responds to motivating factors in the same way and that consequently there is one, best way to motivate everybody.

-

第18题:

(c) Discuss the ethical responsibility of the company accountant in ensuring that manipulation of the statement

of cash flows, such as that suggested by the directors, does not occur. (5 marks)

Note: requirements (b) and (c) include 2 professional marks in total for the quality of the discussion.

正确答案:

(c) Companies can give the impression that they are generating more cash than they are, by manipulating cash flow. The way

in which acquisitions, loans and, as in this case, the sale of assets, is shown in the statement of cash flows, can change the

nature of operating cash flow and hence the impression given by the financial statements. The classification of cash flows

can give useful information to users and operating cash flow is a key figure. The role of ethics in the training and professional

lives of accountants is extremely important. Decision-makers expect the financial statements to be true and fair and fairly

represent the underlying transactions.

There is a fine line between deliberate misrepresentation and acceptable presentation of information. Pressures on

management can result in the misrepresentation of information. Financial statements must comply with International

Financial Reporting Standards (IFRS), the Framework and local legislation. Transparency, and full and accurate disclosure is

important if the financial statements are not to be misleading. Accountants must possess a high degree of professional

integrity and the profession’s reputation depends upon it. Ethics describe a set of moral principles taken as a reference point.

These principles are outside the technical and practical application of accounting and require judgement in their application.

Professional accountancy bodies set out ethical guidelines within which their members operate covering standards of

behaviour, and acceptable practice. These regulations are supported by a number of codes, for example, on corporate

governance which assist accountants in making ethical decisions. The accountant in Warrburt has a responsibility not to mask

the true nature of the statement of cash flow. Showing the sale of assets as an operating cash flow would be misleading if

the nature of the transaction was masked. Users of financial statements would not expect its inclusion in this heading and

could be misled. The potential misrepresentation is unacceptable. The accountant should try and persuade the directors to

follow acceptable accounting principles and comply with accounting standards. There are implications for the truth and

fairness of the financial statements and the accountant should consider his position if the directors insist on the adjustments

by pointing the inaccuracies out to the auditors. -

第19题:

(c) Explain how the use of activity-based techniques may benefit Taliesin Ltd. (5 marks)

正确答案:

(c) The usefulness of activity-based techniques is accentuated in situations where overheads comprise a significant proportion of

product costs. Manufacturing overheads comprise 30·9% of turnover during the year ended 31 May 2005. Traditional

methods of allocating overheads to products might result in product cost information which is misleading and detrimental to

managerial decision-making. Calculations of product costs are more prone to error in situations where higher levels of

overhead exist. The consequences can prove disastrous as, for example, in the under-pricing or over-pricing of products.

Since Taliesin Ltd is going to confine its activities to its home country it must be prepared to face increased competition and

this increases the need for greater visibility and more accurate product cost information.

At present, Taliesin Ltd offers a range of products which is increasing in number and this may lead to the need for a more

detailed costing system. Traditional absorption systems might well be inadequate as the number of product variants increases.

One would expect that each new product developed is more complex than its predecessors. The company would probably

start with simple Vanilla, then a few basic flavours but as Taliesin Ltd has expanded one would expect it to take longer to

originate and test new products until they are ready to be introduced. It will probably take longer to mix the ingredients for a

run of each product.

These two, development and mixing ingredients, are examples of activities which arise when new products are considered.

If traditional absorption costing and budgeting are used based on machine-time in production then the effect of these activities

would be ignored.

In order to gain a full appreciation of the impact of new product introduction activity-based techniques should be used to

guide Taliesin Ltd into the easiest way to maintain its policy of growth. It may be a better decision to expand abroad or into

new markets at home with the existing products than pursue growth by introducing new products to a dwindling number of

customers.

We are not told of the composition of the customer base of Taliesin Ltd. However, one thing we do know is that the scope of

activity-based techniques extends beyond products and services. For example, the application of activity-based costing can

provide vital information that enables management to undertake customer profitability analysis, thereby further improving

management decision-making and operating performance.

-

第20题:

(iv) critiques the performance measurement system at TSC. (5 marks

正确答案:

(iv) The performance measurement system used by TSC appears simplistic. However, it may be considered to be measuring

the right things since the specific measures used cover a range of dimensions designed to focus the organisation on

factors thought to be central to corporate success, and not confined to traditional financial measures.

Internal benchmarking is used at TSC in order to provide sets of absolute standards that all depots are expected to attain.

This should help to ensure that there is a continual focus upon the adoption of ‘best practice’ at all depots. Benchmarks

on delivery performance place an emphasis upon quality of service whereas benchmarks on profitability are focused

solely upon profitability!

Incentive schemes are used throughout the business, linking the achievement of company targets with financial rewards.

It might well be the case that the profit incentive would act as a powerful motivator to each depot management team.

However, what is required for the prosperity of TSC is a focus of management on the determinants of success as opposed

to the results of success.

(Alternative relevant discussion would be acceptable) -

第21题:

(c) mandatory continuing professional development (CPD) requirements. (5 marks)

正确答案:(c) Continuing Professional Development (CPD)

CPD is defined5 as ‘the continuous maintenance, development and enhancement of the professional and personal knowledge

and skills which members of ACCA require throughout their working lives’.

All professional accountants need to maintain their competence and develop new skills to be effective in their current and

future employment. CPD helps keep accountants in practice employable and maintains their reputation with employers,

clients and the public. It also helps maintain the accounting profession’s reputation for producing and supporting high calibre

individuals. Therefore, CPD is something which professional accountants should take personal responsibility for, and be doing

as part of their everyday work.Mandatory CPD for active members of IFAC member bodies (such as ACCA) was introduced with effect from 1 January 2005

onwards. ACCA has introduced CPD as a requirement for all active members, subject to the phasing-in dates (and waivers).

Tutorial note: IFAC issued International Education Standard (IES) 7, which requires the introduction of CPD for all active

members of IFAC member bodies.

ACCA practising certificate and insolvency licence holders are still required to participate in technical CPD training. All other

members will also be asked to state on their annual CPD return that they maintain competence in professional ethics.

The scheme is being introduced in phases:

■ phase 1 (2005) – members admitted since 1 January 2001, and all practising certificate and insolvency licence

holders;

■ phase 2 (2006) – members admitted between 1 January 1995 and 31 December 2000;

■ phase 3 (2007) – all remaining members.

Tutorial note: However, ACCA encouraged all members to adopt the scheme from 1 January 2005.

Affiliates join the CPD scheme on 1 January following their date of admittance to membership.

There are two routes to participation in ACCA’s CPD scheme:

(1) the unit scheme route (40 units approximate to 40 hours required each year); and

(2) the approved CPD employer route (i.e. where employers are recognised as effectively providing ACCA members with

CPD).

Tutorial note: Alternatively, if an ACCA member is also a member of another IFAC accounting body and that CPD scheme

is compliant with IFAC’s CPD IES 7, they may choose to follow that body’ s route. -

第22题:

In relation to company law, explain:

(a) the limitations on the use of company names; (4 marks)

(b) the tort of ‘passing off’; (4 marks)

(c) the role of the company names adjudicators under the Companies Act 2006. (2 marks)

正确答案:(a) Except in relation to specifically exempted companies, such as those involved in charitable work, companies are required to indicate that they are operating on the basis of limited liability. Thus private companies are required to end their names, either with the word ‘limited’ or the abbreviation ‘ltd’, and public companies must end their names with the words ‘public limited company’ or the abbreviation ‘plc’. Welsh companies may use the Welsh language equivalents (Companies Act (CA)2006 ss.58, 59 & 60).

Companies Registry maintains a register of business names, and will refuse to register any company with a name that is the same as one already on that index (CA 2006 s.66).

Certain categories of names are, subject to the decision of the Secretary of State, unacceptable per se, as follows:

(i) names which in the opinion of the Secretary of State constitute a criminal offence or are offensive (CA 2006 s.53)

(ii) names which are likely to give the impression that the company is connected with either government or local government authorities (s.54).

(iii) names which include a word or expression specified under the Company and Business Names Regulations 1981 (s.26(2)(b)). This category requires the express approval of the Secretary of State for the use of any of the names or expressions contained on the list, and relates to areas which raise a matter of public concern in relation to their use.

Under s.67 of the Companies Act 2006 the Secretary of State has power to require a company to alter its name under the following circumstances:

(i) where it is the same as a name already on the Registrar’s index of company names.

(ii) where it is ‘too like’ a name that is on that index.

The name of a company can always be changed by a special resolution of the company so long as it continues to comply with the above requirements (s.77).(b) The tort of passing off was developed to prevent one person from using any name which is likely to divert business their way by suggesting that the business is actually that of some other person or is connected in any way with that other business. It thus enables people to protect the goodwill they have built up in relation to their business activity. In Ewing v Buttercup

Margarine Co Ltd (1917) the plaintiff successfully prevented the defendants from using a name that suggested a link with

his existing dairy company. It cannot be used, however, if there is no likelihood of the public being confused, where for example the companies are conducting different businesses (Dunlop Pneumatic Tyre Co Ltd v Dunlop Motor Co Ltd (1907)

and Stringfellow v McCain Foods GB Ltd (1984). Nor can it be used where the name consists of a word in general use (Aerators Ltd v Tollitt (1902)).

Part 41 of the Companies Act (CA) 2006, which repeals and replaces the Business Names Act 1985, still does not prevent one business from using the same, or a very similar, name as another business so the tort of passing off will still have an application in the wider business sector. However the Act introduced a new procedure to deal specifically with company names. As previously under the CA 1985, a company cannot register with a name that was the same as any already registered (s.665 Companies Act (CA) 2006) and under CA s.67 the Secretary of State may direct a company to change its name if it has been registered in a name that is the same as, or too like a name appearing on the registrar’s index of company names. In addition, however, a completely new system of complaint has been introduced.(c) Under ss.69–74 of CA 2006 a new procedure has been introduced to cover situations where a company has been registered with a name

(i) that it is the same as a name associated with the applicant in which he has goodwill, or

(ii) that it is sufficiently similar to such a name that its use in the United Kingdom would be likely to mislead by suggesting a connection between the company and the applicant (s.69).

Section 69 can be used not just by other companies but by any person to object to a company names adjudicator if a company’s name is similar to a name in which the applicant has goodwill. There is list of circumstances raising a presumption that a name was adopted legitimately, however even then, if the objector can show that the name was registered either, to obtain money from them, or to prevent them from using the name, then they will be entitled to an order to require the company to change its name.

Under s.70 the Secretary of State is given the power to appoint company names adjudicators and their staff and to finance their activities, with one person being appointed Chief Adjudicator.

Section 71 provides the Secretary of State with power to make rules for the proceedings before a company names adjudicator.

Section 72 provides that the decision of an adjudicator and the reasons for it, are to be published within 90 days of the decision.

Section 73 provides that if an objection is upheld, then the adjudicator is to direct the company with the offending name to change its name to one that does not similarly offend. A deadline must be set for the change. If the offending name is not changed, then the adjudicator will decide a new name for the company.

Under s.74 either party may appeal to a court against the decision of the company names adjudicator. The court can either uphold or reverse the adjudicator’s decision, and may make any order that the adjudicator might have made. -

第23题:

What was the price of US dollar against mark on Monday?

A.1.53 marks.

B.1.57 marks.

C.1.55 marks.

D.122.75 yen.

正确答案:B

解析:文章第二段最后一句提到On Monday trading, technical factor...as low as 1.57 marks。在星期一的交易中,由于技术的原因导致美元进一步下跌,只得以低于1.57marks的价格上市。