(b) State the enquiries you would make of the directors of Mulligan Co to ascertain the adequacy of the$3 million finance requested for the new production facility. (7 marks)

题目

(b) State the enquiries you would make of the directors of Mulligan Co to ascertain the adequacy of the

$3 million finance requested for the new production facility. (7 marks)

相似考题

更多“(b) State the enquiries you would make of the directors of Mulligan Co to ascertain the adequacy of the$3 million finance requested for the new production facility. (7 marks)”相关问题

-

第1题:

(ii) State the taxation implications of both equity and loan finance from the point of view of a company.

(3 marks)

正确答案:

(ii) A company needs to be aware of the following issues:

Equity

(1) Costs incurred in issuing share capital are not allowed as a trading deduction.

(2) Distributions to investors are not allowed as a trading deduction.

(3) The cost of making distributions to shareholders are disallowable.

(4) Where profits are taxed at an effective rate of less than 19%, any profits used to make a distribution to noncorporate

shareholders will themselves be taxed at the full 19% rate.

Loan finance/debt

(1) The incidental costs of obtaining/raising loan finance are broadly deductible as a trading expense.

(2) Capital costs of raising loan finance (for example, loans issued at a discount) are not deductible for tax purposes.

(3) Interest incurred on a loan to finance a business is deductible from trading income. -

第2题:

(c) State the specific inquiries you should make of Robson Construction Co’s management relevant to its

accounting for construction contracts. (6 marks)

正确答案:

(c) Specific inquiries – accounting for construction contracts

Tutorial note: This answer is illustrative of the types of inquiry that should be made. Other relevant answer points will be

awarded similar credit. For each full mark to be earned an inquiry should address the specifics of Robson (e.g. that its

accounting policies are ‘generally less prudent’). The identification of asset overstatement/liability understatement may

reduce the purchase price offered by Prescott.

■ Are any constructions being undertaken without signed contracts?

Tutorial note: Any expenditure on constructions without contracts (e.g. of a speculative nature, perhaps to keep the

workforce employed) must be accounted for under IAS ‘Inventories’; revenue cannot be recognised nor profit taken.

■ Is full provision made for future losses foreseen on loss-making contracts?

Tutorial note: The information in the brief is that ‘provisions are made’. The level of provision is not indicated and

could be less than full.

■ Which contracts started during the year are likely to be/have been identified as loss-making (for which no provision has

yet been made)?

Tutorial note: Profits and losses are only determined by contract at each financial year end.

■ What are management’s assumptions and judgments on the likely future outcome on the Sarwar contract (and other

actual and contingent liabilities)?

Tutorial note: Robson would be imprudent if it underestimates the probability of an unfavourable outcome (or

overestimates the likelihood of successful recourse).

■ What claims history has Robson experienced? (What proportion of contracts have been subject to claims? What

proportion of claims brought have been successful? How have they been settled? Under insurance? Out-of-court

settlement?) How effective are the penalty clauses? (Is Robson having to pay penalties for overrunning on contracts?)

■ What are the actual useful lives of assets used in construction? What level of losses are made on disposal?

Tutorial note: If such assets are depreciated over useful lives that are estimated to be too long, depreciation costs

incurred to date (and estimated depreciation to be included in costs to completion) will be understated. This will result

in too much profit/too little loss being calculated on contracts.

■ What is the cause of losses on contracts? For example, if due to theft of building supplies Robson’s management is not

exercising sufficient control over the company’s assets. -

第3题:

(b) You are the audit manager of Johnston Co, a private company. The draft consolidated financial statements for

the year ended 31 March 2006 show profit before taxation of $10·5 million (2005 – $9·4 million) and total

assets of $55·2 million (2005 – $50·7 million).

Your firm was appointed auditor of Tiltman Co when Johnston Co acquired all the shares of Tiltman Co in March

2006. Tiltman’s draft financial statements for the year ended 31 March 2006 show profit before taxation of

$0·7 million (2005 – $1·7 million) and total assets of $16·1 million (2005 – $16·6 million). The auditor’s

report on the financial statements for the year ended 31 March 2005 was unmodified.

You are currently reviewing two matters that have been left for your attention on the audit working paper files for

the year ended 31 March 2006:

(i) In December 2004 Tiltman installed a new computer system that properly quantified an overvaluation of

inventory amounting to $2·7 million. This is being written off over three years.

(ii) In May 2006, Tiltman’s head office was relocated to Johnston’s premises as part of a restructuring.

Provisions for the resulting redundancies and non-cancellable lease payments amounting to $2·3 million

have been made in the financial statements of Tiltman for the year ended 31 March 2006.

Required:

Identify and comment on the implications of these two matters for your auditor’s reports on the financial

statements of Johnston Co and Tiltman Co for the year ended 31 March 2006. (10 marks)

正确答案:

(b) Tiltman Co

Tiltman’s total assets at 31 March 2006 represent 29% (16·1/55·2 × 100) of Johnston’s total assets. The subsidiary is

therefore material to Johnston’s consolidated financial statements.

Tutorial note: Tiltman’s profit for the year is not relevant as the acquisition took place just before the year end and will

therefore have no impact on the consolidated income statement. Calculations of the effect on consolidated profit before

taxation are therefore inappropriate and will not be awarded marks.

(i) Inventory overvaluation

This should have been written off to the income statement in the year to 31 March 2005 and not spread over three

years (contrary to IAS 2 ‘Inventories’).

At 31 March 2006 inventory is overvalued by $0·9m. This represents all Tiltmans’s profit for the year and 5·6% of

total assets and is material. At 31 March 2005 inventory was materially overvalued by $1·8m ($1·7m reported profit

should have been a $0·1m loss).

Tutorial note: 1/3 of the overvaluation was written off in the prior period (i.e. year to 31 March 2005) instead of $2·7m.

That the prior period’s auditor’s report was unmodified means that the previous auditor concurred with an incorrect

accounting treatment (or otherwise gave an inappropriate audit opinion).

As the matter is material a prior period adjustment is required (IAS 8 ‘Accounting Policies, Changes in Accounting

Estimates and Errors’). $1·8m should be written off against opening reserves (i.e. restated as at 1 April 2005).

(ii) Restructuring provision

$2·3m expense has been charged to Tiltman’s profit and loss in arriving at a draft profit of $0·7m. This is very material.

(The provision represents 14·3% of Tiltman’s total assets and is material to the balance sheet date also.)

The provision for redundancies and onerous contracts should not have been made for the year ended 31 March 2006

unless there was a constructive obligation at the balance sheet date (IAS 37 ‘Provisions, Contingent Liabilities and

Contingent Assets’). So, unless the main features of the restructuring plan had been announced to those affected (i.e.

redundancy notifications issued to employees), the provision should be reversed. However, it should then be disclosed

as a non-adjusting post balance sheet event (IAS 10 ‘Events After the Balance Sheet Date’).

Given the short time (less than one month) between acquisition and the balance sheet it is very possible that a

constructive obligation does not arise at the balance sheet date. The relocation in May was only part of a restructuring

(and could be the first evidence that Johnston’s management has started to implement a restructuring plan).

There is a risk that goodwill on consolidation of Tiltman may be overstated in Johnston’s consolidated financial

statements. To avoid the $2·3 expense having a significant effect on post-acquisition profit (which may be negligible

due to the short time between acquisition and year end), Johnston may have recognised it as a liability in the

determination of goodwill on acquisition.

However, the execution of Tiltman’s restructuring plan, though made for the year ended 31 March 2006, was conditional

upon its acquisition by Johnston. It does not therefore represent, immediately before the business combination, a

present obligation of Johnston. Nor is it a contingent liability of Johnston immediately before the combination. Therefore

Johnston cannot recognise a liability for Tiltman’s restructuring plans as part of allocating the cost of the combination

(IFRS 3 ‘Business Combinations’).

Tiltman’s auditor’s report

The following adjustments are required to the financial statements:

■ restructuring provision, $2·3m, eliminated;

■ adequate disclosure of relocation as a non-adjusting post balance sheet event;

■ current period inventory written down by $0·9m;

■ prior period inventory (and reserves) written down by $1·8m.

Profit for the year to 31 March 2006 should be $3·9m ($0·7 + $0·9 + $2·3).

If all these adjustments are made the auditor’s report should be unmodified. Otherwise, the auditor’s report should be

qualified ‘except for’ on grounds of disagreement. If none of the adjustments are made, the qualification should still be

‘except for’ as the matters are not pervasive.

Johnston’s auditor’s report

If Tiltman’s auditor’s report is unmodified (because the required adjustments are made) the auditor’s report of Johnston

should be similarly unmodified. As Tiltman is wholly-owned by Johnston there should be no problem getting the

adjustments made.

If no adjustments were made in Tiltman’s financial statements, adjustments could be made on consolidation, if

necessary, to avoid modification of the auditor’s report on Johnston’s financial statements.

The effect of these adjustments on Tiltman’s net assets is an increase of $1·4m. Goodwill arising on consolidation (if

any) would be reduced by $1·4m. The reduction in consolidated total assets required ($0·9m + $1·4m) is therefore

the same as the reduction in consolidated total liabilities (i.e. $2·3m). $2·3m is material (4·2% consolidated total

assets). If Tiltman’s financial statements are not adjusted and no adjustments are made on consolidation, the

consolidated financial position (balance sheet) should be qualified ‘except for’. The results of operations (i.e. profit for

the period) should be unqualified (if permitted in the jurisdiction in which Johnston reports).

Adjustment in respect of the inventory valuation may not be required as Johnston should have consolidated inventory

at fair value on acquisition. In this case, consolidated total liabilities should be reduced by $2·3m and goodwill arising

on consolidation (if any) reduced by $2·3m.

Tutorial note: The effect of any possible goodwill impairment has been ignored as the subsidiary has only just been

acquired and the balance sheet date is very close to the date of acquisition. -

第4题:

3 You are the manager responsible for the audit of Lamont Co. The company’s principal activity is wholesaling frozen

fish. The draft consolidated financial statements for the year ended 31 March 2007 show revenue of $67·0 million

(2006 – $62·3 million), profit before taxation of $11·9 million (2006 – $14·2 million) and total assets of

$48·0 million (2006 – $36·4 million).

The following issues arising during the final audit have been noted on a schedule of points for your attention:

(a) In early 2007 a chemical leakage from refrigeration units owned by Lamont caused contamination of some of its

property. Lamont has incurred $0·3 million in clean up costs, $0·6 million in modernisation of the units to

prevent future leakage and a $30,000 fine to a regulatory agency. Apart from the fine, which has been expensed,

these costs have been capitalised as improvements. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Lamont Co for the year ended

31 March 2007.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

3 LAMONT CO

(a) Chemical leakage

(i) Matters

■ $30,000 fine is very immaterial (just 1/4% profit before tax). This is revenue expenditure and it is correct that it

has been expensed to the income statement.

■ $0·3 million represents 0·6% total assets and 2·5% profit before tax and is not material on its own. $0·6 million

represents 1·2% total assets and 5% profit before tax and is therefore material to the financial statements.

■ The $0·3 million clean-up costs should not have been capitalised as the condition of the property is not improved

as compared with its condition before the leakage occurred. Although not material in isolation this amount should

be adjusted for and expensed, thereby reducing the aggregate of uncorrected misstatements.

■ It may be correct that $0·6 million incurred in modernising the refrigeration units should be capitalised as a major

overhaul (IAS 16 Property, Plant and Equipment). However, any parts scrapped as a result of the modernisation

should be treated as disposals (i.e. written off to the income statement).

■ The carrying amount of the refrigeration units at 31 March 2007, including the $0·6 million for modernisation,

should not exceed recoverable amount (i.e. the higher of value in use and fair value less costs to sell). If it does,

an allowance for the impairment loss arising must be recognised in accordance with IAS 36 Impairment of Assets.

(ii) Audit evidence

■ A breakdown/analysis of costs incurred on the clean-up and modernisation amounting to $0·3 million and

$0·6 million respectively.

■ Agreement of largest amounts to invoices from suppliers/consultants/sub-contractors, etc and settlement thereof

traced from the cash book to the bank statement.

■ Physical inspection of the refrigeration units to confirm their modernisation and that they are in working order. (Do

they contain frozen fish?)

■ Sample of components selected from the non-current asset register traced to the refrigeration units and inspected

to ensure continuing existence.

■ $30,000 penalty notice from the regulatory agency and corresponding cash book payment/payment per the bank

statement.

■ Written management representation that there are no further penalties that should be provided for or disclosed other

than the $30,000 that has been accounted for. -

第5题:

(b) You are the manager responsible for the audit of Poppy Co, a manufacturing company with a year ended

31 October 2008. In the last year, several investment properties have been purchased to utilise surplus funds

and to provide rental income. The properties have been revalued at the year end in accordance with IAS 40

Investment Property, they are recognised on the statement of financial position at a fair value of $8 million, and

the total assets of Poppy Co are $160 million at 31 October 2008. An external valuer has been used to provide

the fair value for each property.

Required:

(i) Recommend the enquiries to be made in respect of the external valuer, before placing any reliance on their

work, and explain the reason for the enquiries; (7 marks)

正确答案:

(b) (i) Enquiries in respect of the external valuer

Enquiries would need to be made for two main reasons, firstly to determine the competence, and secondly the objectivity

of the valuer. ISA 620 Using the Work of an Expert contains guidance in this area.

Competence

Enquiries could include:

– Is the valuer a member of a recognised professional body, for example a nationally or internationally recognised

institute of registered surveyors?

– Does the valuer possess any necessary licence to carry out valuations for companies?

– How long has the valuer been a member of the recognised body, or how long has the valuer been licensed under

that body?

– How much experience does the valuer have in providing valuations of the particular type of investment properties

held by Poppy Co?

– Does the valuer have specific experience of evaluating properties for the purpose of including their fair value within

the financial statements?

– Is there any evidence of the reputation of the valuer, e.g. professional references, recommendations from other

companies for which a valuation service has been provided?

– How much experience, if any, does the valuer have with Poppy Co?

Using the above enquiries, the auditor is trying to form. an opinion as to the relevance and reliability of the valuation

provided. ISA 500 Audit Evidence requires that the auditor gathers evidence that is both sufficient and appropriate. The

auditor needs to ensure that the fair values provided by the valuer for inclusion in the financial statements have been

arrived at using appropriate knowledge and skill which should be evidenced by the valuer being a member of a

professional body, and, if necessary, holding a licence under that body.

It is important that the fair values have been arrived at using methods allowed under IAS 40 Investment Property. If any

other valuation method has been used then the value recognised in the statement of financial position may not be in

accordance with financial reporting standards. Thus it is important to understand whether the valuer has experience

specifically in providing valuations that comply with IAS 40, and how many times the valuer has appraised properties

similar to those owned by Poppy Co.

In gauging the reliability of the fair value, the auditor may wish to consider how Poppy Co decided to appoint this

particular valuer, e.g. on the basis of a recommendation or after receiving references from companies for which

valuations had previously been provided.

It will also be important to consider how familiar the valuer is with Poppy Co’s business and environment, as a way to

assess the reliability and appropriateness of any assumptions used in the valuation technique.

Objectivity

Enquiries could include:

– Does the valuer have any financial interest in Poppy Co, e.g. shares held directly or indirectly in the company?

– Does the valuer have any personal relationship with any director or employee of Poppy Co?

– Is the fee paid for the valuation service reasonable and a fair, market based price?

With these enquiries, the auditor is gaining assurance that the valuer will perform. the valuation from an independent

point of view. If the valuer had a financial interest in Poppy Co, there would be incentive to manipulate the valuation in

a way best suited to the financial statements of the company. Equally if the valuer had a personal relationship with a

senior member of staff at Poppy Co, the valuer may feel pressured to give a favourable opinion on the valuation of the

properties.

The level of fee paid is important. It should be commensurate with the market rate paid for this type of valuation. If the

valuer was paid in excess of what might be considered a normal fee, it could indicate that the valuer was encouraged,

or even bribed, to provide a favourable valuation. -

第6题:

You are the manager responsible for performing hot reviews on audit files where there is a potential disagreement

between your firm and the client regarding a material issue. You are reviewing the going concern section of the audit

file of Dexter Co, a client with considerable cash flow difficulties, and other, less significant operational indicators of

going concern problems. The working papers indicate that Dexter Co is currently trying to raise finance to fund

operating cash flows, and state that if the finance is not received, there is significant doubt over the going concern

status of the company. The working papers conclude that the going concern assumption is appropriate, but it is

recommended that the financial statements should contain a note explaining the cash flow problems faced by the

company, along with a description of the finance being sought, and an evaluation of the going concern status of the

company. The directors do not wish to include the note in the financial statements.

Required:

(b) Consider and comment on the possible reasons why the directors of Dexter Co are reluctant to provide the

note to the financial statements. (5 marks)

正确答案:

(b) Directors reluctance to disclose

The directors are likely to have several reasons behind their reluctance to disclose the note as recommended by the audit

manager. The first is that the disclosure of Dexter Co’s poor cash flow position and perilous going concern status may reflect

badly on the directors themselves. The company’s shareholders and other stakeholders will be displeased to see the company

in such a poor position, and the directors will be held accountable for the problems. Of course it may not be the case that

the directors have exercised poor management of the company – the problems could be caused by external influences outside

the control of the directors. However, it is natural that the directors will not want to highlight the situation in order to protect

their own position.

Secondly, the note could itself trigger further financial distress for the company. Dexter Co is trying to raise finance, and it is

probable that the availability of further finance will be detrimentally affected by the disclosure of the company’s financial

problems. In particular, if the cash flow difficulties are highlighted, providers of finance will consider the company too risky

an investment, and are not likely to make funds available for fear of non-repayment. Existing lenders may seek repayment of

their funds in fear that the company may be unable in the future to meet repayments.

In addition, the disclosures could cause operational problems, for example, suppliers may curtail trading relationships as they

become concerned that they will not be paid, or customers may be deterred from purchasing from the company if they feel

that there is no long-term future for the business. Unfortunately the mere disclosure of financial problems can be self-fulfilling,

and cause such further problems for the company that it is pushed into non-going concern status.

The directors may also be concerned that if staff were to hear of this they may worry about the future of the company and

seek alternative employment, which could lead in turn to the loss of key members of staff. This would be detrimental to the

business and trigger further operational problems.

Finally, the reluctance to disclose may be caused by an entirely different reason. The directors could genuinely feel that the

cash flow and operational problems faced by the company do not constitute factors affecting the going concern status. They

may be confident that although a final decision has not been made regarding financing, the finance is likely to be forthcoming,

and therefore there is no long-term material uncertainty over the future of the company. However audit working papers

conclude that there is a significant level of doubt over the going concern status of Dexter Co, and therefore it seems that the

directors may be over optimistic if they feel that there is no significant doubt to be disclosed in the financial statements. -

第7题:

The finance director of Blod Co, Uma Thorton, has requested that your firm type the financial statements in the form

to be presented to shareholders at the forthcoming company general meeting. Uma has also commented that the

previous auditors did not use a liability disclaimer in their audit report, and would like more information about the use

of liability disclaimer paragraphs.

Required:

(b) Discuss the ethical issues raised by the request for your firm to type the financial statements of Blod Co.

(3 marks)

正确答案:

(b) It is not uncommon for audit firms to word process and typeset the financial statements of their clients, especially where the

client is a relatively small entity, which may lack the resources and skills to perform. this task. It is not prohibited by ethical

standards.

However, there could be a perceived threat to independence, with risk magnified in the case of Blod Co, which is a listed

company. The auditors could be perceived to be involved with the preparation of the financial statements of a listed client

company, which is prohibited by ethical standards. IFAC’s Code of Ethics for Professional Accountants states that for a listed

client, the audit firm should not be involved with the preparation of financial statements, which would create a self-review

threat so severe that safeguards could not reduce the threat to an acceptable level. Although the typing of financial statements

itself is not prohibited by ethical guidance, the risk is that providing such a service could be perceived to be an element of

the preparation of the financial statements.

It is possible that during the process of typing the financial statements, decisions and judgments would be made. This could

be perceived as making management decisions in relation to the financial statements, a clear breach of independence.

Therefore to eliminate any risk exposure, the prudent decision would be not to type the financial statements, ensuring that

Blod Co appreciates the ethical problems that this would cause.

Tutorial note: This is an area not specifically covered by ethical guides, where different audit firms may have different views

on whether it is acceptable to provide a typing service for the financial statements of their clients. Credit will be awarded for

sensible discussion of the issues raised bearing in mind other options for the audit firm, for example, it could be argued that

it is acceptable to offer the typing service provided that it is performed by people independent of the audit team, and that

the matter has been discussed with the audit committee/those charged with governance -

第8题:

(a) Contrast the role of internal and external auditors. (8 marks)

(b) Conoy Co designs and manufactures luxury motor vehicles. The company employs 2,500 staff and consistently makes a net profit of between 10% and 15% of sales. Conoy Co is not listed; its shares are held by 15 individuals, most of them from the same family. The maximum shareholding is 15% of the share capital.

The executive directors are drawn mainly from the shareholders. There are no non-executive directors because the company legislation in Conoy Co’s jurisdiction does not require any. The executive directors are very successful in running Conoy Co, partly from their training in production and management techniques, and partly from their ‘hands-on’ approach providing motivation to employees.

The board are considering a significant expansion of the company. However, the company’s bankers are

concerned with the standard of financial reporting as the financial director (FD) has recently left Conoy Co. The board are delaying provision of additional financial information until a new FD is appointed.

Conoy Co does have an internal audit department, although the chief internal auditor frequently comments that the board of Conoy Co do not understand his reports or provide sufficient support for his department or the internal control systems within Conoy Co. The board of Conoy Co concur with this view. Anders & Co, the external auditors have also expressed concern in this area and the fact that the internal audit department focuses work on control systems, not financial reporting. Anders & Co are appointed by and report to the board of Conoy Co.

The board of Conoy Co are considering a proposal from the chief internal auditor to establish an audit committee.

The committee would consist of one executive director, the chief internal auditor as well as three new appointees.

One appointee would have a non-executive seat on the board of directors.

Required:

Discuss the benefits to Conoy Co of forming an audit committee. (12 marks)

正确答案:

(a)Roleofinternalandexternalauditors–differencesObjectivesThemainobjectiveofinternalauditistoimproveacompany’soperations,primarilyintermsofvalidatingtheefficiencyandeffectivenessoftheinternalcontrolsystemsofacompany.Themainobjectiveoftheexternalauditoristoexpressanopiniononthetruthandfairnessofthefinancialstatements,andotherjurisdictionspecificrequirementssuchasconfirmingthatthefinancialstatementscomplywiththereportingrequirementsincludedinlegislation.ReportingInternalauditreportsarenormallyaddressedtotheboardofdirectors,orotherpeoplechargedwithgovernancesuchastheauditcommittee.Thosereportsarenotpubliclyavailable,beingconfidentialbetweentheinternalauditorandtherecipient.Externalauditreportsareprovidedtotheshareholdersofacompany.Thereportisattachedtotheannualfinancialstatementsofthecompanyandisthereforepubliclyavailabletotheshareholdersandanyreaderofthefinancialstatements.ScopeofworkTheworkoftheinternalauditornormallyrelatestotheoperationsoftheorganisation,includingthetransactionprocessingsystemsandthesystemstoproducetheannualfinancialstatements.Theinternalauditormayalsoprovideotherreportstomanagement,suchasvalueformoneyauditswhichexternalauditorsrarelybecomeinvolvedwith.Theworkoftheexternalauditorrelatesonlytothefinancialstatementsoftheorganisation.However,theinternalcontrolsystemsoftheorganisationwillbetestedastheseprovideevidenceonthecompletenessandaccuracyofthefinancialstatements.RelationshipwithcompanyInmostorganisations,theinternalauditorisanemployeeoftheorganisation,whichmayhaveanimpactontheauditor’sindependence.However,insomeorganisationstheinternalauditfunctionisoutsourced.Theexternalauditorisappointedbytheshareholdersofanorganisation,providingsomedegreeofindependencefromthecompanyandmanagement.(b)BenefitsofauditcommitteeinConoyCoAssistancewithfinancialreporting(nofinanceexpertise)TheexecutivedirectorsofConoyCodonotappeartohaveanyspecificfinancialskills–asthefinancialdirectorhasrecentlyleftthecompanyandhasnotyetbeenreplaced.ThismaymeanthatfinancialreportinginConoyCoislimitedorthattheothernon-financialdirectorsspendasignificantamountoftimekeepinguptodateonfinancialreportingissues.AnauditcommitteewillassistConoyCobyprovidingspecialistknowledgeoffinancialreportingonatemporarybasis–atleastoneofthenewappointeesshouldhaverelevantandrecentfinancialreportingexperienceundercodesofcorporategovernance.ThiswillallowtheexecutivedirectorstofocusonrunningConoyCo.EnhanceinternalcontrolsystemsTheboardofConoyCodonotnecessarilyunderstandtheworkoftheinternalauditor,ortheneedforcontrolsystems.ThismeansthatinternalcontrolwithinConoyComaybeinadequateorthatemployeesmaynotrecognisetheimportanceofinternalcontrolsystemswithinanorganisation.TheauditcommitteecanraiseawarenessoftheneedforgoodinternalcontrolsystemssimplybybeingpresentinConoyCoandbyeducatingtheboardontheneedforsoundcontrols.Improvingtheinternalcontrol‘climate’willensuretheneedforinternalcontrolsisunderstoodandreducecontrolerrors.RelianceonexternalauditorsConoyCo’sinternalauditorscurrentlyreporttotheboardofConoyCo.Aspreviouslynoted,thelackoffinancialandcontrolexpertiseontheboardwillmeanthatexternalauditorreportsandadvicewillnotnecessarilybeunderstood–andtheboardmayrelytoomuchonexternalauditorsIfConoyCoreporttoanauditcommitteethiswilldecreasethedependenceoftheboardontheexternalauditors.Theauditcommitteecantaketimetounderstandtheexternalauditor’scomments,andthenviathenon-executivedirector,ensurethattheboardtakeactiononthosecomments.AppointmentofexternalauditorsAtpresent,theboardofConoyCoappointtheexternalauditors.Thisraisesissuesofindependenceastheboardmaybecometoofamiliarwiththeexternalauditorsandsoappointonthisfriendshipratherthanmerit.Ifanauditcommitteeisestablished,thenthiscommitteecanrecommendtheappointmentoftheexternalauditors.Thecommitteewillhavethetimeandexpertisetoreviewthequalityofserviceprovidedbytheexternalauditors,removingtheindependenceissue.Corporategovernancerequirements–bestpracticeConoyCodonotneedtofollowcorporategovernancerequirements(thecompanyisnotlisted).However,notfollowingthoserequirementsmaystarttohaveadverseeffectsonConoy.Forexample,ConoyCo’sbankisalreadyconcernedaboutthelackoftransparencyinreporting.EstablishinganauditcommitteewillshowthattheboardofConoyCoarecommittedtomaintainingappropriateinternalsystemsinthecompanyandprovidingthestandardofreportingexpectedbylargecompanies.Obtainingthenewbankloanshouldalsobeeasierasthebankwillbesatisfiedwithfinancialreportingstandards.Givennonon-executives–independentadvicetoboardCurrentlyConoyCodoesnothaveanynon-executivedirectors.Thismeansthatthedecisionsoftheexecutivedirectorsarenotbeingchallengedbyotherdirectorsindependentofthecompanyandwithlittleornofinancialinterestinthecompany.Theappointmentofanauditcommitteewithonenon-executivedirectorontheboardofConoyCowillstarttoprovidesomenon-executiveinputtoboardmeetings.Whilenotsufficientintermsofcorporategovernancerequirements(aboutequalnumbersofexecutiveandnon-executivedirectorsareexpected)itdoesshowtheboardofConoyCoareattemptingtoestablishappropriategovernancesystems.AdviceonriskmanagementFinally,thereareothergeneralareaswhereConoyCowouldbenefitfromanauditcommittee.Forexample,lackofcorporategovernancestructuresprobablymeansConoyCodoesnothaveariskmanagementcommittee.Theauditcommitteecanalsoprovideadviceonriskmanagement,helpingtodecreasetheriskexposureofthecompany. -

第9题:

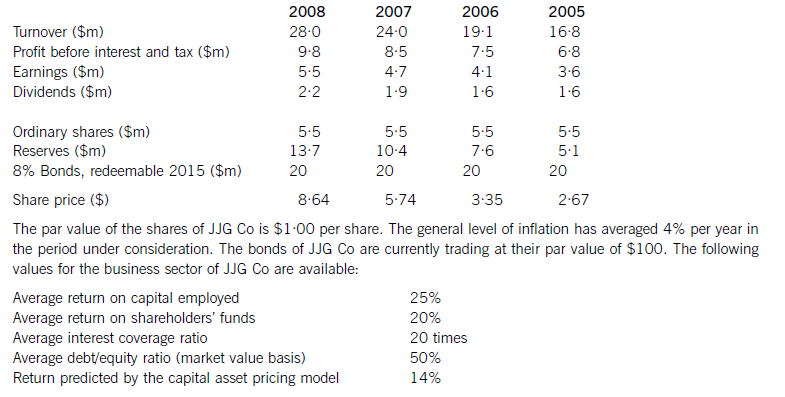

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

正确答案:

AchievementofcorporateobjectivesJJGCohasshareholderwealthmaximisationasanobjective.Thewealthofshareholdersisincreasedbydividendsreceivedandcapitalgainsonsharesowned.Totalshareholderreturncomparesthesumofthedividendreceivedandthecapitalgainwiththeopeningshareprice.TheshareholdersofJJGCohadareturnof58%in2008,comparedwithareturnpredictedbythecapitalassetpricingmodelof14%.Thelowestreturnshareholdershavereceivedwas21%andthehighestreturnwas82%.Onthisbasis,theshareholdersofthecompanyhaveexperiencedasignificantincreaseinwealth.Itisdebatablewhetherthishasbeenasaresultoftheactionsofthecompany,however.Sharepricesmayincreaseirrespectiveoftheactionsanddecisionsofmanagers,orevendespitethem.Infact,lookingatthedividendpersharehistoryofthecompany,therewasoneyear(2006)wheredividendswereconstant,eventhoughearningspershareincreased.Itisalsodifficulttoknowwhenwealthhasbeenmaximised.Anotherobjectiveofthecompanywastoachieveacontinuousincreaseinearningspershare.Analysisshowsthatearningspershareincreasedeveryyear,withanaverageincreaseof14·9%.Thisobjectiveappearstohavebeenachieved.CommentonfinancialperformanceReturnoncapitalemployed(ROCE)hasbeengrowingtowardsthesectoraverageof25%onayear-by-yearbasisfrom22%in2005.Thissteadygrowthintheprimaryaccountingratiocanbecontrastedwithirregulargrowthinturnover,thereasonsforwhichareunknown.Returnonshareholders’fundshasbeenconsistentlyhigherthantheaverageforthesector.ThismaybeduemoretothecapitalstructureofJJGCothantogoodperformancebythecompany,however,inthesensethatshareholders’fundsaresmalleronabookvaluebasisthanthelong-termdebtcapital.Ineverypreviousyearbut2008thegearingofthecompanywashigherthanthesectoraverage.(b)CalculationoftheoreticalexrightspershareCurrentshareprice=$8·64pershareCurrentnumberofshares=5·5millionsharesFinancetoberaised=$15mRightsissueprice=$7·50pershareNumberofsharesissued=15m/7·50=2millionsharesTheoreticalexrightspricepershare=((5·5mx8·64)+(2mx7·50))/7·5m=$8·34pershareThesharepricewouldfallfrom$8·64to$8·34pershareHowever,therewouldbenoeffectonshareholderwealthEffectofrightsissueonearningspershareCurrentEPS=100centspershareRevisedEPS=100x5·5m/7·5m=73centspershareTheEPSwouldfallfrom100centspershareto73centspershareHowever,asmentionedearlier,therewouldbenoeffectonshareholderwealthEffectofrightsissueonthedebt/equityratioCurrentdebt/equityratio=100x20/47·5=42%Revisedmarketvalueofequity=7·5mx8·34=$62·55millionReviseddebt/equityratio=100x20/62·55=32%Thedebt/equityratiowouldfallfrom42%to32%,whichiswellbelowthesectoraveragevalueandwouldsignalareductioninfinancialrisk(c)Thecurrentdebt/equityratioofJJGCois42%(20/47·5).Althoughthisislessthanthesectoraveragevalueof50%,itismoreusefulfromafinancialriskperspectivetolookattheextenttowhichinterestpaymentsarecoveredbyprofits.Theinterestonthebondissueis$1·6million(8%of$20m),givinganinterestcoverageratioof6·1times.IfJJGCohasoverdraftfinance,theinterestcoverageratiowillbelowerthanthis,butthereisinsufficientinformationtodetermineifanoverdraftexists.Theinterestcoverageratioisnotonlybelowthesectoraverage,itisalsolowenoughtobeacauseforconcern.Whiletheratioshowsanupwardtrendovertheperiodunderconsideration,itstillindicatesthatanissueoffurtherdebtwouldbeunwise.Aplacing,oranyissueofnewsharessuchasarightsissueorapublicoffer,woulddecreasegearing.Iftheexpansionofbusinessresultsinanincreaseinprofitbeforeinterestandtax,theinterestcoverageratiowillincreaseandfinancialriskwillfall.GiventhecurrentfinancialpositionofJJGCo,adecreaseinfinancialriskiscertainlypreferabletoanincrease.Aplacingwilldiluteownershipandcontrol,providingthenewequityissueistakenupbynewinstitutionalshareholders,whilearightsissuewillnotdiluteownershipandcontrol,providingexistingshareholderstakeuptheirrights.Abondissuedoesnothaveownershipandcontrolimplications,althoughrestrictiveornegativecovenantsinbondissuedocumentscanlimittheactionsofacompanyanditsmanagers.Allthreefinancingchoicesarelong-termsourcesoffinanceandsoareappropriateforalong-terminvestmentsuchastheproposedexpansionofexistingbusiness.Equityissuessuchasaplacingandarightsissuedonotrequiresecurity.Noinformationisprovidedonthenon-currentassetsofJJGCo,butitislikelythattheexistingbondissueissecured.Ifanewbondissuewasbeingconsidered,JJGCowouldneedtoconsiderwhetherithadsufficientnon-currentassetstoofferassecurity,althoughitislikelythatnewnon-currentassetswouldbeboughtaspartofthebusinessexpansion. -

第10题:

You are the audit supervisor of Maple & Co and are currently planning the audit of an existing client, Sycamore Science Co (Sycamore), whose year end was 30 April 2015. Sycamore is a pharmaceutical company, which manufactures and supplies a wide range of medical supplies. The draft financial statements show revenue of $35·6 million and profit before tax of $5·9 million.

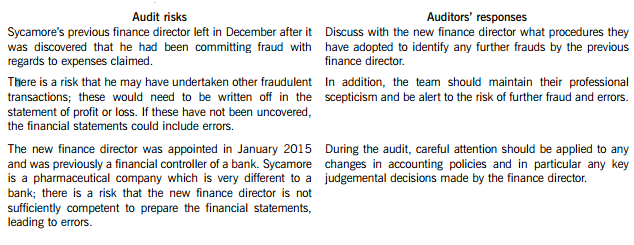

Sycamore’s previous finance director left the company in December 2014 after it was discovered that he had been claiming fraudulent expenses from the company for a significant period of time. A new finance director was appointed in January 2015 who was previously a financial controller of a bank, and she has expressed surprise that Maple & Co had not uncovered the fraud during last year’s audit.

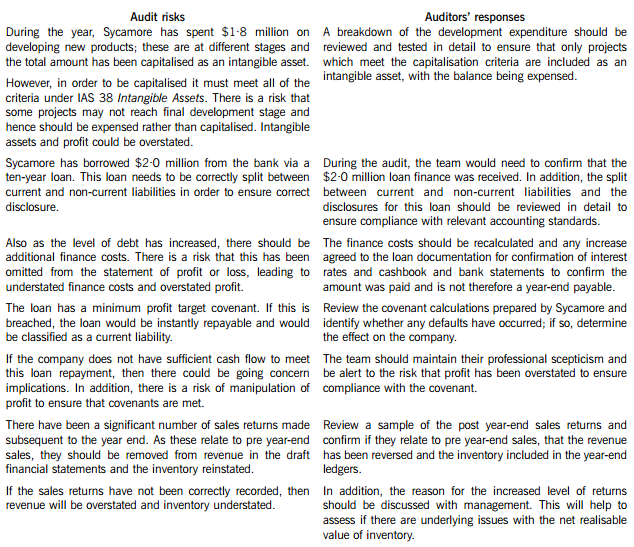

During the year Sycamore has spent $1·8 million on developing several new products. These projects are at different stages of development and the draft financial statements show the full amount of $1·8 million within intangible assets. In order to fund this development, $2·0 million was borrowed from the bank and is due for repayment over a ten-year period. The bank has attached minimum profit targets as part of the loan covenants.

The new finance director has informed the audit partner that since the year end there has been an increased number of sales returns and that in the month of May over $0·5 million of goods sold in April were returned.

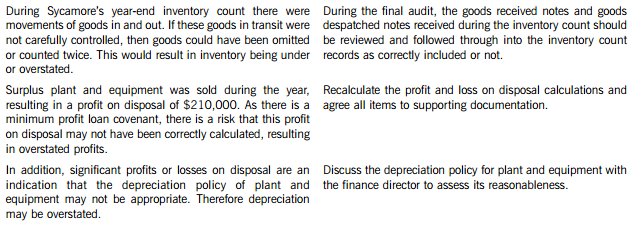

Maple & Co attended the year-end inventory count at Sycamore’s warehouse. The auditor present raised concerns that during the count there were movements of goods in and out the warehouse and this process did not seem well controlled.

During the year, a review of plant and equipment in the factory was undertaken and surplus plant was sold, resulting in a profit on disposal of $210,000.

Required:

(a) State Maples & Co’s responsibilities in relation to the prevention and detection of fraud and error. (4 marks)

(b) Describe SIX audit risks, and explain the auditor’s response to each risk, in planning the audit of Sycamore Science Co. (12 marks)

(c) Sycamore’s new finance director has read about review engagements and is interested in the possibility of Maple & Co undertaking these in the future. However, she is unsure how these engagements differ from an external audit and how much assurance would be gained from this type of engagement.

Required:

(i) Explain the purpose of review engagements and how these differ from external audits; and (2 marks)

(ii) Describe the level of assurance provided by external audits and review engagements. (2 marks)

正确答案:(a) Fraud responsibility

Maple & Co must conduct an audit in accordance with ISA 240 The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements and are responsible for obtaining reasonable assurance that the financial statements taken as a whole are free from material misstatement, whether caused by fraud or error.

In order to fulfil this responsibility, Maple & Co is required to identify and assess the risks of material misstatement of the financial statements due to fraud.

They need to obtain sufficient appropriate audit evidence regarding the assessed risks of material misstatement due to fraud, through designing and implementing appropriate responses. In addition, Maple & Co must respond appropriately to fraud or suspected fraud identified during the audit.

When obtaining reasonable assurance, Maple & Co is responsible for maintaining professional scepticism throughout the audit, considering the potential for management override of controls and recognising the fact that audit procedures which are effective in detecting error may not be effective in detecting fraud.

To ensure that the whole engagement team is aware of the risks and responsibilities for fraud and error, ISAs require that a discussion is held within the team. For members not present at the meeting, Sycamore’s audit engagement partner should determine which matters are to be communicated to them.

(b) Audit risks and auditors’ responses

(c) (i) Review engagements

Review engagements are often undertaken as an alternative to an audit, and involve a practitioner reviewing financial data, such as six-monthly figures. This would involve the practitioner undertaking procedures to state whether anything has come to their attention which causes the practitioner to believe that the financial data is not in accordance with the financial reporting framework.

A review engagement differs to an external audit in that the procedures undertaken are not nearly as comprehensive as those in an audit, with procedures such as analytical review and enquiry used extensively. In addition, the practitioner does not need to comply with ISAs as these only relate to external audits.

(ii) Levels of assurance

The level of assurance provided by audit and review engagements is as follows:

External audit – A high but not absolute level of assurance is provided, this is known as reasonable assurance. This provides comfort that the financial statements present fairly in all material respects (or are true and fair) and are free of material misstatements.

Review engagements – where an opinion is being provided, the practitioner gathers sufficient evidence to be satisfied that the subject matter is plausible; in this case negative assurance is given whereby the practitioner confirms that nothing has come to their attention which indicates that the subject matter contains material misstatements.

-

第11题:

On behalf of board of directors I appreciate you for providing the____information.A.request

B.requester

C.requesting

D.requested答案:D解析:本题考查动词的语态。四个选项是request的不同形式,题目意为:“我代表董事会,感谢您提供所需信息” 。

requested information,被动语态表示被要求提供的信息。

-

第12题:

单选题Your production database uses an Automatic Storage Management (ASM) instance to manage its files. You want to add a new disk group to the ASM instance to manage the increased data load. What action would you perform to include the new disk group in the ASM instance without causing any impact on the currently connected users?()Amount the new disk group in the ASM instance

Brestart the ASM instance and the production database instance

Cregister the new disk groups in the production database instance

Drestart the ASM instance without restarting the production database instance

Einclude the new disk group in the ASM_DISKSTRING parameter in the parameter file and restart the ASM instance

正确答案: D解析: 暂无解析 -

第13题:

(c) During the year Albreda paid $0·1 million (2004 – $0·3 million) in fines and penalties relating to breaches of

health and safety regulations. These amounts have not been separately disclosed but included in cost of sales.

(5 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Albreda Co for the year ended

30 September 2005.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(c) Fines and penalties

(i) Matters

■ $0·1 million represents 5·6% of profit before tax and is therefore material. However, profit has fallen, and

compared with prior year profit it is less than 5%. So ‘borderline’ material in quantitative terms.

■ Prior year amount was three times as much and represented 13·6% of profit before tax.

■ Even though the payments may be regarded as material ‘by nature’ separate disclosure may not be necessary if,

for example, there are no external shareholders.

■ Treatment (inclusion in cost of sales) should be consistent with prior year (‘The Framework’/IAS 1 ‘Presentation of

Financial Statements’).

■ The reason for the fall in expense. For example, whether due to an improvement in meeting health and safety

regulations and/or incomplete recording of liabilities (understatement).

■ The reason(s) for the breaches. For example, Albreda may have had difficulty implementing new guidelines in

response to stricter regulations.

■ Whether expenditure has been adjusted for in the income tax computation (as disallowed for tax purposes).

■ Management’s attitude to health and safety issues (e.g. if it regards breaches as an acceptable operational practice

or cheaper than compliance).

■ Any references to health and safety issues in other information in documents containing audited financial

statements that might conflict with Albreda incurring these costs.

■ Any cost savings resulting from breaches of health and safety regulations would result in Albreda possessing

proceeds of its own crime which may be a money laundering offence.

(ii) Audit evidence

■ A schedule of amounts paid totalling $0·1 million with larger amounts being agreed to the cash book/bank

statements.

■ Review/comparison of current year schedule against prior year for any apparent omissions.

■ Review of after-date cash book payments and correspondence with relevant health and safety regulators (e.g. local

authorities) for liabilities incurred before 30 September 2005.

■ Notes in the prior year financial statements confirming consistency, or otherwise, of the lack of separate disclosure.

■ A ‘signed off’ review of ‘other information’ (i.e. directors’ report, chairman’s statement, etc).

■ Written management representation that there are no fines/penalties other than those which have been reflected in

the financial statements. -

第14题:

(b) A sale of industrial equipment to Deakin Co in May 2005 resulted in a loss on disposal of $0·3 million that has

been separately disclosed on the face of the income statement. The equipment cost $1·2 million when it was

purchased in April 1996 and was being depreciated on a straight-line basis over 20 years. (6 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Keffler Co for the year ended

31 March 2006.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(b) Sale of industrial equipment

(i) Matters

■ The industrial equipment was in use for nine years (from April 1996) and would have had a carrying value of

$660,000 at 31 March 2005 (11/20 × $1·2m – assuming nil residual value and a full year’s depreciation charge

in the year of acquisition and none in the year of disposal). Disposal proceeds were therefore only $360,000.

■ The $0·3m loss represents 15% of PBT (for the year to 31 March 2006) and is therefore material. The equipment

was material to the balance sheet at 31 March 2005 representing 2·6% of total assets ($0·66/$25·7 × 100).

■ Separate disclosure, of a material loss on disposal, on the face of the income statement is in accordance with

IAS 16 ‘Property, Plant and Equipment’. However, in accordance with IAS 1 ‘Presentation of Financial Statements’,

it should not be captioned in any way that might suggest that it is not part of normal operating activities (i.e. not

‘extraordinary’, ‘exceptional’, etc).

Tutorial note: However, note that if there is a prior period error to be accounted for (see later), there would be

no impact on the current period income statement requiring consideration of any disclosure.

■ The reason for the sale. For example, whether the equipment was:

– surplus to operating requirements (i.e. not being replaced); or

– being replaced with newer equipment (thereby contributing to the $8·1m increase (33·8 – 25·7) in total

assets).

■ The reason for the loss on sale. For example, whether:

– the sale was at an under-value (e.g. to a related party);

– the equipment had a bad maintenance history (or was otherwise impaired);

– the useful life of the equipment is less than 20 years;

– there is any deferred consideration not yet recorded;

– any non-cash disposal proceeds have been overlooked (e.g. if another asset was acquired in a part-exchange).

■ If the useful life was less than 20 years, tangible non-current assets may be materially overstated in respect of other

items of equipment that are still in use and being depreciated on the same basis.

■ If the sale was to a related party then additional disclosure should be required in a note to the financial statements

for the year to 31 March 2006 (IAS 24 ‘Related Party Disclosures’).

Tutorial note: Since there are no specific pointers to a related party transaction (RPT), this point is not expanded

on.

■ Whether the sale was identified in the prior year audit’s post balance sheet event review. If so:

– the disclosure made in the prior year’s financial statements (IAS 10 ‘Events After the Balance Sheet Date’);

– whether an impairment loss was recognised at 31 March 2005.

■ If not, and the equipment was impaired at 31 March 2005, a prior period error should be accounted for (IAS 8

‘Accounting Policies, Changes in Accounting Estimates and Errors’). An impairment loss of $0·3m would have

been material to prior year profit (12·5%).

Tutorial note: Unless this was a RPT or the impairment arose after 31 March 2005 a prior period adjustment

should be made.

■ Failure to account for a prior period error (if any) would result in modification of the audit opinion ‘except for’ noncompliance

with IAS 8 (in the current year) and IAS 36 (in the prior period).

(ii) Audit evidence

■ Carrying amount ($0·66m as above) agreed to the non-current asset register balances at 31 March 2005 and

recalculation of the loss on disposal.

■ Cost and accumulated depreciation removed from the asset register in the year to 31 March 2006.

■ Receipt of proceeds per cash book agreed to bank statement.

■ Sales invoice transferring title to Deakin.

■ A review of maintenance expenses and records (e.g. to confirm reason for loss on sale).

■ Post balance sheet event review on prior year audit working papers file.

■ Management representation confirming that Deakin is not a related party (provided that there is no evidence to

suggest otherwise). -

第15题:

3 You are the manager responsible for the audit of Seymour Co. The company offers information, proprietary foods and

medical innovations designed to improve the quality of life. (Proprietary foods are marketed under and protected by

registered names.) The draft consolidated financial statements for the year ended 30 September 2006 show revenue

of $74·4 million (2005 – $69·2 million), profit before taxation of $13·2 million (2005 – $15·8 million) and total

assets of $53·3 million (2005 – $40·5 million).

The following issues arising during the final audit have been noted on a schedule of points for your attention:

(a) In 2001, Seymour had been awarded a 20-year patent on a new drug, Tournose, that was also approved for

food use. The drug had been developed at a cost of $4 million which is being amortised over the life of the

patent. The patent cost $11,600. In September 2006 a competitor announced the successful completion of

preliminary trials on an alternative drug with the same beneficial properties as Tournose. The alternative drug is

expected to be readily available in two years time. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Seymour Co for the year ended

30 September 2006.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

■ A change in the estimated useful life should be accounted for as a change in accounting estimate in accordance

with IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors. For example, if the development

costs have little, if any, useful life after the introduction of the alternative drug (‘worst case’ scenario), the carrying

value ($3 million) should be written off over the current and remaining years, i.e. $1 million p.a. The increase in

amortisation/decrease in carrying value ($800,000) is material to PBT (6%) and total assets (1·5%).

■ Similarly a change in the expected pattern of consumption of the future economic benefits should be accounted for

as a change in accounting estimate (IAS 8). For example, it may be that the useful life is still to 2020 but that

the economic benefits may reduce significantly in two years time.

■ After adjusting the carrying amount to take account of the change in accounting estimate(s) management should

have tested it for impairment and any impairment loss recognised in profit or loss.

(ii) Audit evidence

■ $3 million carrying amount of development costs brought forward agreed to prior year working papers and financial

statements.

■ A copy of the press release announcing the competitor’s alternative drug.

■ Management’s projections of future cashflows from Tournose-related sales as evidence of the useful life of the

development costs and pattern of consumption.

■ Reperformance of management’s impairment test on the development costs: Recalculation of management’s

calculation of the carrying amount after revising estimates of useful life and/or consumption of benefits compared

with management’s calculation of value in use.

■ Sensitivity analysis on management’s key assumptions (e.g. estimates of useful life, discount rate).

■ Written management representation on the key assumptions concerning the future that have a significant risk of

causing material adjustment to the carrying amount of the development costs. (These assumptions should be

disclosed in accordance with IAS 1 Presentation of Financial Statements.) -

第16题:

3 You are an audit manager in Webb & Co, a firm of Chartered Certified Accountants. Your audit client, Mulligan Co,

designs and manufactures wooden tables and chairs. The business has expanded rapidly in the last two years, since

the arrival of Patrick Tiler, an experienced sales and marketing manager.

The directors want to secure a loan of $3 million in order to expand operations, following the design of a completely

new range of wooden garden furniture. The directors have approached LCT Bank for the loan. The bank’s lending

criteria stipulate the following:

‘Loan applications must be accompanied by a detailed business plan, including an analysis of how the finance will

be used. LCT Bank need to see that the finance requested is adequate for the proposed business purpose. The

business plan must be supported by an assurance opinion on the adequacy of the requested finance.’

The $3 million finance raised will be used as follows:

$000

Construction of new factory 1,250

Purchase of new machinery 1,000

Initial supply of timber raw material 250

Advertising and marketing of new product 500

Your firm has agreed to review the business plan and to provide an assurance opinion on the completeness of the

finance request. A meeting will be held tomorrow to discuss this assignment.

Required:

(a) Identify and explain the matters relating to the assurance assignment that should be discussed at the meeting

with Mulligan Co. (8 marks)

正确答案:

3 MULLIGAN CO

(a) Matters to be discussed would include the following:

The exact content of the business plan which could include:

– Description of past business performance and key products

– Discussion of the new product

– Evidence of the marketability of the new product

– Cash flow projections

– Capital expenditure forecasts

– Key business assumptions.

The form. of the assurance report that is required – in an assurance engagement the nature and wording of the expected

opinion should be discussed. Webb & Co should clarify that an opinion of ‘negative assurance’ will be required, and whether

this will meet the bank’s lending criteria.

The intended recipient of the report – Webb & Co need to clarify the name and address of the recipient at LCT Bank. For the

limitation of professional liability, it should be clarified that LCT Bank will be the only recipient, and that the assurance opinion

is being used only as part of the bank’s overall lending decision.

Limiting liability – Webb & Co may want to receive in writing a statement that the report is for information purposes only, and

does not give rise to any responsibility, liability, duty or obligation from the firm to the lender.

Deadlines – it should be discussed when the bank need the report. This in turn will be influenced by when Mulligan Co needs

the requested $3 million finance. The bank may need a considerable period of time to assess the request, review the report,

and ensure that their lending criteria have been fully met prior to advancing the finance.

Availability of evidence – Mulligan Co should be made aware that in order to express an opinion on the finance request, they

must be prepared to provide all the necessary paperwork to assist the assurance provider. Evidence is likely to include

discussions with key management, and written representations of discussions may be required.

Professional regulation – Webb & Co should discuss the kind of procedures that will be undertaken, and confirm that they

will be complying with relevant professional guidance, for example:

– ISAE 3000 Assurance Engagements other than Audits or Reviews of Historical Financial Information

– ISAE 3400 The Examination of Prospective Financial Information

Engagement administration – any points not yet discussed in detail when deciding to take the assurance engagement should

be finalised at the meeting. These points could include the following:

– Fees – the total fee and billing arrangements must be agreed before any work is carried out

– Personnel – Webb & Co should identify the key personnel who will be involved in the assignment

– Complaints procedures – should be briefly outlined (the complaints procedures in an assurance engagement may differ

from an audit assignment)

– Engagement letter – if not already signed by both Webb & Co and Mulligan Co, the engagement letter should be

discussed and signed at the meeting before any assignment work is conducted.

Tutorial note: the scenario states that Webb & Co have already decided to take the assurance assignment for their existing

client, therefore the answer to this requirement should not focus on client or engagement acceptance procedures. -

第17题:

4 You are a senior manager in Becker & Co, a firm of Chartered Certified Accountants offering audit and assurance

services mainly to large, privately owned companies. The firm has suffered from increased competition, due to two

new firms of accountants setting up in the same town. Several audit clients have moved to the new firms, leading to

loss of revenue, and an over staffed audit department. Bob McEnroe, one of the partners of Becker & Co, has asked

you to consider how the firm could react to this situation. Several possibilities have been raised for your consideration:

1. Murray Co, a manufacturer of electronic equipment, is one of Becker & Co’s audit clients. You are aware that the

company has recently designed a new product, which market research indicates is likely to be very successful.

The development of the product has been a huge drain on cash resources. The managing director of Murray Co

has written to the audit engagement partner to see if Becker & Co would be interested in making an investment

in the new product. It has been suggested that Becker & Co could provide finance for the completion of the

development and the marketing of the product. The finance would be in the form. of convertible debentures.

Alternatively, a joint venture company in which control is shared between Murray Co and Becker & Co could be

established to manufacture, market and distribute the new product.

2. Becker & Co is considering expanding the provision of non-audit services. Ingrid Sharapova, a senior manager in

Becker & Co, has suggested that the firm could offer a recruitment advisory service to clients, specialising in the

recruitment of finance professionals. Becker & Co would charge a fee for this service based on the salary of the

employee recruited. Ingrid Sharapova worked as a recruitment consultant for a year before deciding to train as

an accountant.

3. Several audit clients are experiencing staff shortages, and it has been suggested that temporary staff assignments

could be offered. It is envisaged that a number of audit managers or seniors could be seconded to clients for

periods not exceeding six months, after which time they would return to Becker & Co.

Required:

Identify and explain the ethical and practice management implications in respect of:

(a) A business arrangement with Murray Co. (7 marks)

正确答案:

4 Becker & Co

(a) Joint business arrangement

The business opportunity in respect of Murray Co could be lucrative if the market research is to be believed.

However, IFAC’s Code of Ethics for Professional Accountants states that a mutual business arrangement is likely to give rise

to self-interest and intimidation threats to independence and objectivity. The audit firm must be and be seen to be independent

of the audit client, which clearly cannot be the case if the audit firm and the client are seen to be working together for a

mutual financial gain.

In the scenario, two options are available. Firstly, Becker & Co could provide the audit client with finance to complete the

development and take the product to market. There is a general prohibition on audit firms providing finance to their audit

clients. This would create a clear financial self-interest threat as the audit firm would be receiving a return on investment from

their client. The Code states that if a firm makes a loan (or guarantees a loan) to a client, the self-interest threat created would

be so significant that no safeguard could reduce the threat to an acceptable level.

The provision of finance using convertible debentures raises a further ethical problem, because if the debentures are ultimately

converted to equity, the audit firm would then hold equity shares in their audit client. This is a severe financial self-interest,

which safeguards are unlikely to be able to reduce to an acceptable level.

The finance should not be advanced to Murray Co while the company remains an audit client of Becker & Co.

The second option is for a joint venture company to be established. This would be perceived as a significant mutual business

interest as Becker & Co and Murray Co would be investing together, sharing control and sharing a return on investment in

the form. of dividends. IFAC’s Code of Ethics states that unless the relationship between the two parties is clearly insignificant,

the financial interest is immaterial, and the audit firm is unable to exercise significant influence, then no safeguards could

reduce the threat to an acceptable level. In this case Becker & Co may not enter into the joint venture arrangement while

Murray Co is still an audit client.

The audit practice may consider that investing in the new electronic product is a commercial strategy that it wishes to pursue,

either through loan finance or using a joint venture arrangement. In this case the firm should resign as auditor with immediate

effect in order to eliminate any ethical problem with the business arrangement. The partners should carefully consider if the

potential return on investment will more than compensate for the lost audit fee from Murray Co.

The partners should also reflect on whether they want to diversify to such an extent – this investment is unlikely to be in an

area where any of the audit partners have much knowledge or expertise. A thorough commercial evaluation and business risk

analysis must be performed on the new product to ensure that it is a sound business decision for the firm to invest.

The audit partners should also consider how much time they would need to spend on this business development, if they

decided to resign as auditors and to go ahead with the investment. Such a new and important project could mean that they

take their focus off the key business i.e. the audit practice. They should consider if it would be better to spend their time trying

to compete effectively with the two new firms of accountants, trying to retain key clients, and to attract new accounting and

audit clients rather than diversify into something completely different. -

第18题:

(b) (i) Explain the matters you should consider, and the evidence you would expect to find in respect of the

carrying value of the cost of investment of Dylan Co in the financial statements of Rosie Co; and

(7 marks)

正确答案:

(b) (i) Cost of investment on acquisition of Dylan Co

Matters to consider

According to the schedule provided by the client, the cost of investment comprises three elements. One matter to

consider is whether the cost of investment is complete.

It appears that no legal or professional fees have been included in the cost of investment (unless included within the

heading ‘cash consideration’). Directly attributable costs should be included per IFRS 3 Business Combinations, and

there is a risk that these costs may be expensed in error, leading to understatement of the investment.

The cash consideration of $2·5 million is the least problematical component. The only matter to consider is whether the

cash has actually been paid. Given that Dylan Co was acquired in the last month of the financial year it is possible that

the amount had not been paid before the year end, in which case the amount should be recognised as a current liability

on the statement of financial position (balance sheet). However, this seems unlikely given that normally control of an

acquired company only passes to the acquirer on cash payment.

IFRS 3 states that the cost of investment should be recognised at fair value, which means that deferred consideration

should be discounted to present value at the date of acquisition. If the consideration payable on 31 January 2009 has

not been discounted, the cost of investment, and the corresponding liability, will be overstated. It is possible that the

impact of discounting the $1·5 million payable one year after acquisition would be immaterial to the financial

statements, in which case it would be acceptable to leave the consideration at face value within the cost of investment.

Contingent consideration should be accrued if it is probable to be paid. Here the amount is payable if revenue growth

targets are achieved over the next four years. The auditor must therefore assess the probability of the targets being

achieved, using forecasts and projections of Maxwell Co’s revenue. Such information is inherently subjective, and could

have been manipulated, if prepared by the vendor of Maxwell Co, in order to secure the deal and maximise

consideration. Here it will be crucial to be sceptical when reviewing the forecasts, and the assumptions underlying the

data. The management of Rosie Co should have reached their own opinion on the probability of paying the contingent

consideration, but they may have relied heavily on information provided at the time of the acquisition.

Audit evidence

– Agreement of the monetary value and payment dates of the consideration per the client schedule to legal

documentation signed by vendor and acquirer.

– Agreement of $2·5 million paid to Rosie Co’s bank statement and cash book prior to year end. If payment occurs

after year end confirm that a current liability is recognised on the individual company and consolidated statement

of financial position (balance sheet).

– Board minutes approving the payment.

– Recomputation of discounting calculations applied to deferred and contingent consideration.

– Agreement that the discount rate used is pre-tax, and reflects current market assessment of the time value of money

(e.g. by comparison to Rosie Co’s weighted average cost of capital).

– Revenue and profit projections for the period until January 2012, checked for arithmetic accuracy.

– A review of assumptions used in the projections, and agreement that the assumptions are comparable with the

auditor’s understanding of Dylan Co’s business.

Tutorial note: As the scenario states that Chien & Co has audited Dylan Co for several years, it is reasonable to rely on

their cumulative knowledge and understanding of the business in auditing the revenue projections. -

第19题:

() your needs, please write to us with your specific enquiries.

A、Should these new products suit

B、Had these new products suited

C、If these new products would suit

D、If these new products were to suit

参考答案:A

-

第20题:

One of your audit clients is Tye Co a company providing petrol, aviation fuel and similar oil based products to the government of the country it is based in. Although the company is not listed on any stock exchange, it does follow best practice regarding corporate governance regulations. The audit work for this year is complete, apart from the matter referred to below.

As part of Tye Co’s service contract with the government, it is required to hold an emergency inventory reserve of 6,000 barrels of aviation fuel. The inventory is to be used if the supply of aviation fuel is interrupted due to unforeseen events such as natural disaster or terrorist activity.

This fuel has in the past been valued at its cost price of $15 a barrel. The current value of aviation fuel is $120 a barrel. Although the audit work is complete, as noted above, the directors of Tye Co have now decided to show the ‘real’ value of this closing inventory in the financial statements by valuing closing inventory of fuel at market value, which does not comply with relevant accounting standards. The draft financial statements of Tye Co currently show a profit of approximately $500,000 with net assets of $170 million.

Required:

(a) List the audit procedures and actions that you should now take in respect of the above matter. (6 marks)

(b) For the purposes of this section assume from part (a) that the directors have agreed to value inventory at

$15/barrel.

Having investigated the matter in part (a) above, the directors present you with an amended set of financial

statements showing the emergency reserve stated not at 6,000 barrels, but reported as 60,000 barrels. The final financial statements now show a profit following the inclusion of another 54,000 barrels of oil in inventory. When queried about the change from 6,000 to 60,000 barrels of inventory, the finance director stated that this change was made to meet expected amendments to emergency reserve requirements to be published in about six months time. The inventory will be purchased this year, and no liability will be shown in the financial statements for this future purchase. The finance director also pointed out that part of Tye Co’s contract with the government requires Tye Co to disclose an annual profit and that a review of bank loans is due in three months. Finally the finance director stated that if your audit firm qualifies the financial statements in respect of the increase in inventory, they will not be recommended for re-appointment at the annual general meeting. The finance director refuses to amend the financial statements to remove this ‘fictitious’ inventory.

Required:

(i) State the external auditor’s responsibilities regarding the detection of fraud; (4 marks)

(ii) Discuss to which groups the auditors of Tye Co could report the ‘fictitious’ aviation fuel inventory;

(6 marks)

(iii) Discuss the safeguards that the auditors of Tye Co can use in an attempt to overcome the intimidation

threat from the directors of Tye Co. (4 marks)

正确答案: