(b) Explain the meaning of the term ‘Efficient Market Hypothesis’ and discuss the implications for a company ifthe stock market on which it is listed has been found to be semi-strong form. efficient. (9 marks)

题目

(b) Explain the meaning of the term ‘Efficient Market Hypothesis’ and discuss the implications for a company if

the stock market on which it is listed has been found to be semi-strong form. efficient. (9 marks)

相似考题

更多“(b) Explain the meaning of the term ‘Efficient Market Hypothesis’ and discuss the implications for a company ifthe stock market on which it is listed has been found to be semi-strong form. efficient. (9 marks)”相关问题

-

第1题:

(c) Define ‘market risk’ for Mr Allejandra and explain why Gluck and Goodman’s market risk exposure is

increased by failing to have an effective audit committee. (5 marks)

正确答案:

(c) Market risk

Definition of market risk

Market risks are those arising from any of the markets that a company operates in. Most common examples are those risks

from resource markets (inputs), product markets (outputs) or capital markets (finance).

[Tutorial note: markers should exercise latitude in allowing definitions of market risk. IFRS 7, for example, offers a technical

definition: ‘Market risk is the risk that the fair value or cash flows of a financial instrument will fluctuate due to changes in

market prices. Market risk reflects interest rate risk, currency risk, and other price risks’.]

Why non-compliance increases market risk

The lack of a fully compliant committee structure (such as having a non-compliant audit committee) erodes investor

confidence in the general governance of a company. This will, over time, affect share price and hence company value. Low

company value will threaten existing management (possibly with good cause in the case of Gluck and Goodman) and make

the company a possible takeover target. It will also adversely affect price-earnings and hence market confidence in Gluck and

Goodman’s shares. This will make it more difficult to raise funds from the stock market. -

第2题:

(ii) Explain how the existing product range and the actions per Note (3) would feature in Ansoff’s

product-market matrix. (7 marks)

正确答案:

(ii) Market Penetration

With regard to existing products it would appear that a strategy of market penetration is being followed, whereby attempts

are made to sell existing products into existing markets. This is a low risk strategy which is most unlikely to lead to high

rates of growth, reflected in the forecast increase of 2% per annum in the years ending 30 November 2008 and 2009.

Management seeks here to increase its market share with the current product range. In pursuing a penetration strategy

the management of Vision plc may to some extent be able to exploit opportunities including the following:

– Encouraging existing customers to buy more of their brand

– Encouraging customers who are buying a competitor’s brand to switch to their brand

– Encouraging non-users within the segment to buy their brand

‘Strengths’ within the current portfolio will need to be consolidated and any areas of weakness addressed with remedial

action.

Market Development

The purchase of the retail outlets will enable management to sell existing products via new channels of distribution. The

products of both the Astronomy and Outdoor Pursuits divisions could be sold via the retail outlets. Very often new

markets can be established in geographical terms. Management could, for example, look to promote the sale of

microscopes and associated equipment to overseas hospitals.

Product Development

The launch of the Birdcam-V is an example of a product development strategy whereby new products are targeted at

existing markets. Very often, existing products can be improved, or if an organisation possesses adequate resources,

completely new products can be developed to meet existing market needs. Some of the main risks here lie in the ‘time

to market’ and product development costs which frequently go well beyond initial estimates.

Diversification

The purchase of Racquets Ltd is an example of diversification on the part of Vision plc since the products and markets

of Racquets Ltd bear no relationship to the existing products and markets of the company. In this regard the

diversification is said to be unrelated.

The establishment of the Oceanic division could be regarded as a related diversification since existing technology will be

used to develop new products for new markets. The success of this strategy will very much depend on the strength of

the Vision brand. -

第3题:

JOL Co was the market leader with a share of 30% three years ago. The managing director of JOL Co stated at a

recent meeting of the board of directors that: ‘our loss of market share during the last three years might lead to the

end of JOL Co as an organisation and therefore we must address this issue immediately’.

Required:

(b) Discuss the statement of the managing director of JOL Co and discuss six performance indicators, other than

decreasing market share, which might indicate that JOL Co might fail as a corporate entity. (10 marks)

正确答案:

(b) It would appear that JOL’s market share has declined from 30% to (80 – 26)/3 = 18% during the last three years. A 12%

fall in market share is probably very significant with a knock-on effect on profits and resultant cash flows. Obviously such a

declining trend needs to be arrested immediately and this will require a detailed investigation to be undertaken by the directors

of JOL. Consequently loss of market share can be seen to be an indicator of potential corporate failure. Other indicators of

corporate failure are as follows:

Six performance indicators that an organisation might fail are as follows:

Poor cash flow

Poor cash flow might render an organisation unable to pay its debts as and when they fall due for payment. This might mean,

for example, that providers of finance might be able to invoke the terms of a loan covenant and commence legal action against

an organisation which might eventually lead to its winding-up.

Lack of new production/service introduction

Innovation can often be seen to be the difference between ‘life and death’ as new products and services provide continuity

of income streams in an ever-changing business environment. A lack of new product/service introduction may arise from a

shortage of funds available for re-investment. This can lead to organisations attempting to compete with their competitors with

an out of date range of products and services, the consequences of which will invariably turn out to be disastrous.

General economic conditions

Falling demand and increasing interest rates can precipitate the demise of organisations. Highly geared organisations will

suffer as demand falls and the weight of the interest burden increases. Organisations can find themselves in a vicious circle

as increasing amounts of interest payable are paid from diminishing gross margins leading to falling profits/increasing losses

and negative cash flows. This leads to the need for further loan finance and even higher interest burden, further diminution

in margins and so on.

Lack of financial controls

The absence of sound financial controls has proven costly to many organisations. In extreme circumstances it can lead to

outright fraud (e.g. Enron and WorldCom).

Internal rivalry

The extent of internal rivalry that exists within an organisation can prove to be of critical significance to an organisation as

managerial effort is effectively channeled into increasing the amount of internal conflict that exists to the detriment of the

organisation as a whole. Unfortunately the adverse consequences of internal rivalry remain latent until it is too late to redress

them.

Loss of key personnel

In certain types of organisation the loss of key personnel can ‘spell the beginning of the end’ for an organisation. This is

particularly the case when individuals possess knowledge which can be exploited by direct competitors, e.g. sales contacts,

product specifications, product recipes, etc.

-

第4题:

(b) Draft a report as at today’s date advising Cutlass Inc on its proposed activities. The report should cover the

following issues:

(i) The rate at which the profits of Cutlass Inc will be taxed. This section of the report should explain:

– the company’s residency position and what Ben and Amy would have to do in order for the company

to be regarded as resident in the UK under the double tax treaty;

– the meaning of the term ‘permanent establishment’ and the implications of Cutlass Inc having a

permanent establishment in Sharpenia;

– the rate at which the profits of Cutlass Inc will be taxed on the assumption that it is resident in the

UK under the double tax treaty and either does or does not have a permanent establishment in

Sharpenia. (9 marks)

正确答案:

(b) Report to the management of Razor Ltd

To The management of Razor Ltd

From Tax advisers

Date 6 June 2007

Subject The proposed activities of Cutlass Inc

(i) Rate of tax on profits of Cutlass Inc

When considering the manner in which the profits of Cutlass Inc will be taxed it must be recognised that the system of

corporation tax in Sharpenia is the same as that in the UK.

The profits of Cutlass Inc will be subject to corporation tax in the country in which it is resident or where it has a

permanent establishment. It is desirable for the profits of Cutlass Inc to be taxed in the UK rather than in Sharpenia as

the rate of corporation tax in the UK on annual profits of £120,000 will be 19% whereas in Sharpenia the rate of tax

would be 38%.

Residency of Cutlass Inc

Cutlass Inc will be resident in Sharpenia, because it is incorporated there. However, it will also be resident in the UK if

it is centrally managed and controlled from the UK. For this to be the case, Amy and Ben should hold the company’s

board meetings in the UK.

Under the double tax treaty between the UK and Sharpenia, a company resident in both countries is treated as being

resident in the country where it is effectively managed and controlled. For Cutlass Inc to be treated as UK resident under

the treaty, Amy and Ben would need to ensure that all key management and commercial decisions are made in the UK

and not in Sharpenia.

Permanent establishment

A permanent establishment is a fixed place of business, including an office, factory or workshop, through which the

business of an enterprise is carried on. A permanent establishment will also exist in a country if contracts in the

company’s name are habitually concluded there.

The trading profits of Cutlass Inc will be taxable in Sharpenia if they are derived from a permanent establishment in

Sharpenia even if it can be established that Cutlass Inc is UK resident under the double tax treaty.

Double taxation

If Cutlass Inc is UK resident but has a permanent establishment in Sharpenia, its trading profits will be subject to

corporation tax in both the UK and Sharpenia with double tax relief available in the UK. The double tax relief will be the

lower of the UK tax and the Sharpenian tax on the trading profits. Accordingly, as the rate of tax is higher in Sharpenia

than it is in the UK, there will be no UK tax to pay on the company’s trading profits and the rate of tax on the profits

would be the rate in Sharpenia, i.e. 38%.

If Cutlass Inc is UK resident and does not have a permanent establishment in Sharpenia, its profits will be taxable in

the UK at the rate of 19% and not in Sharpenia. -

第5题:

根据下面 ,回答 53 ~56 题:D

The American newspaper has been around for about three hundred years. In 1721, the printer James Franklin. Benjamin's older brother, started the New England Courant, and that was what we might recognize today as a real newspaper. He filled his paper with stories of adventure, articles on art, on famous people, and on all sorts of political subjects.

Three centuries after the appearance of Franklin's Courant. few believe that newspapers in their present printed form. will remain alive for long Newspaper complies are losing advertisers (广告商), readers, market value. and in some cases, their sense of purpose at a speed that would not have been imaginable just several years ago The chief editor (主编) of the times said recently, "At places where they gather, editors ask one another, 'How are you?', as if they have just come out of the hospital or a lost law came. “An article about the newspaper appeared on the website of the Guardian, under the headline “NOT DEAD YET.”

Perhaps not, but the rise of the Internet which has made the daily newspaper look slow and out of step with the world, has brought about a real sense of death. Some American newspapers have lost 42% of their market value in the past thee years The New York Times Company has seen its stock (股票) drop by 54% since the end of 2004, with much of the loss coming in the past year A manager at Deutsche Bank suggested that stock-holders sell off their Times stock The Washington Post Comply has prevented the trouble only by changing part of its business to education its testing and test-preparation service now brings in at least half the company's income.

第13题:What can we learn about the New England Curran?

A.It is mainly about the stock market.

B.It marks the beginning of the American newspaper.

C.It remains a successful newspaper in America.

D.It comes articles by political leaders.

正确答案:B

-

第6题:

ALIBABA SEEKS TO RAISE BILLIONS IN IPO Investors in the United States are preparing for the first public sale of stock in the Chinese company Alibaba. The company sells goods________ linking buyers and sellers in the huge Chinese online market. Alibaba is expected to ________ its initial public offering, called an IPO, in September on the New York Stock Exchange. The total value of the company, based in Hangzhou, has been estimated at about $200 billion. Reports from Bloomberg News say Alibaba is offering investors a 12 percent ________ of the company. That would mean the company could raise ________ $20 billion dollars in the public stock sale. After the IPO, Alibaba could become one of the most ________ technology companies in the world. Apple, for example, has a market value of about $600 billion. Google is valued at about $390 billion and Microsoft is worth about $370 billion.

参考答案:by; make; share; as much as; valuable

-

第7题:

听力原文:The foreign exchange market operates much like other financial markets, but isn't located in a specific place like a stock exchange.

(9)

A.The foreign exchange market operates like other financial markets in every respect.

B.The foreign exchange market has a specific place like a stock exchange.

C.There's no physical market place such as stock exchanges for the foreign exchange transactions.

D.The foreign exchange market operates quite differently since the former has no physical market place.

正确答案:C

解析:单句意思为“外汇市场和其他金融市场运行很相似,但是和股票市场不同的是,它没有特定的交易场所。” -

第8题:

KFP Co, a company listed on a major stock market, is looking at its cost of capital as it prepares to make a bid to buy a rival unlisted company, NGN. Both companies are in the same business sector. Financial information on KFP Co and NGN is as follows:

NGN has a cost of equity of 12% per year and has maintained a dividend payout ratio of 45% for several years. The current earnings per share of the company is 80c per share and its earnings have grown at an average rate of 4·5% per year in recent years.

The ex div share price of KFP Co is $4·20 per share and it has an equity beta of 1·2. The 7% bonds of the company are trading on an ex interest basis at $94·74 per $100 bond. The price/earnings ratio of KFP Co is eight times.

The directors of KFP Co believe a cash offer for the shares of NGN would have the best chance of success. It has been suggested that a cash offer could be financed by debt.

Required:

(a) Calculate the weighted average cost of capital of KFP Co on a market value weighted basis. (10 marks)

(b) Calculate the total value of the target company, NGN, using the following valuation methods:

(i) Price/earnings ratio method, using the price/earnings ratio of KFP Co; and

(ii) Dividend growth model. (6 marks)

(c) Discuss the relationship between capital structure and weighted average cost of capital, and comment on

the suggestion that debt could be used to finance a cash offer for NGN. (9 marks)

正确答案:

(b)(i)Price/earningsratiomethodEarningspershareofNGN=80cpersharePrice/earningsratioofKFPCo=8SharepriceofNGN=80x8=640cor$6·40NumberofordinarysharesofNGN=5/0·5=10millionsharesValueofNGN=6·40x10m=$64millionHowever,itcanbearguedthatareductionintheappliedprice/earningsratioisneededasNGNisunlistedandthereforeitssharesaremoredifficulttobuyandsellthanthoseofalistedcompanysuchasKFPCo.Ifwereducetheappliedprice/earningsratioby10%(othersimilarpercentagereductionswouldbeacceptable),itbecomes7·2timesandthevalueofNGNwouldbe(80/100)x7·2x10m=$57·6million(ii)DividendgrowthmodelDividendpershareofNGN=80cx0·45=36cpershareSincethepayoutratiohasbeenmaintainedforseveralyears,recentearningsgrowthisthesameasrecentdividendgrowth,i.e.4·5%.Assumingthatthisdividendgrowthcontinuesinthefuture,thefuturedividendgrowthratewillbe4·5%.Sharepricefromdividendgrowthmodel=(36x1·045)/(0·12–0·045)=502cor$5·02ValueofNGN=5·02x10m=$50·2million(c)Adiscussionofcapitalstructurecouldstartfromrecognisingthatequityismoreexpensivethandebtbecauseoftherelativeriskofthetwosourcesoffinance.Equityisriskierthandebtandsoequityismoreexpensivethandebt.Thisdoesnotdependonthetaxefficiencyofdebt,sincewecanassumethatnotaxesexist.Wecanalsoassumethatasacompanygearsup,itreplacesequitywithdebt.Thismeansthatthecompany’scapitalbaseremainsconstantanditsweightedaveragecostofcapital(WACC)isnotaffectedbyincreasinginvestment.Thetraditionalviewofcapitalstructureassumesanon-linearrelationshipbetweenthecostofequityandfinancialrisk.Asacompanygearsup,thereisinitiallyverylittleincreaseinthecostofequityandtheWACCdecreasesbecausethecostofdebtislessthanthecostofequity.Apointisreached,however,wherethecostofequityrisesataratethatexceedsthereductioneffectofcheaperdebtandtheWACCstartstoincrease.Inthetraditionalview,therefore,aminimumWACCexistsand,asaresult,amaximumvalueofthecompanyarises.ModiglianiandMillerassumedaperfectcapitalmarketandalinearrelationshipbetweenthecostofequityandfinancialrisk.Theyarguedthat,asacompanygearedup,thecostofequityincreasedataratethatexactlycancelledoutthereductioneffectofcheaperdebt.WACCwasthereforeconstantatalllevelsofgearingandnooptimalcapitalstructure,wherethevalueofthecompanywasatamaximum,couldbefound.Itwasarguedthattheno-taxassumptionmadebyModiglianiandMillerwasunrealistic,sinceintherealworldinterestpaymentswereanallowableexpenseincalculatingtaxableprofitandsotheeffectivecostofdebtwasreducedbyitstaxefficiency.Theyrevisedtheirmodeltoincludethistaxeffectandshowedthat,asaresult,theWACCdecreasedinalinearfashionasacompanygearedup.Thevalueofthecompanyincreasedbythevalueofthe‘taxshield’andanoptimalcapitalstructurewouldresultbygearingupasmuchaspossible.Itwaspointedoutthatmarketimperfectionsassociatedwithhighlevelsofgearing,suchasbankruptcyriskandagencycosts,wouldlimittheextenttowhichacompanycouldgearup.Inpractice,therefore,itappearsthatcompaniescanreducetheirWACCbyincreasinggearing,whileavoidingthefinancialdistressthatcanariseathighlevelsofgearing.Ithasfurtherbeensuggestedthatcompanieschoosethesourceoffinancewhich,foronereasonoranother,iseasiestforthemtoaccess(peckingordertheory).Thisresultsinaninitialpreferenceforretainedearnings,followedbyapreferencefordebtbeforeturningtoequity.TheviewsuggeststhatcompaniesmaynotinpracticeseektominimisetheirWACC(andconsequentlymaximisecompanyvalueandshareholderwealth).TurningtothesuggestionthatdebtcouldbeusedtofinanceacashbidforNGN,thecurrentandpostacquisitioncapitalstructuresandtheirrelativegearinglevelsshouldbeconsidered,aswellastheamountofdebtfinancethatwouldbeneeded.Earliercalculationssuggestthatatleast$58mwouldbeneeded,ignoringanypremiumpaidtopersuadetargetcompanyshareholderstoselltheirshares.Thecurrentdebt/equityratioofKFPCois60%(15m/25m).Thedebtofthecompanywouldincreaseby$58minordertofinancethebidandbyafurther$20maftertheacquisition,duetotakingontheexistingdebtofNGN,givingatotalof$93m.Ignoringotherfactors,thegearingwouldincreaseto372%(93m/25m).KFPCowouldneedtoconsiderhowitcouldservicethisdangerouslyhighlevelofgearinganddealwiththesignificantriskofbankruptcythatitmightcreate.ItwouldalsoneedtoconsiderwhetherthebenefitsarisingfromtheacquisitionofNGNwouldcompensateforthesignificantincreaseinfinancialriskandbankruptcyriskresultingfromusingdebtfinance. -

第9题:

共用题干

第一篇

What's NASDAQ?

NASDAQ is a familiar but strange name for people.We often learn its news via different kinds of media,though quite a lot of people can not tell what exactly it means.

NASDAQ,short for the National Association of Securities Dealers Automated Quotations system,is one of the largest market in the world for stocks trading. The number of companies in NASDAQ is more than that of the other stock exchange in America,including the New York Stock Exchange(NYSE)and the American Stock Exchange(AMEX).

Most of the companies listed on NASDAQ are smaller than most of those on the NYSE and AMEX.NASDAQ has become recognized as the home of new technology companies,especially computer and computer-related businesses.Trading on NASDAQ is initiated by stock brokers acting on behalf of their clients.The brokers negotiate with market makers who concentrate on trading specific stocks to reach a price for the stock.

Different from other stock exchange,NASDAQ has no central location where trading takes place.Instead,its market makers can be found all over the country and make trades by telephone and via the Internet. Since brokers and market makers trade stocks directly instead of on the floor of a stock exchange,NASDAQ is called an over-the-counter market. The term over-the-counter refers to the direct nature of the trading,as in a store where goods are handed over a counter.

Since its foundation in 1971,the NASDAQ Stock Market has been the innovator. As the world's first electronic stock market,NASDAQ long ago set a precedent for technological trading innovation that is unrivaled.Now poised to become the world's first truly global market,the NASDAQ Stock Market is the market of choice for business industry leaders worldwide.By providing an efficient environment for raising capital NASDAQ has helped thousands of companies achieve their desired growth and successfully make the leap into public ownership.Who started NASDAQ?

A:By stock brokers acting representing their clients.

B:By market makers who concentrate on trading specific stocks to reach a price for the stock.

C:By business industry leaders worldwide.

D:By companies listed on NASDAQ.答案:A解析:本题是主旨概括题。题干是:这篇文章主要告诉我们什么?选D的依据是题目和各段的第一句,其中涉及了纳斯达克的名称、与其他股市的区别以及历史等,所以选项D有关纳斯达克的一般信息是正确答案。

本题是细节推理题。题干是:从短文中可以推理出以下哪一项? 选C的依据是最后一段第一句:"Since its foundation in 1971, the NASDAQ Stock Market has been the innovator"自1971年成立之日起,纳斯达克股票市场就成了产业的革新者。选项C纳斯达克已经做出了很多对股市的革新,与原文意思相符。

本题是细节考查题。题干是:以下哪个说法是正确的? 选B的依据是最后一段第二句:"As the world's first electronic stock market..."。选项B纳斯达克已经准备好成为世界上第一个真正的全球电子股票市场,与原文意思相符。

本题是细节考查题。题干是:谁是纳斯达克的创始人?选A的依据是第三段第三句:"Trading on NASDAQ is initiated by stock brokers acting on behalf of their clients." 纳斯达克的交易是通过代表客户利益的股票经纪人发起的。选项A代表客户利益的股票经纪人,与原文意思相符,是正确答案。

本题考查考生结合上下文理解多义词意思的能力。题干是:纳斯达克是如何帮助成百上千家公司完成其市值的预期增长,同时也成功地、跨越式地实现公司股权的公众所有?全文的最后一句提到“By providing an efficient environment for raising capital NASDAQ has helped thousands of companies achieve their desired growth and successfully make the leap into public ownership.“通过提供一个有效的融资环境,纳斯达克已经帮助成百上千家公司完成了其市值的预期增长,同时也成功地、跨越式地实现了公司股权的公众所有。所以选项B通过提供一个有效的融资环境是正确答案。 -

第10题:

共用题干

第一篇

What's NASDAQ?

NASDAQ is a familiar but strange name for people.We often learn its news via different kinds of media,though quite a lot of people can not tell what exactly it means.

NASDAQ,short for the National Association of Securities Dealers Automated Quotations system,is one of the largest market in the world for stocks trading. The number of companies in NASDAQ is more than that of the other stock exchange in America,including the New York Stock Exchange(NYSE)and the American Stock Exchange(AMEX).

Most of the companies listed on NASDAQ are smaller than most of those on the NYSE and AMEX.NASDAQ has become recognized as the home of new technology companies,especially computer and computer-related businesses.Trading on NASDAQ is initiated by stock brokers acting on behalf of their clients.The brokers negotiate with market makers who concentrate on trading specific stocks to reach a price for the stock.

Different from other stock exchange,NASDAQ has no central location where trading takes place.Instead,its market makers can be found all over the country and make trades by telephone and via the Internet. Since brokers and market makers trade stocks directly instead of on the floor of a stock exchange,NASDAQ is called an over-the-counter market. The term over-the-counter refers to the direct nature of the trading,as in a store where goods are handed over a counter.

Since its foundation in 1971,the NASDAQ Stock Market has been the innovator. As the world's first electronic stock market,NASDAQ long ago set a precedent for technological trading innovation that is unrivaled.Now poised to become the world's first truly global market,the NASDAQ Stock Market is the market of choice for business industry leaders worldwide.By providing an efficient environment for raising capital NASDAQ has helped thousands of companies achieve their desired growth and successfully make the leap into public ownership.How NASDAQ help thousands of companies achieve their desired growth and successfully make the leap into public ownership?

A:the environment where someone get to know something.

B:By providing an efficient environment for raising capital.

C:By setting a precedent for technological trading innovation that is unrivaled.

D:By concentrate on trading specific stocks to reach a price for the stock.答案:B解析:本题是主旨概括题。题干是:这篇文章主要告诉我们什么?选D的依据是题目和各段的第一句,其中涉及了纳斯达克的名称、与其他股市的区别以及历史等,所以选项D有关纳斯达克的一般信息是正确答案。

本题是细节推理题。题干是:从短文中可以推理出以下哪一项? 选C的依据是最后一段第一句:"Since its foundation in 1971, the NASDAQ Stock Market has been the innovator"自1971年成立之日起,纳斯达克股票市场就成了产业的革新者。选项C纳斯达克已经做出了很多对股市的革新,与原文意思相符。

本题是细节考查题。题干是:以下哪个说法是正确的? 选B的依据是最后一段第二句:"As the world's first electronic stock market..."。选项B纳斯达克已经准备好成为世界上第一个真正的全球电子股票市场,与原文意思相符。

本题是细节考查题。题干是:谁是纳斯达克的创始人?选A的依据是第三段第三句:"Trading on NASDAQ is initiated by stock brokers acting on behalf of their clients." 纳斯达克的交易是通过代表客户利益的股票经纪人发起的。选项A代表客户利益的股票经纪人,与原文意思相符,是正确答案。

本题考查考生结合上下文理解多义词意思的能力。题干是:纳斯达克是如何帮助成百上千家公司完成其市值的预期增长,同时也成功地、跨越式地实现公司股权的公众所有?全文的最后一句提到“By providing an efficient environment for raising capital NASDAQ has helped thousands of companies achieve their desired growth and successfully make the leap into public ownership.“通过提供一个有效的融资环境,纳斯达克已经帮助成百上千家公司完成了其市值的预期增长,同时也成功地、跨越式地实现了公司股权的公众所有。所以选项B通过提供一个有效的融资环境是正确答案。 -

第11题:

单选题The passage mainly wants to tell us ______.Ahow to buy or sell shares

BABC of stock markets

Cthe stock market is like gambling

Dinvesting money in the stock market is not the safest way

正确答案: C解析:

主旨大意题。纵观全文,本文讲解了一些股票的基本知识,如什么是股票,股票的性质以及投资股票的人等,即股票的一些常识。ABC of表示某个领域的基本知识。因此B选项正确。 -

第12题:

单选题The results of that company are _____ stock market expectations.Aout of line

Bin line

Cin line with

Din line for

正确答案: D解析:

in line with与……一致,符合。out of line没排齐,不守秩序。in line成一直线,有秩序。in line for即将得到。 -

第13题:

2 (a) Explain the term ‘backflush accounting’ and the circumstances in which its use would be appropriate.

(6 marks)

正确答案:

(a) Backflush accounting focuses upon output of an organisation and then works backwards when allocating costs between cost

of goods sold and inventories. It can be argued that backflush accounting simplifies costing since it ignores both labour

variances and work-in-progress. Whilst in a perfect just-in-time environment there would be no work-in-progress at all, there

will in practice be a small amount of work-in-progress in the system at any point in time. This amount, however, is likely to

be negligible in quantity and therefore not significant in terms of value. Thus, a backflush accounting system simplifies the

accounting records by avoiding the need to follow the movement of materials and work-in-progress through the manufacturing

process within the organisation.

The backflush accounting system is likely to involve the maintenance of a raw materials and work-in–progress account

together with a finished goods account. The use of standard costs and variances is likely to be incorporated into the

accounting entries. Transfers from raw materials and work-in-progress account to finished goods (or cost of sales) will probably

be made at standard cost. The difference between the actual inputs and the standard charges from the raw materials and

work-in-progress account will be recorded as a residual variance, which will be recorded in the profit and loss account. Thus,

it is essential that standard costs are a good surrogate for actual costs if large variances are to be avoided. Backflush

accounting is ideally suited to a just-in-time philosophy and is employed where the overall cycle time is relatively short and

inventory levels are low. Naturally, management will still be eager to ascertain the cause of any variances that arise from the

inefficient usage of materials, labour and overhead. However investigations are far more likely to be undertaken using nonfinancial

performance indicators as opposed to detailed cost variances. -

第14题:

(c) Explain the term ‘target costing’ and how it may be applied by GWCC. Briefly discuss any potential

limitations in its application. (8 marks)

正确答案:

(c) Target costing should be viewed as an integral part of a strategic profit management system. The initial consideration in target

costing is the determination of an estimate of the selling price for a new product which will enable a firm to capture its required

share of the market. In this particular example, Superstores plc, which on the face of it looks a powerful commercial

organisation, wishes to apply a 35% mark-up on the purchase price of each cake from GWCC. Since Superstores plc has

already decided on a launch price of £20·25 then it follows that the maximum selling price that can be charged by GWCC

is (100/135) x £20·25 which is £15·00.

This is clearly a situation which lends itself to the application of target costing/pricing techniques as in essence GWCC can

see the extent to which they fall short of the required level of return with regard to a contract with Superstores plc which ends

after twelve months. Thus it is necessary to reduce the total costs by £556,029 to this figure in order to achieve the desired

level of profit, having regard to the rate of return required on new capital investment. The deduction of required profit from

the proposed selling price will produce a target price that must be met in order to ensure that the desired rate of return is

obtained. Thus the main theme that underpins target costing can be seen to be ‘what should a product cost in order to achieve

the desired level of return’.

Target costing will necessitate comparison of current estimated cost levels against the target level which must be achieved if

the desired levels of profitability, and hence return on investment, are to be achieved. Thus where a gap exists between the

current estimated cost levels and the target cost, it is essential that this gap be closed.

The Directors of GWCC plc should be aware of the fact that it is far easier to ‘design out’ cost during the pre-production phase

than to ‘control out’ cost during the production phase. Thus cost reduction at this stage of a product’s life cycle is of critical

significance to business success.

A number of techniques may be employed in order to help in the achievement and maintenance of the desired level of target

cost. Attention should be focussed upon the identification of value added and non-value added activities with the aim of the

elimination of the latter. The product should be developed in an atmosphere of ‘continuous improvement’. In this regard, total

quality techniques such as the use of Quality circles may be used in attempting to find ways of achieving reductions in product

cost.

Value engineering techniques can be used to evaluate necessary product features such as the quality of materials used. It is

essential that a collaborative approach is taken by the management of GWCC and that all interested parties such as suppliers

and customers are closely involved in order to engineer product enhancements at reduced cost.

The degree of success that will be achieved by GWCC via the application of target costing principles will be very much

dependent on the extent of ‘flexibility’ in variable costs. Also the accuracy of information gathered by GWCC will assume

critical importance because the use of inaccurate information will produce calculated ‘cost gaps’ which are meaningless and

render the application of target costing principles of little value. -

第15题:

(c) (i) Explain the capital gains tax (CGT) implications of a takeover where the consideration is in the form. of

shares (a ‘paper for paper’ transaction) stating any conditions that need to be satisfied. (4 marks)

正确答案:

(c) (i) Paper for paper rules

The proposed transaction broadly falls under the ‘paper for paper’ rules. Where this is the case, chargeable gains do not

arise. Instead, the new holding stands in the shoes (and inherits the base cost) of the original holding.

The company issuing the new shares must:

(i) end up with more than 25% of the ordinary share capital (or a majority of the voting power) of the old company,

OR

(ii) make a general offer to shareholders in the other company with a condition that, if satisfied, would give the

acquiring company control of the other company.

The exchange must be for bona fide commercial reasons and must not have as its main purpose (or one of its main

purposes) the avoidance of CGT or corporation tax. The acquiring company can obtain advance clearance from the

Inland Revenue that the conditions will be met.

If part of the offer consideration is in the form. of cash, a gain must be calculated using the part disposal rules. If the

cash received is not more than the higher of £3,000 or 5% of the total value on takeover, then the amount received in

cash can be deducted from the base cost of the securities under the small distribution rules. -

第16题:

D

The American newspaper has been around for about three hundred years. In 1721, the printer James Franklin. Benjamin's older brother, started the New England Courant, and that was what we might recognize today as a real newspaper. He filled his paper with stories of adventure, articles on art, on famous people, and on all sorts of political subjects.

Three centuries after the appearance of Franklin's Courant. few believe that newspapers in their present printed form. will remain alive for long Newspaper complies are losing advertisers (广告商), readers, market value. and. in some cases, their sense of purpose at a speed that would not have been imaginable just several years ago The chief editor (主编) of the times said recently, "At places where they gather, editors ask one another, 'How are you?', as if they have just come out of the hospital or a lost law came. “An article about the newspaper appeared on the website of the Guardian, under the headline “NOT DEAD YET.”

perhaps not, but the rise of the Internet which has made the daily newspaper look slow and out of step with the world, has brought about a real sense of death. Some American newspapers have lost 42% of their market value in the past thee years The New York Times Company has seen its stock (股票) drop by 54% since the end of 2004, with much of the loss coming in the past year A manager at Deutsche Bank suggested that stock-holders sell off their Times stock The Washington Post Comply has prevented the trouble only by changing part of its business to education its testing and test-preparation service now brings in at least half the company's income.

53. What can we learn about the New England Curran?

A. It is mainly about the stock market.

B. It marks the beginning of the American newspaper.

C. It remains a successful newspaper in America.

D. It comes articles by political leaders.

正确答案:B

-

第17题:

The marketplace where short-term debt securities are traded is referred to as ______.

A.a mortgage market

B.a stock market

C.a bond market

D.a money market

正确答案:D

解析:短期债务凭证交易的市场是货币市场,而前三个属于资本市场。mortgage market抵押市场。stock market股票市场。bond market债券市场。 -

第18题:

The company has successfully expanded its market.(英译汉)

参考答案:这家企业成功拓展了市场。

-

第19题:

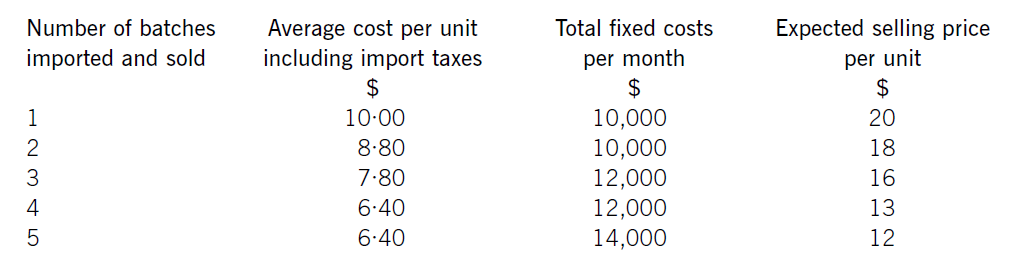

Jewel Co is setting up an online business importing and selling jewellery headphones. The cost of each set of headphones varies depending on the number purchased, although they can only be purchased in batches of 1,000 units. It also has to pay import taxes which vary according to the quantity purchased.

Jewel Co has already carried out some market research and identified that sales quantities are expected to vary depending on the price charged. Consequently, the following data has been established for the first month:

Required:

(a) Calculate how many batches Jewel Co should import and sell. (6 marks)

(b) Explain why Jewel Co could not use the algebraic method to establish the optimum price for its product.

(4 marks)

正确答案:

(b)Thealgebraicmodelrequiresseveralassumptionstobetrue.First,theremustbeaconsistentrelationshipbetweenprice(P)anddemand(Q),sothatademandequationcanbeestablished,usuallyintheform.P=a–bQ.Here,althoughthereisaclearrelationshipbetweenthetwo,itisnotaperfectlylinearrelationshipandsomorecomplicatedtechniquesarerequiredtocalculatethedemandequation.ItalsocannotbeassumedthatalinearrelationshipwillholdforallvaluesofPandQotherthanthefivegiven.Similarly,theremustbeaclearrelationshipbetweendemandandmarginalcost,usuallysatisfiedbyconstantvariablecostperunitandconstantfixedcosts.Thechangingvariablecostsperunitagaincomplicatetheissue,butitisthechangesinfixedcostswhichmakethealgebraicmethodlessusefulinJewel’scase.Thealgebraicmodelisonlysuitableforcompaniesoperatinginamonopolyanditisnotclearherewhetherthisisthecase,butitseemsunlikely,soany‘optimum’pricemightbecomeirrelevantifJewel’scompetitorschargesignificantlylowerprices.Othermoregeneralfactorsnotconsideredbythealgebraicmodelarepoliticalfactorswhichmightaffectimports,socialfactorswhichmayaffectcustomertastesandeconomicfactorswhichmayaffectexchangeratesorcustomerspendingpower.Thereliabilityoftheestimatesthemselves–forsalesprices,variablecostsandfixedcosts–couldalsobecalledintoquestion. -

第20题:

共用题干

第一篇

What's NASDAQ?

NASDAQ is a familiar but strange name for people.We often learn its news via different kinds of media,though quite a lot of people can not tell what exactly it means.

NASDAQ,short for the National Association of Securities Dealers Automated Quotations system,is one of the largest market in the world for stocks trading. The number of companies in NASDAQ is more than that of the other stock exchange in America,including the New York Stock Exchange(NYSE)and the American Stock Exchange(AMEX).

Most of the companies listed on NASDAQ are smaller than most of those on the NYSE and AMEX.NASDAQ has become recognized as the home of new technology companies,especially computer and computer-related businesses.Trading on NASDAQ is initiated by stock brokers acting on behalf of their clients.The brokers negotiate with market makers who concentrate on trading specific stocks to reach a price for the stock.

Different from other stock exchange,NASDAQ has no central location where trading takes place.Instead,its market makers can be found all over the country and make trades by telephone and via the Internet. Since brokers and market makers trade stocks directly instead of on the floor of a stock exchange,NASDAQ is called an over-the-counter market. The term over-the-counter refers to the direct nature of the trading,as in a store where goods are handed over a counter.

Since its foundation in 1971,the NASDAQ Stock Market has been the innovator. As the world's first electronic stock market,NASDAQ long ago set a precedent for technological trading innovation that is unrivaled.Now poised to become the world's first truly global market,the NASDAQ Stock Market is the market of choice for business industry leaders worldwide.By providing an efficient environment for raising capital NASDAQ has helped thousands of companies achieve their desired growth and successfully make the leap into public ownership.What does the passage mainly tell us?

A:The history of NASDAQ.

B:The difference between NASDAQ and other stock exchanges.

C:How NASDAQ is managed.

D:The general information about NASDAQ.答案:D解析:本题是主旨概括题。题干是:这篇文章主要告诉我们什么?选D的依据是题目和各段的第一句,其中涉及了纳斯达克的名称、与其他股市的区别以及历史等,所以选项D有关纳斯达克的一般信息是正确答案。

本题是细节推理题。题干是:从短文中可以推理出以下哪一项? 选C的依据是最后一段第一句:"Since its foundation in 1971, the NASDAQ Stock Market has been the innovator"自1971年成立之日起,纳斯达克股票市场就成了产业的革新者。选项C纳斯达克已经做出了很多对股市的革新,与原文意思相符。

本题是细节考查题。题干是:以下哪个说法是正确的? 选B的依据是最后一段第二句:"As the world's first electronic stock market..."。选项B纳斯达克已经准备好成为世界上第一个真正的全球电子股票市场,与原文意思相符。

本题是细节考查题。题干是:谁是纳斯达克的创始人?选A的依据是第三段第三句:"Trading on NASDAQ is initiated by stock brokers acting on behalf of their clients." 纳斯达克的交易是通过代表客户利益的股票经纪人发起的。选项A代表客户利益的股票经纪人,与原文意思相符,是正确答案。

本题考查考生结合上下文理解多义词意思的能力。题干是:纳斯达克是如何帮助成百上千家公司完成其市值的预期增长,同时也成功地、跨越式地实现公司股权的公众所有?全文的最后一句提到“By providing an efficient environment for raising capital NASDAQ has helped thousands of companies achieve their desired growth and successfully make the leap into public ownership.“通过提供一个有效的融资环境,纳斯达克已经帮助成百上千家公司完成了其市值的预期增长,同时也成功地、跨越式地实现了公司股权的公众所有。所以选项B通过提供一个有效的融资环境是正确答案。 -

第21题:

共用题干

第一篇

What's NASDAQ?

NASDAQ is a familiar but strange name for people.We often learn its news via different kinds of media,though quite a lot of people can not tell what exactly it means.

NASDAQ,short for the National Association of Securities Dealers Automated Quotations system,is one of the largest market in the world for stocks trading. The number of companies in NASDAQ is more than that of the other stock exchange in America,including the New York Stock Exchange(NYSE)and the American Stock Exchange(AMEX).

Most of the companies listed on NASDAQ are smaller than most of those on the NYSE and AMEX.NASDAQ has become recognized as the home of new technology companies,especially computer and computer-related businesses.Trading on NASDAQ is initiated by stock brokers acting on behalf of their clients.The brokers negotiate with market makers who concentrate on trading specific stocks to reach a price for the stock.

Different from other stock exchange,NASDAQ has no central location where trading takes place.Instead,its market makers can be found all over the country and make trades by telephone and via the Internet. Since brokers and market makers trade stocks directly instead of on the floor of a stock exchange,NASDAQ is called an over-the-counter market. The term over-the-counter refers to the direct nature of the trading,as in a store where goods are handed over a counter.

Since its foundation in 1971,the NASDAQ Stock Market has been the innovator. As the world's first electronic stock market,NASDAQ long ago set a precedent for technological trading innovation that is unrivaled.Now poised to become the world's first truly global market,the NASDAQ Stock Market is the market of choice for business industry leaders worldwide.By providing an efficient environment for raising capital NASDAQ has helped thousands of companies achieve their desired growth and successfully make the leap into public ownership.What can be inferred from the passage?

A:NASDAQ is the headquarters of new technology companies.

B:Companies in NASDAQ are smaller than most of those on the NYSE and AMEX.

C:NASDAQ has innovated a lot in stock market.

D:Hundreds of companies achieve their desired growth every year.答案:C解析:本题是主旨概括题。题干是:这篇文章主要告诉我们什么?选D的依据是题目和各段的第一句,其中涉及了纳斯达克的名称、与其他股市的区别以及历史等,所以选项D有关纳斯达克的一般信息是正确答案。

本题是细节推理题。题干是:从短文中可以推理出以下哪一项? 选C的依据是最后一段第一句:"Since its foundation in 1971, the NASDAQ Stock Market has been the innovator"自1971年成立之日起,纳斯达克股票市场就成了产业的革新者。选项C纳斯达克已经做出了很多对股市的革新,与原文意思相符。

本题是细节考查题。题干是:以下哪个说法是正确的? 选B的依据是最后一段第二句:"As the world's first electronic stock market..."。选项B纳斯达克已经准备好成为世界上第一个真正的全球电子股票市场,与原文意思相符。

本题是细节考查题。题干是:谁是纳斯达克的创始人?选A的依据是第三段第三句:"Trading on NASDAQ is initiated by stock brokers acting on behalf of their clients." 纳斯达克的交易是通过代表客户利益的股票经纪人发起的。选项A代表客户利益的股票经纪人,与原文意思相符,是正确答案。

本题考查考生结合上下文理解多义词意思的能力。题干是:纳斯达克是如何帮助成百上千家公司完成其市值的预期增长,同时也成功地、跨越式地实现公司股权的公众所有?全文的最后一句提到“By providing an efficient environment for raising capital NASDAQ has helped thousands of companies achieve their desired growth and successfully make the leap into public ownership.“通过提供一个有效的融资环境,纳斯达克已经帮助成百上千家公司完成了其市值的预期增长,同时也成功地、跨越式地实现了公司股权的公众所有。所以选项B通过提供一个有效的融资环境是正确答案。 -

第22题:

共用题干

第一篇

What's NASDAQ?

NASDAQ is a familiar but strange name for people.We often learn its news via different kinds of media,though quite a lot of people can not tell what exactly it means.

NASDAQ,short for the National Association of Securities Dealers Automated Quotations system,is one of the largest market in the world for stocks trading. The number of companies in NASDAQ is more than that of the other stock exchange in America,including the New York Stock Exchange(NYSE)and the American Stock Exchange(AMEX).

Most of the companies listed on NASDAQ are smaller than most of those on the NYSE and AMEX.NASDAQ has become recognized as the home of new technology companies,especially computer and computer-related businesses.Trading on NASDAQ is initiated by stock brokers acting on behalf of their clients.The brokers negotiate with market makers who concentrate on trading specific stocks to reach a price for the stock.

Different from other stock exchange,NASDAQ has no central location where trading takes place.Instead,its market makers can be found all over the country and make trades by telephone and via the Internet. Since brokers and market makers trade stocks directly instead of on the floor of a stock exchange,NASDAQ is called an over-the-counter market. The term over-the-counter refers to the direct nature of the trading,as in a store where goods are handed over a counter.

Since its foundation in 1971,the NASDAQ Stock Market has been the innovator. As the world's first electronic stock market,NASDAQ long ago set a precedent for technological trading innovation that is unrivaled.Now poised to become the world's first truly global market,the NASDAQ Stock Market is the market of choice for business industry leaders worldwide.By providing an efficient environment for raising capital NASDAQ has helped thousands of companies achieve their desired growth and successfully make the leap into public ownership.Which of the following is stated to be true?

A:NASDAQ came into being in 1972.

B:NASDAQ has been ready to become the world's first truly electronic global stock market.

C:New York Stock Exchange is called an over-the-counter market.

D:AMEX is the market of choice for business industry leaders worldwide.答案:B解析:本题是主旨概括题。题干是:这篇文章主要告诉我们什么?选D的依据是题目和各段的第一句,其中涉及了纳斯达克的名称、与其他股市的区别以及历史等,所以选项D有关纳斯达克的一般信息是正确答案。

本题是细节推理题。题干是:从短文中可以推理出以下哪一项? 选C的依据是最后一段第一句:"Since its foundation in 1971, the NASDAQ Stock Market has been the innovator"自1971年成立之日起,纳斯达克股票市场就成了产业的革新者。选项C纳斯达克已经做出了很多对股市的革新,与原文意思相符。

本题是细节考查题。题干是:以下哪个说法是正确的? 选B的依据是最后一段第二句:"As the world's first electronic stock market..."。选项B纳斯达克已经准备好成为世界上第一个真正的全球电子股票市场,与原文意思相符。

本题是细节考查题。题干是:谁是纳斯达克的创始人?选A的依据是第三段第三句:"Trading on NASDAQ is initiated by stock brokers acting on behalf of their clients." 纳斯达克的交易是通过代表客户利益的股票经纪人发起的。选项A代表客户利益的股票经纪人,与原文意思相符,是正确答案。

本题考查考生结合上下文理解多义词意思的能力。题干是:纳斯达克是如何帮助成百上千家公司完成其市值的预期增长,同时也成功地、跨越式地实现公司股权的公众所有?全文的最后一句提到“By providing an efficient environment for raising capital NASDAQ has helped thousands of companies achieve their desired growth and successfully make the leap into public ownership.“通过提供一个有效的融资环境,纳斯达克已经帮助成百上千家公司完成了其市值的预期增长,同时也成功地、跨越式地实现了公司股权的公众所有。所以选项B通过提供一个有效的融资环境是正确答案。 -

第23题:

单选题MRK Consulting Ltd has been operating in the global market since 1988. We have successfully placed hundreds of IT & Banking professionals in leading companies in the Finance, Banking and IT industries.AMRK is a leading company in Finance and IT Industries.

BThere are many IT and Banking talents working with MRK.

CMRK has helped many people found good jobs.

正确答案: C解析:

公司的名称“MRK Consulting Ltd”表示“MRK咨询公司”,所以选项A可以被排除。根据原文第二句可知,MRK为成百上千的IT业和银行业的专业人士在一流的企业中找到了工作,而不是这些IT业和银行业的精英在MRK工作,所以选项B可以排除,C项正确。