(b) Calculate the internal rate of return of the proposed investment and comment on your findings. (5 marks)

题目

(b) Calculate the internal rate of return of the proposed investment and comment on your findings. (5 marks)

相似考题

更多“(b) Calculate the internal rate of return of the proposed investment and comment on your findings. (5 marks)”相关问题

-

第1题:

(ii) Explain the organisational factors that determine the need for internal audit in public listed companies.

(5 marks)

正确答案:

(ii) Factors affecting the need for internal audit and controls

(Based partly on Turnbull guidance)

The nature of operations within the organisation arising from its sector, strategic positioning and main activities.

The scale and size of operations including factors such as the number of employees. It is generally assumed that larger

and more complex organisations have a greater need for internal controls and audit than smaller ones owing to the

number of activities occurring that give rise to potential problems.

Cost/benefit considerations. Management must weigh the benefits of instituting internal control and audit systems

against the costs of doing so. This is likely to be an issue for medium-sized companies or companies experiencing

growth.

Internal or external changes affecting activities, structures or risks. Changes arising from new products or internal

activities can change the need for internal audit and so can external changes such as PESTEL factors.

Problems with existing systems, products and/or procedures including any increase in unexplained events. Repeated or

persistent problems can signify the need for internal control and audit.

The need to comply with external requirements from relevant stock market regulations or laws. This appears to be a

relevant factor at Gluck & Goodman. -

第2题:

(b) Identify and explain THREE approaches that the directors of Moffat Ltd might apply in assessing the

QUALITATIVE benefits of the proposed investment in a new IT system. (6 marks)

正确答案:

(b) One approach that the directors of Moffat Ltd could adopt would be to ignore the qualitative benefits that may arise on the

basis that there is too much subjectivity involved in their assessment. The problem that this causes is that the investment will

probably look unattractive since all costs will be included in the evaluation whereas significant benefits and savings will have

been ignored. Hence such an approach is lacking in substance and is not recommended.

An alternative approach would involve attempting to attribute values to each of the identified benefits that are qualitative in

nature. Such an approach will necessitate the use of management estimates in order to derive the cash flows to be

incorporated in a cost benefit analysis. The problems inherent in this approach include gaining consensus among interested

parties regarding the footing of the assumptions from which estimated cash flows have been derived. Furthermore, if the

proposed investment does take place then it may well be impossible to prove that the claimed benefits of the new system

have actually been realised.

Perhaps the preferred approach is to acknowledge the existence of qualitative benefits and attempt to assess them in a

reasonable manner acceptable to all parties including the company’s bank. The financial evaluation would then not only

incorporate ‘hard’ facts relating to costs and benefits that are quantitative in nature, but also would include details of

qualitative benefits which management consider exist but have not attempted to assess in financial terms. Such benefits might

include, for example, the average time saved by location managers in analysing information during each operating period.

Alternatively the management of Moffat Ltd could attempt to express qualitative benefits in specific terms linked to a hierarchy

of organisational requirements. For example, qualitative benefits could be categorised as being:

(1) Essential to the business

(2) Very useful attributes

(3) Desirable, but not essential

(4) Possible, if funding is available

(5) Doubtful and difficult to justify. -

第3题:

(ii) Briefly discuss TWO factors which could reduce the rate of return earned by the investment as per the

results in part (a). (4 marks)

正确答案:

(ii) Two factors which might reduce the return earned by the investment are as follows:

(i) Poor product quality

The very nature of the product requires that it is of the highest quality i.e. the cakes are made for human

consumption. Bad publicity via a ‘product recall’ could potentially have a catastrophic effect on the total sales to

Superstores plc over the eighteen month period.

(ii) The popularity of the Mighty Ben character

There is always the risk that the popularity of the character upon which the product is based will diminish with a

resultant impact on sales volumes achieved. In this regard it would be advisable to attempt to negotiate with

Superstores plc in order to minimise potential future losses. -

第4题:

(ii) Comment on the figures in the statement prepared in (a)(i) above. (4 marks)

正确答案:

(ii) The statement of product profitability shows that CTC is forecast to achieve a profit of $2·185 million in 2008 giving a

profit:sales ratio of 11·9%. However, the forecast profit in 2009 is only $22,000 which would give a profit:sales ratio

of just 0·19%! Total sales volume in 2008 is 390,000 units which represent 97·5% utilisation of total annual capacity.

In stark contrast, the total sales volume in 2009 is forecast to be 240,000 units which represents 60% utilisation of

total annual capacity and shows the expected rapid decline in sales volumes of Bruno and Kong products. The rapid

decline in the sales of these two products is only offset to a relatively small extent by increased sales volume from the

Leo product. It is vital that a new product or products with healthy contribution to sales ratios are introduced.

Management should also undertake cost/benefit analyses in order to assess the potential of extending the life of Bruno

and Kong products. -

第5题:

(ii) Calculate Paul’s tax liability if he exercises the share options in Memphis plc and subsequently sells the

shares in Memphis plc immediately, as proposed, and show how he may reduce this tax liability.

(4 marks)

正确答案:

-

第6题:

(c) Pinzon, a limited liability company and audit client, is threatening to sue your firm in respect of audit fees charged

for the year ended 31 December 2004. Pinzon is alleging that Bartolome billed the full rate on air fares for audit

staff when substantial discounts had been obtained by Bartolome. (4 marks)

Required:

Comment on the ethical and other professional issues raised by each of the above matters and their implications,

if any, for the continuation of each assignment.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(c) Threatened legal action

Ethical and professional issues

■ An advocacy threat has arisen as Bartolome and Pinzon are in opposition concerning the fee note for the 2004 audit.

■ If Pinzon’s allegations are true this may cast serious doubt on the integrity of Bartolome. Pinzon should be advised to

take their claims first to ACCA’s Disciplinary Committee.

■ If Bartolome has indeed charged full air fares when substantial discounts had been obtained this could be due to:

– Bartolome incorrectly believing this to be an acceptable industry practice; or

– a billing error/oversight.

In either case Bartolome should issue a credit note, although this may be insufficient to make amends and salvage the

auditor-client relationship.

■ Bartolome may have legitimately claimed for full airfares if this was agreed in its contract (i.e. the terms of engagement)

with Pinzon.

Implications for continuation with assignment

Unless the threat of legal action is amicably resolved very quickly (which is perhaps unlikely) Pinzon and Bartolome are in

conflict. Bartolome cannot therefore be seen to be independent and so should tender their resignation as auditor for the year

ending 31 December 2005 (assuming they were re-appointed and have not already been removed from office). -

第7题:

(b) Describe the principal matters that should be included in your firm’s submission to provide internal audit

services to RBG. (10 marks)

正确答案:

(b) Principal matters to be included in submission to provide internal audit services

■ Introduction/background – details about York including its organisation (of functions), offices (locations) and number of

internal auditors working within each office. The office that would be responsible for managing the contract should be

stated.

■ A description of York’s services most relevant to RBG’s needs (e.g. in the areas of risk management, IT audits, value for

money (VFM) and corporate governance).

■ Client-specific issues identified. For example, revenue audits will be required routinely for control purposes and to

substantiate the contingent rents due. Other areas of expertise that RBG may be interested in taking advantage of, for

example, special projects such as acquisitions and mergers.

■ York’s approach to assessing audit needs including the key stages and who will be involved. For example:

(1) Preliminary – review of business, industry and the entity’s operating characteristics

(2) Planning – including needs analysis and co-ordination with external audit plan

(3) Post-Audit – assurance that activities were effectively and efficiently executed

(4) Review – of services provided, reports issued and management’s responses.

■ A description of internal audit tools used and methodologies/approach to audit fieldwork including use of embedded

audit software and programs developed by York.

■ A description of York’s systems-based audit, the IT issues to be addressed and the technological support that can be

provided.

■ Any training that will be offered to RBG’s managers and staff, for example, in a risk management approach.

■ A description and quantity of resources, in particular the number of full-time staff, to be deployed in providing services

to RBG. An outline of RBG’s track record in human resource retention and development.

■ Relevant experience – e.g. in internal and external audit in the retail industry. The relative qualifications and skills of

each grade of audit staff and the contract manager in particular.

■ Insurance certifications covering, for example, public liability and professional indemnity insurance.

■ Work ethic policies relating to health and safety, equal opportunities’ and race relations.

■ How York ensures quality throughout the internal audit process including standards to be followed (e.g. Institute of

Internal Auditors’ standards).

■ Sample report templates – e.g. for reporting the results of risk analysis, audit plans and quarterly reporting of findings

to the Audit and Risk Management Committee.

■ Current clients to whom internal audit services are provided from whom RBG will be able to take up references, by

arrangement, if York is short-listed.

■ Any work currently carried out/competed for that could cause a conflict of interest (and the measures to avoid such

conflicts).

■ Fees (daily rates) for each grade of staff and travel and other expenses to be reimbursed. An indication of price increases,

if any, over the three-year contract period. Invoicing terms (e.g. on presentation of reports) and payment terms (e.g. the

end of the month following receipt of the invoice).

■ Performance targets to be met such as deadlines for completing work and submitting and issuing reports. -

第8题:

PV Co is evaluating an investment proposal to manufacture Product W33, which has performed well in test marketing trials conducted recently by the company’s research and development division. The following information relating to this investment proposal has now been prepared.

Initial investment $2 million

Selling price (current price terms) $20 per unit

Expected selling price inflation 3% per year

Variable operating costs (current price terms) $8 per unit

Fixed operating costs (current price terms) $170,000 per year

Expected operating cost inflation 4% per year

The research and development division has prepared the following demand forecast as a result of its test marketing trials. The forecast reflects expected technological change and its effect on the anticipated life-cycle of Product W33.

It is expected that all units of Product W33 produced will be sold, in line with the company’s policy of keeping no inventory of finished goods. No terminal value or machinery scrap value is expected at the end of four years, when production of Product W33 is planned to end. For investment appraisal purposes, PV Co uses a nominal (money) discount rate of 10% per year and a target return on capital employed of 30% per year. Ignore taxation.

Required:

(a) Identify and explain the key stages in the capital investment decision-making process, and the role of

investment appraisal in this process. (7 marks)

(b) Calculate the following values for the investment proposal:

(i) net present value;

(ii) internal rate of return;

(iii) return on capital employed (accounting rate of return) based on average investment; and

(iv) discounted payback period. (13 marks)

(c) Discuss your findings in each section of (b) above and advise whether the investment proposal is financially acceptable. (5 marks)

正确答案:

(a)Thekeystagesinthecapitalinvestmentdecision-makingprocessareidentifyinginvestmentopportunities,screeninginvestmentproposals,analysingandevaluatinginvestmentproposals,approvinginvestmentproposals,andimplementing,monitoringandreviewinginvestments.IdentifyinginvestmentopportunitiesInvestmentopportunitiesorproposalscouldarisefromanalysisofstrategicchoices,analysisofthebusinessenvironment,researchanddevelopment,orlegalrequirements.Thekeyrequirementisthatinvestmentproposalsshouldsupporttheachievementoforganisationalobjectives.ScreeninginvestmentproposalsIntherealworld,capitalmarketsareimperfect,soitisusualforcompaniestoberestrictedintheamountoffinanceavailableforcapitalinvestment.Companiesthereforeneedtochoosebetweencompetinginvestmentproposalsandselectthosewiththebeststrategicfitandthemostappropriateuseofeconomicresources.AnalysingandevaluatinginvestmentproposalsCandidateinvestmentproposalsneedtobeanalysedindepthandevaluatedtodeterminewhichofferthemostattractiveopportunitiestoachieveorganisationalobjectives,forexampletoincreaseshareholderwealth.Thisisthestagewhereinvestmentappraisalplaysakeyrole,indicatingforexamplewhichinvestmentproposalshavethehighestnetpresentvalue.ApprovinginvestmentproposalsThemostsuitableinvestmentproposalsarepassedtotherelevantlevelofauthorityforconsiderationandapproval.Verylargeproposalsmayrequireapprovalbytheboardofdirectors,whilesmallerproposalsmaybeapprovedatdivisionallevel,andsoon.Onceapprovalhasbeengiven,implementationcanbegin.Implementing,monitoringandreviewinginvestmentsThetimerequiredtoimplementtheinvestmentproposalorprojectwilldependonitssizeandcomplexity,andislikelytobeseveralmonths.Followingimplementation,theinvestmentprojectmustbemonitoredtoensurethattheexpectedresultsarebeingachievedandtheperformanceisasexpected.Thewholeoftheinvestmentdecision-makingprocessshouldalsobereviewedinordertofacilitateorganisationallearningandtoimprovefutureinvestmentdecisions. -

第9题:

什么叫内部利润率(internal rate of return,简记为IRR)?其经济含义和实际意义是什么?

正确答案:内部利润率又称内部收益率,是使投资项目在其寿命期(包括建设期和生产服务期)内,各年净现金流量的现值累计等于零时的折现率(discountrate)i*。

如果项目的投资全靠借贷筹资,当贷款利率i=i*时,整个寿命期内的全部收益刚够偿还贷款本息,此时项目投资不亏不赢。故IRR表示项目所能负担的最高利率和资金成本。 -

第10题:

内部收益率(Internal rate of return)

正确答案: 内部收益率是使一项投资项目的净现金流的现值等于项目投资支出的利率。 -

第11题:

单选题One reason is that ______ offers a seemingly short return on your investment from both a technology and human resources standpoint.Ait

Bthey

Cthem

Dthere

正确答案: C解析:

句意:一个原因是,从技术和人力资源的角度看,你的投资似乎得到了短期收益。空格处为是that所引导从句的主语,谓语动词offers为第三人称单数形式,则主语为单数。选择A。seemingly表面上地,仿佛。short return短期回报。standpoint立场,观点,角度。 -

第12题:

问答题什么叫内部利润率(internal rate of return,简记为IRR)?其经济含义和实际意义是什么?正确答案: 内部利润率又称内部收益率,是使投资项目在其寿命期(包括建设期和生产服务期)内,各年净现金流量的现值累计等于零时的折现率(discountrate)i*。

如果项目的投资全靠借贷筹资,当贷款利率i=i*时,整个寿命期内的全部收益刚够偿还贷款本息,此时项目投资不亏不赢。故IRR表示项目所能负担的最高利率和资金成本。解析: 暂无解析 -

第13题:

(ii) Using the previous overhead allocation basis (as per note 4), calculate the budgeted profit/(loss)

attributable to each type of service for the year ending 31 December 2006 and comment on the results

obtained using the previous and revised methods of overhead allocation. (5 marks)

正确答案:

-

第14题:

(b) (i) Advise the directors of GWCC on specific actions which may be considered in order to improve the

estimated return on their investment of £1,900,000. (8 marks)

正确答案:

(b) (i) The directors of GWCC might consider any of the following specific actions in order to improve the return on the

investment:

– Attempt to raise the selling price of the Mighty Ben cake to Superstores plc. Much will depend on the nature of the

relationship in terms of mutuality of trust and co-operation between the parties. If Superstores plc are insistent on

a launch price of £20·25 and a mark-up of 35% on its purchase price from GWCC then this is likely to be

unsuccessful.

– Attempt to reduce the material losses in the first 600 batches of production via improved process control.

– Attempt to negotiate a retrospective rebate based on volumes of packaging purchased.

– Improve the rate of learning of the hand-skilled cake decorators via a more intensive training programme and/or

altering the flow of production.

– Undertake a thorough review of all variable overheads which have been absorbed on the basis of direct labour

hours. It might well be the case that labour is not the only ‘cost driver’ in which case variable overheads might be

overstated.

– Undertake a thorough review of all fixed overheads to ensure that they are specific to the production of the Mighty

Ben cake.

– Adopt a ‘value engineering’ approach in order to identify ‘non value added’ features/aspects of the product or

processes used to produce it. This would have to be done in conjunction with Superstores plc, but might end in a

‘win-win’ scenario.

– Ensure that all overhead expenditure will be incurred in the most ‘economic’ manner. -

第15题:

2 Alpha Division, which is part of the Delta Group, is considering an investment opportunity to which the following

estimated information relates:

(1) An initial investment of $45m in equipment at the beginning of year 1 will be depreciated on a straight-line basis

over a three-year period with a nil residual value at the end of year 3.

(2) Net operating cash inflows in each of years 1 to 3 will be $12·5m, $18·5m and $27m respectively.

(3) The management accountant of Alpha Division has estimated that the NPV of the investment would be

$1·937m using a cost of capital of 10%.

(4) A bonus scheme which is based on short-term performance evaluation is in operation in all divisions within the

Delta Group.

Required:

(a) (i) Calculate the residual income of the proposed investment and comment briefly (using ONLY the above

information) on the values obtained in reconciling the short-term and long-term decision views likely to

be adopted by divisional management regarding the viability of the proposed investment. (6 marks)

正确答案:

-

第16题:

(c) Advise Alan on the proposed disposal of the shares in Mobile Ltd. Your answer should include calculations

of the potential capital gain, and explain any options available to Alan to reduce this tax liability. (7 marks)

正确答案:

However, an exemption from corporation tax exists for any gain arising when a trading company (or member of a trading

group) sells the whole or any part of a substantial shareholding in another trading company.

A substantial shareholding is one where the investing company holds 10% of the ordinary share capital and is beneficially

entitled to at least 10% of the

(i) profits available for distribution to equity holders and

(ii) assets of the company available for distribution to equity holders on a winding up.

In meeting the 10% test, shares owned by a chargeable gains group may be amalgamated. The 10% test must have been

met for a continuous 12 month period during the 2 years preceding the disposal.

The companies making the disposals must have been trading companies (or members of a trading group) throughout the

12 month period, as well as at the date of disposal. In addition, they must also be trading companies (or members of a trading

group) immediately after the disposal.

The exemption is given automatically, and acts to deny losses as well as eliminate gains.

While Alantech Ltd has owned its holding in Mobile Ltd for 33 months, its ownership of the Boron holding has only lasted

for 10 months (at 1 June 2005) since Boron was acquired on 1 July 2004. Selling the shares in June 2005 will fail the

12 month test, and the gain will become chargeable.

It would be better for the companies to wait for a further month until July 2005 before selling the amalgamated shareholding.

By doing so, they will both be able to take advantage of the substantial shareholdings relief, thereby saving tax of £29,625

assuming a corporation tax rate of 19%. -

第17题:

(b) State the immediate tax implications of the proposed gift of the share portfolio to Avril and identify an

alternative strategy that would achieve Crusoe’s objectives whilst avoiding a possible tax liability in the

future. State any deadline(s) in connection with your proposed strategy. (5 marks)

正确答案:

(b) Gift of the share portfolio to Avril

Inheritance tax

The gift would be a potentially exempt transfer at market value. No inheritance tax would be due at the time of the gift.

Capital gains tax

The gift would be a disposal by Crusoe deemed to be made at market value for the purposes of capital gains tax. No gain

would arise as the deemed proceeds will equal Crusoe’s base cost of probate value.

Stamp duty

There is no stamp duty on a gift of shares for no consideration.

Strategy to avoid a possible tax liability in the future

Crusoe should enter into a deed of variation directing the administrators to transfer the shares to Avril rather than to him. This

will not be regarded as a gift by Crusoe. Instead, provided the deed states that it is intended to be effective for inheritance tax

purposes, it will be as if Noland had left the shares to Avril in a will.

This strategy is more tax efficient than Crusoe gifting the shares to Avril as such a gift would be a potentially exempt transfer

and inheritance tax may be due if Crusoe were to die within seven years.

The deed of variation must be entered into by 1 October 2009, i.e. within two years of the date of Noland’s death. -

第18题:

(b) Comment on the need for ethical guidance for accountants on money laundering. (4 marks)

正确答案:

(b) Need for ethical guidance

■ Accountants (firms and individuals) working in a country that criminalises money laundering are required to comply with

anti-money laundering legislation and failure to do so can lead to severe penalties. Guidance is needed because:

– legal requirements are onerous;

– money laundering is widely defined; and

– accountants may otherwise be used, unwittingly, to launder criminal funds.

■ Accountants need ethical guidance on matters where there is conflict between legal responsibilities and professional

responsibilities. In particular, professional accountants are bound by a duty of confidentiality to their clients. Guidance

is needed to explain:

– how statutory provisions give protection against criminal action for members in respect of their confidentiality

requirements;

– when client confidentiality over-ride provisions are available.

■ Further guidance is needed to explain the interaction between accountants’ responsibilities to report money laundering

offences and other reporting responsibilities, for example:

– reporting to regulators;

– auditor’s reports on financial statements (ISA 700);

– reports to those charged with governance (ISA 260);

– reporting misconduct by members of the same body.

■ Professional accountants are required to communicate with each other when there is a change in professional

appointment (i.e. ‘professional etiquette’). Additional ethical guidance is needed on how to respond to a ‘clearance’ letter

where a report of suspicion has been made (or is being contemplated) in respect of the client in question.

Tutorial note: Although the term ‘professional clearance’ is widely used, remember that there is no ‘clearance’ that the

incumbent accountant can give or withhold.

■ Ethical guidance is needed to make accountants working in countries that do not criminalise money laundering aware

of how anti-money laundering legislation may nevertheless affect them. Such accountants may commit an offence if,

for example, they conduct limited assignments or have meetings in a country having anti-money laundering legislation

(e.g. UK, Ireland, Singapore, Australia and the United States). -

第19题:

(b) Given his recent diagnosis, advise Stuart as to which of the two proposed investments (Omikron plc/Omega

plc) would be the more tax efficient alternative. Give reasons for your choice. (3 marks)

正确答案:

(b) Both companies are listed. The only difference will be in the availability of inheritance tax relief – specifically business property

relief (BPR). If Stuart and Rebecca jointly hold in excess of 50% of the share capital of a listed company, BPR will apply at

the rate of 50%. Otherwise, no BPR is available.

Stuart can only buy 1,005,000 (£422,100/£0·42) shares in Omikron plc. This represents a shareholding of 2·00%

(1,005,000/50,250,000). As the shares in Omikron plc are listed, a 2% holding will not qualify for BPR.

At the moment, both Stuart and Rebecca own 2,400,000 shares in Omega plc. Their shareholdings are amalgamated for

IHT purposes under the related property rules. With a joint holding of 48%, BPR is not available. A further 200,001 shares

will be required to attain a 50% holding. Assuming Stuart and Rebecca can buy these shares, they must then hold their 50%

interest in the company for the period of at least two years in order to ensure that BPR applies.

On the basis that Stuart is expected to survive for two to three years, he should therefore buy further shares in Omega plc in

order to take advantage of the BPR available. -

第20题:

Moonstar Co is a property development company which is planning to undertake a $200 million commercial property development. Moonstar Co has had some difficulties over the last few years, with some developments not generating the expected returns and the company has at times struggled to pay its finance costs. As a result Moonstar Co’s credit rating has been lowered, affecting the terms it can obtain for bank finance. Although Moonstar Co is listed on its local stock exchange, 75% of the share capital is held by members of the family who founded the company. The family members who are shareholders do not wish to subscribe for a rights issue and are unwilling to dilute their control over the company by authorising a new issue of equity shares. Moonstar Co’s board is therefore considering other methods of financing the development, which the directors believe will generate higher returns than other recent investments, as the country where Moonstar Co is based appears to be emerging from recession.

Securitisation proposals

One of the non-executive directors of Moonstar Co has proposed that it should raise funds by means of a securitisation process, transferring the rights to the rental income from the commercial property development to a special purpose vehicle. Her proposals assume that the leases will generate an income of 11% per annum to Moonstar Co over a ten-year period. She proposes that Moonstar Co should use 90% of the value of the investment for a collateralised loan obligation which should be structured as follows:

– 60% of the collateral value to support a tranche of A-rated floating rate loan notes offering investors LIBOR plus 150 basis points

– 15% of the collateral value to support a tranche of B-rated fixed rate loan notes offering investors 12%

– 15% of the collateral value to support a tranche of C-rated fixed rate loan notes offering investors 13%

– 10% of the collateral value to support a tranche as subordinated certificates, with the return being the excess of receipts over payments from the securitisation process

The non-executive director believes that there will be sufficient demand for all tranches of the loan notes from investors. Investors will expect that the income stream from the development to be low risk, as they will expect the property market to improve with the recession coming to an end and enough potential lessees to be attracted by the new development.

The non-executive director predicts that there would be annual costs of $200,000 in administering the loan. She acknowledges that there would be interest rate risks associated with the proposal, and proposes a fixed for variable interest rate swap on the A-rated floating rate notes, exchanging LIBOR for 9·5%.

However the finance director believes that the prediction of the income from the development that the non-executive director has made is over-optimistic. He believes that it is most likely that the total value of the rental income will be 5% lower than the non-executive director has forecast. He believes that there is some risk that the returns could be so low as to jeopardise the income for the C-rated fixed rate loan note holders.

Islamic finance

Moonstar Co’s chief executive has wondered whether Sukuk finance would be a better way of funding the development than the securitisation.

Moonstar Co’s chairman has pointed out that a major bank in the country where Moonstar Co is located has begun to offer a range of Islamic financial products. The chairman has suggested that a Mudaraba contract would be the most appropriate method of providing the funds required for the investment.

Required:

(a) Calculate the amounts in $ which each of the tranches can expect to receive from the securitisation arrangement proposed by the non-executive director and discuss how the variability in rental income affects the returns from the securitisation. (11 marks)

(b) Discuss the benefits and risks for Moonstar Co associated with the securitisation arrangement that the non-executive director has proposed. (6 marks)

(c) (i) Discuss the suitability of Sukuk finance to fund the investment, including an assessment of its appeal to potential investors. (4 marks)

(ii) Discuss whether a Mudaraba contract would be an appropriate method of financing the investment and discuss why the bank may have concerns about providing finance by this method. (4 marks)

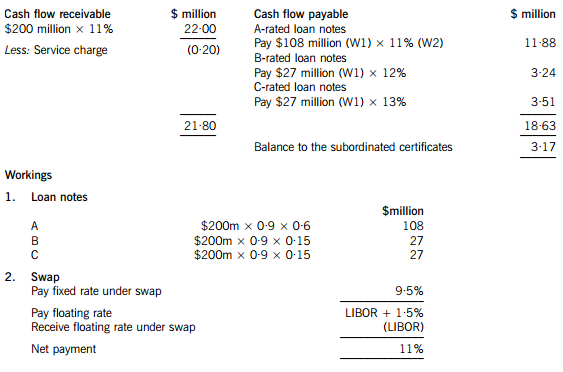

正确答案:(a) An annual cash flow account compares the estimated cash flows receivable from the property against the liabilities within the securitisation process. The swap introduces leverage into the arrangement.

The holders of the certificates are expected to receive $3·17million on $18 million, giving them a return of 17·6%. If the cash flows are 5% lower than the non-executive director has predicted, annual revenue received will fall to $20·90 million, reducing the balance available for the subordinated certificates to $2·07 million, giving a return of 11·5% on the subordinated certificates, which is below the returns offered on the B and C-rated loan notes. The point at which the holders of the certificates will receive nothing and below which the holders of the C-rated loan notes will not receive their full income will be an annual income of $18·83 million (a return of 9·4%), which is 14·4% less than the income that the non-executive director has forecast.

(b) Benefits

The finance costs of the securitisation may be lower than the finance costs of ordinary loan capital. The cash flows from the commercial property development may be regarded as lower risk than Moonstar Co’s other revenue streams. This will impact upon the rates that Moonstar Co is able to offer borrowers.

The securitisation matches the assets of the future cash flows to the liabilities to loan note holders. The non-executive director is assuming a steady stream of lease income over the next 10 years, with the development probably being close to being fully occupied over that period.

The securitisation means that Moonstar Co is no longer concerned with the risk that the level of earnings from the properties will be insufficient to pay the finance costs. Risks have effectively been transferred to the loan note holders.

Risks

Not all of the tranches may appeal to investors. The risk-return relationship on the subordinated certificates does not look very appealing, with the return quite likely to be below what is received on the C-rated loan notes. Even the C-rated loan note holders may question the relationship between the risk and return if there is continued uncertainty in the property sector.

If Moonstar Co seeks funding from other sources for other developments, transferring out a lower risk income stream means that the residual risks associated with the rest of Moonstar Co’s portfolio will be higher. This may affect the availability and terms of other borrowing.

It appears that the size of the securitisation should be large enough for the costs to be bearable. However Moonstar Co may face unforeseen costs, possibly unexpected management or legal expenses.

(c) (i) Sukuk finance could be appropriate for the securitisation of the leasing portfolio. An asset-backed Sukuk would be the same kind of arrangement as the securitisation, where assets are transferred to a special purpose vehicle and the returns and repayments are directly financed by the income from the assets. The Sukuk holders would bear the risks and returns of the relationship.

The other type of Sukuk would be more like a sale and leaseback of the development. Here the Sukuk holders would be guaranteed a rental, so it would seem less appropriate for Moonstar Co if there is significant uncertainty about the returns from the development.

The main issue with the asset-backed Sukuk finance is whether it would be as appealing as certainly the A-tranche of the securitisation arrangement which the non-executive director has proposed. The safer income that the securitisation offers A-tranche investors may be more appealing to investors than a marginally better return from the Sukuk. There will also be costs involved in establishing and gaining approval for the Sukuk, although these costs may be less than for the securitisation arrangement described above.

(ii) A Mudaraba contract would involve the bank providing capital for Moonstar Co to invest in the development. Moonstar Co would manage the investment which the capital funded. Profits from the investment would be shared with the bank, but losses would be solely borne by the bank. A Mudaraba contract is essentially an equity partnership, so Moonstar Co might not face the threat to its credit rating which it would if it obtained ordinary loan finance for the development. A Mudaraba contract would also represent a diversification of sources of finance. It would not require the commitment to pay interest that loan finance would involve.

Moonstar Co would maintain control over the running of the project. A Mudaraba contract would offer a method of obtaining equity funding without the dilution of control which an issue of shares to external shareholders would bring. This is likely to make it appealing to Moonstar Co’s directors, given their desire to maintain a dominant influence over the business.

The bank would be concerned about the uncertainties regarding the rental income from the development. Although the lack of involvement by the bank might appeal to Moonstar Co's directors, the bank might not find it so attractive. The bank might be concerned about information asymmetry – that Moonstar Co’s management might be reluctant to supply the bank with the information it needs to judge how well its investment is performing.

-

第21题:

public class Person { private String name, comment; private int age; public Person(String n, int a, String c) { name = n; age = a; comment = c; } public boolean equals(Object o) { if(! (o instanceof Person)) return false; Person p = (Person)o; return age == p.age && name.equals(p.name); } } What is the appropriate definition of the hashCode method in class Person?()

- A、 return super.hashCode();

- B、 return name.hashCode() + age * 7;

- C、 return name.hashCode() + comment.hashCode() /2;

- D、 return name.hashCode() + comment.hashCode() / 2 - age * 3;

正确答案:B -

第22题:

名词解释题内部收益率(Internal rate of return)正确答案: 内部收益率是使一项投资项目的净现金流的现值等于项目投资支出的利率。解析: 暂无解析 -

第23题:

单选题public class Person { private String name, comment; private int age; public Person(String n, int a, String c) { name = n; age = a; comment = c; } public boolean equals(Object o) { if(! (o instanceof Person)) return false; Person p = (Person)o; return age == p.age && name.equals(p.name); } } What is the appropriate definition of the hashCode method in class Person?()Areturn super.hashCode();

Breturn name.hashCode() + age * 7;

Creturn name.hashCode() + comment.hashCode() /2;

Dreturn name.hashCode() + comment.hashCode() / 2 - age * 3;

正确答案: D解析: 暂无解析