5 Financial statements have seen an increasing move towards the use of fair values in accounting. Advocates of ‘fairvalue accounting’ believe that fair value is the most relevant measure for financial reporting whilst others believe thathistorical cost pr

题目

5 Financial statements have seen an increasing move towards the use of fair values in accounting. Advocates of ‘fair

value accounting’ believe that fair value is the most relevant measure for financial reporting whilst others believe that

historical cost provides a more useful measure.

Issues have been raised over the reliability and measurement of fair values, and over the nature of the current level

of disclosure in financial statements in this area.

Required:

(a) Discuss the problems associated with the reliability and measurement of fair values and the nature of any

additional disclosures which may be required if fair value accounting is to be used exclusively in corporate

reporting. (13 marks)

相似考题

更多“5 Financial statements have seen an increasing move towards the use of fair values in accounting. Advocates of ‘fairvalue accounting’ believe that fair value is the most relevant measure for financial reporting whilst others believe thathistorical cost pr”相关问题

-

第1题:

(b) Misson has purchased goods from a foreign supplier for 8 million euros on 31 July 2006. At 31 October 2006,

the trade payable was still outstanding and the goods were still held by Misson. Similarly Misson has sold goods

to a foreign customer for 4 million euros on 31 July 2006 and it received payment for the goods in euros on

31 October 2006. Additionally Misson had purchased an investment property on 1 November 2005 for

28 million euros. At 31 October 2006, the investment property had a fair value of 24 million euros. The company

uses the fair value model in accounting for investment properties.

Misson would like advice on how to treat these transactions in the financial statements for the year ended 31

October 2006. (7 marks)

Required:

Discuss the accounting treatment of the above transactions in accordance with the advice required by the

directors.

(Candidates should show detailed workings as well as a discussion of the accounting treatment used.)

正确答案:

(b) Inventory, Goods sold and Investment property

The inventory and trade payable initially would be recorded at 8 million euros ÷ 1·6, i.e. $5 million. At the year end, the

amount payable is still outstanding and is retranslated at 1 dollar = 1·3 euros, i.e. $6·2 million. An exchange loss of

$(6·2 – 5) million, i.e. $1·2 million would be reported in profit or loss. The inventory would be recorded at $5 million at the

year end unless it is impaired in value.

The sale of goods would be recorded at 4 million euros ÷ 1·6, i.e. $2·5 million as a sale and as a trade receivable. Payment

is received on 31 October 2006 in euros and the actual value of euros received will be 4 million euros ÷ 1·3,

i.e. $3·1 million.

Thus a gain on exchange of $0·6 million will be reported in profit or loss.

The investment property should be recognised on 1 November 2005 at 28 million euros ÷ 1·4, i.e. $20 million. At

31 October 2006, the property should be recognised at 24 million euros ÷ 1·3, i.e. $18·5 million. The decrease in fair value

should be recognised in profit and loss as a loss on investment property. The property is a non-monetary asset and any foreign

currency element is not recognised separately. When a gain or loss on a non-monetary item is recognised in profit or loss,

any exchange component of that gain or loss is also recognised in profit or loss. If any gain or loss is recognised in equity ona non-monetary asset, any exchange gain is also recognised in equity. -

第2题:

(b) Prepare the balance sheet of York at 31 October 2006, using International Financial Reporting Standards,

discussing the nature of the accounting treatments selected, the adjustments made and the values placed

on the items in the balance sheet. (20 marks)

正确答案:

Gow’s net assets

IAS36 ‘Impairment of Assets’, sets out the events that might indicate that an asset is impaired. These circumstances include

external events such as the decline in the market value of an asset and internal events such as a reduction in the cash flows

to be generated from an asset or cash generating unit. The loss of the only customer of a cash generating unit (power station)

would be an indication of the possible impairment of the cash generating unit. Therefore, the power station will have to be

impairment tested.

The recoverable amount will have to be determined and compared to the value given to the asset on the setting up of the

joint venture. The recoverable amount is the higher of the cash generating unit’s fair value less costs to sell, and its value-inuse.

The fair value less costs to sell will be $15 million which is the offer for the purchase of the power station ($16 million)

less the costs to sell ($1 million). The value-in-use is the discounted value of the future cash flows expected to arise from the

cash generating unit. The future dismantling costs should be provided for as it has been agreed with the government that it

will be dismantled. The cost should be included in the future cash flows for the purpose of calculating value-in-use and

provided for in the financial statements and the cost added to the property, plant and equipment ($4 million ($5m/1·064)).

The value-in-use based on a discount rate of 6 per cent is $21 million (working). Therefore, the recoverable amount is

$21 million which is higher than the carrying value of the cash generating unit ($20 million) and, therefore, the value of the

cash generating unit is not impaired when compared to the present carrying value of $20 million (value before impairment

test).

Additionally IAS39, ‘Financial Instruments: recognition and measurement’, says that an entity must assess at each balance

sheet date whether a financial asset is impaired. In this case the receivable of $7 million is likely to be impaired as Race is

going into administration. The present value of the estimated future cash flows will be calculated. Normally cash receipts from

trade receivables will not be discounted but because the amounts are not likely to be received for a year then the anticipated

cash payment is 80% of ($5 million × 1/1·06), i.e. $3·8 million. Thus a provision for the impairment of the trade receivables

of $3·2 million should be made. The intangible asset of $3 million would be valueless as the contract has been terminated.

Glass’s Net Assets

The leased property continues to be accounted for as property, plant and equipment and the carrying amount will not be

adjusted. However, the remaining useful life of the property will be revised to reflect the shorter term. Thus the property will

be depreciated at $2 million per annum over the next two years. The change to the depreciation period is applied prospectively

not retrospectively. The lease liability must be assessed under IAS39 in order to determine whether it constitutes a

de-recognition of a financial liability. As the change is a modification of the lease and not an extinguishment, the lease liability

would not be derecognised. The lease liability will be adjusted for the one off payment of $1 million and re-measured to the

present value of the revised future cash flows. That is $0·6 million/1·07 + $0·6 million/(1·07 × 1·07) i.e. $1·1 million. The

adjustment to the lease liability would normally be recognised in profit or loss but in this case it will affect the net capital

contributed by Glass.

The termination cost of the contract cannot be treated as an intangible asset. It is similar to redundancy costs paid to terminate

a contract of employment. It represents compensation for the loss of future income for the agency. Therefore it must be

removed from the balance sheet of York. The recognition criteria for an intangible asset require that there should be probable

future economic benefits flowing to York and the cost can be measured reliably. The latter criterion is met but the first criterion

is not. The cost of gaining future customers is not linked to this compensation.

IAS18 ‘Revenue’ contains a concept of a ‘multiple element’ arrangement. This is a contract which contains two or more

elements which are in substance separate and are separately identifiable. In other words, the two elements can operate

independently from each other. In this case, the contract with the overseas company has two distinct elements. There is a

contract not to supply gas to any other customer in the country and there is a contract to sell gas at fair value to the overseas

company. The contract has not been fulfilled as yet and therefore the payment of $1·5 million should not be taken to profit

or loss in its entirety at the first opportunity. The non supply of gas to customers in that country occurs over the four year

period of the contract and therefore the payment should be recognised over that period. Therefore the amount should be

shown as deferred income and not as a deduction from intangible assets. The revenue on the sale of gas will be recognised

as normal according to IAS18.

There may be an issue over the value of the net assets being contributed. The net assets contributed by Glass amount to

$21·9 million whereas those contributed by Gow only total $13·8 million after taking into account any adjustments required

by IFRS. The joint venturers have equal shareholding in York but no formal written agreements, thus problems may arise ifGlass feels that the contributions to the joint venture are unequal.

-

第3题:

(c) At 1 June 2006, Router held a 25% shareholding in a film distribution company, Wireless, a public limited

company. On 1 January 2007, Router sold a 15% holding in Wireless thus reducing its investment to a 10%

holding. Router no longer exercises significant influence over Wireless. Before the sale of the shares the net asset

value of Wireless on 1 January 2007 was $200 million and goodwill relating to the acquisition of Wireless was

$5 million. Router received $40 million for its sale of the 15% holding in Wireless. At 1 January 2007, the fair

value of the remaining investment in Wireless was $23 million and at 31 May 2007 the fair value was

$26 million. (6 marks)

Required:

Discuss how the above items should be dealt with in the group financial statements of Router for the year ended

31 May 2007.Required:

Discuss how the above items should be dealt with in the group financial statements of Router for the year ended

31 May 2007.

正确答案:

(c) The investment in Wireless is currently accounted for using the equity method of accounting under IAS28 ‘Investments in

Associates’. On the sale of a 15% holding, the investment in Wireless will be accounted for in accordance with IAS39. Router

should recognise a gain on the sale of the holding in Wireless of $7 million (Working 1). The gain comprises the following:

(i) the difference between the sale proceeds and the proportion of the net assets sold and

(ii) the goodwill disposed of.

The total gain is shown in the income statement.

The remaining 10 per cent investment will be classified as an ‘available for sale’ financial asset or at ‘fair value through profit

or loss’ financial asset. Changes in fair value for these categories are reported in equity or in the income statement respectively.

At 1 January 2007, the investment will be recorded at fair value and a gain of $1 million $(23 – 22) recorded. At 31 May

2007 a further gain of $(26 – 23) million, i.e. $3 million will be recorded. In order for the investment to be categorised as

at fair value through profit or loss, certain conditions have to be fulfilled. An entity may use this designation when doing so

results in more relevant information by eliminating or significantly reducing a measurement or recognition inconsistency (an

‘accounting mismatch’) or where a group of financial assets and/or financial liabilities is managed and its performance is

evaluated on a fair value basis, in accordance with a documented risk management or investment strategy, and information

about the assets and/ or liabilities is provided internally to the entity’s key management personnel.

-

第4题:

4 The transition to International Financial Reporting Standards (IFRSs) involves major change for companies as IFRSs

introduce significant changes in accounting practices that were often not required by national generally accepted

accounting practice. It is important that the interpretation and application of IFRSs is consistent from country to

country. IFRSs are partly based on rules, and partly on principles and management’s judgement. Judgement is more

likely to be better used when it is based on experience of IFRSs within a sound financial reporting infrastructure. It is

hoped that national differences in accounting will be eliminated and financial statements will be consistent and

comparable worldwide.

Required:

(a) Discuss how the changes in accounting practices on transition to IFRSs and choice in the application of

individual IFRSs could lead to inconsistency between the financial statements of companies. (17 marks)

正确答案:

(a) The transition to International Financial Reporting Standards (IFRS) involves major change for companies as IFRS introduces

significant changes in accounting practices that often were not required by national GAAPs. For example financial instruments

and share-based payment plans in many instances have appeared on the statements of financial position of companies for

the first time. As a result IFRS financial statements are often significantly more complex than financial statements based on

national GAAP. This complexity is caused by the more extensive recognition and measurement rules in IFRS and a greater

number of disclosure requirements. Because of this complexity, it can be difficult for users of financial statements which have

been produced using IFRS to understand and interpret them, and thus can lead to inconsistency of interpretation of those

financial statements.

The form. and presentation of financial statements is dealt with by IAS1 ‘Presentation of Financial Statements’. This standard

sets out alternative forms or presentations of financial statements. Additionally local legislation often requires supplementary

information to be disclosed in financial statements, and best practice as to the form. or presentation of financial statements

has yet to emerge internationally. As a result companies moving to IFRS have tended to adopt IFRS in a way which minimises

the change in the form. of financial reporting that was applied under national GAAP. For example UK companies have tended

to present a statement of recognised income and expense, and a separate statement of changes in equity whilst French

companies tend to present a single statement of changes in equity.

It is possible to interpret standards in different ways and in some standards there is insufficient guidance. For example there

are different acceptable methods of classifying financial assets under IAS39 ‘Financial Instruments: Recognition and

Measurement’ in the statement of financial position as at fair value through profit or loss (subject to certain conditions) or

available for sale.

IFRSs are not based on a consistent set of principles, and there are conceptual inconsistencies within and between standards.

Certain standards allow alternative accounting treatments, and this is a further source of inconsistency amongst financial

statements. IAS31 ‘Interests in Joint Ventures’ allows interests in jointly controlled entities to be accounted for using the equity

method or proportionate consolidation. Companies may tend to use the method which was used under national GAAP.

Another example of choice in accounting methods under IFRS is IAS16 ‘Property, Plant and equipment’ where the cost or

revaluation model can be used for a class of property, plant and equipment. Also there is very little industry related accounting

guidance in IFRS. As a result judgement plays an important role in the selection of accounting policies. In certain specific

areas this can lead to a degree of inconsistency and lack of comparability.

IFRS1, ‘First time Adoption of International Financial Reporting Standards’, allows companies to use a number of exemptions

from the requirements of IFRS. These exemptions can affect financial statements for several years. For example, companies

can elect to recognise all cumulative actuarial gains and losses relating to post-employment benefits at the date of transition

to IFRS but use the ‘corridor’ approach thereafter. Thus the effect of being able to use a ‘one off write off’ of any actuarial

losses could benefit future financial statements significantly, and affect comparability. Additionally after utilising the above

exemption, companies can elect to recognise subsequent gains and losses outside profit or loss in ‘other comprehensive

income’ in the period in which they occur and not use the ‘corridor’ approach thus affecting comparability further.

Additionally IAS18 ‘Revenue’ allows variations in the way revenue is recognised. There is no specific guidance in IFRS on

revenue arrangements with multiple deliverables. Transactions have to be analysed in accordance with their economic

substance but there is often no more guidance than this in IFRS. The identification of the functional currency under IAS21,

‘The effects of changes in foreign exchange rates’, can be subjective. For example the functional currency can be determined

by the currency in which the commodities that a company produces are commonly traded, or the currency which influences

its operating costs, and both can be different.

Another source of inconsistency is the adoption of new standards and interpretations earlier than the due date of application

of the standard. With the IASB currently preparing to issue standards with an adoption date of 1 January 2009, early adoption

or lack of it could affect comparability although IAS8 ‘Accounting Policies, Changes in Accounting Estimates and Errors’

requires a company to disclose the possible impact of a new standard on its initial application. Many companies make very

little reference to the future impact of new standards. -

第5题:

4 Whilst acknowledging the importance of high quality corporate reporting, the recommendations to improve it are

sometimes questioned on the basis that the marketplace for capital can determine the nature and quality of corporate

reporting. It could be argued that additional accounting and disclosure standards would only distort a market

mechanism that already works well and would add costs to the reporting mechanism, with no apparent benefit. It

could be said that accounting standards create costly, inefficient, and unnecessary regulation. It could be argued that

increased disclosure reduces risks and offers a degree of protection to users. However, increased disclosure has several

costs to the preparer of financial statements.

Required:

(a) Explain why accounting standards are needed to help the market mechanism work effectively for the benefit

of preparers and users of corporate reports. (9 marks)

正确答案:

(a) It could be argued that the marketplace already offers powerful incentives for high-quality reporting as it rewards such by

easing or restricting access to capital or raising or lowering the cost of borrowing capital depending on the quality of the entity’s

reports. However, accounting standards play an important role in helping the market mechanism work effectively. Accounting

standards are needed because they:

– Promote a common understanding of the nature of corporate performance and this facilitates any negotiations between

users and companies about the content of financial statements. For example, many loan agreements specify that a

company provide the lender with financial statements prepared in accordance with generally accepted accounting

principles or International Financial Reporting Standards. Both the company and the lender understand the terms and

are comfortable that statements prepared according to those standards will meet certain information needs. Without

standards, the statements would be less useful to the lender, and the company and the lender would have to agree to

create some form. of acceptable standards which would be inefficient and less effective.

– Assist neutral and unbiased reporting. Companies may wish to portray their past performance and future prospects in

the most favourable light. Users are aware of this potential bias and are sceptical about the information they receive.

Standards build credibility and confidence in the capital marketplace to the benefit of both users and companies.

– Improve the comparability of information across companies and national boundaries. Without standards, there would be

little basis to compare one company with others across national boundaries which is a key feature of relevant

information.

– Create credibility in financial statements. Auditors verify that information is reported in accordance with standards and

this creates public confidence in financial statements

– Facilitate consistency of information by producing data in accordance with an agreed conceptual framework. A consistent

approach to the development and presentation of information assists users in accessing information in an efficient

manner and facilitates decision-making. -

第6题:

6 Discuss how developments in each of the following areas has affected the scope of the audit and the audit work

undertaken:

(a) fair value accounting; (6 marks)

正确答案:

6 DEVELOPMENTS

General comments

Tutorial note: The following comments, that could be made in respect of any of the three areas of development, will be given

credit only once.

■ Audit scope – the scope of a statutory audit should be as necessary to form. an audit opinion (i.e. unlimited).

■ Audit work undertaken – the nature, timing and extent of audit procedures should be as necessary to implement the overall

audit plan.

(a) Fair value accounting

■ Different definitions of fair value exist (among financial reporting frameworks or for different assets and liabilities within

a particular framework). For example, under IFRS it is ‘the amount for which an asset could be exchanged (or a liability

settled) between knowledgeable, willing parties in an arm’s length transaction’.

■ The term ‘fair value accounting’ is used to describe the measurement and disclosure of assets and/or liabilities at fair

value and the charging to profit and loss (or directly to equity) of any changes in fair value measurements.

■ Fair value accounting concerns measurements and disclosures but not initial recognition of assets and liabilities in

financial statements. It does not then, for example, affect the nature, timing and extent of audit procedures to confirm

the existence and completeness of rights and obligations.

■ Fair value may be determined with varying degrees of subjectivity. For example, there will be little (if any) subjectivity

for assets bought and sold in active and open markets that readily provide reliable information on the prices at which

exchange transactions occur. However, the valuation of assets with unique characteristics (or entity-specific assets) often

requires the projection and discounting of future cash flows.

■ The audit of estimates of fair values based on valuation models/techniques can be approached like other accounting

estimates (in accordance with ISA 540 ‘Audit of Accounting Estimates’). However, although the auditor should be able

to review and test the process used by management to develop the estimate, there may be:

? a much greater need for an independent estimate (and hence greater reliance on the work of experts in accordance

with ISA 620);

? no suitable subsequent events to confirm the estimate made (e.g. for assets that are held for use and not for

trading).

Tutorial note: Consider, for example, how the audit of ‘in-process research and development’ might compare with that

for an allowance for slow-moving inventory.

■ Different financial reporting frameworks require or permit a variety of fair value measures and disclosures in financial

statements. They also vary in the level of guidance provided (to preparers of the financial statements – and hence their

auditors). Under IFRS, certain fair values are based on management intent and ‘reasonable supportable assumptions’.

■ The audit of management intent potentially increases the auditor’s reliance on management representations. The auditor

must obtain such representations from the highest level of management and exercise an appropriate degree of

professional scepticism, being particularly alert to the implications of any conflicting evidence.

■ A significant development in international financial reporting is that it is no longer sufficient to report transactions and

past and future events that may only be possible. IAS 1 ‘Presentation of Financial Statements’ (Revised) requires that

key assumptions (and other key sources of estimation uncertainty) be disclosed. This requirement gives rise to yet

another area on which auditors may qualify their audit opinion, on grounds of disagreement, where such disclosure is

incorrect or inadequate.

■ Perhaps one of the most significant impacts of fair value accounting on audit work is that it necessarily increases it.

Consider for example, that even where the fair value of an asset is as easily vouched as original cost, fair value is

determined at least annually whereas historic cost is unchanged (and not re-vouched to original purchase

documentation). -

第7题:

3 (a) Financial statements often contain material balances recognised at fair value. For auditors, this leads to additional

audit risk.

Required:

Discuss this statement. (7 marks)

正确答案:

3 Poppy Co

(a) Balances held at fair value are frequently recognised as material items in the statement of financial position. Sometimes it is

required by the financial reporting framework that the measurement of an asset or liability is at fair value, e.g. certain

categories of financial instruments, whereas it is sometimes the entity’s choice to measure an item using a fair value model

rather than a cost model, e.g. properties. It is certainly the case that many of these balances will be material, meaning that

the auditor must obtain sufficient appropriate evidence that the fair value measurement is in accordance with the

requirements of financial reporting standards. ISA 540 (Revised and Redrafted) Auditing Accounting Estimates Including Fair

Value Accounting Estimates and Related Disclosures and ISA 545 Auditing Fair Value Measurements and Disclosures

contain guidance in this area.

As part of the understanding of the entity and its environment, the auditor should gain an insight into balances that are stated

at fair value, and then assess the impact of this on the audit strategy. This will include an evaluation of the risk associated

with the balance(s) recognised at fair value.

Audit risk comprises three elements; each is discussed below in the context of whether material balances shown at fair value

will lead to increased risk for the auditor.

Inherent risk

Many measurements based on estimates, including fair value measurements, are inherently imprecise and subjective in

nature. The fair value assessment is likely to involve significant judgments, e.g. regarding market conditions, the timing of

cash flows, or the future intentions of the entity. In addition, there may be a deliberate attempt by management to manipulate

the fair value to achieve a desired aim within the financial statements, in other words to attempt some kind of window

dressing.

Many fair value estimation models are complicated, e.g. discounted cash flow techniques, or the actuarial calculations used

to determine the value of a pension fund. Any complicated calculations are relatively high risk, as difficult valuation techniques

are simply more likely to contain errors than simple valuation techniques. However, there will be some items shown at fair

value which have a low inherent risk, because the measurement of fair value may be relatively straightforward, e.g. assets

that are regularly bought and sold on open markets that provide readily available and reliable information on the market prices

at which actual exchanges occur.

In addition to the complexities discussed above, some fair value measurement techniques will contain significant

assumptions, e.g. the most appropriate discount factor to use, or judgments over the future use of an asset. Management

may not always have sufficient experience and knowledge in making these judgments.

Thus the auditor should approach some balances recognised at fair value as having a relatively high inherent risk, as their

subjective and complex nature means that the balance is prone to contain an error. However, the auditor should not just

assume that all fair value items contain high inherent risk – each balance recognised at fair value should be assessed for its

individual level of risk.

Control risk

The risk that the entity’s internal monitoring system fails to prevent and detect valuation errors needs to be assessed as part

of overall audit risk assessment. One problem is that the fair value assessment is likely to be performed once a year, outside

the normal accounting and management systems, especially where the valuation is performed by an external specialist.

Therefore, as a non-routine event, the assessment of fair value is likely not to have the same level of monitoring or controls

as a day-to-day business transaction.

However, due to the material impact of fair values on the statement of financial position, and in some circumstances on profit,

management may have made great effort to ensure that the assessment is highly monitored and controlled. It therefore could

be the case that there is extremely low control risk associated with the recognition of fair values.

Detection risk

The auditor should minimise detection risk via thorough planning and execution of audit procedures. The audit team may

lack experience in dealing with the fair value in question, and so would be unlikely to detect errors in the valuation techniques

used. Over-reliance on an external specialist could also lead to errors not being found.

Conclusion

It is true that the increasing recognition of items measured at fair value will in many cases cause the auditor to assess the

audit risk associated with the balance as high. However, it should not be assumed that every fair value item will be likely to

contain a material misstatement. The auditor must be careful to identify and respond to the level of risk for fair value items

on an individual basis to ensure that sufficient and appropriate evidence is gathered, thus reducing the audit risk to an

acceptable level. -

第8题:

(b) (i) Explain the matters you should consider, and the evidence you would expect to find in respect of the

carrying value of the cost of investment of Dylan Co in the financial statements of Rosie Co; and

(7 marks)

正确答案:

(b) (i) Cost of investment on acquisition of Dylan Co

Matters to consider

According to the schedule provided by the client, the cost of investment comprises three elements. One matter to

consider is whether the cost of investment is complete.

It appears that no legal or professional fees have been included in the cost of investment (unless included within the

heading ‘cash consideration’). Directly attributable costs should be included per IFRS 3 Business Combinations, and

there is a risk that these costs may be expensed in error, leading to understatement of the investment.

The cash consideration of $2·5 million is the least problematical component. The only matter to consider is whether the

cash has actually been paid. Given that Dylan Co was acquired in the last month of the financial year it is possible that

the amount had not been paid before the year end, in which case the amount should be recognised as a current liability

on the statement of financial position (balance sheet). However, this seems unlikely given that normally control of an

acquired company only passes to the acquirer on cash payment.

IFRS 3 states that the cost of investment should be recognised at fair value, which means that deferred consideration

should be discounted to present value at the date of acquisition. If the consideration payable on 31 January 2009 has

not been discounted, the cost of investment, and the corresponding liability, will be overstated. It is possible that the

impact of discounting the $1·5 million payable one year after acquisition would be immaterial to the financial

statements, in which case it would be acceptable to leave the consideration at face value within the cost of investment.

Contingent consideration should be accrued if it is probable to be paid. Here the amount is payable if revenue growth

targets are achieved over the next four years. The auditor must therefore assess the probability of the targets being

achieved, using forecasts and projections of Maxwell Co’s revenue. Such information is inherently subjective, and could

have been manipulated, if prepared by the vendor of Maxwell Co, in order to secure the deal and maximise

consideration. Here it will be crucial to be sceptical when reviewing the forecasts, and the assumptions underlying the

data. The management of Rosie Co should have reached their own opinion on the probability of paying the contingent

consideration, but they may have relied heavily on information provided at the time of the acquisition.

Audit evidence

– Agreement of the monetary value and payment dates of the consideration per the client schedule to legal

documentation signed by vendor and acquirer.

– Agreement of $2·5 million paid to Rosie Co’s bank statement and cash book prior to year end. If payment occurs

after year end confirm that a current liability is recognised on the individual company and consolidated statement

of financial position (balance sheet).

– Board minutes approving the payment.

– Recomputation of discounting calculations applied to deferred and contingent consideration.

– Agreement that the discount rate used is pre-tax, and reflects current market assessment of the time value of money

(e.g. by comparison to Rosie Co’s weighted average cost of capital).

– Revenue and profit projections for the period until January 2012, checked for arithmetic accuracy.

– A review of assumptions used in the projections, and agreement that the assumptions are comparable with the

auditor’s understanding of Dylan Co’s business.

Tutorial note: As the scenario states that Chien & Co has audited Dylan Co for several years, it is reasonable to rely on

their cumulative knowledge and understanding of the business in auditing the revenue projections. -

第9题:

听力原文:The financial reporting is used to provide information useful for making investment and lending decision.

(2)

A.The objective of financial reporting is to provide information useful for making investment and lending decisions.

B.The financial reporting is useless.

C.The financial reporting can't help people to decide whether they invest on something or not.

D.The financial reporting has no objectives.

正确答案:A

解析:单句的意思为“财务报告被用来为投资及借贷决策提供有用信息。” -

第10题:

The two most common specialized fields of accounting in practice are().A.managerial accounting and financial accounting

B.managerial accounting and environmental accounting

C.forensic accounting and financial accounting

D.financial accounting and tax accounting systems

正确答案:A

-

第11题:

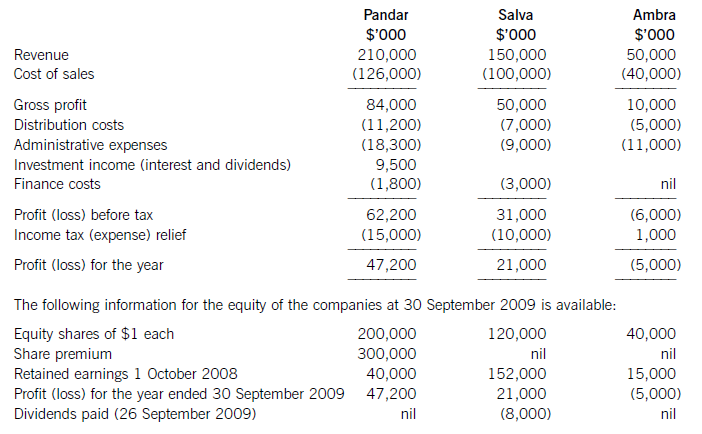

On 1 April 2009 Pandar purchased 80% of the equity shares in Salva. The acquisition was through a share exchange of three shares in Pandar for every five shares in Salva. The market prices of Pandar’s and Salva’s shares at 1 April

2009 were $6 per share and $3.20 respectively.

On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share.

The summarised income statements for the three companies for the year ended 30 September 2009 are:

The following information is relevant:

(i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales.

In addition Salva owns the registration of a popular internet domain name. The registration, which had a

negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million.

The fair values of the plant and the domain name have not been reflected in Salva’s financial statements.

No fair value adjustments were required on the acquisition of the investment in Ambra.

(ii) Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 2009 had been accounted for by both companies. Salva also has other loans in issue at 30 September 2009.

(iii) Pandar has credited the whole of the dividend it received from Salva to investment income.

(iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 2009. There are no intra-group current account balances at 30 September 2009.

(v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this

purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest.

(vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s

investment in Ambra has been impaired by $3 million at 30 September 2009.

(vii) All items in the above income statements are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Calculate the goodwill arising on the acquisition of Salva at 1 April 2009; (6 marks)

(ii) Calculate the carrying amount of the investment in Ambra to be included within the consolidated

statement of financial position as at 30 September 2009. (3 marks)

(b) Prepare the consolidated income statement for the Pandar Group for the year ended 30 September 2009.(16 marks)

正确答案:

-

第12题:

单选题The World’s Fair won’t be a financial success _____ there are enough visitors.Alest

Bprovided

Cif

Dunless

正确答案: B解析:

句意:世界博览会在财政上不会取得成功,除非有足够的参观者。用unless连接比较合适,故为D。 -

第13题:

3 Seejoy is a famous football club but has significant cash flow problems. The directors and shareholders wish to take

steps to improve the club’s financial position. The following proposals had been drafted in an attempt to improve the

cash flow of the club. However, the directors need advice upon their implications.

(a) Sale and leaseback of football stadium (excluding the land element)

The football stadium is currently accounted for using the cost model in IAS16, ‘Property, Plant, and Equipment’.

The carrying value of the stadium will be $12 million at 31 December 2006. The stadium will have a remaining

life of 20 years at 31 December 2006, and the club uses straight line depreciation. It is proposed to sell the

stadium to a third party institution on 1 January 2007 and lease it back under a 20 year finance lease. The sale

price and fair value are $15 million which is the present value of the minimum lease payments. The agreement

transfers the title of the stadium back to the football club at the end of the lease at nil cost. The rental is

$1·2 million per annum in advance commencing on 1 January 2007. The directors do not wish to treat this

transaction as the raising of a secured loan. The implicit interest rate on the finance in the lease is 5·6%.

(9 marks)

Required:

Discuss how the above proposals would be dealt with in the financial statements of Seejoy for the year ending

31 December 2007, setting out their accounting treatment and appropriateness in helping the football club’s

cash flow problems.

(Candidates do not need knowledge of the football finance sector to answer this question.)

正确答案:

-

第14题:

(c) Wader is reviewing the accounting treatment of its buildings. The company uses the ‘revaluation model’ for its

buildings. The buildings had originally cost $10 million on 1 June 2005 and had a useful economic life of

20 years. They are being depreciated on a straight line basis to a nil residual value. The buildings were revalued

downwards on 31 May 2006 to $8 million which was the buildings’ recoverable amount. At 31 May 2007 the

value of the buildings had risen to $11 million which is to be included in the financial statements. The company

is unsure how to treat the above events. (7 marks)

Required:

Discuss the accounting treatments of the above items in the financial statements for the year ended 31 May

2007.

Note: a discount rate of 5% should be used where necessary. Candidates should show suitable calculations where

necessary.

正确答案:

-

第15题:

(b) Discuss the view that fair value is a more relevant measure to use in corporate reporting than historical cost.

(12 marks)

正确答案:

(b) The main disagreement over a shift to fair value measurement is the debate over relevance versus reliability. It is argued that

historical cost financial statements are not relevant because they do not provide information about current exchange values

for the entity’s assets which to some extent determine the value of the shares of the entity. However, the information provided

by fair values may be unreliable because it may not be based on arm’s-length transactions. Proponents of fair value

accounting argue that this measurement is more relevant to decision makers even if it is less reliable and would produce

balance sheets that are more representative of a company’s value. However it can be argued that relevant information that is

unreliable is of no use to an investor. One advantage of historical cost financial information is that it produces earnings

numbers that are not based on appraisals or other valuation techniques. Therefore, the income statement is less likely to be

subject to manipulation by management. In addition, historical cost balance sheet figures comprise actual purchase prices,

not estimates of current values that can be altered to improve various financial ratios. Because historical cost statements rely

less on estimates and more on ‘hard’ numbers, it can be said that historical cost financial statements are more reliable than

fair value financial statements. Furthermore, fair value measurements may be less reliable than historical costs measures

because fair value accounting provides management with the opportunity to manipulate the reported profit for the period.

Developing reliable methods of measuring fair value so that investors trust the information reported in financial statements is

critical.

Fair value measurement could be said to be more relevant than historical cost as it is based on market values and not entity

specific measurement on initial recognition, so long as fair values can be reliably measured. Generally the fair value of the

consideration given or received (effectively historical cost) also represents the fair value of the item at the date of initial

recognition. However there are many cases where significant differences between historical cost and fair value can arise on

initial recognition.

Historical cost does not purport to measure the value received. It cannot be assumed that the price paid can be recovered in

the market place. Hence the need for some additional measure of recoverable value and impairment testing of assets.

Historical cost can be an entity specific measurement. The recorded historical cost can be lower or higher than its fair value.

For example the valuation of inventory is determined by the costing method adopted by the entity and this can vary from

entity to entity. Historical cost often requires the allocation of costs to an asset or liability. These costs are attributed to assets,

liabilities and expenses, and are often allocated arbitrarily. An example of this is self constructed assets. Rules set out in

accounting standards help produce some consistency of historical cost measurements but such rules cannot improve

representational faithfulness.

Another problem with historical cost arises as regards costs incurred prior to an asset being recognised. Historical costs

recorded from development expenditure cannot be capitalised if they are incurred prior to the asset meeting the recognition

criteria in IAS38 ‘Intangible Assets’. Thus the historical cost amount does not represent the fair value of the consideration

given to create the asset.

The relevance of historical cost has traditionally been based on a cost/revenue matching principle. The objective has been to

expense the cost of the asset when the revenue to which the asset has contributed is recognised. If the historical cost of the

asset differs from its fair value on initial recognition then the matching process in future periods becomes arbitrary. The

measurement of assets at fair value will enhance the matching objective. Historical cost may have use in predicting future

net reported income but does not have any necessary implications for future cash flows. Fair value does embody the market’s

expectations for those future cash flows.

However, historical cost is grounded in actual transaction amounts and has existed for many years to the extent that it is

supported by practical experience and familiarity. Historical cost is accepted as a reliable measure especially where no other

relevant measurement basis can be applied.

-

第16题:

(b) Discuss how management’s judgement and the financial reporting infrastructure of a country can have a

significant impact on financial statements prepared under IFRS. (6 marks)

Appropriateness and quality of discussion. (2 marks)

正确答案:

(b) Management judgement may have a greater impact under IFRS than generally was the case under national GAAP. IFRS

utilises fair values extensively. Management have to use their judgement in selecting valuation methods and formulating

assumptions when dealing with such areas as onerous contracts, share-based payments, pensions, intangible assets acquired

in business combinations and impairment of assets. Differences in methods or assumptions can have a major impact on

amounts recognised in financial statements. IAS1 expects companies to disclose the sensitivity of carrying amounts to the

methods, assumptions and estimates underpinning their calculation where there is a significant risk of material adjustment

to their carrying amounts within the next financial year. Often management’s judgement is that there is no ‘significant risk’

and they often fail to disclose the degree of estimation or uncertainty and thus comparability is affected.

In addition to the IFRSs themselves, a sound financial reporting infrastructure is required. This implies effective corporate

governance practices, high quality auditing standards and practices, and an effective enforcement or oversight mechanism.

Therefore, consistency and comparability of IFRS financial statements will also depend on the robust nature of the other

elements of the financial reporting infrastructure.

Many preparers of financial statements will have been trained in national GAAP and may not have been trained in the

principles underlying IFRS and this can lead to unintended inconsistencies when implementing IFRS especially where the

accounting profession does not have a CPD requirement. Additionally where the regulatory system of a country is not well

developed, there may not be sufficient market information to utilise fair value measurements and thus this could lead to

hypothetical markets being created or the use of mathematical modelling which again can lead to inconsistencies because of

lack of experience in those countries of utilising these techniques. This problem applies to other assessments or estimates

relating to such things as actuarial valuations, investment property valuations, impairment testing, etc.

The transition to IFRS can bring significant improvement to the quality of financial performance and improve comparability

worldwide. However, there are issues still remaining which can lead to inconsistency and lack of comparability with those

financial statements. -

第17题:

5 An enterprise has made a material change to an accounting policy in preparing its current financial statements.

Which of the following disclosures are required by IAS 8 Accounting policies, changes in accounting estimates

and errors in these financial statements?

1 The reasons for the change.

2 The amount of the consequent adjustment in the current period and in comparative information for prior periods.

3 An estimate of the effect of the change on future periods, where possible.

A 1 and 2 only

B 1 and 3 only

C 2 and 3 only

D All three items

正确答案:A

-

第18题:

4 (a) The purpose of ISA 250 Consideration of Laws and Regulations in an Audit of Financial Statements is to

establish standards and provide guidance on the auditor’s responsibility to consider laws and regulations in an

audit of financial statements.

Explain the auditor’s responsibilities for reporting non-compliance that comes to the auditor’s attention

during the conduct of an audit. (5 marks)

正确答案:

4 CLEEVES CO

(a) Reporting non-compliance

Non-compliance refers to acts of omission or commission by the entity being audited, either intentional or unintentional, that

are contrary to the prevailing laws or regulations.

To management

Regarding non-compliance that comes to the auditor’s attention the auditor should, as soon as practicable, either:

■ communicate with those charged with governance; or

■ obtain audit evidence that they are appropriately informed.

However, the auditor need not do so for matters that are clearly inconsequential or trivial and may reach agreement1 in

advance on the nature of such matters to be communicated.

If in the auditor’s judgment the non-compliance is believed to be intentional and material, the auditor should communicate

the finding without delay.

If the auditor suspects that members of senior management are involved in non-compliance, the auditor should report the

matter to the next higher level of authority at the entity, if it exists (e.g. an audit committee or a supervisory board). Where

no higher authority exists, or if the auditor believes that the report may not be acted upon or is unsure as to the person to

whom to report, the auditor would consider seeking legal advice.

To the users of the auditor’s report on the financial statements

If the auditor concludes that the non-compliance has a material effect on the financial statements, and has not been properly

reflected in the financial statements, the auditor expresses a qualified (i.e. ‘except for disagreement’) or an adverse opinion.

If the auditor is precluded by the entity from obtaining sufficient appropriate audit evidence to evaluate whether or not noncompliance

that may be material to the financial statements has (or is likely to have) occurred, the auditor should express a

qualified opinion or a disclaimer of opinion on the financial statements on the basis of a limitation on the scope of the audit.

Tutorial note: For example, if management denies the auditor access to information from which he would be able to assess

whether or not illegal dumping had taken place (and, if so, the extent of it).

If the auditor is unable to determine whether non-compliance has occurred because of limitations imposed by circumstances

rather than by the entity, the auditor should consider the effect on the auditor’s report.

Tutorial note: For example, if new legal requirements have been announced as effective but the detailed regulations are not

yet published.

To regulatory and enforcement authorities

The auditor’s duty of confidentiality ordinarily precludes reporting non-compliance to a third party. However, in certain

circumstances, that duty of confidentiality is overridden by statute, law or by courts of law (e.g. in some countries the auditor

is required to report non-compliance by financial institutions to the supervisory authorities). The auditor may need to seek

legal advice in such circumstances, giving due consideration to the auditor’s responsibility to the public interest. -

第19题:

(b) You are the manager responsible for the audit of Poppy Co, a manufacturing company with a year ended

31 October 2008. In the last year, several investment properties have been purchased to utilise surplus funds

and to provide rental income. The properties have been revalued at the year end in accordance with IAS 40

Investment Property, they are recognised on the statement of financial position at a fair value of $8 million, and

the total assets of Poppy Co are $160 million at 31 October 2008. An external valuer has been used to provide

the fair value for each property.

Required:

(i) Recommend the enquiries to be made in respect of the external valuer, before placing any reliance on their

work, and explain the reason for the enquiries; (7 marks)

正确答案:

(b) (i) Enquiries in respect of the external valuer

Enquiries would need to be made for two main reasons, firstly to determine the competence, and secondly the objectivity

of the valuer. ISA 620 Using the Work of an Expert contains guidance in this area.

Competence

Enquiries could include:

– Is the valuer a member of a recognised professional body, for example a nationally or internationally recognised

institute of registered surveyors?

– Does the valuer possess any necessary licence to carry out valuations for companies?

– How long has the valuer been a member of the recognised body, or how long has the valuer been licensed under

that body?

– How much experience does the valuer have in providing valuations of the particular type of investment properties

held by Poppy Co?

– Does the valuer have specific experience of evaluating properties for the purpose of including their fair value within

the financial statements?

– Is there any evidence of the reputation of the valuer, e.g. professional references, recommendations from other

companies for which a valuation service has been provided?

– How much experience, if any, does the valuer have with Poppy Co?

Using the above enquiries, the auditor is trying to form. an opinion as to the relevance and reliability of the valuation

provided. ISA 500 Audit Evidence requires that the auditor gathers evidence that is both sufficient and appropriate. The

auditor needs to ensure that the fair values provided by the valuer for inclusion in the financial statements have been

arrived at using appropriate knowledge and skill which should be evidenced by the valuer being a member of a

professional body, and, if necessary, holding a licence under that body.

It is important that the fair values have been arrived at using methods allowed under IAS 40 Investment Property. If any

other valuation method has been used then the value recognised in the statement of financial position may not be in

accordance with financial reporting standards. Thus it is important to understand whether the valuer has experience

specifically in providing valuations that comply with IAS 40, and how many times the valuer has appraised properties

similar to those owned by Poppy Co.

In gauging the reliability of the fair value, the auditor may wish to consider how Poppy Co decided to appoint this

particular valuer, e.g. on the basis of a recommendation or after receiving references from companies for which

valuations had previously been provided.

It will also be important to consider how familiar the valuer is with Poppy Co’s business and environment, as a way to

assess the reliability and appropriateness of any assumptions used in the valuation technique.

Objectivity

Enquiries could include:

– Does the valuer have any financial interest in Poppy Co, e.g. shares held directly or indirectly in the company?

– Does the valuer have any personal relationship with any director or employee of Poppy Co?

– Is the fee paid for the valuation service reasonable and a fair, market based price?

With these enquiries, the auditor is gaining assurance that the valuer will perform. the valuation from an independent

point of view. If the valuer had a financial interest in Poppy Co, there would be incentive to manipulate the valuation in

a way best suited to the financial statements of the company. Equally if the valuer had a personal relationship with a

senior member of staff at Poppy Co, the valuer may feel pressured to give a favourable opinion on the valuation of the

properties.

The level of fee paid is important. It should be commensurate with the market rate paid for this type of valuation. If the

valuer was paid in excess of what might be considered a normal fee, it could indicate that the valuer was encouraged,

or even bribed, to provide a favourable valuation. -

第20题:

听力原文:The primary objective of financial reporting is to provide information useful for making investment and lending decisions.

(6)

A.The financial reporting is to provide information for the investors and lenders only.

B.The main aim of financial reporting is to offer information useful for decision-making.

C.Investment and lending decisions can be made from the financial reporting.

D.Investment and lending decisions can not be made from the financial reporting.

正确答案:B

解析:录音单句意思为“财务报告的主要目标是为投资者和贷款者做决定提供有用信息”。 -

第21题:

听力原文:M: The primary objective of financial reporting is to provide information useful for making investment and lending decisions.

W: The information must be relevant, reliable, and comparable.

Q: What is the primary objective of financial reporting?

(15)

A.To make investment.

B.To record data.

C.To provide useful information.

D.To understand some basic accounting principles.

正确答案:C

解析:根据男士的说法,财务报告的作用在于为投资决策和筹资决策提供有用的信息。 -

第22题:

Any difference between the fair market values of the securities and their cost is a realized gain or loss.()

正确答案:错

-

第23题:

You are an audit manager at Rockwell & Co, a firm of Chartered Certified Accountants. You are responsible for the audit of the Hopper Group, a listed audit client which supplies ingredients to the food and beverage industry worldwide.

The audit work for the year ended 30 June 2015 is nearly complete, and you are reviewing the draft audit report which has been prepared by the audit senior. During the year the Hopper Group purchased a new subsidiary company, Seurat Sweeteners Co, which has expertise in the research and design of sugar alternatives. The draft financial statements of the Hopper Group for the year ended 30 June 2015 recognise profit before tax of $495 million (2014 – $462 million) and total assets of $4,617 million (2014: $4,751 million). An extract from the draft audit report is shown below:

Basis of modified opinion (extract)

In their calculation of goodwill on the acquisition of the new subsidiary, the directors have failed to recognise consideration which is contingent upon meeting certain development targets. The directors believe that it is unlikely that these targets will be met by the subsidiary company and, therefore, have not recorded the contingent consideration in the cost of the acquisition. They have disclosed this contingent liability fully in the notes to the financial statements. We do not feel that the directors’ treatment of the contingent consideration is correct and, therefore, do not believe that the criteria of the relevant standard have been met. If this is the case, it would be appropriate to adjust the goodwill balance in the statement of financial position.

We believe that any required adjustment may materially affect the goodwill balance in the statement of financial position. Therefore, in our opinion, the financial statements do not give a true and fair view of the financial position of the Hopper Group and of the Hopper Group’s financial performance and cash flows for the year then ended in accordance with International Financial Reporting Standards.

Emphasis of Matter Paragraph

We draw attention to the note to the financial statements which describes the uncertainty relating to the contingent consideration described above. The note provides further information necessary to understand the potential implications of the contingency.

Required:

(a) Critically appraise the draft audit report of the Hopper Group for the year ended 30 June 2015, prepared by the audit senior.

Note: You are NOT required to re-draft the extracts from the audit report. (10 marks)

(b) The audit of the new subsidiary, Seurat Sweeteners Co, was performed by a different firm of auditors, Fish Associates. During your review of the communication from Fish Associates, you note that they were unable to obtain sufficient appropriate evidence with regard to the breakdown of research expenses. The total of research costs expensed by Seurat Sweeteners Co during the year was $1·2 million. Fish Associates has issued a qualified audit opinion on the financial statements of Seurat Sweeteners Co due to this inability to obtain sufficient appropriate evidence.

Required:

Comment on the actions which Rockwell & Co should take as the auditor of the Hopper Group, and the implications for the auditor’s report on the Hopper Group financial statements. (6 marks)

(c) Discuss the quality control procedures which should be carried out by Rockwell & Co prior to the audit report on the Hopper Group being issued. (4 marks)

正确答案:(a) Critical appraisal of the draft audit report

Type of opinion

When an auditor issues an opinion expressing that the financial statements ‘do not give a true and fair view’, this represents an adverse opinion. The paragraph explaining the modification should, therefore, be titled ‘Basis of Adverse Opinion’ rather than simply ‘Basis of Modified Opinion’.

An adverse opinion means that the auditor considers the misstatement to be material and pervasive to the financial statements of the Hopper Group. According to ISA 705 Modifications to Opinions in the Independent Auditor’s Report, pervasive matters are those which affect a substantial proportion of the financial statements or fundamentally affect the users’ understanding of the financial statements. It is unlikely that the failure to recognise contingent consideration is pervasive; the main effect would be to understate goodwill and liabilities. This would not be considered a substantial proportion of the financial statements, neither would it be fundamental to understanding the Hopper Group’s performance and position.

However, there is also some uncertainty as to whether the matter is even material. If the matter is determined to be material but not pervasive, then a qualified opinion would be appropriate on the basis of a material misstatement. If the matter is not material, then no modification would be necessary to the audit opinion.

Wording of opinion/report

The auditor’s reference to ‘the acquisition of the new subsidiary’ is too vague; the Hopper Group may have purchased a number of subsidiaries which this phrase could relate to. It is important that the auditor provides adequate description of the event and in these circumstances it would be appropriate to name the subsidiary referred to.

The auditor has not quantified the amount of the contingent element of the consideration. For the users to understand the potential implications of any necessary adjustments, they need to know how much the contingent consideration will be if it becomes payable. It is a requirement of ISA 705 that the auditor quantifies the financial effects of any misstatements, unless it is impracticable to do so.

In addition to the above point, the auditor should provide more description of the financial effects of the misstatement, including full quantification of the effect of the required adjustment to the assets, liabilities, incomes, revenues and equity of the Hopper Group.

The auditor should identify the note to the financial statements relevant to the contingent liability disclosure rather than just stating ‘in the note’. This will improve the understandability and usefulness of the contents of the audit report.

The use of the term ‘we do not feel that the treatment is correct’ is too vague and not professional. While there may be some interpretation necessary when trying to apply financial reporting standards to unique circumstances, the expression used is ambiguous and may be interpreted as some form. of disclaimer by the auditor with regard to the correct accounting treatment. The auditor should clearly explain how the treatment applied in the financial statements has departed from the requirements of the relevant standard.

Tutorial note: As an illustration to the above point, an appropriate wording would be: ‘Management has not recognised the acquisition-date fair value of contingent consideration as part of the consideration transferred in exchange for the acquiree, which constitutes a departure from International Financial Reporting Standards.’

The ambiguity is compounded by the use of the phrase ‘if this is the case, it would be appropriate to adjust the goodwill’. This once again suggests that the correct treatment is uncertain and perhaps open to interpretation.

If the auditor wishes to refer to a specific accounting standard they should refer to its full title. Therefore instead of referring to ‘the relevant standard’ they should refer to International Financial Reporting Standard 3 Business Combinations.

The opinion paragraph requires an appropriate heading. In this case the auditors have issued an adverse opinion and the paragraph should be headed ‘Adverse Opinion’.

As with the basis paragraph, the opinion paragraph lacks authority; suggesting that the required adjustments ‘may’ materially affect the financial statements implies that there is a degree of uncertainty. This is not the case; the amount of the contingent consideration will be disclosed in the relevant purchase agreement, so the auditor should be able to determine whether the required adjustments are material or not. Regardless, the sentence discussing whether the balance is material or not is not required in the audit report as to warrant inclusion in the report the matter must be considered material. The disclosure of the nature and financial effect of the misstatement in the basis paragraph is sufficient.

Finally, the emphasis of matter paragraph should not be included in the audit report. An emphasis of matter paragraph is only used to draw attention to an uncertainty/matter of fundamental importance which is correctly accounted for and disclosed in the financial statements. An emphasis of matter is not required in this case for the following reasons:

– Emphasis of matter is only required to highlight matters which the auditor believes are fundamental to the users’ understanding of the business. An example may be where a contingent liability exists which is so significant it could lead to the closure of the reporting entity. That is not the case with the Hopper Group; the contingent liability does not appear to be fundamental.

– Emphasis of matter is only used for matters where the auditor has obtained sufficient appropriate evidence that the matter is not materially misstated in the financial statements. If the financial statements are materially misstated, in this regard the matter would be fully disclosed by the auditor in the basis of qualified/adverse opinion paragraph and no emphasis of matter is necessary.

(b) Communication from the component auditor

The qualified opinion due to insufficient evidence may be a significant matter for the Hopper Group audit. While the possible adjustments relating to the current year may not be material to the Hopper Group, the inability to obtain sufficient appropriate evidence with regard to a material matter in Seurat Sweeteners Co’s financial statements may indicate a control deficiency which the auditor was not aware of at the planning stage and it could indicate potential problems with regard to the integrity of management, which could also indicate a potential fraud. It could also indicate an unwillingness of management to provide information, which could create problems for future audits, particularly if research and development costs increase in future years. If the group auditor suspects that any of these possibilities are true, they may need to reconsider their risk assessment and whether the audit procedures performed are still appropriate.

If the detail provided in the communication from the component auditor is insufficient, the group auditor should first discuss the matter with the component auditor to see whether any further information can be provided. The group auditor can request further working papers from the component auditor if this is necessary. However, if Seurat Sweeteners has not been able to provide sufficient appropriate evidence, it is unlikely that this will be effective.

If the discussions with the component auditor do not provide satisfactory responses to evaluate the potential impact on the Hopper Group, the group auditor may need to communicate with either the management of Seurat Sweeteners or the Hopper Group to obtain necessary clarification with regard to the matter.

Following these procedures, the group auditor needs to determine whether they have sufficient appropriate evidence to draw reasonable conclusions on the Hopper Group’s financial statements. If they believe the lack of information presents a risk of material misstatement in the group financial statements, they can request that further audit procedures be performed, either by the component auditor or by themselves.

Ultimately the group engagement partner has to evaluate the effect of the inability to obtain sufficient appropriate evidence on the audit opinion of the Hopper Group. The matter relates to research expenses totalling $1·2 million, which represents 0·2% of the profit for the year and 0·03% of the total assets of the Hopper Group. It is therefore not material to the Hopper Group’s financial statements. For this reason no modification to the audit report of the Hopper Group would be required as this does not represent a lack of sufficient appropriate evidence with regard to a matter which is material to the Group financial statements.

Although this may not have an impact on the Hopper Group audit opinion, this may be something the group auditor wishes to bring to the attention of those charged with governance. This would be particularly likely if the group auditor believed that this could indicate some form. of fraud in Seurat Sweeteners Co, a serious deficiency in financial reporting controls or if this could create problems for accepting future audits due to management’s unwillingness to provide access to accounting records.

(c) Quality control procedures prior to issuing the audit report

ISA 220 Quality Control for an Audit of Financial Statements and ISQC 1 Quality Control for Firms that Perform. Audits and Reviews of Historical Financial Information, and Other Assurance and Related Services Agreements require that an engagement quality control reviewer shall be appointed for audits of financial statements of listed entities. The audit engagement partner then discusses significant matters arising during the audit engagement with the engagement quality control reviewer.

The engagement quality control reviewer and the engagement partner should discuss the failure to recognise the contingent consideration and its impact on the auditor’s report. The engagement quality control reviewer must review the financial statements and the proposed auditor’s report, in particular focusing on the conclusions reached in formulating the auditor’s report and consideration of whether the proposed auditor’s opinion is appropriate. The audit documentation relating to the acquisition of Seurat Sweeteners Co will be carefully reviewed, and the reviewer is likely to consider whether procedures performed in relation to these balances were appropriate.

Given the listed status of the Hopper Group, any modification to the auditor’s report will be scrutinised, and the firm must be sure of any decision to modify the report, and the type of modification made. Once the engagement quality control reviewer has considered the necessity of a modification, they should consider whether a qualified or an adverse opinion is appropriate in the circumstances. This is an important issue, given that it requires judgement as to whether the matters would be material or pervasive to the financial statements.

The engagement quality control reviewer should ensure that there is adequate documentation regarding the judgements used in forming the final audit opinion, and that all necessary matters have been brought to the attention of those charged with governance.

The auditor’s report must not be signed and dated until the completion of the engagement quality control review.

Tutorial note: In the case of the Hopper Group’s audit, the lack of evidence in respect of research costs is unlikely to be discussed unless the audit engagement partner believes that the matter could be significant, for example, if they suspected the lack of evidence is being used to cover up a financial statements fraud.