(c) State the tax consequences for both Glaikit Limited and Alasdair if he borrows money from the company, asproposed, on 1 January 2006. (3 marks)

题目

(c) State the tax consequences for both Glaikit Limited and Alasdair if he borrows money from the company, as

proposed, on 1 January 2006. (3 marks)

相似考题

参考答案和解析

(c) Alasdair is not employed, nor is he a director, of Glaikit Limited. As he holds 25% of the shares in Glaikit Limited, he is a

participator in a close company and therefore the special close company provisions will apply. Thus Alsadair will be taxed

under the ‘loans to participator’ rules.

When the loan is written off, the amount waived will be treated as a gross distribution of £16,667 (£15,000 x 10/9). This

will be assessed in the tax year in which the loan is written off (expected to be 2006/07 or 2007/08). To the extent that this

additional income makes Alasdair a higher rate taxpayer in that year, he will have to pay additional income tax of 32·5% of

the gross amount, less the available 10% tax credit.

From the company’s perspective, Glaikit Limited will have to pay 25% of the net value of any loan made to Alasdair which

has not been repaid to the company (or written off) within nine months of the year end. As the loan will remain outstanding

as at 31 March 2006, Glaikit Limited will have to pay £3,750 (25% x £15,000) to the Revenue by 1 January 2007. This

amount will not be repaid until the loan is repaid or written off. This usually takes place nine months after the year end in

which the loan is written off, so Glaikit Limited should ensure that any write-off occurs prior to 31 March 2007, or else the

repayment may be delayed for up to one year.

As the loan is tax free, the Revenue may also seek to tax Alasdair under the beneficial loan rules. If the Revenue were to seek

an assessment in this manner, the value of the benefit would be calculated and taxed as a deemed distribution. However, as

Alasdair has no connection with the company other than as an investor, it is unlikely that the beneficial loan benefit will lead

to such a deemed distribution.

更多“(c) State the tax consequences for both Glaikit Limited and Alasdair if he borrows money from the company, asproposed, on 1 January 2006. (3 marks)”相关问题

-

第1题:

6 Alasdair, aged 42, is single. He is considering investing in property, as he has heard that this represents a good

investment. In order to raise the funds to buy the property, he wants to extract cash from his personal company, Beezer

Limited, whose year end is 31 December.

Beezer Limited was formed on 1 May 1998 with £1,000 of capital issued as 1,000 £1 ordinary shares, and traded

until 1 January 2005 when Alasdair sold the trade and related assets. The company’s only asset is cash of

£120,000. Alasdair wants to extract this cash from the company with the minimum amount of tax payable. He is

considering either, paying himself a dividend of £120,000, on 31 March 2006, after which the company would have

no assets and be wound up or, leaving the cash in the company and then liquidating the company. Costs of liquidation

of £5,000 would then be incurred.

Since Beezer Limited ceased trading, Alasdair has been taken on as a partner at a marketing firm, Gallus & Co. He

estimates his profit share for the year of assessment 2005/06 will be £30,000. He has not made any capital disposals

in the current tax year.

Alasdair wishes to reinvest the cash extracted from Beezer Limited in property but is not sure whether he should invest

directly in residential or commercial property, or do so via some form. of collective investment. He is aware that Gallus

& Co are looking to rent a new warehouse which could be bought for £200,000. Alasdair thinks that he may be able

to buy the warehouse himself and lease it to his firm, but only if he can borrow the additional money to buy the

property.

Alasdair has a 25% shareholding in another company, Glaikit Limited, whose year end is 31 March. The remaining

shares in this company are held by his friend, Gill. Alasdair is considering borrowing £15,000 from Glaikit Limited

on 1 January 2006. He does not intend to pay any interest on the loan, which is likely to be written off some time

in 2007. Alasdair does not have any connection with Glaikit Limited other than his shareholding.

Required:

(a) Advise Alasdair whether or not a dividend payment will result in a higher after-tax cash sum than the

liquidation of Beezer Limited. Assume that either the dividend would be paid on 31 March 2006 or the

liquidation would take place on 31 March 2006. (9 marks)

Assume that Beezer Limited has always paid corporation tax at or above the small companies rate of 19%

and that the tax rates and allowances for 2004/05 apply throughout this part.

正确答案:

-

第2题:

(ii) State, giving reasons, the tax reliefs in relation to inheritance tax (IHT) and capital gains tax (CGT) which

would be available to Alasdair if he acquires the warehouse and leases it to Gallus & Co, rather than to

an unconnected tenant. (4 marks)

正确答案:

(ii) Apart from the fact that Alasdair can keep an eye on his tenant, the main advantages are twofold:

IHT: If the firm are the tenants, the property will be land and buildings used in a business carried on by a partnership

in which the donor is a partner. Thus, Alasdair will be able to claim business property relief (BPR) at a rate of 50%

so long as he remains a partner in the firm. However, this relief would not be available until Alasdair has owned

the property for at least two years from his firm taking up the tenancy.

CGT: As Alasdair is a partner in the firm using the building, it will also be a qualifying asset for the purposes of rollover

relief on any gains arising from the disposal of the property. Assuming that Alasdair acquires a replacement asset

which will be used in the trade, the gain on sale can be deferred against the tax base cost of the replacement asset.

In the event that rollover relief cannot be used, any gains on disposal will be subject to business asset taper relief. -

第3题:

(b) (i) Advise Benny of the income tax implications of the grant and exercise of the share options in Summer

Glow plc on the assumption that the share price on 1 September 2007 and on the day he exercises the

options is £3·35 per share. Explain why the share option scheme is not free from risk by reference to

the rules of the scheme and the circumstances surrounding the company. (4 marks)

正确答案:

(b) (i) The share options

There are no income tax implications on the grant of the share options.

In the tax year in which Benny exercises the options and acquires the shares, the excess of the market value of the

shares over the price paid, i.e. £11,500 ((£3·35 – £2·20) x 10,000) will be subject to income tax.

Benny’s financial exposure is caused by the rule within the share option scheme obliging him to hold the shares for a

year before he can sell them. If the company’s expansion into Eastern Europe fails, such that its share price

subsequently falls to less than £2·20 before Benny has the chance to sell the shares, Benny’s financial position may be

summarised as follows:

– Benny will have paid £22,000 (£2·20 x 10,000) for shares which are now worth less than that.

– He will also have paid income tax of £4,600 (£11,500 x 40%). -

第4题:

(b) Explain the advantages from a tax point of view of operating the new business as a partnership rather than

as a company whilst it is making losses. You should calculate the tax adjusted trading loss for the year

ending 31 March 2008 for both situations and indicate the years in which the loss relief will be obtained.

You are not required to prepare any other supporting calculations. (10 marks)

正确答案:(b) The new business

There are two tax advantages to operating the business as a partnership.

(i) Reduction in taxable income

If the new business is operated as a company, Cindy and Arthur would both be taxed at 40% on their salaries. In

addition, employer and employee national insurance contributions would be due on £105 (£5,000 – £4,895) in respect

of each of them.

If the new business is operated as a partnership, the partners would have no taxable trading income because the

partnership has made a loss; any salaries paid to the partners would be appropriations of the profit or loss of the

business and not employment income. They would, however, each have to pay Class 2 national insurance contributions

of £2·10 each per week.

(ii) Earlier relief for trading losses

If the new business is operated as a company, its tax adjusted trading loss in the year ending 31 March 2008 would

be as follows:

-

第5题:

3 Damian is the finance director of Linden Limited, a medium sized, unquoted, UK trading company, with a 31 July

year end. Damian personally owns 10% of the ordinary issued share capital of Linden Limited, for which he paid

£10,000 in June 1998. He estimates that the current market value of Linden Limited is £9 million and that the

company will make taxable profits of £1·4 million in the forthcoming year to 31 July 2007.

(a) Damian believes that Linden Limited should conduct its activities in a socially responsible manner and to this

end has proposed that in future all cars purchased by the company should be low emission vehicles. The sales

director has stated that several of his staff, who are the main recipients of company cars, other than the directors,

are extremely unhappy with this proposal, perceiving it as downgrading their value and status.

The cars currently provided to the sales staff have a list price of £19,600, on which Linden Limited receives a

bulk purchase discount of 6% from the dealer, and a CO2 emission rate of 168 grams/kilometre. The company

pays for up to £400 of accessories, of the salesmen’s own choice to be fitted to the cars and all of the running

costs, including private petrol. The cars are replaced every three years and the ‘old’ cars are sold at auction,

because they are high mileage vehicles.

The low emission cars it is proposed to purchase will have the same list price as the current cars, but the dealer

is only prepared to offer a bulk discount of 5% on these vehicles. Damian does not propose to make any other

changes to Linden Limited’s company car policy or practice.

Required:

(i) Explain the tax consequences of the proposed move to low emission vehicles for both the individual

salesmen and Linden Limited, illustrating your answer by means of relevant calculations of the tax and

national insurance (NIC) savings arising. (9 marks)

正确答案:

(a) (i) Individual salesmen

The taxable benefit is determined by the list price of the vehicle plus the cost of the accessories (£20,000) and the CO2

emission rate. The current vehicles have a CO2 emission rate of 168 grams/kilometre, so the benefit will be calculated

at the rate of 20% ((168 – 140)/5 + 15), resulting in a total annual car and car fuel benefit charge of £6,880 (20,000

x 20% + 14,400 x 20%). The low emission vehicles will be chargeable at the basic percentage rate of 15% resulting

in a total annual car and fuel benefit charge of £5,160 (20,000 x 15% + 14,400 x 15%). The salesmen will thus

make an annual income tax saving at their marginal rate of tax, i.e. £378 (1,720 x 22%) if they are basic rate taxpayers

and £688 (1,720 x 40%) if they are higher rate taxpayers.

Linden Limited

The current vehicles will be classed as ‘expensive’ cars based on the discounted list price plus the cost of the accessories

of £18,824 (19,600 x 94% + 400). The annual writing down allowances will thus be restricted to £3,000 throughout

the period of ownership, but there will be no restriction of the balancing allowance available on disposal. The low

emission vehicles will be eligible for a 100% first year allowance of £19,020 (19,600 x 95% + 400), but there will

also be a balancing charge on disposal equivalent to the sales proceeds. Therefore, the total of the allowances available

over the life of the cars will be effectively the same in both cases. As a single company with taxable profits of

£1·4 million, Linden Limited will pay corporation tax at the small companies marginal rate of 32·75% in the year to

31 July 2007, giving a tax benefit in that year of £5,247 for each low emission car purchased ((19,020 – 3,000) x

32·75%).

The company will also make an annual saving in terms of the Class 1A national insurance contributions payable on the

salesmen’s benefits of £220 ((6,880 – 5,160) x 12·8%). But, as these Class 1A contributions are deductible for

corporation tax, the net saving will only be £205 (220 x (100 – 32·75)%).

As the VAT liability payable on the provision of private fuel is based on engine capacity (not the CO2 emission rate) this

will not necessarily be affected. -

第6题:

(c) For commercial reasons, Damian believes that it would be sensible to place a new holding company, Bold plc,

over the existing company, Linden Limited. Bold plc would also be unquoted and would acquire the existing

Linden Limited shares in exchange for the issue of its own shares.

If the new structure is implemented, Bold plc will provide management services to Linden Limited, but the

amount that will be charged for these services is yet to be determined.

Required:

(i) State the capital gains tax (CGT) issues that Damian should be aware of before disposing of his shares

in Linden Limited to Bold plc. Your answer should include details of any conditions that will need to be

satisfied if an immediate charge to tax is to be avoided. (4 marks)

正确答案:

(c) (i) The proposed transaction broadly falls under the ‘paper for paper’ rules. Where this is the case, chargeable gains do not

arise. Instead, the new holding stands in the shoes (and inherits the base cost) of the original holding.

The company issuing the new shares must:

(i) end up with more than 25% of the ordinary share capital or a majority of the voting power of the old company,

OR

(ii) make a general offer to shareholders in the old company with a condition which would give the acquiring company

control of the company if accepted.

The exchange must be for bona fide commercial reasons and not have as its main purpose (or one of its main purposes)

the avoidance of capital gains tax or corporation tax.

The issue of shares by Bold plc satisfies these conditions, thus Damian, as a shareholder of Linden Limited, will not be

taxed on the exchange of shares. -

第7题:

4 (a) For this part, assume today’s date is 1 March 2006.

Bill and Ben each own 50% of the ordinary share capital in Flower Limited, an unquoted UK trading company

that makes electronic toys. Flower Limited was incorporated on 1 August 2005 with 1,000 £1 ordinary shares,

and commenced trading on the same day. The business has been successful, and the company has accumulated

a large cash balance of £180,000, which is to be used to purchase a new factory. However, Bill and Ben have

received an offer from a rival company, which they are considering. The offer provides Bill and Ben with two

alternative methods of payment for the purchase of their shares:

(i) £480,000 for the company, inclusive of the £180,000 cash balance.

(ii) £300,000 for the company assuming the cash available for the factory purchase is extracted prior to sale.

Bill and Ben each currently receive a gross salary of £3,750 per month from Flower Limited. Part of the offer

terms is that Bill and Ben would be retained as employees of the company on the same salary.

Neither Bill nor Ben has used any of their capital gains tax annual exemption for the tax year 2005/06.

Required:

(i) Calculate which of the following means of extracting the £180,000 from Flower Limited on 31 March

2006 will result in the highest after tax cash amount for Bill and Ben:

(1) payment of a dividend, or

(2) payment of a salary bonus.

You are not required to consider the corporation tax (CT) implications for Flower Limited in your

answer. (5 marks)

正确答案:

As a result, Bill and Ben would each be better off by £15,005 (69,142 – 54,137). If the cash were extracted by way

of dividend.

Tutorial note: In this answer the employers’ national insurance liability on the salary has been ignored. Credit would be

given to a candidate who recognised this issue. -

第8题:

(iii) State how your answer in (ii) would differ if the sale were to be delayed until August 2006. (3 marks)

正确答案:

-

第9题:

(ii) Calculate the corporation tax (CT) payable by Tay Limited for the year ended 31 March 2006, taking

advantage of all available reliefs. (3 marks)

正确答案:

-

第10题:

(d) Advise Trent Limited of the consequences arising from the submission of the incorrect value added tax (VAT)

return, assuming that the company has previously had a good compliance record with regard to accounting

for VAT. (6 marks)

正确答案:

(d) Default surcharge

Although the VAT return was submitted on time (i.e. within one month of the end of the tax period), part of the quarterly VAT

liability has not yet been paid. As a result this payment will be made late and a surcharge liability notice will be issued on

the company. The surcharge period will run from the date of the notice until the anniversary of the end of the period for which

the VAT was paid late (i.e. until 31 March 2007). During this period any further default will extend the surcharge period and

any further late payments of VAT will attract a surcharge penalty of 2% on the first occasion, rising to 15% for successive late

payments.

Mis-declaration penalty

As the return understates the VAT payable, a potential mis-declaration penalty arises. The amount understated exceeds 30%

of the sum of the true input tax and output tax, known as the gross amount of tax (GAT) ((30% of (87,500 + 55,000) +

40,000) = 54,750). There has, thus, been a significant understatement of the true VAT return liability, resulting in a penalty

rate of 15% of the VAT which would have been lost had the error not been discovered. However, where an under declaration

arises out of a true error i.e. there is no intention to evade tax involved, and it is voluntarily disclosed, then a mis-declaration

penalty is not normally imposed. Although the company is still within the ‘period of grace’ allowed by HMRC for the correction

of errors in the next following VAT return, it would be advisable for Trent Limited to notify HMRC of the error immediately, in

writing, unless it has a ‘reasonable excuse’ for the error having occurred.

Default interest

Default interest is chargeable when an assessment to VAT arises for an amount that has been under declared in a previous

period, whether as a result of voluntary disclosure or as identified by HMRC. Interest is charged on a daily basis from the

date the under declaration should have been declared (i.e. 1 May 2006) to the date shown on the notice of assessment or

notice of voluntary disclosure. As given the size of the error the de minimis relief for voluntarily declared errors of less than

£2,000 is not applicable, the only way for Trent Limited to minimise the interest charge is by means of early disclosure and

payment of the additional VAT due. -

第11题:

In relation to company law, explain:

(a) the limitations on the use of company names; (4 marks)

(b) the tort of ‘passing off’; (4 marks)

(c) the role of the company names adjudicators under the Companies Act 2006. (2 marks)

正确答案:(a) Except in relation to specifically exempted companies, such as those involved in charitable work, companies are required to indicate that they are operating on the basis of limited liability. Thus private companies are required to end their names, either with the word ‘limited’ or the abbreviation ‘ltd’, and public companies must end their names with the words ‘public limited company’ or the abbreviation ‘plc’. Welsh companies may use the Welsh language equivalents (Companies Act (CA)2006 ss.58, 59 & 60).

Companies Registry maintains a register of business names, and will refuse to register any company with a name that is the same as one already on that index (CA 2006 s.66).

Certain categories of names are, subject to the decision of the Secretary of State, unacceptable per se, as follows:

(i) names which in the opinion of the Secretary of State constitute a criminal offence or are offensive (CA 2006 s.53)

(ii) names which are likely to give the impression that the company is connected with either government or local government authorities (s.54).

(iii) names which include a word or expression specified under the Company and Business Names Regulations 1981 (s.26(2)(b)). This category requires the express approval of the Secretary of State for the use of any of the names or expressions contained on the list, and relates to areas which raise a matter of public concern in relation to their use.

Under s.67 of the Companies Act 2006 the Secretary of State has power to require a company to alter its name under the following circumstances:

(i) where it is the same as a name already on the Registrar’s index of company names.

(ii) where it is ‘too like’ a name that is on that index.

The name of a company can always be changed by a special resolution of the company so long as it continues to comply with the above requirements (s.77).(b) The tort of passing off was developed to prevent one person from using any name which is likely to divert business their way by suggesting that the business is actually that of some other person or is connected in any way with that other business. It thus enables people to protect the goodwill they have built up in relation to their business activity. In Ewing v Buttercup

Margarine Co Ltd (1917) the plaintiff successfully prevented the defendants from using a name that suggested a link with

his existing dairy company. It cannot be used, however, if there is no likelihood of the public being confused, where for example the companies are conducting different businesses (Dunlop Pneumatic Tyre Co Ltd v Dunlop Motor Co Ltd (1907)

and Stringfellow v McCain Foods GB Ltd (1984). Nor can it be used where the name consists of a word in general use (Aerators Ltd v Tollitt (1902)).

Part 41 of the Companies Act (CA) 2006, which repeals and replaces the Business Names Act 1985, still does not prevent one business from using the same, or a very similar, name as another business so the tort of passing off will still have an application in the wider business sector. However the Act introduced a new procedure to deal specifically with company names. As previously under the CA 1985, a company cannot register with a name that was the same as any already registered (s.665 Companies Act (CA) 2006) and under CA s.67 the Secretary of State may direct a company to change its name if it has been registered in a name that is the same as, or too like a name appearing on the registrar’s index of company names. In addition, however, a completely new system of complaint has been introduced.(c) Under ss.69–74 of CA 2006 a new procedure has been introduced to cover situations where a company has been registered with a name

(i) that it is the same as a name associated with the applicant in which he has goodwill, or

(ii) that it is sufficiently similar to such a name that its use in the United Kingdom would be likely to mislead by suggesting a connection between the company and the applicant (s.69).

Section 69 can be used not just by other companies but by any person to object to a company names adjudicator if a company’s name is similar to a name in which the applicant has goodwill. There is list of circumstances raising a presumption that a name was adopted legitimately, however even then, if the objector can show that the name was registered either, to obtain money from them, or to prevent them from using the name, then they will be entitled to an order to require the company to change its name.

Under s.70 the Secretary of State is given the power to appoint company names adjudicators and their staff and to finance their activities, with one person being appointed Chief Adjudicator.

Section 71 provides the Secretary of State with power to make rules for the proceedings before a company names adjudicator.

Section 72 provides that the decision of an adjudicator and the reasons for it, are to be published within 90 days of the decision.

Section 73 provides that if an objection is upheld, then the adjudicator is to direct the company with the offending name to change its name to one that does not similarly offend. A deadline must be set for the change. If the offending name is not changed, then the adjudicator will decide a new name for the company.

Under s.74 either party may appeal to a court against the decision of the company names adjudicator. The court can either uphold or reverse the adjudicator’s decision, and may make any order that the adjudicator might have made. -

第12题:

问答题A farmer buys a horse for $60. He sells it to his neighbour for $70. Then he discovers he could have made a better deal. He borrows $10 from his wife, and buys the horse back for $80. He then sells it to another neighbour for $90. How much money did he make?正确答案: $10解析: 农民买马总共花了$60+$80=$140。他的总收入:$70+$90=$160。他获得的利润$160-$140=$20。再减掉从妻子那儿借来的$10,他一共赚了$10。 -

第13题:

(b) (i) Advise Alasdair of the tax implications and relative financial risks attached to the following property

investments:

(1) buy to let residential property;

(2) commercial property; and

(3) shares in a property investment company/unit trust. (9 marks)

正确答案:

(b) (i) Income tax:

Direct investment in residential or commercial property

The income will be taxed under Schedule A for both residential and commercial property investment. Expenses can be

offset against income under the normal trading rules. These will include interest charges incurred in borrowing funds to

acquire the properties. Schedule A losses are restricted to use against future Schedule A profits, with the earliest profits

being relieved first.

When acquiring commercial properties, it may be possible to claim capital allowances on the fixtures and plant held in

the building. In addition, industrial buildings allowances (IBA) may also be available if the property qualifies as an

industrial building.

Capital allowances are not normally available for fixtures and fittings included in a residential property. Instead, a wear

and tear allowance can be claimed if the property is furnished. This is equal to 10% of the rental income after any

tenants cost (for example, council tax) paid by the landlord.

Income tax is levied at the normal tax rates (10/22/40%) as appropriate.

Collective investment (shares in a property investment company/unit trust)

With collective investments, the investor either buys shares (in an investment company) or units (in an equity unit trust).

The income tax treatment of both is the same in that the investor receives dividends. These are taxed at 10% and 32·5%

respectively (for basic and higher rate taxpayers).

Investors are not able to claim income tax relief on either interest costs (of borrowing) or any other expenses.

Capital gains tax (CGT):

The normal rules apply for CGT purposes in all situations. Property investments do not normally qualify for business

rates of taper relief unless they are furnished holiday lets or in certain circumstances, commercial property. Investments

in unit trusts or property investment companies will never qualify for business taper rates.

It is possible to use an individual savings account (ISA) to make collective investments. If this is done, income and

capital gains will be exempt from tax.

Other taxes:

New commercial property is subject to value added tax (VAT) at the standard rate, but new residential property is subject

to VAT at the zero rate. If a commercial building is acquired second hand as an investment, VAT may be payable if a

previous owner has opted to tax the property. If this is the case, VAT at the standard rate will be payable on the purchase

price, and rental charges to tenants will also be subject to VAT, again at the standard rate.

The acquisition of shares is not subject ot VAT.

Stamp duty land tax (SDLT) will be payable broadly on the direct acquisition of any property. The rates vary from 0 to

4% depending on the value of the land and building and its nature (whether residential or non-residential). Stamp duty

is payable at a rate of 0·5% on the acquisition of shares.

Investment risks/benefits

Direct investment

Investing directly in property represents a long term investment, and unless this is the case, investment risks are high.

Substantial initial costs (such as SDLT, VAT and transactions costs) are incurred, and ongoing running costs (such as

letting agents’ fees and vacant periods) can be significant. The investments are illiquid, particularly commercial

properties which can take months to sell.

All types of properties are dependent on a cyclical market, and the values of property investments can vary significantly

as a result. However, residential property has (on a long term basis) proven to be a good hedge against inflation.

Collective investments

The nature of collective investments is that the investor’s risk is reduced by the investment being spread over a large

portfolio as opposed to one or a few properties. In addition, investors can take advantage of the higher levels of liquidity

afforded by such vehicles. -

第14题:

(ii) Briefly outline the tax consequences for Henry if the types of protection identified in (i) were to be

provided for him by Happy Home Ltd compared to providing them for himself. You are not required to

discuss the corporation tax (CT) consequences for Happy Home Ltd. (4 marks)

正确答案:

(ii) Provision of protection: company or individual

If any of the policies are taken out and paid for by Henry personally, then there will be no tax relief on the premiums,

but neither will there normally be any tax payable on the proceeds or benefits received.

If Happy Home Ltd were to pay the premiums on a policy taken out by Henry, and of which he was the direct beneficiary,

then this will constitute a benefit, on the grounds that the company will have satisfied a personal liability of Henry’s.

Accordingly, income tax and Class 1A national insurance contributions will be payable on the benefit.

If, however, Happy Home Ltd were to decide to offer protection benefits to their employees on a group basis (and not

just to Henry), then it would be possible to avoid a charge under the benefits rules and/or obtain a lower rate of premium

under a collective policy. For example:

– A death in service benefit of up to four times remuneration can be provided as part of an approved pension scheme.

No benefit charge arises on Henry and any lump sum will be paid tax free. This could be considered a substitute

for a term assurance policy.

– If a group permanent health insurance policy were taken out, no benefit charge would arise on Henry, but any

benefits payable under the policy would be paid to Happy Home Ltd in the first instance. When subsequently paid

on to Henry, such payments would be treated as arising from his employment and subject to PAYE and national

insurance as for normal salary payments.

– If a group critical illness policy were taken out, again no benefit charge would arise on Henry, but in this case also,

any benefits received by Henry directly from Happy Home Ltd as a result of the payments under the policy would

be considered as derived from his employment and subject to income tax and national insurance. Such a charge

to tax and national insurance would however be avoided if these payments were made in terms of a trust. -

第15题:

(ii) Compute the annual income tax saving from your recommendation in (i) above as compared with the

situation where Cindy retains both the property and the shares. Identify any other tax implications

arising from your recommendation. Your answer should consider all relevant taxes. (3 marks)

正确答案:

-

第16题:

(b) (i) State the condition that would need to be satisfied for the exercise of Paul’s share options in Memphis

plc to be exempt from income tax and the tax implications if this condition is not satisfied.

(2 marks)

正确答案:

(b) (i) Paul has options in an HMRC approved share scheme. Under such schemes, no tax liabilities arise either on the grant

or exercise of the option. The excess of the proceeds over the price paid for the shares (the exercise price) is charged to

capital gains tax on their disposal.

However, in order to secure this treatment, one of the conditions to be satisfied is that the options cannot be exercised

within three years of the date of grant. If Paul were to exercise his options now (i.e. before the third anniversary of the

grant), the exercise would instead be treated as an unapproved exercise. At that date, income tax would be charged on

the difference between the market value of the shares on exercise and the price paid to exercise the option. -

第17题:

(b) Peter, one of Linden Limited’s non-executive directors, having lived and worked in the UK for most of his adult

life, sold his home near London on 22 March 2006 and, together with his wife (a French citizen), moved to live

in a villa which she owns in the south of France. Peter is now demanding that the tax deducted from his director’s

fees, for the board meetings held on 18 April and 16 May 2006, be refunded, on the grounds that, as he is no

longer resident in the UK, he is no longer liable to UK income tax. All of the company’s board meetings are held

at its offices in Cambridge.

Despite Peter’s assurance that none of the other companies of which he is a director has disputed his change of

tax status, Damian is uncertain whether he should make the refunds requested. However, as Peter is a friend of

the company’s founder, Linden Limited’s managing director is urging him to do so, stating that if the tax does

have to be paid, then Linden Limited could always bear the cost.

Required:

Advise Damian whether Peter is correct in his assertion regarding his tax position and in the case that there

is a UK tax liability the implications of the managing director’s suggestion. You are not required to consider

national insurance (NIC) issues. (4 marks)

正确答案:

(b) Peter will have been resident and ordinarily resident in the UK. When such individuals leave the UK for a purpose other than

to take up full time employment abroad, they normally continue to still be so regarded unless their absence spans a complete

tax year. But, where someone intends to live permanently abroad or to do so for a period of at least three tax years, they may

be treated as non-resident and non-ordinarily resident from the day after the date of their departure, if they can provide

evidence to HMRC of that intention. Selling a residence in the UK and setting up home abroad will normally constitute such

evidence. However to retain non-resident status the intention must actually be fulfilled, and visits to the UK must not exceed

182 days in any tax year or average more than 90 days per year over a period of four tax years. Given that Peter would appear

to have several company directorships in the UK, it is possible that he might fail to satisfy the 90 day average ‘substantial

visits’ rule.

Even if Peter is classed as non-resident, any remuneration earned in the UK will still be liable to UK income tax, and subject

to PAYE, unless it is for duties incidental to an overseas employment, which is unlikely to be the case for fees paid to a nonexecutive

director for attending board meetings. Thus, income tax should still be deducted from the fees under PAYE. Where

PAYE should have been deducted from a director’s emoluments and it has not been, but the tax is nevertheless accounted

for by the company to HMRC, then to the extent that the tax is not reimbursed by the director, he will be treated as receiving

a benefit equivalent to the amount of tax. -

第18题:

(iii) State the value added tax (VAT) and stamp duty (SD) issues arising as a result of inserting Bold plc as

a holding company and identify any planning actions that can be taken to defer or minimise these tax

costs. (4 marks)

You should assume that the corporation tax rates for the financial year 2005 and the income tax rates

and allowances for the tax year 2005/06 apply throughout this question.

正确答案:

(iii) Bold plc will be making a taxable supply of services, likely to exceed the VAT threshold. It should therefore consider

registering for VAT – either immediately on a voluntary basis, or when its cumulative taxable supplies in the previous

twelve months exceed £60,000.

As an alternative, the new group can apply for a group VAT registration. This will simplify its VAT administration as intragroup

transactions are broadly disregarded for VAT purposes, and only one VAT return is required for the group as a

whole.

Stamp duty normally applies at 0·5% on the consideration payable in respect of transactions in shares. However, an

exemption is available in the case of a takeover, reconstruction or amalgamation where there is no real change in

ownership, i.e. the new shareholdings mirror the old shareholdings, and the transaction is for commercial purposes. The

insertion of a new holding company over an existing company, as proposed here, would qualify for this exemption.

There is no VAT on transactions in shares. -

第19题:

(ii) Following on from your answer to (i), evaluate the two purchase proposals, and advise Bill and Ben

which course of action will result in the highest amount of after tax cash being received by the

shareholders if the disposal takes place on 31 March 2006. (4 marks)

正确答案:

-

第20题:

(b) For this part, assume today’s date is 1 May 2010.

Bill and Ben decided not to sell their company, and instead expanded the business themselves. Ben, however,

is now pursuing other interests, and is no longer involved with the day to day activities of Flower Limited. Bill

believes that the company would be better off without Ben as a voting shareholder, and wishes to buy Ben’s

shares. However, Bill does not have sufficient funds to buy the shares himself, and so is wondering if the

company could acquire the shares instead.

The proposed price for Ben’s shares would be £500,000. Both Bill and Ben pay income tax at the higher rate.

Required:

Write a letter to Ben:

(1) stating the income tax (IT) and/or capital gains tax (CGT) implications for Ben if Flower Limited were to

repurchase his 50% holding of ordinary shares, immediately in May 2010; and

(2) advising him of any available planning options that might improve this tax position. Clearly explain any

conditions which must be satisfied and quantify the tax savings which may result.

(13 marks)

Assume that the corporation tax rates for the financial year 2005 and the income tax rates and allowances

for the tax year 2005/06 apply throughout this question.

正确答案:(b) [Ben’s address] [Firm’s address]

Dear Ben [Date]

A company purchase of own shares can be subject to capital gains treatment if certain conditions are satisfied. However, one

of these conditions is that the shares in question must have been held for a minimum period of five years. As at 1 May 2010,

your shares in Flower Limited have only been held for four years and ten months. As a result, the capital gains treatment will

not apply.

In the absence of capital gains treatment, the position on a company repurchase of its own shares is that the payment will

be treated as an income distribution (i.e. a dividend) in the hands of the recipient. The distribution element is calculated as

the proceeds received for the shares less the price paid for them. On the basis that the purchase price is £500,000, then the

element of distribution will be £499,500 (500,000 – 500). This would be taxed as follows:

-

第21题:

(iii) Explain the potential corporation tax (CT) implications of Tay Limited transferring work to Trent Limited,

and suggest how these can be minimised or eliminated. (3 marks)

正确答案:

(iii) Trading losses may not be carried forward where, within a period of three years there is both a change in the ownership

of a company and a major change in the nature or conduct of its trade. The transfer of work from Tay Limited to Trent

Limited is likely to constitute a major change in the nature or conduct of the latter’s trade. As a consequence, any tax

losses at the date of acquisition will be forfeited. Assuming losses were incurred uniformly in 2005, the tax losses at the

date of acquisition were £380,000 (300,000 + 2/3 x 120,000)). This is worth £114,000 assuming a corporation tax

rate of 30%.

Thus, Tay Limited should not consider transferring any trade to Trent Limited until after the third anniversary of the date

of the change of ownership i.e. not before 1 September 2008. As the trades are similar, there should be little problem

in transferring work from that date onwards. -

第22题:

(ii) State the taxation implications of both equity and loan finance from the point of view of a company.

(3 marks)

正确答案:

(ii) A company needs to be aware of the following issues:

Equity

(1) Costs incurred in issuing share capital are not allowed as a trading deduction.

(2) Distributions to investors are not allowed as a trading deduction.

(3) The cost of making distributions to shareholders are disallowable.

(4) Where profits are taxed at an effective rate of less than 19%, any profits used to make a distribution to noncorporate

shareholders will themselves be taxed at the full 19% rate.

Loan finance/debt

(1) The incidental costs of obtaining/raising loan finance are broadly deductible as a trading expense.

(2) Capital costs of raising loan finance (for example, loans issued at a discount) are not deductible for tax purposes.

(3) Interest incurred on a loan to finance a business is deductible from trading income. -

第23题:

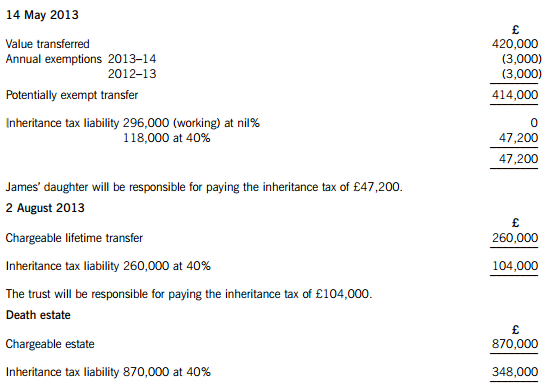

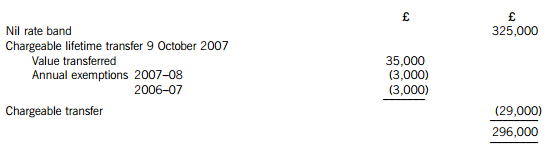

James died on 22 January 2015. He had made the following gifts during his lifetime:

(1) On 9 October 2007, a cash gift of £35,000 to a trust. No lifetime inheritance tax was payable in respect of this gift.

(2) On 14 May 2013, a cash gift of £420,000 to his daughter.

(3) On 2 August 2013, a gift of a property valued at £260,000 to a trust. No lifetime inheritance tax was payable in respect of this gift because it was covered by the nil rate band. By the time of James’ death on 22 January 2015, the property had increased in value to £310,000.

On 22 January 2015, James’ estate was valued at £870,000. Under the terms of his will, James left his entire estate to his children.

The nil rate band of James’ wife was fully utilised when she died ten years ago.

The nil rate band for the tax year 2007–08 is £300,000, and for the tax year 2013–14 it is £325,000.

Required:

(a) Calculate the inheritance tax which will be payable as a result of James’ death, and state who will be responsible for paying the tax. (6 marks)

(b) Explain why it might have been beneficial for inheritance tax purposes if James had left a portion of his estate to his grandchildren rather than to his children. (2 marks)

(c) Explain why it might be advantageous for inheritance tax purposes for a person to make lifetime gifts even when such gifts are made within seven years of death.

Notes:

1. Your answer should include a calculation of James’ inheritance tax saving from making the gift of property to the trust on 2 August 2013 rather than retaining the property until his death.

2. You are not expected to consider lifetime exemptions in this part of the question. (2 marks)

正确答案:(a) James – Inheritance tax arising on death

Lifetime transfers within seven years of death

The personal representatives of James’ estate will be responsible for paying the inheritance tax of £348,000.

Working – Available nil rate band

(b) Skipping a generation avoids a further charge to inheritance tax when the children die. Gifts will then only be taxed once before being inherited by the grandchildren, rather than twice.

(c) (1) Even if the donor does not survive for seven years, taper relief will reduce the amount of IHT payable after three years.

(2) The value of potentially exempt transfers and chargeable lifetime transfers are fixed at the time they are made.

(3) James therefore saved inheritance tax of £20,000 ((310,000 – 260,000) at 40%) by making the lifetime gift of property.